Investment Banker | Macroeconomist | @LBS & @UWaterloo Alum | Tweets are personal; don’t publish w/o permission. Retweets are not necessarily endorsements.

How to get URL link on X (Twitter) App

Scenario 1 —

Scenario 1 —

https://twitter.com/pak_investor/status/1603650672284602368Founded in 1972, during a meeting of senior bankers in Beirut, #Lebanon 🇱🇧, #BCCI went on to open up branches & launch full-fledged commercial banking operations in 73 countries around the world by 1989. This included opening the first branch of a foreign-owned bank in #China 🇨🇳.

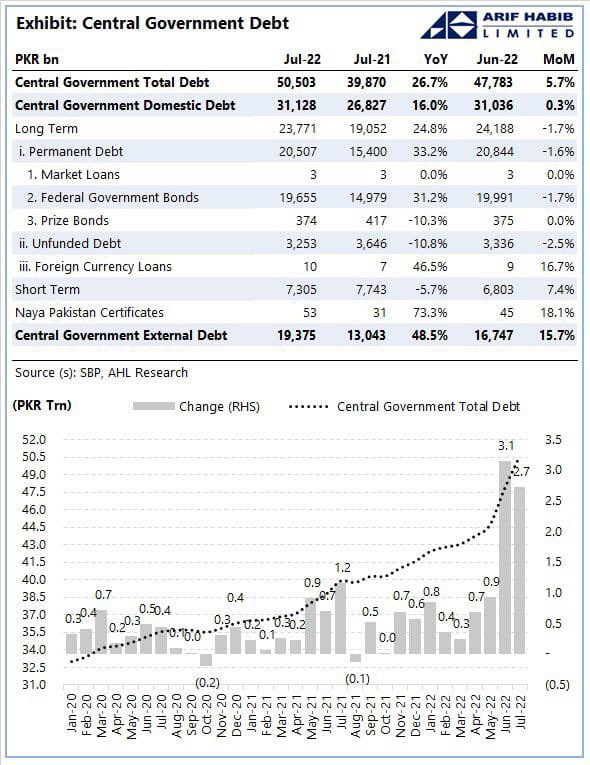

Note: even though most of #Pakistan’s debt is not USD-denominated, but by providing the USD-equivalent no., I’ve just tried to provide an idea of the country’s sheer scale of debt accumulation.

Note: even though most of #Pakistan’s debt is not USD-denominated, but by providing the USD-equivalent no., I’ve just tried to provide an idea of the country’s sheer scale of debt accumulation.

https://twitter.com/KhaleeqKiani/status/1466238979980894218Spending $ billions a year on imported CBU’s & CKD’s for fossil fuel cars for a country that is heavily dependent on imported energy is a highly unintelligent strategy.

1) Ramp up tax revenue growth —

1) Ramp up tax revenue growth —

Silk Bank is on perpetual sale after its abysmal performance in #Pakistan 🇵🇰 despite benefitting from one of the highest equity injections till-date. It is to be sold 🔜 and IFC / Nomura / Bank Muscat / Gourmet Group along with others will take a massive hit on their investment.

Silk Bank is on perpetual sale after its abysmal performance in #Pakistan 🇵🇰 despite benefitting from one of the highest equity injections till-date. It is to be sold 🔜 and IFC / Nomura / Bank Muscat / Gourmet Group along with others will take a massive hit on their investment.