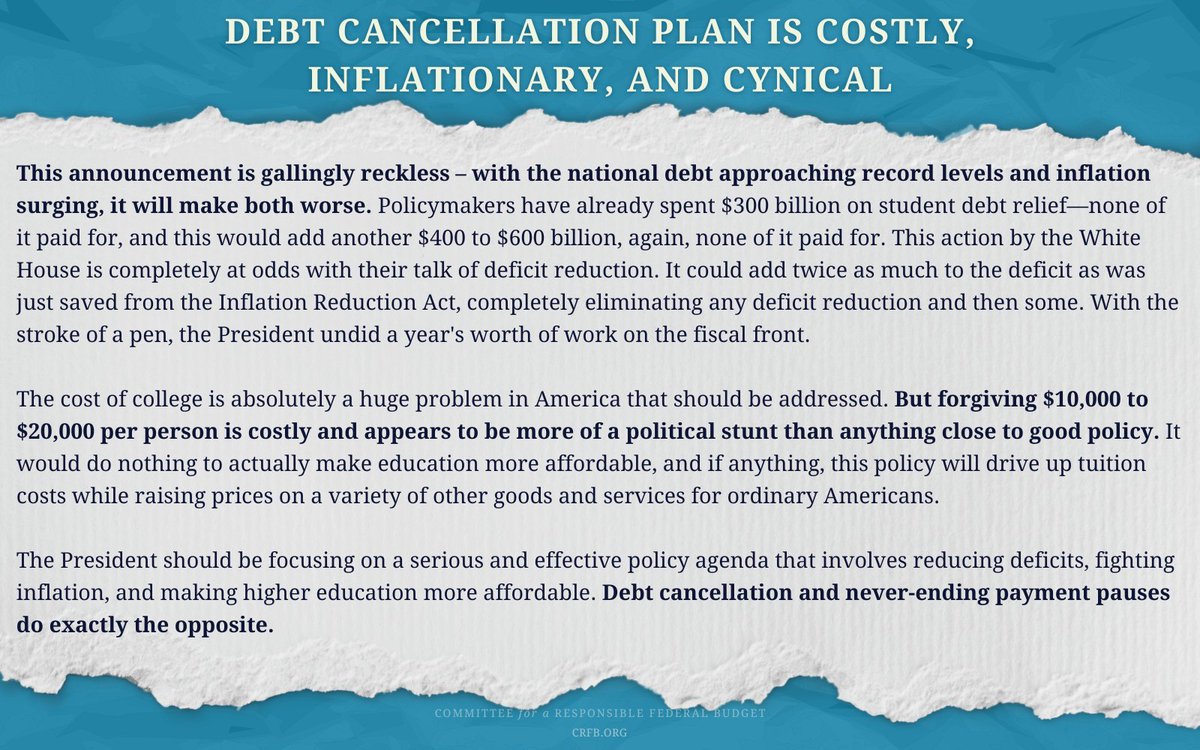

🚨Two days after announcing it would cancel large amounts of student debt, the @WhiteHouse has failed to produce either a cost estimate or a proposal for how it would be paid for. We've estimated the cost of the full plan to be ~$500 billion.

A statement from @MayaMacGuineas ⤵️

A statement from @MayaMacGuineas ⤵️

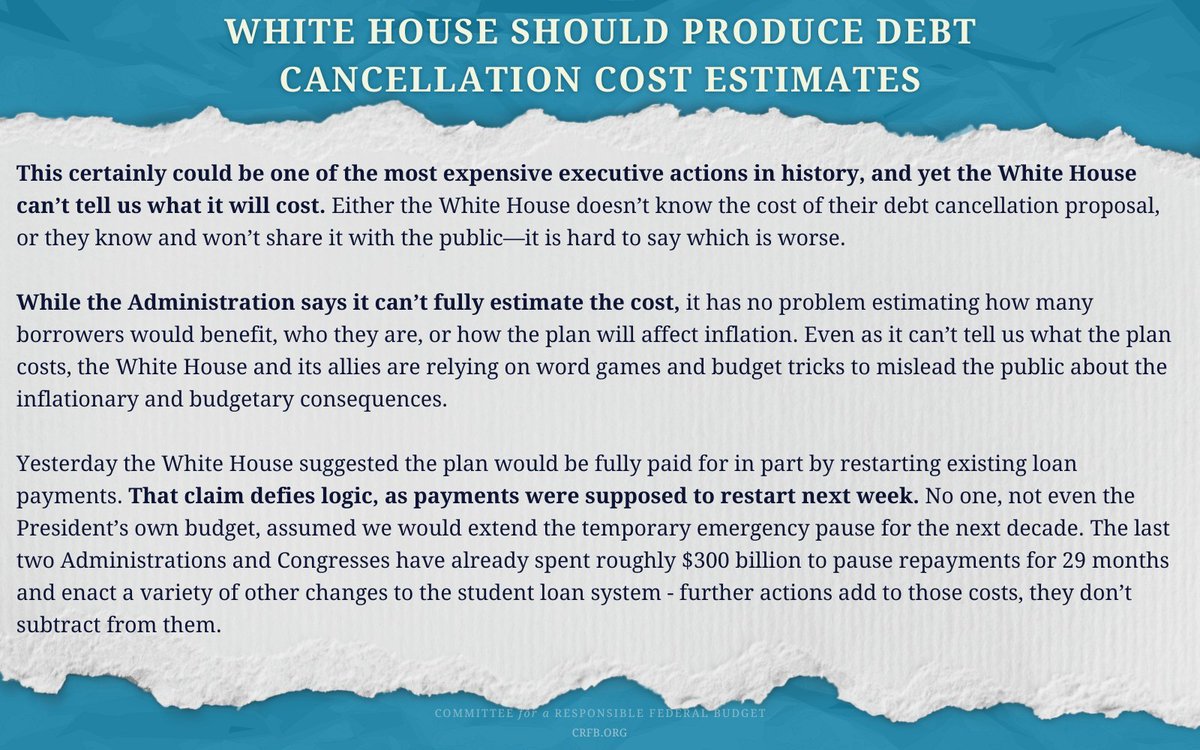

"This certainly could be one of the most expensive executive actions in history, and yet the White House can’t tell us what it will cost. Either the White House doesn’t know the cost of their debt cancellation proposal, or they know and won’t share it with the public..."

"...it is hard to say which is worse.

While the Administration says it can’t fully estimate the cost, it has no problem estimating how many borrowers would benefit, who they are, or how the plan will affect inflation. Even as it can’t tell us what the plan costs,..."

While the Administration says it can’t fully estimate the cost, it has no problem estimating how many borrowers would benefit, who they are, or how the plan will affect inflation. Even as it can’t tell us what the plan costs,..."

"...the White House and its allies are relying on word games and budget tricks to mislead the public about the inflationary and budgetary consequences.

Yesterday the White House suggested the plan would be fully paid for in part by restarting existing loan payments."

Yesterday the White House suggested the plan would be fully paid for in part by restarting existing loan payments."

"That claim defies logic, as payments were supposed to restart next week.

No one, not even the President’s own budget, assumed we would extend the temporary emergency pause for the next decade." crfb.org/press-releases…

No one, not even the President’s own budget, assumed we would extend the temporary emergency pause for the next decade." crfb.org/press-releases…

"The last two Administrations and Congresses have already spent roughly $300 billion to pause repayments for 29 months and enact a variety of other changes to the student loan system - further actions add to those costs, they don’t subtract from them."

"The White House Press Secretary also stated that one part of the plan might reduce government cash flow by $24 billion per year, but that tells us very little about the overall cost of the plan." crfb.org/press-releases…

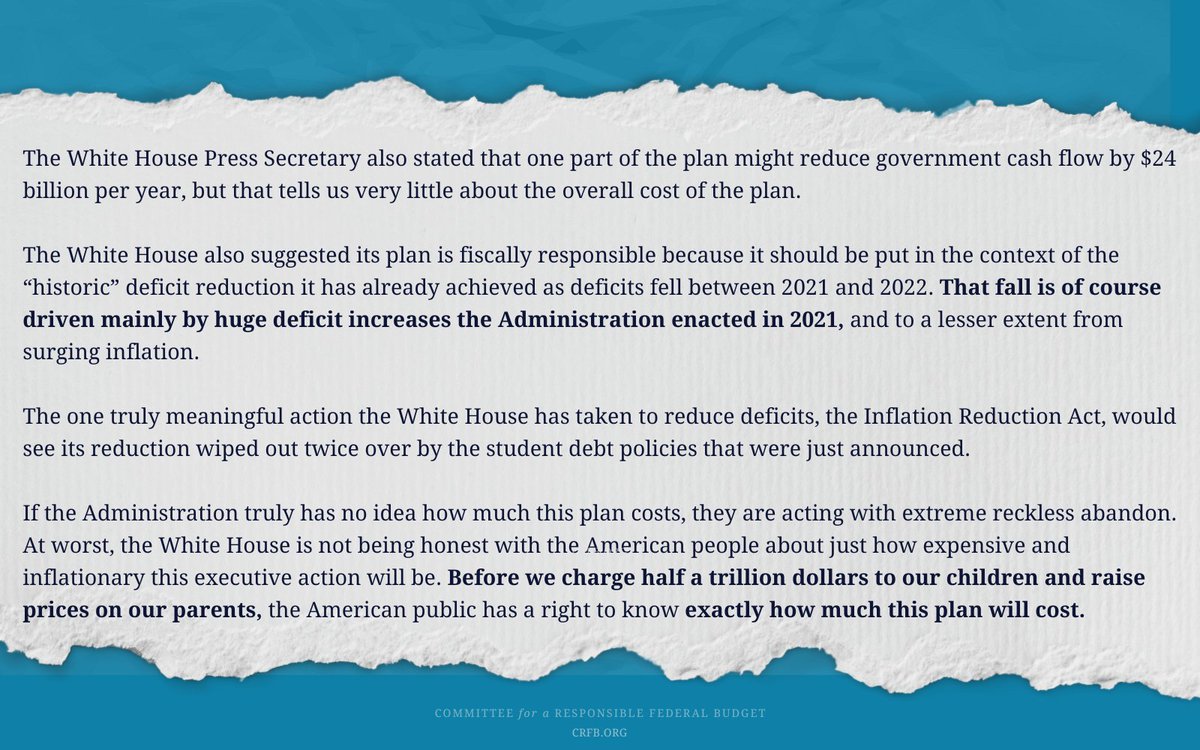

"The White House also suggested its plan is fiscally responsible because it should be put in the context of the “historic” deficit reduction it has already achieved as deficits fell between 2021 and 2022..." crfb.org/press-releases…

"...That fall is of course driven mainly by huge deficit increases the Administration enacted in 2021, and to a lesser extent from surging inflation." (See crfb.org/blogs/no-presi…).

"The one truly meaningful action the White House has taken to reduce deficits, the #InflationReductionAct, would see its reduction wiped out twice over by the student debt policies that were just announced." crfb.org/press-releases…

"If the Administration truly has no idea how much this plan costs, they are acting with extreme reckless abandon. At worst, the White House is not being honest with the American people about just how expensive and inflationary this executive action will be."

"Before we charge half a trillion dollars to our children and raise prices on our parents, the American public has a right to know exactly how much this plan will cost."

Read the full statement at crfb.org/press-releases….

Read the full statement at crfb.org/press-releases….

• • •

Missing some Tweet in this thread? You can try to

force a refresh