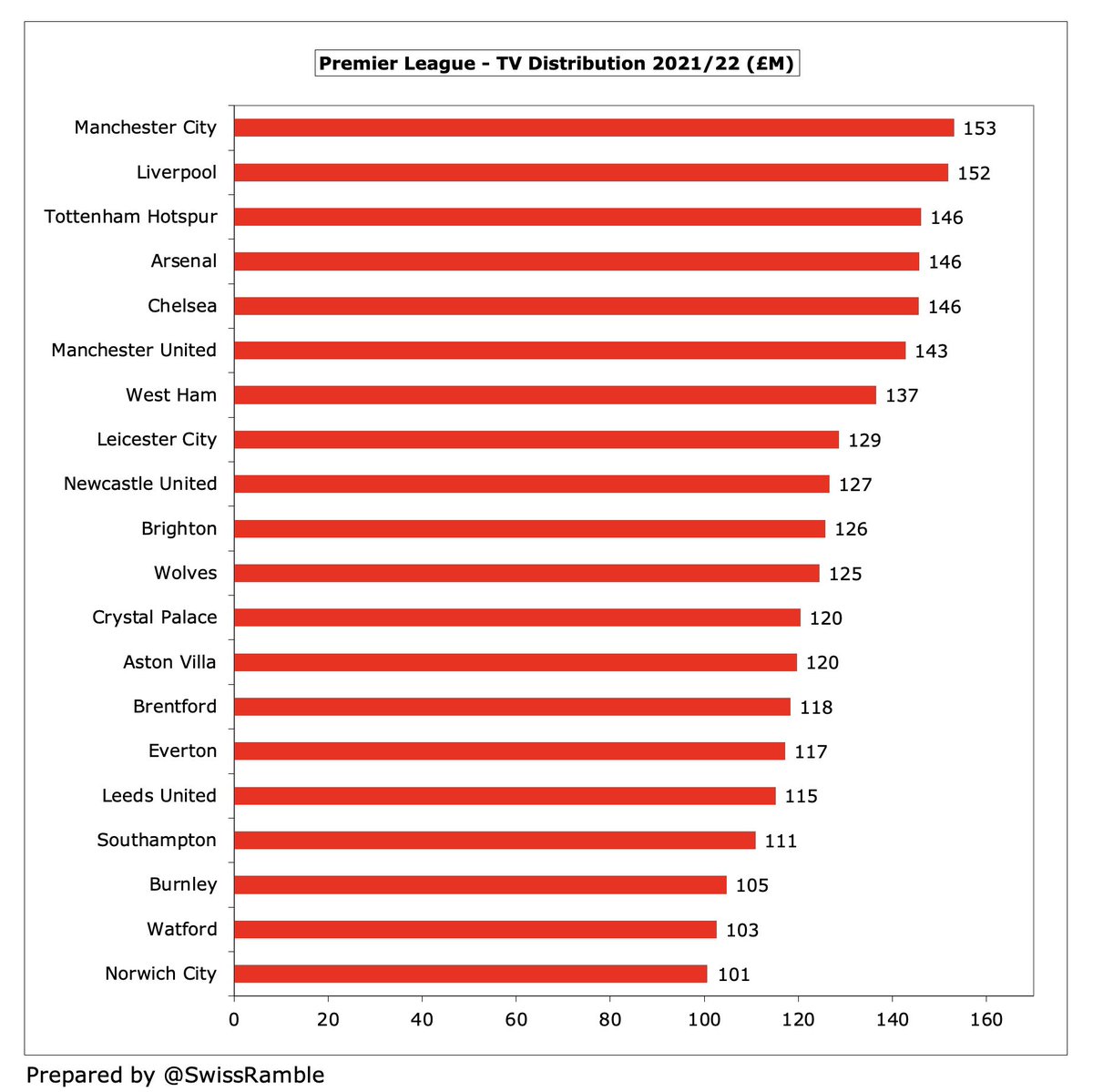

The Premier League has published details of the TV payments to clubs for the 2021/22 season. These amounted to £2.5 bln, ranging from £153m for champions #MCFC to £101m for 20th placed #NCFC (the first time the bottom club got more than £100m).

The largest increases compared to the previous season came at #BHAFC, up £16m, and #AFC, up £11m. In contrast, three clubs received over £10m less than 2020/21: #LUFC £17m, #EFC £13m and #LCFC £11m.

Each of the 20 Premier League clubs received £87.5m as an equal share, coming from domestic rights £31.8m, overseas rights £48.9m and commercial revenue £6.8m.

Merit payment depends on finishing place in the league, ranging from £41.1m for champions #MCFC to £2.1m for 20th placed #NCFC. There has always been a merit payment for domestic rights, but latest deal also introduced a merit element for overseas rights. Each place worth £2.1m.

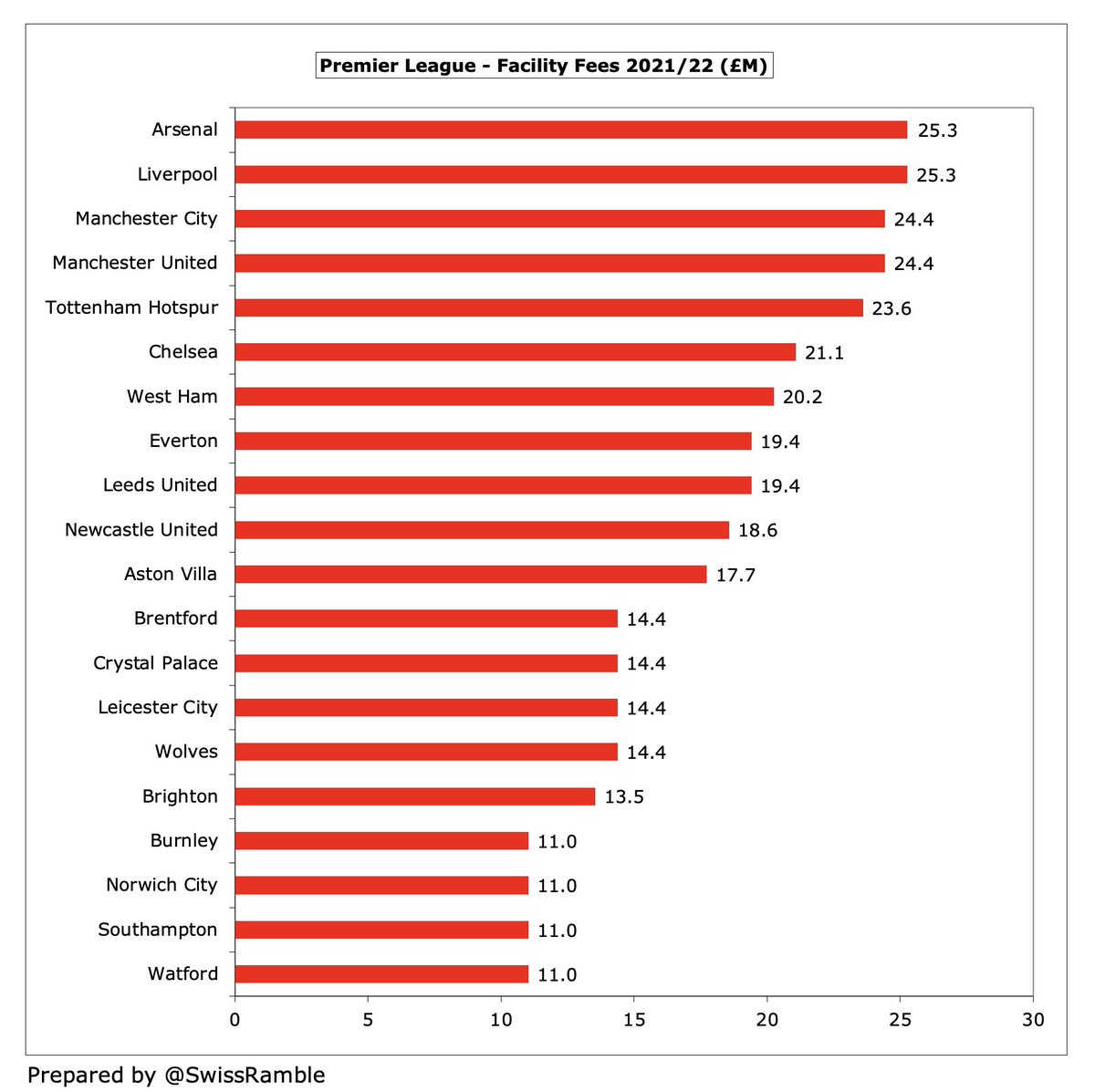

Facility fees are paid based on the number of games broadcast live. In 2021/22 the minimum payment was £11.0m for 12 live games, while the maximum was £25.3m for 29 games (for both #AFC and #LFC). Each live game is worth an additional £0.8m.

A club that is frequently broadcast live can actually earn more than a club finishing above it in the league, e.g. in 20221/22 #AFC finished 5th in the league, but received more money than 3rd placed #CFC, as they were shown live 5 more times (29 games vs 24).

The split of TV payments in the Premier League highlights the importance of the equal share, especially for clubs finishing lower, e.g. #NCFC £101m total TV money was very largely driven by the £88m equal share, while this contributed to only 57% of #MCFC £153m.

In total the Premier League £2.5 bln TV money was split as follows: equal share £1.75 bln (69%), merit payments £432m (17%) and facility fees £355m (14%).

The TV money distribution method in the Premier League remains the most equitable of Europe’s major football leagues with the ratio from top to bottom earning club being only 1.5. This is much better than other leagues: Serie A 2.7, Bundesliga 3.1, Ligue 1 3.1 and La Liga 3.5.

• • •

Missing some Tweet in this thread? You can try to

force a refresh