The job market is falling back to trend:

Aug's #JobsReport shows 315,000 job gains, slower & more consistent w/ softer spring gains, moderating after Jul's blockbuster report

The unemployment rate rose to 3.7 percent, but on the back of strong labor force gains.

Aug's #JobsReport shows 315,000 job gains, slower & more consistent w/ softer spring gains, moderating after Jul's blockbuster report

The unemployment rate rose to 3.7 percent, but on the back of strong labor force gains.

Job gains fell back to trend in August, w/ 315,000 jobs added, more in line with the slower job gains from the spring.

July's blockbuster job gains seem like a positive fluke, though they largely held up to revisions, revised down only 2,000.

#jobsreport 2/

July's blockbuster job gains seem like a positive fluke, though they largely held up to revisions, revised down only 2,000.

#jobsreport 2/

Unfortunately, today's revisions pushed July's payroll employment below pre-pandemic levels, but no worries, instead we hit the milestone in August instead. As of August 2022, payroll employment is back to pre-pandemic levels.

#jobsreport 3/

#jobsreport 3/

Job gains were broad-based again in August. While services like health care, prof & biz services, retail led job gains, goods-producing sectors also saw healthy job gains e.g. construction which added 16,000 jobs despite the cooling housing market.

#jobsreport 4/

#jobsreport 4/

Goods-producing sectors like construction & manufacturing are just above pre-pandemic job levels. Education & health services is closing in, though the largest job shortfalls are still in leisure & hospitality and government.

#jobsreport 5/

#jobsreport 5/

Average hourly earnings were up 5.2 percent year-over-year, flat compared to July. However, month-over-month growth was only 0.3 percent (3.8 percent annualized), the slowest rate since February 2022.

#jobsreport 6/

#jobsreport 6/

For production & nonsupervisory workers in leisure & hospitality and transportation & warehousing, YoY wage growth has slowed dramatically in recent months, but MoM growth did jump in August.

#jobsreport 7/

#jobsreport 7/

The unemployment rate rose to 3.7 percent in Aug, up off the five-decade low hit in Jul. Not a good sign and definitely a canary in the coal mine to watch for in coming months, though it was married with an encouraging rise in labor force participation in Aug.

#jobsreport 8/

#jobsreport 8/

The labor force participation rate rebounded to 62.4 percent, erasing the softening we've seen since March which also ties the highest level during the recovery.

Rebounding LFP is an encouraging sign for the Fed hoping to relieve pressure in the job market

#jobsreport 9/

Rebounding LFP is an encouraging sign for the Fed hoping to relieve pressure in the job market

#jobsreport 9/

In particular, prime-age labor force participation is a star metric for this report, rising to 82.8 percent, the highest level we've seen since the pandemic began.

#jobsreport 10/

#jobsreport 10/

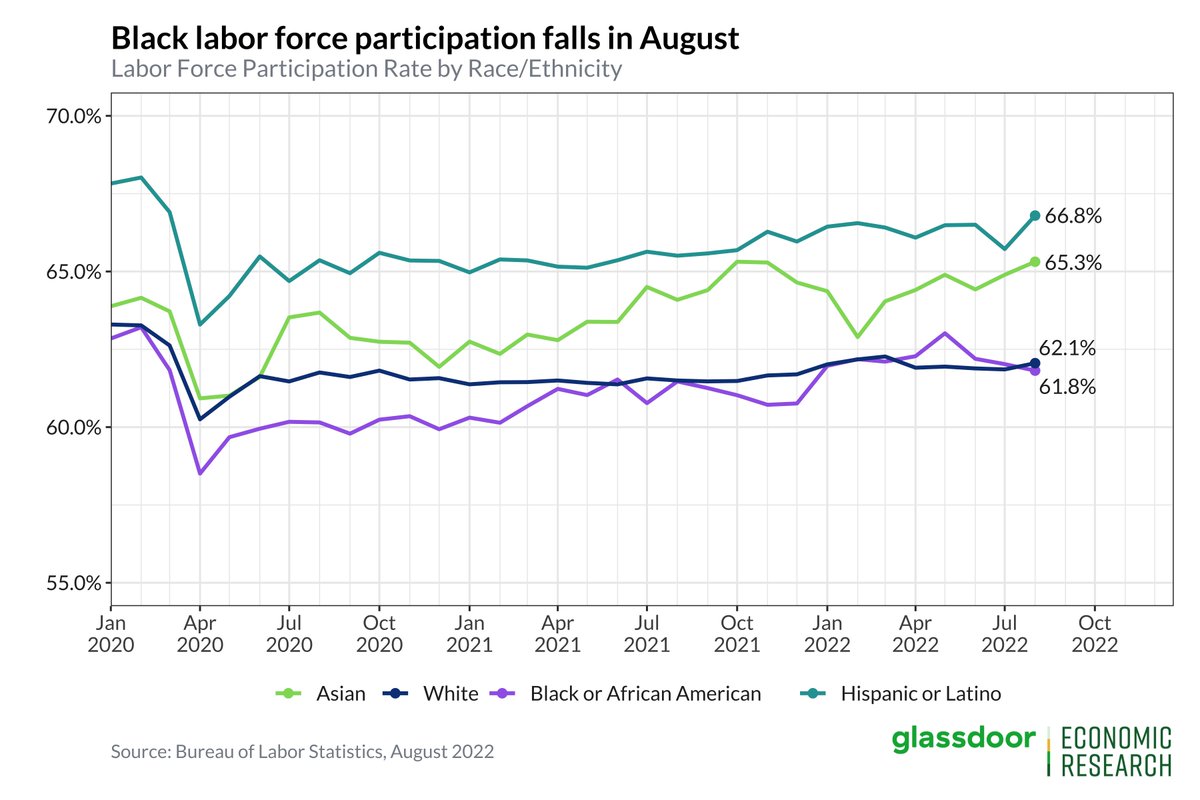

One key exception to the encouraging labor force participation trend in August: Black labor force participation fell in August, extending a three-month streak of declining LFP and in contrast to rising LFP for other groups.

#jobsreport 11/

#jobsreport 11/

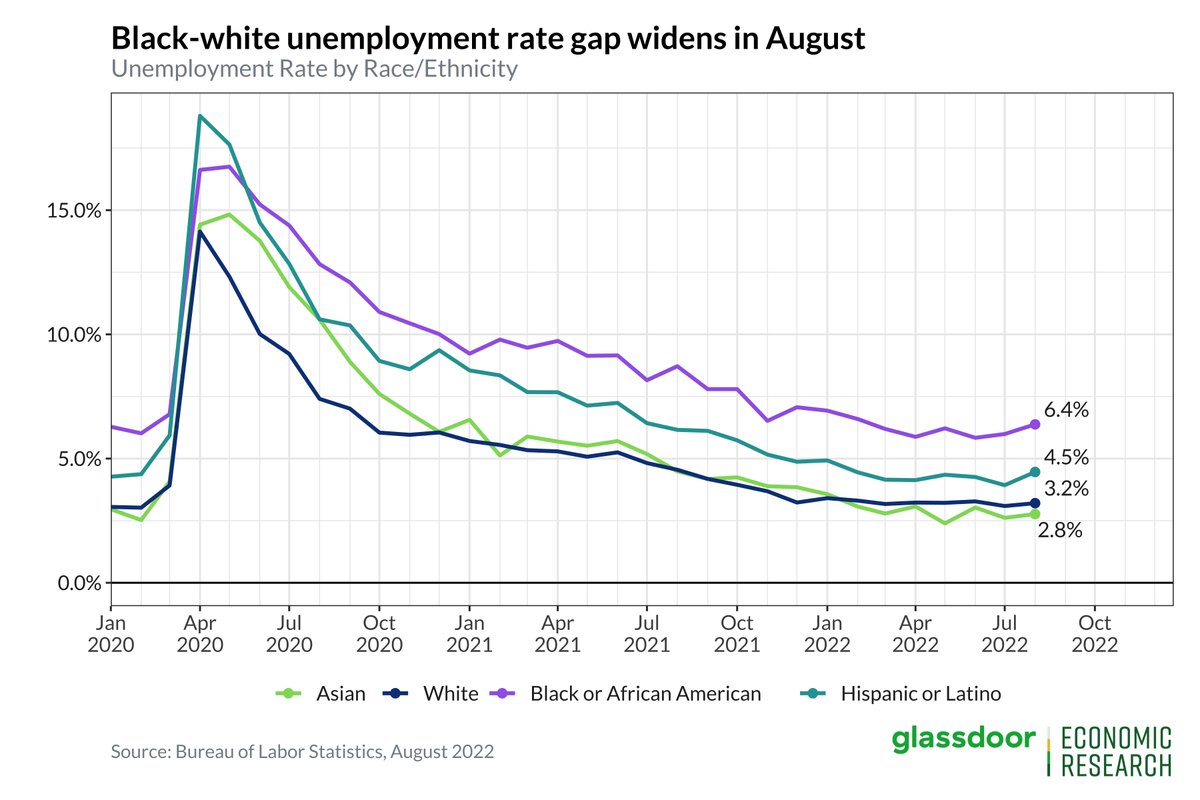

And that's contributing to a widening gap in the unemployment rates for Black & white workers. The Black unemployment rate is now up 0.6pp from its recovery low of 5.8 percent, reached in June.

#jobsreport 12/

#jobsreport 12/

Bonus (low-quality) chart: Labor force participation rose as inflows increased & outflows decreased. In particular, NILF->E or U (middle panel) are back to levels not seen in many months, hopefully indicating workers feel more confident that they can find jobs.

#jobsreport 13/

#jobsreport 13/

Bonus #2: Teen labor force participation jumped to 37.7% in Aug, the highest since 2009. Teen employment trends have been particularly weird during the pandemic. The past few recessions have seen a step-down in teen LFP. Not true now.

#jobsreport 14/

#jobsreport 14/

• • •

Missing some Tweet in this thread? You can try to

force a refresh