🐻♉️↗️↘️↔️⚠️🚩🔺🔻🧮 💰

1/7 🧵

Global Macro Review 08/28/2022

What a difference a week and an 8-minute JH speech make.

Trend indicators green into #OPEX, only to have JPOW reiterate, "Our responsibility to deliver price stability is unconditional.”

Let’s dig into the 🧮!

1/7 🧵

Global Macro Review 08/28/2022

What a difference a week and an 8-minute JH speech make.

Trend indicators green into #OPEX, only to have JPOW reiterate, "Our responsibility to deliver price stability is unconditional.”

Let’s dig into the 🧮!

2/7

Having retraced 50-60% off their lows, US equities ↘️ hard on Powell’s speech

$SPX -4.05% (w) -2.4% (T)

$COMP -4.45% (w) +0.1% (T)

$IWM -2.9% (w) 0.7% (T)

Chart: $COMPQ failed to retrace 50% before ↘️

Having retraced 50-60% off their lows, US equities ↘️ hard on Powell’s speech

$SPX -4.05% (w) -2.4% (T)

$COMP -4.45% (w) +0.1% (T)

$IWM -2.9% (w) 0.7% (T)

Chart: $COMPQ failed to retrace 50% before ↘️

2a/7

Equity vol ↗️ and firmly in the 🪓🪣

$VIX 25.56 +4.96 pts

$VXN 31.72 +4.98 pts

$RVX 30.48 +5.14 pts

$VSTOXX +2.08 pts

$VXEEM 21.28 +1.85 pts

Chart: $VIX back > 25

Equity vol ↗️ and firmly in the 🪓🪣

$VIX 25.56 +4.96 pts

$VXN 31.72 +4.98 pts

$RVX 30.48 +5.14 pts

$VSTOXX +2.08 pts

$VXEEM 21.28 +1.85 pts

Chart: $VIX back > 25

2b/7

Energy +4.25% bucked the Trend, as Tech and Discretionary led ↘️

$XLK -5.55% (w) -1.1% (T)

$XLY -4.7% (w) +3.85% (T)

$XLC -4.4% (w) -8.4% (T)

Chart: $XLC - home to meta and alphabet never really bounced 🐻

Energy +4.25% bucked the Trend, as Tech and Discretionary led ↘️

$XLK -5.55% (w) -1.1% (T)

$XLY -4.7% (w) +3.85% (T)

$XLC -4.4% (w) -8.4% (T)

Chart: $XLC - home to meta and alphabet never really bounced 🐻

2c/7

Dispersion in internat’l equities

Asia ↔️ Europe ↘️

$CAC -3.4% (w) -3.7% (T)

$DAX -4.25% (w) -10.3% (T)

$HSI +2.0% (w) -2.55% (T)

$KOSPI -0.45% (w) -5.95% (T)

$NIKK -1.0% (w) +6.95% (T)

$SSEC -1.0% (w) +3.05% (T)

Chart: $NIKK ♉️ but very overbought

Dispersion in internat’l equities

Asia ↔️ Europe ↘️

$CAC -3.4% (w) -3.7% (T)

$DAX -4.25% (w) -10.3% (T)

$HSI +2.0% (w) -2.55% (T)

$KOSPI -0.45% (w) -5.95% (T)

$NIKK -1.0% (w) +6.95% (T)

$SSEC -1.0% (w) +3.05% (T)

Chart: $NIKK ♉️ but very overbought

2d/7

Some green spots among Country EFTs

$FXI +5.2% (w) -0.8% (T)

$EWZ +2.7% (w) -10.4% (T)

But otherwise, #fugly

$EWG -5.9% (w) -20.95% (T)

$EWQ -4.85% (w) -13.25% (T)

Chart: $EWG - last week's quote “Short with impunity”

Some green spots among Country EFTs

$FXI +5.2% (w) -0.8% (T)

$EWZ +2.7% (w) -10.4% (T)

But otherwise, #fugly

$EWG -5.9% (w) -20.95% (T)

$EWQ -4.85% (w) -13.25% (T)

Chart: $EWG - last week's quote “Short with impunity”

3/7

While equities were under pressure, commodities showed signs of life ↗️ - and that is troubling with a 🦅 Fed

Chart: $CRB +3.1% (w) -6.7% (T)

While equities were under pressure, commodities showed signs of life ↗️ - and that is troubling with a 🦅 Fed

Chart: $CRB +3.1% (w) -6.7% (T)

3a/7

Industrial metals ↗️ precious metals ↘️

$COPPER +1.1% (w) -14.15% (T)

$GOLD -0.75% (w) -5.8% (T)

$SILVER -1.65% (w) -15.15% (T)

Chart: $DBB +2.2% (w) -12.25% (T)

Industrial metals ↗️ precious metals ↘️

$COPPER +1.1% (w) -14.15% (T)

$GOLD -0.75% (w) -5.8% (T)

$SILVER -1.65% (w) -15.15% (T)

Chart: $DBB +2.2% (w) -12.25% (T)

3b/7

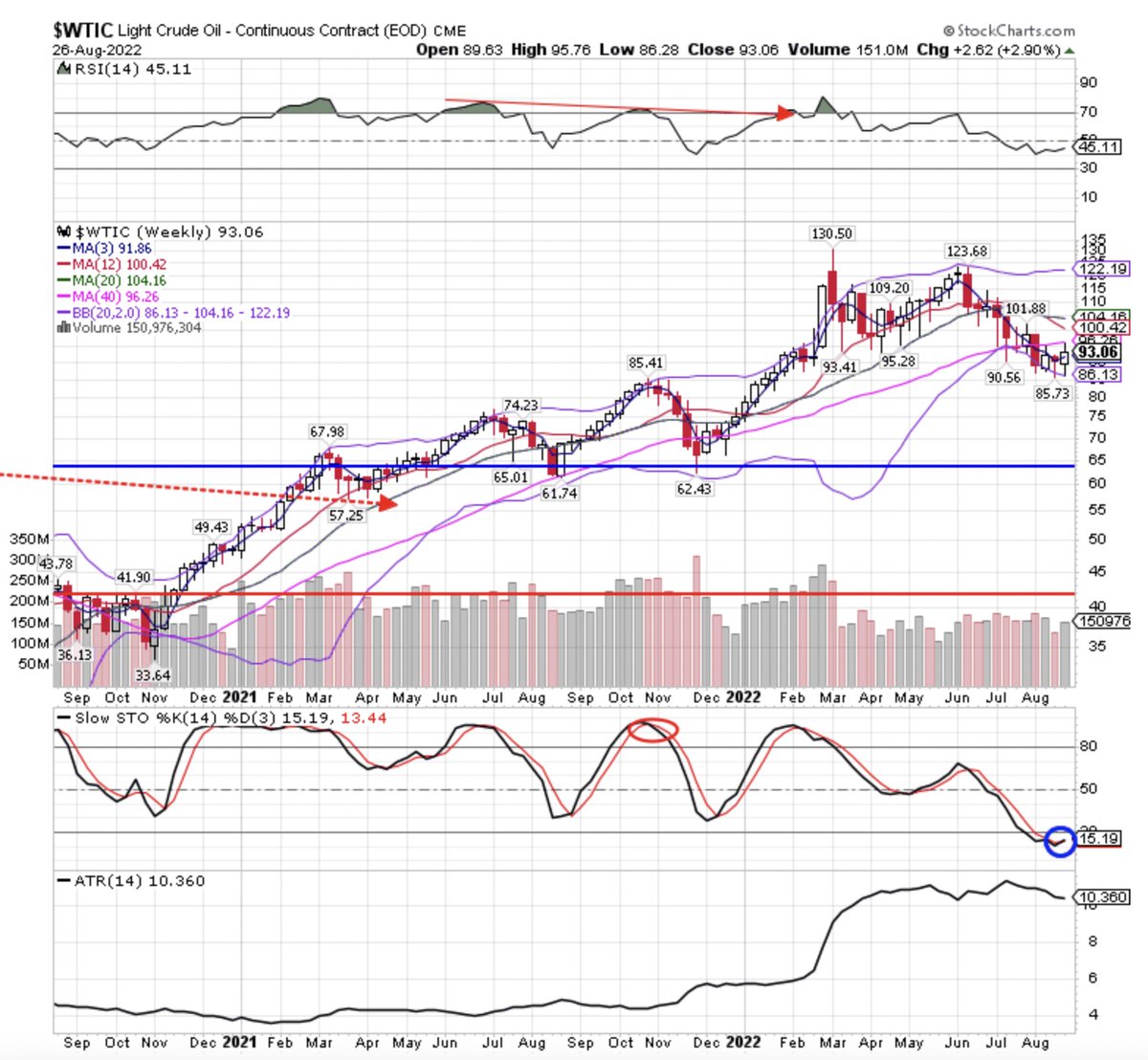

Hydrocarbons ↔️ with 🛢↗️

$BRENT +3.55% (w) -13.2% (T)

$WTIC +2.9% (w) -19.15% (T)

$NATGAS -0.75% (w) +6.2% (T)

$GASO -3.95% (w) -31.45% (T)

Chart: $WTIC bouncing off low end of the range …

Hydrocarbons ↔️ with 🛢↗️

$BRENT +3.55% (w) -13.2% (T)

$WTIC +2.9% (w) -19.15% (T)

$NATGAS -0.75% (w) +6.2% (T)

$GASO -3.95% (w) -31.45% (T)

Chart: $WTIC bouncing off low end of the range …

3d/7

Grains ripped ↗️ this week

$CORN +6.6% (w) -14.55% (T)

$SOYB +4.1% (w) -15.65% (T)

$SUGAR +2.2% (w) -5.6% (T)

$WHEAT +4.45% (w) -30.45% (T)

Chart: $DBA +3.3% (w) -7.4% (T) has retraced 38% of its ↘️ move

Grains ripped ↗️ this week

$CORN +6.6% (w) -14.55% (T)

$SOYB +4.1% (w) -15.65% (T)

$SUGAR +2.2% (w) -5.6% (T)

$WHEAT +4.45% (w) -30.45% (T)

Chart: $DBA +3.3% (w) -7.4% (T) has retraced 38% of its ↘️ move

4/7

Let’s not forget #Cryptocurrencies

$BTC -7.0% (w) -34.8% (T)

$ETH -7.85% (w) -25.4% (T)

Chart: $BTCUSD on the precipice 😳

Let’s not forget #Cryptocurrencies

$BTC -7.0% (w) -34.8% (T)

$ETH -7.85% (w) -25.4% (T)

Chart: $BTCUSD on the precipice 😳

5/7

UST yields ↗️ and ♉️ across the curve

10/2s to -35.2 BPS 🔻

MOVE 122.95 -86 BPS 🛗

Chart: $TNX +1.55% (w) +10.75% (T) as the range tightens

UST yields ↗️ and ♉️ across the curve

10/2s to -35.2 BPS 🔻

MOVE 122.95 -86 BPS 🛗

Chart: $TNX +1.55% (w) +10.75% (T) as the range tightens

5b/7

Bond ETFs ↔️ on the week but 🐻 (T)

$BND -0.4% (w) -2.5% (T)

$HYG -1.5% (w) -5.5% (T)

$IEF -0.5% (w) -2.35% (T)

$LQD -0.45% (w) -3.65% (T)

$TIP +0.1% (w) -3.6% (T)

$TLT +0.5% (w) -4.6% (T)

Chart: $TLT bouncing off low end of the range

Bond ETFs ↔️ on the week but 🐻 (T)

$BND -0.4% (w) -2.5% (T)

$HYG -1.5% (w) -5.5% (T)

$IEF -0.5% (w) -2.35% (T)

$LQD -0.45% (w) -3.65% (T)

$TIP +0.1% (w) -3.6% (T)

$TLT +0.5% (w) -4.6% (T)

Chart: $TLT bouncing off low end of the range

6/7

The wrecking 🎳 known as the $USD to a new cycle high

$UUP +0.7% (w) +7.25% (T)

$FXA +0.15% (w) -3.8% (T)

$FXC -0.35% (w) -2.4% (T)

$FXY -0.45% (w) -7.7% (T)

$FXB -0.75% (w) -7.05% (T)

$FXE -0.8% (w) -7.5% (T)

$FXF -0.9% (w) -1.2% (T)

Chart: $USD +13.77% YTD ♉️

The wrecking 🎳 known as the $USD to a new cycle high

$UUP +0.7% (w) +7.25% (T)

$FXA +0.15% (w) -3.8% (T)

$FXC -0.35% (w) -2.4% (T)

$FXY -0.45% (w) -7.7% (T)

$FXB -0.75% (w) -7.05% (T)

$FXE -0.8% (w) -7.5% (T)

$FXF -0.9% (w) -1.2% (T)

Chart: $USD +13.77% YTD ♉️

7/7

With the Fed committed to demand destruction and bringing "pain to households and businesses,” do you really think equities will be spared?

"A 🤡 and his 💰 are soon parted."

Pity the 🤡 and have a super profitable 💰 week!

🐻♉️↗️↘️↔️⚠️🚩🔺🔻🧮 💰

With the Fed committed to demand destruction and bringing "pain to households and businesses,” do you really think equities will be spared?

"A 🤡 and his 💰 are soon parted."

Pity the 🤡 and have a super profitable 💰 week!

🐻♉️↗️↘️↔️⚠️🚩🔺🔻🧮 💰

• • •

Missing some Tweet in this thread? You can try to

force a refresh