Even the biggest handles with 100k+ followers get this simple thing wrong in charting!🤦♂️

This is the most important thing especially if you are analysing long term charts!🧐

So, let's get this right today!

USE LOG CHARTS 📈 FOR ANALYSING LONG TERM CHARTS!

Let’s go🧵...

This is the most important thing especially if you are analysing long term charts!🧐

So, let's get this right today!

USE LOG CHARTS 📈 FOR ANALYSING LONG TERM CHARTS!

Let’s go🧵...

1⃣ Wait, What's Log chart?

Before I define Log chart, let's look at the chart you are using daily - 'The Linear Chart'

- Linear chart is used by default in most platforms. This is probably why you never knew log charts

Wait, don't click on 'log' yet before you understand it...

Before I define Log chart, let's look at the chart you are using daily - 'The Linear Chart'

- Linear chart is used by default in most platforms. This is probably why you never knew log charts

Wait, don't click on 'log' yet before you understand it...

2⃣ ok, so what does Linear chart mean?

Take a look at the image

- The y-axis is separated equally by 1000 points starting from 0 to 11000.

- So, any linear chart would have its y-axis equally separated by 'N' points always

And... that's where the problem lies...

Take a look at the image

- The y-axis is separated equally by 1000 points starting from 0 to 11000.

- So, any linear chart would have its y-axis equally separated by 'N' points always

And... that's where the problem lies...

3⃣ But, I don't see any problem?🤔

Ok ok.. let me explain...

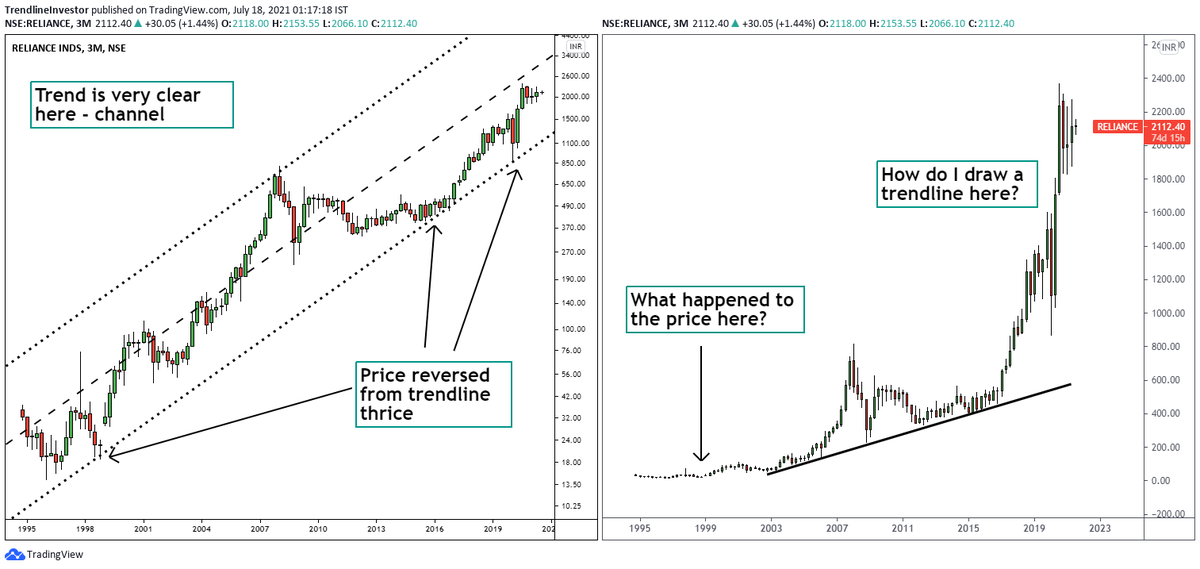

- Can you look at this #TATAELXSI chart & tell me the price in '99 when it was listed? No!

- Can you draw a proper trendline in this chart? No!

Reason is because of the price congestion between '07 to '20...

Ok ok.. let me explain...

- Can you look at this #TATAELXSI chart & tell me the price in '99 when it was listed? No!

- Can you draw a proper trendline in this chart? No!

Reason is because of the price congestion between '07 to '20...

4⃣ What else?🧐

- Whenever there is a price change in an instrument & it's drastic it'd be difficult to analyse on a linear chart

- Look at this example of #BTCUSD. What happened in 2021(refer to the red box)? 🤔

All this is because of the equally spaced Y-axis!

hmmm... ok🙄

- Whenever there is a price change in an instrument & it's drastic it'd be difficult to analyse on a linear chart

- Look at this example of #BTCUSD. What happened in 2021(refer to the red box)? 🤔

All this is because of the equally spaced Y-axis!

hmmm... ok🙄

5⃣ Let's talk about our hero - 'The Log Chart' 🦸♂️

Let's click on log first (refer chart)...

Do you see the change in the same #TATAELXSI chart? 😃(Reason in chart)

Yes, but what do you see?..

There you go!

- Price trend visible clearly

- You can identify trends since listing

Let's click on log first (refer chart)...

Do you see the change in the same #TATAELXSI chart? 😃(Reason in chart)

Yes, but what do you see?..

There you go!

- Price trend visible clearly

- You can identify trends since listing

6⃣ Here's a side-by-side comparison

- Basically a log scale considers the 'Percentage' price change in the Y-axis which makes a huge difference especially where prices have moved dramatically

- This dramatic price change could have happened in just a month or over many years

- Basically a log scale considers the 'Percentage' price change in the Y-axis which makes a huge difference especially where prices have moved dramatically

- This dramatic price change could have happened in just a month or over many years

7⃣ Ok, so when to use log/linear scale

- See, in the short term charts log/linear scale don't make a difference (Refer chat)

- If you're purely an intraday or a short term trader, then you can continue to use linear charts

But, if price moves drastically(crypto) then use log...

- See, in the short term charts log/linear scale don't make a difference (Refer chat)

- If you're purely an intraday or a short term trader, then you can continue to use linear charts

But, if price moves drastically(crypto) then use log...

8⃣ But, I am a long term investor + swing/positional trader?

Yes, then you ought to switch to 'Log chart' FOREVER so that...

- You can analyse charts properly

- Draw clean trendlines

- Identify primary trendline/channel reversals

Short term charts should be just fine with log!

Yes, then you ought to switch to 'Log chart' FOREVER so that...

- You can analyse charts properly

- Draw clean trendlines

- Identify primary trendline/channel reversals

Short term charts should be just fine with log!

9⃣ So, the next time you see a big handle analysing a long term chart with 'Linear chart' like this on #twitter 🤦♂️share this thread on that tweet and kill it🔪

And, yes switch to 'Log' now...🫡

And, yes switch to 'Log' now...🫡

🔟 Learnt something? If yes, please👇

1. Retweet the first tweet

2. Follow @dmdsplyinvestor

3. Subscribe to my YouTube channel for more content! youtube.com/c/TrendlineInv…

1. Retweet the first tweet

https://twitter.com/dmdsplyinvestor/status/1563775819515936768?s=20&t=9OfDptjivfa8WJHb63E-GQ

2. Follow @dmdsplyinvestor

3. Subscribe to my YouTube channel for more content! youtube.com/c/TrendlineInv…

• • •

Missing some Tweet in this thread? You can try to

force a refresh