🚨Today @POTUS announced his plan to cancel $10k/borrower of student debt by executive action for individuals making <$125k and up to $20k for Pell Grant recipients while extending the current repayment pause until December 31st.

A statement from @MayaMacGuineas: ⤵️

A statement from @MayaMacGuineas: ⤵️

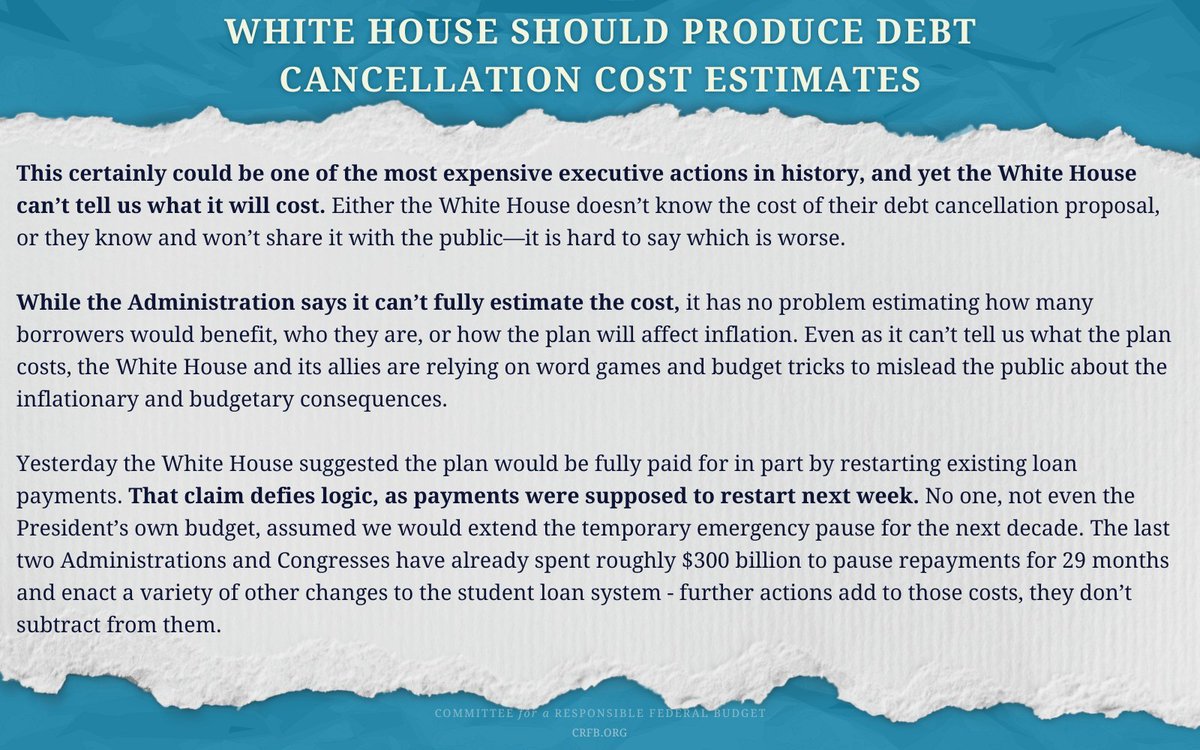

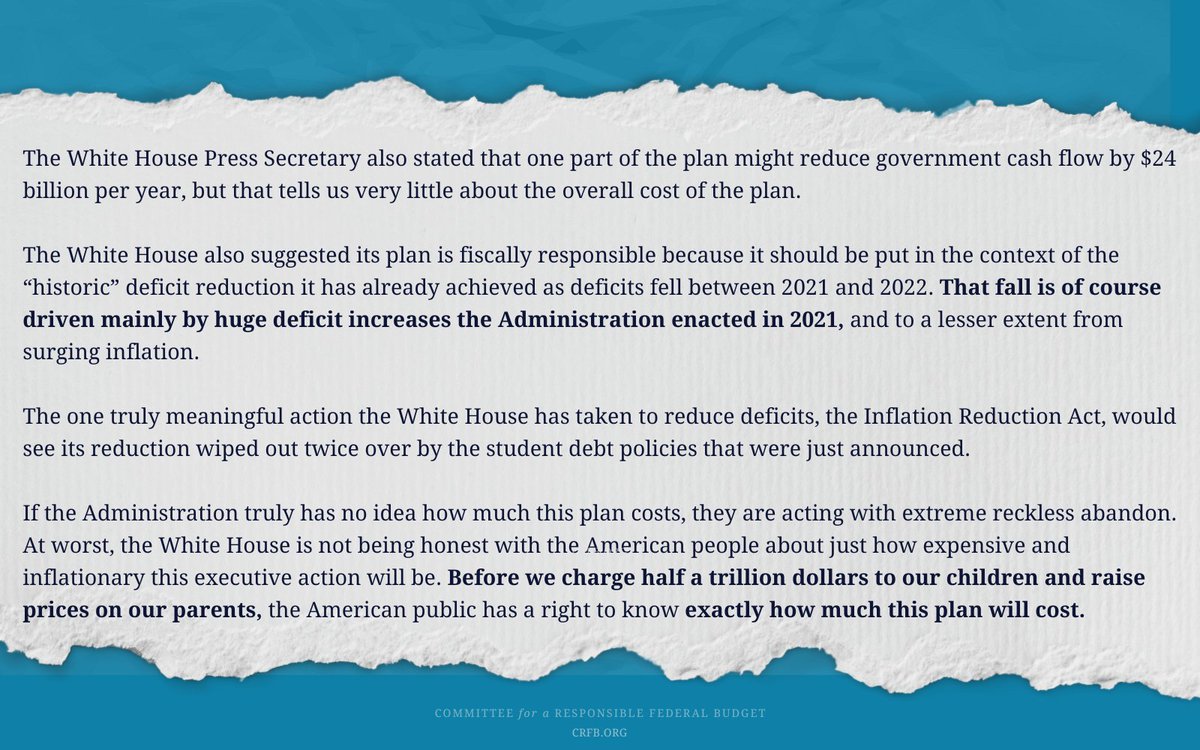

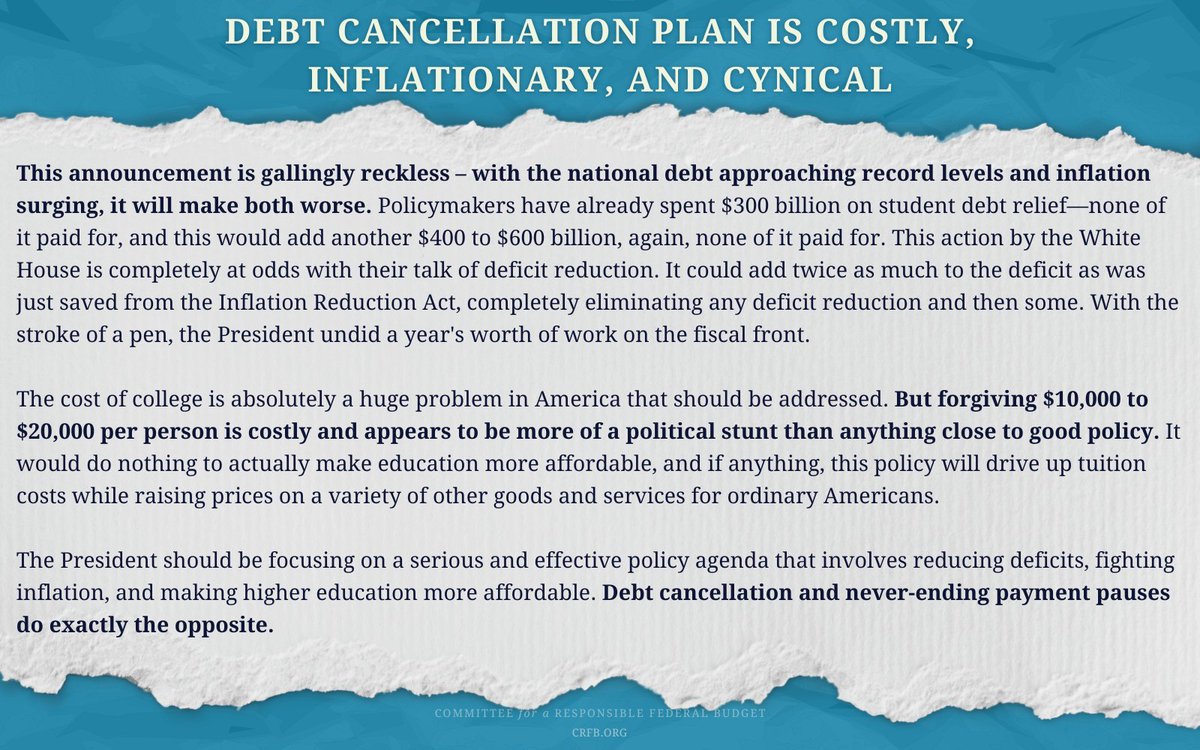

"This announcement is gallingly reckless – with the national debt approaching record levels and inflation surging, it will make both worse. Policymakers have already spent $300 billion on student debt relief—none of it paid for, and this would add another $400 to $600 billion..."

"...again, none of it paid for. This action by the White House is completely at odds with their talk of deficit reduction. It could add twice as much to the deficit as was just saved from the #InflationReductionAct, completely eliminating any deficit reduction and then some."

"With the stroke of a pen, the President undid a year's worth of work on the fiscal front." crfb.org/press-releases…

"The cost of college is absolutely a huge problem in America that should be addressed. But forgiving $10,000 to $20,000 per person is costly and appears to be more of a political stunt than anything close to good policy." crfb.org/press-releases…

"It would do nothing to actually make education more affordable, and if anything, this policy will drive up tuition costs while raising prices on a variety of other goods and services for ordinary Americans." crfb.org/press-releases…

"The President should be focusing on a serious and effective policy agenda that involves reducing deficits, fighting inflation, and making higher education more affordable. Debt cancellation and never-ending payment pauses do exactly the opposite."

➡️crfb.org/press-releases….

➡️crfb.org/press-releases….

• • •

Missing some Tweet in this thread? You can try to

force a refresh