* #PAKISTAN 🇵🇰 DEBT ACCUMULATION — CAUTION ⚠️ *

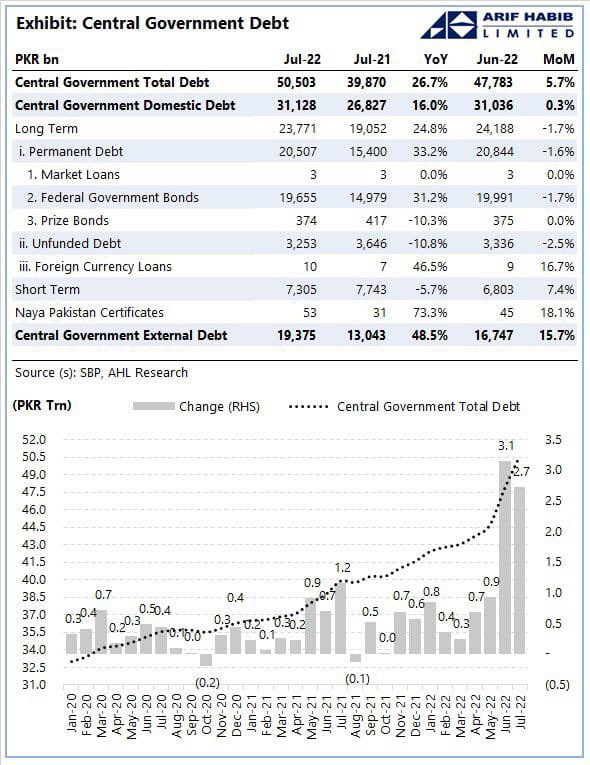

During @PTIofficial’s last year in power (Jul-2021 to Mar-2022), Pakistan’s total debt (domestic + external) increased by PKR 4.4 trillion (or US$25.1 billion @ an average USD:PKR parity of 175).

@ImranKhanPTI @shaukat_tarin

During @PTIofficial’s last year in power (Jul-2021 to Mar-2022), Pakistan’s total debt (domestic + external) increased by PKR 4.4 trillion (or US$25.1 billion @ an average USD:PKR parity of 175).

@ImranKhanPTI @shaukat_tarin

Note: even though most of #Pakistan’s debt is not USD-denominated, but by providing the USD-equivalent no., I’ve just tried to provide an idea of the country’s sheer scale of debt accumulation.

@PTIofficial added debt at a rate of PKR 550 billion (or US$3.1 billion) per month.

@PTIofficial added debt at a rate of PKR 550 billion (or US$3.1 billion) per month.

Now let’s have a look at what happened post-VONC:

During the first 4 months of @pmln_org & @MediaCellPPP’s govt. aka PDM (Apr-2022 to Jul-2022), #Pakistan’s total debt has increased by PKR 7.4 trillion (or US$36.1 billion @ ave. USD:PKR parity of 205).

@CMShehbaz @MiftahIsmail

During the first 4 months of @pmln_org & @MediaCellPPP’s govt. aka PDM (Apr-2022 to Jul-2022), #Pakistan’s total debt has increased by PKR 7.4 trillion (or US$36.1 billion @ ave. USD:PKR parity of 205).

@CMShehbaz @MiftahIsmail

Note: even though most of #Pakistan’s debt is not USD-denominated, but by providing the USD-equivalent no., I’ve just tried to provide an idea of the country’s sheer scale of debt accumulation.

#PDM has added debt at a rate of PKR 1.85 trillion (or US$9.0 billion) per month.

#PDM has added debt at a rate of PKR 1.85 trillion (or US$9.0 billion) per month.

* MATTER OF GRAVE CONCERN 🚨*

Given its current trajectory (see graph), one can easily expect the first 5-months debt accumulation of #PDM to cross the PKR 10 trillion mark (or US$47.6 billion @ upwards revised ave. USD:PKR parity of 210).

Alarm bells ringing 🔔 in Islamabad?

Given its current trajectory (see graph), one can easily expect the first 5-months debt accumulation of #PDM to cross the PKR 10 trillion mark (or US$47.6 billion @ upwards revised ave. USD:PKR parity of 210).

Alarm bells ringing 🔔 in Islamabad?

For decades, each successive govt. in #Pakistan has lacked both fiscal discipline (through poor reforms in @FBRSpokesperson) & monetary discipline (through a quasi-control over @StateBank_Pak).

In the process, #GOP has racked up an atrocious quantum of domestic & external debt.

In the process, #GOP has racked up an atrocious quantum of domestic & external debt.

Irresponsible & incompetent politicians, bureaucrats, and military dictatorships come and go.

It shall, however, fall on the shoulders of the current and future generations of #Pakistan 🇵🇰 to repay this staggering debt.

It shall, however, fall on the shoulders of the current and future generations of #Pakistan 🇵🇰 to repay this staggering debt.

• • •

Missing some Tweet in this thread? You can try to

force a refresh