A Sources and Uses analysis for any company can be helpful when analyzing a potential investment

#SMB #investing #valuation

Let's look at $ADBE 👇(1-5)

#SMB #investing #valuation

Let's look at $ADBE 👇(1-5)

1/5 $ADBE 's

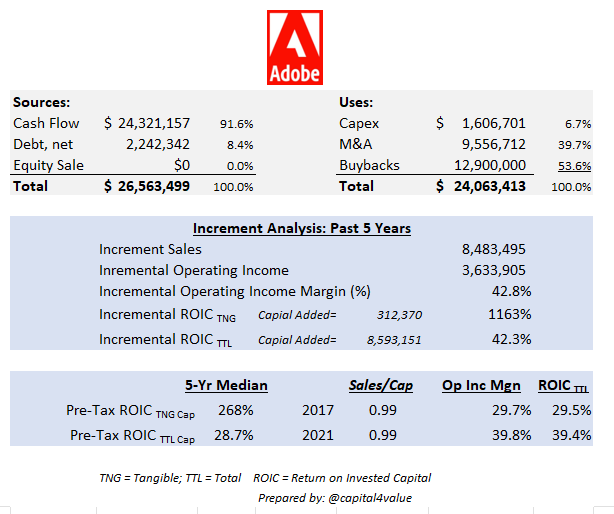

Sources: Primarily cash flow from operations. Debt is used for acquisitions.

Uses: A capital light business so little on Capex. The main uses are M&A and Buybacks.

Let's review why $ADBE buys back so much stock, but first we need to look at returns on capital

Sources: Primarily cash flow from operations. Debt is used for acquisitions.

Uses: A capital light business so little on Capex. The main uses are M&A and Buybacks.

Let's review why $ADBE buys back so much stock, but first we need to look at returns on capital

2/5 During past 5 years, $ADBE increased sales by $8.5b, and Opr Inc by $3.6b for an incremental margin of 42.8%

Same period, added $8.6b in total capital & generated a 42% return on that capital. Impressive!

Total capital incudes NWC, PPE, & Goodwill/Intangibles

Same period, added $8.6b in total capital & generated a 42% return on that capital. Impressive!

Total capital incudes NWC, PPE, & Goodwill/Intangibles

3/5 Adobe earns high returns on tangible capital (excl Goodwill) and total capital

Ttl Capital is the best measure b/c $ADBE is acquisitive

ROIC improved from 2017 to 2021, due to improvements in operating margins 29% -> 39%

Margins are the primary driver for high ROICs

Ttl Capital is the best measure b/c $ADBE is acquisitive

ROIC improved from 2017 to 2021, due to improvements in operating margins 29% -> 39%

Margins are the primary driver for high ROICs

4/5

Adobe's Sales to capital ratio has remained flat from 2017 to 2021 at .99x

A .99x is a 1-to-1 ratio of sales to capital. If sales were to double, so would the capital base

This suggests $ADBE has little ability to improve its capital usage to increase ROIC

Adobe's Sales to capital ratio has remained flat from 2017 to 2021 at .99x

A .99x is a 1-to-1 ratio of sales to capital. If sales were to double, so would the capital base

This suggests $ADBE has little ability to improve its capital usage to increase ROIC

5/5

Why does $ADBE buyback so much stock?

$ADBE earns such high ROICs (39%) and has very little reinvestment requirements that the company has lots of cash available for distribution that benefits shareholders.

This is why ROIC matters

These are signs of a very good business

Why does $ADBE buyback so much stock?

$ADBE earns such high ROICs (39%) and has very little reinvestment requirements that the company has lots of cash available for distribution that benefits shareholders.

This is why ROIC matters

These are signs of a very good business

• • •

Missing some Tweet in this thread? You can try to

force a refresh