All Things Valuation Related | I value all businesses both Public & Private | Follow to learn how | Charlie Stanton, CFA

How to get URL link on X (Twitter) App

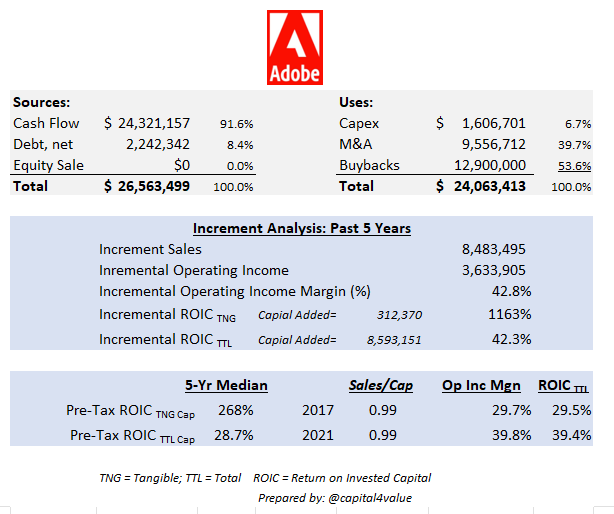

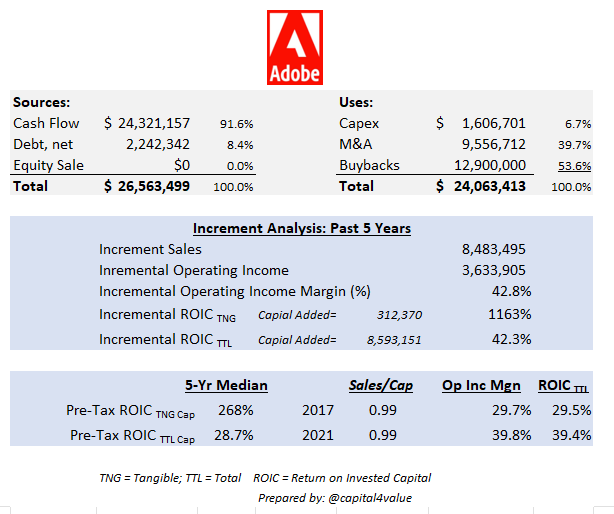

1/5 $ADBE 's

1/5 $ADBE 's