I've never been more excited about #silver. And it has nothing to do with the Fed or the USD. It's a story of the #oil and #gas crisis and it's 2nd/3rd order effects.

Let's start with the supply side. 73% of silver is a byproduct of Zinc, Copper, Lead, and Gold.

Let's start with the supply side. 73% of silver is a byproduct of Zinc, Copper, Lead, and Gold.

Smelting is energy intensive. According to @Eurometaux, half of the EU's Zinc output has already been shut off. As Zinc's smelting process separates the Silver from the ore, this is decreasing supply.

Since only 27% of Silver supply is primary,

Since only 27% of Silver supply is primary,

the cure for high prices is not necessarily high prices. Silver rocketing to $50 wouldn't bring much more mine supply online (although it could incent bullion sales).

It's also questionable whether many incremental high-quality primary mines exist. The silver companies investing in Gold mines can't seem to find them, at least.

Silver recycling is a low-margin business. With the silver price plummeting and energy costs rising, recycled silver likely will drop meaningfully. At 180 moz/year estimated by the @SilverInstitute, this matters.

Let's talk demand.

Industrial demand is 52% of the total supply and 64% of mine supply. Which number you use depends on your view on the reliability of the recycling data, which is often debated (strong arguments by @keith_neumeyer that it's aggressive).

Industrial demand is 52% of the total supply and 64% of mine supply. Which number you use depends on your view on the reliability of the recycling data, which is often debated (strong arguments by @keith_neumeyer that it's aggressive).

Before the energy crisis, we had a projected DEFICIT of 70 moz.

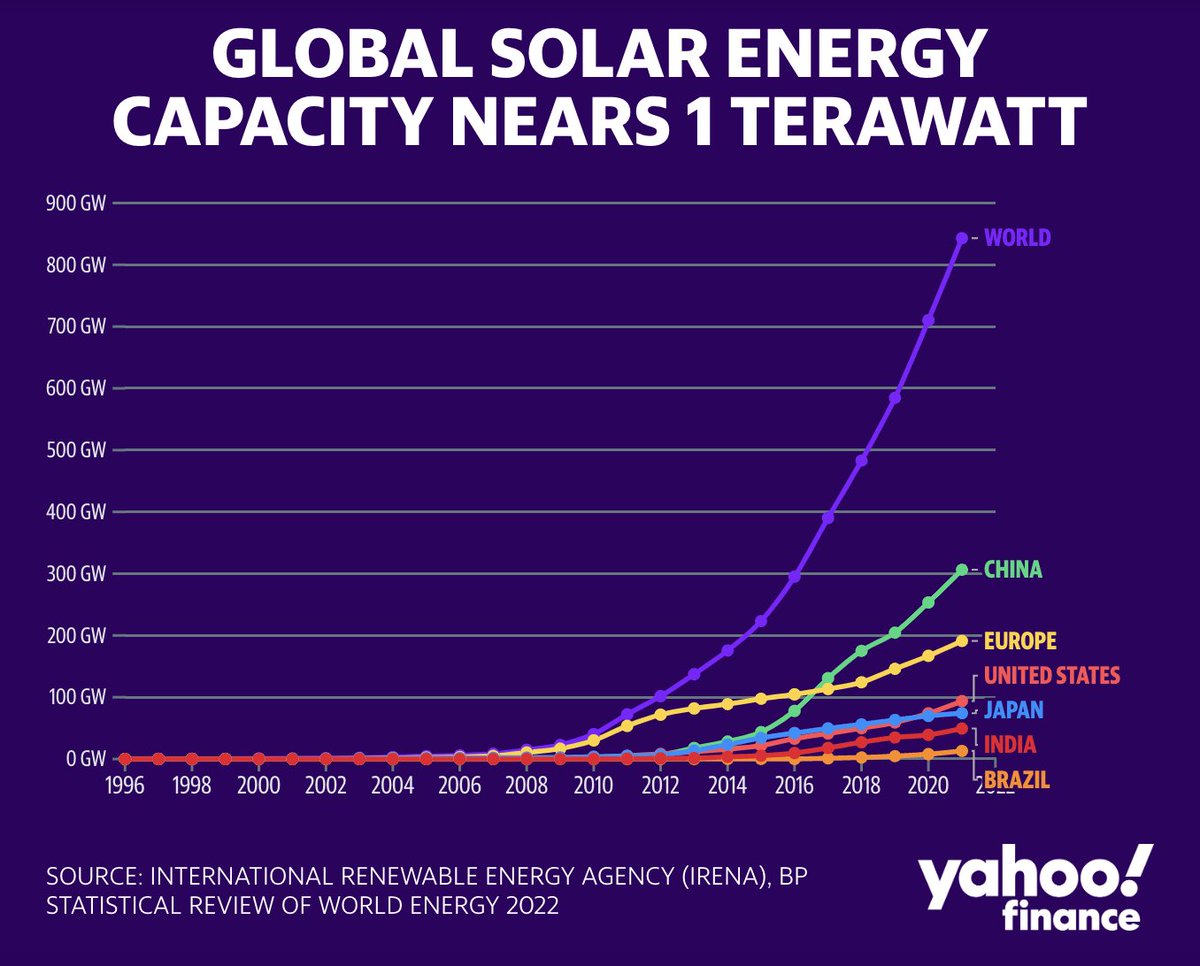

Note the largest industrial use - solar. While reasonable people can debate where we should be focusing, the reality is solar is seeing incredible growth and is getting massive subsidies from global governments.

Note the largest industrial use - solar. While reasonable people can debate where we should be focusing, the reality is solar is seeing incredible growth and is getting massive subsidies from global governments.

Nobody knows how much faster growth will accelerate because of this push. But, an estimate from Bloomberg says 30%. finance.yahoo.com/news/global-so…

This is occurring while many in the industry say we've reached the limit of "thrifting," aka reducing silver load per panel. I believe we'll see much more than 12% growth here as estimated by the Silver Institute.

It's estimated that electric vehicles use over 100 moz/year. Global governments are rolling out massive subsidies to increase adoption.

Also, the secular demand increases are largely intact. Billions of humans in EM will continue their ascent out of poverty

Also, the secular demand increases are largely intact. Billions of humans in EM will continue their ascent out of poverty

Getting electricity, phones, TVs, etc, all of which require silver.

So for the two people still with me, if supply is headed down and demand is headed up, is any of this reflected in the markets? The answer is yes if you know where to look.

So for the two people still with me, if supply is headed down and demand is headed up, is any of this reflected in the markets? The answer is yes if you know where to look.

Let's start with the CoT report:

Historically, this is bullish. Why? Commercial banks have an enormous amount of... "influence" in the Silver market. JP Morgan is the largest holder of physical silver in the world. If they are long (I assume from

https://twitter.com/profitsplusid/status/1568353286792843264

Historically, this is bullish. Why? Commercial banks have an enormous amount of... "influence" in the Silver market. JP Morgan is the largest holder of physical silver in the world. If they are long (I assume from

this report. Could be other banks) you want to be on their side of the trade.

Next, the cost to borrow SLV is skyrocketing:

Next, the cost to borrow SLV is skyrocketing:

https://twitter.com/profitsplusid/status/1568282403604660225

What happens next? @contrarian8888 puts it well:

@mikesay98 reports exchange inventory volumes often. Silver is leaving the vaults - and fast:

https://twitter.com/contrarian8888/status/1564642355650641920

@mikesay98 reports exchange inventory volumes often. Silver is leaving the vaults - and fast:

https://twitter.com/mikesay98/status/1567925955129397248

A hat tip in this thread to @SRSroccoReport who has been pounding the table that the energy cliff would drive investors into silver.

I'll end on sentiment. Silver is HATED. Go read #silver twit. People have completely given up. Even the bulls are like "love it long term but

I'll end on sentiment. Silver is HATED. Go read #silver twit. People have completely given up. Even the bulls are like "love it long term but

the charts say $15. Hold off."

Maybe it does go to $15. But keep in mind that historically, silver prices in future events with the foresight and precision of a time traveler. When the "reasons" to own silver appear in the mainstream (e.g. a Fed pivot)

Maybe it does go to $15. But keep in mind that historically, silver prices in future events with the foresight and precision of a time traveler. When the "reasons" to own silver appear in the mainstream (e.g. a Fed pivot)

much of the move will be priced in and those who pile in will whine it "doesn't work" because they were late.

Now is your shot.

Now is your shot.

• • •

Missing some Tweet in this thread? You can try to

force a refresh