#NIFTY

Faced resistance at 18115 i.e. near highs of April 2022

Outlook for the week Sep 19 - Sep 23, 2022.

THREAD: Deconstructing NIFTY on 4 different TF's.

Faced resistance at 18115 i.e. near highs of April 2022

Outlook for the week Sep 19 - Sep 23, 2022.

THREAD: Deconstructing NIFTY on 4 different TF's.

#NIFTY

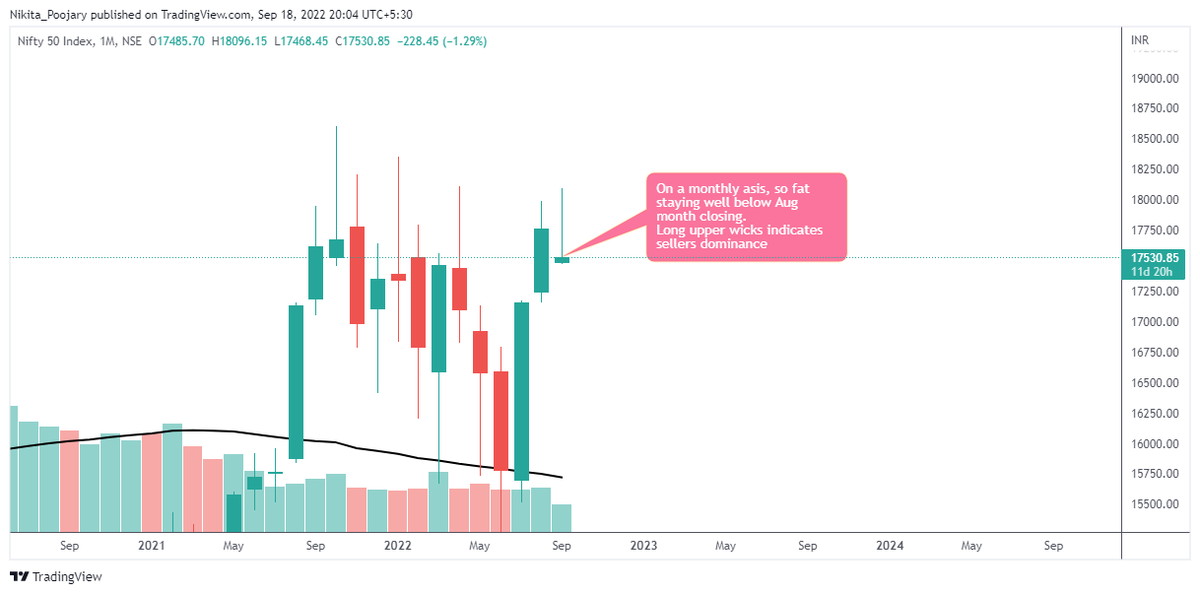

1. Monthly TF:

• Current month unable to sustain near August close.

• Sellers presence > 18k.

• NF would underperform BNF (due to sectors like IT, Metals, Pharma).

1. Monthly TF:

• Current month unable to sustain near August close.

• Sellers presence > 18k.

• NF would underperform BNF (due to sectors like IT, Metals, Pharma).

#NIFTY

2. Weekly TF:

• Bearish engulfing under formation, however need to wait for the confirmation.

• On a higher TF, expecting NF to make a fresh ATH in the upcoming months.

• However, for the current week we might see sideways action with some -ve bias.

2. Weekly TF:

• Bearish engulfing under formation, however need to wait for the confirmation.

• On a higher TF, expecting NF to make a fresh ATH in the upcoming months.

• However, for the current week we might see sideways action with some -ve bias.

#NIFTY

3. Daily TF:

• Closed well below low of Sep 14 candle.

• 18100 CE likely to go to 0 for the current week.

•Closing below 17150 on daily might open the levels for 16750.

3. Daily TF:

• Closed well below low of Sep 14 candle.

• 18100 CE likely to go to 0 for the current week.

•Closing below 17150 on daily might open the levels for 16750.

Conclusion:

•18115 might be the ceiling for the current week.

• Expecting some healthy correction before the next leg up for ATH in coming months, before the end of 2022.

• Closing below 17350 on daily might open the levels for 16750.

•18115 might be the ceiling for the current week.

• Expecting some healthy correction before the next leg up for ATH in coming months, before the end of 2022.

• Closing below 17350 on daily might open the levels for 16750.

We have an upcoming two day workshop on October 15th and 16th, 2022.

Venue: Andheri East.

Go through these links and sign up for the workshop.

- FAQ here: bit.ly/3wRBirR

- Registration form: bit.ly/3ezh4Nk

Venue: Andheri East.

Go through these links and sign up for the workshop.

- FAQ here: bit.ly/3wRBirR

- Registration form: bit.ly/3ezh4Nk

I regularly share weekly outlook on indices (NIFTY & BANKNIFTY) and many more threads on trading & finance.

If you enjoyed this, then do check out the outlook for #BANKNIFTY by clicking here:

If you enjoyed this, then do check out the outlook for #BANKNIFTY by clicking here:

https://twitter.com/niki_poojary/status/1571476591607427074?s=20&t=Pgck4ltJbIamdEyrnGRe5g

• • •

Missing some Tweet in this thread? You can try to

force a refresh