This thread will teach you several more ways to find potential #crypto #altcoin gems such as:

$MATIC +44,000%,

$SOL +51,000%,

$EGLD +11,000%,

$LUNA +11,000% before it went to 0

early.

A part 2 continuation of my first thread that you guys loved to help you print millions 👇🏽

$MATIC +44,000%,

$SOL +51,000%,

$EGLD +11,000%,

$LUNA +11,000% before it went to 0

early.

A part 2 continuation of my first thread that you guys loved to help you print millions 👇🏽

If you haven’t read Part 1 that goes deep into tracking new #altcoins and narratives focusing on Binance launchpad assets, please do so here:

https://twitter.com/MacnBTC/status/1569732990112079873

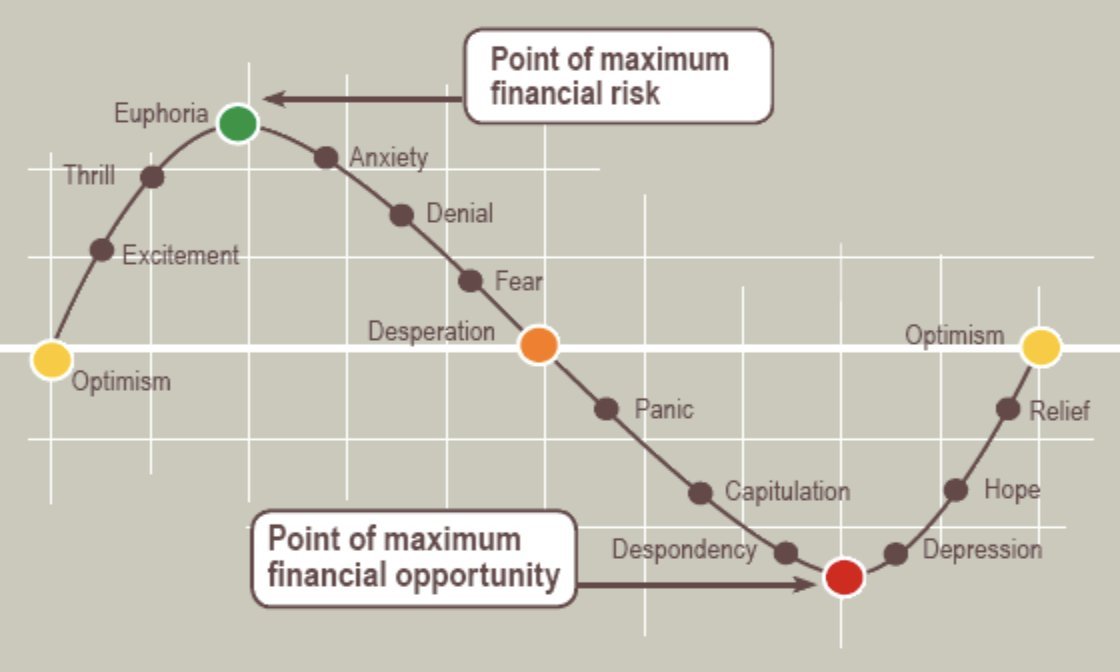

There are few times a year where the market literally drops you free money and you just have to pay attention and pick it up.

Why does it matter if we get into projects early, even before they are listed and trading?

Why does it matter if we get into projects early, even before they are listed and trading?

Most high quality projects aim to reward early community members.

This is often with some form of a:

- Retroactive Airdrop

- Whitelist

- Community Sale Allocation

etc.

These can be highly profitable and often require minimal effort.

This is often with some form of a:

- Retroactive Airdrop

- Whitelist

- Community Sale Allocation

etc.

These can be highly profitable and often require minimal effort.

Last bullrun we had several airdrops worth $50k-$250k+ rewarded to users that beta tested a protocol, ran nodes or just joined the discord early and stayed active.

I mean getting $50k for joining a discord and saying “gm” sounds fkn great but how do we find these projects?

I mean getting $50k for joining a discord and saying “gm” sounds fkn great but how do we find these projects?

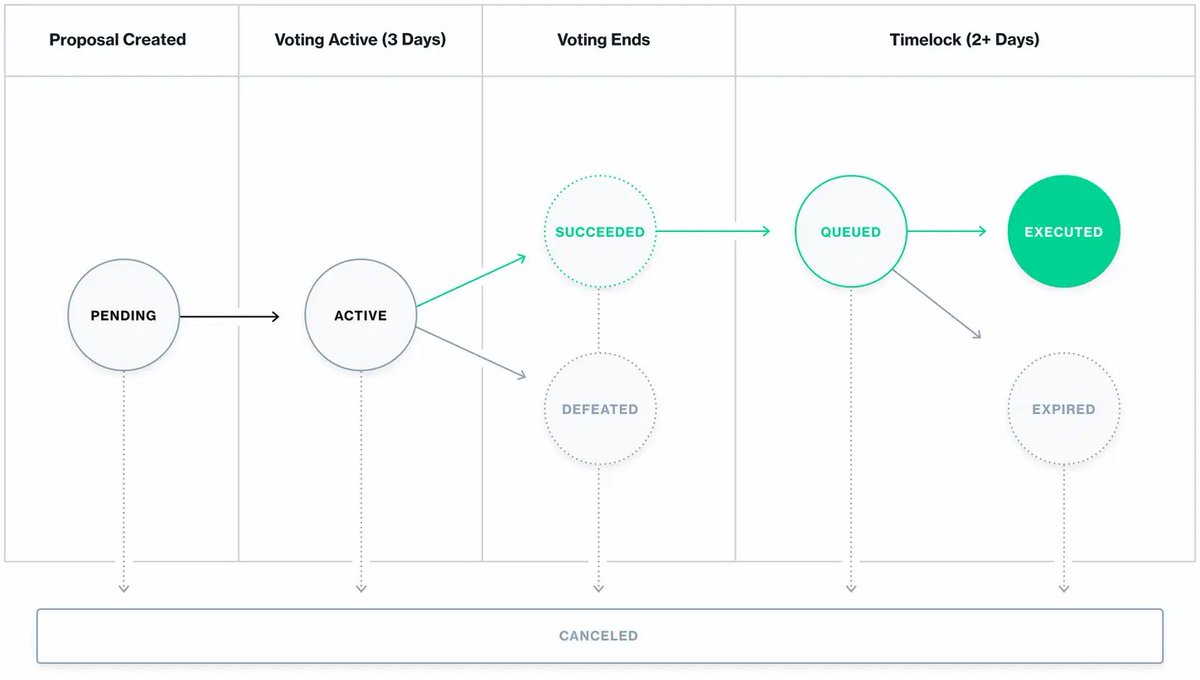

1) Keeping track of Governance forums of existing protocols and infrastructure projects.

Most crypto projects that aim to be decentralised are “run” by some sort of governance.

Most crypto projects that aim to be decentralised are “run” by some sort of governance.

Governance forums are places where the community discusses and makes proposals that the token holders then vote on.

Oftentimes new tokens have been announced/hinted at in the governance forums, there is a lot of alpha that can be found if you pay attention.

Oftentimes new tokens have been announced/hinted at in the governance forums, there is a lot of alpha that can be found if you pay attention.

Governance forums to keep track of:

• All infrastructure projects such as $OP, $METIS etc

coingecko.com/en/categories/…

• All DeFi protocols:

coingecko.com/en/categories/…

• Projects that haven’t launched their token yet but have finished raising and have a governance board

• All infrastructure projects such as $OP, $METIS etc

coingecko.com/en/categories/…

• All DeFi protocols:

coingecko.com/en/categories/…

• Projects that haven’t launched their token yet but have finished raising and have a governance board

2) Keeping track of projects doing different forms of community accessible sales and listings such as:

- Balancer LBPs: We had a few months last run where LBPs such as Copper that everyone could access were popular and several projects pumped and ran few hundred %

- Balancer LBPs: We had a few months last run where LBPs such as Copper that everyone could access were popular and several projects pumped and ran few hundred %

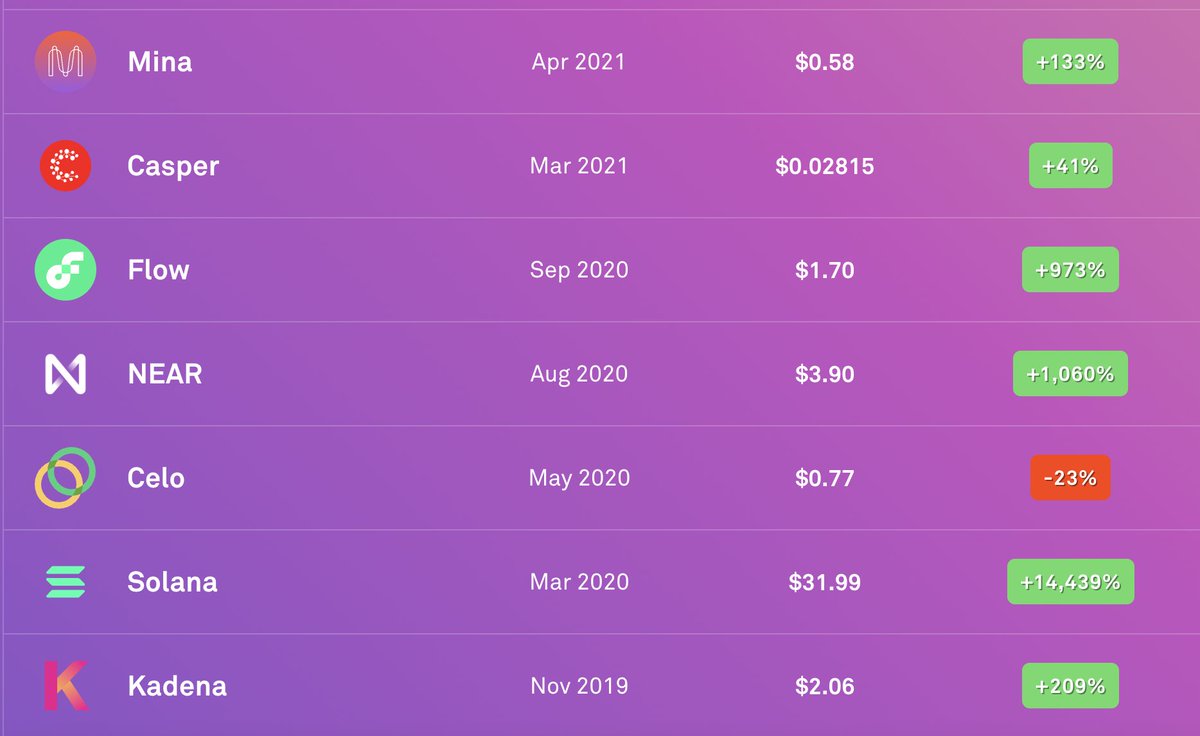

- Coinlist: coinlist.co does community sales of (mostly) highly curated assets that raised from good VCs

Several assets such as $MINA, $CSPR, $FLOW, $NEAR, $SOL, $KDN had their sales there.

Several assets such as $MINA, $CSPR, $FLOW, $NEAR, $SOL, $KDN had their sales there.

- IDOs/Public Sales on DEX platforms etc: For the most part 99% of the projects you find launched this way are shit but from time to time there can be this one that is halfway good. This way of sales used to pump hard for a short while last run.

TLDR keep track of new narratives

TLDR keep track of new narratives

- Primary listings: Often times, especially recently projects have stopped doing any form of public sales and started listing directly on exchanges.

Join this free Telegram to keep track of exchange listings: t.me/layergg

Join this free Telegram to keep track of exchange listings: t.me/layergg

It takes a lot of skill analyzing token metrics to know if something is a good buy on listing.

Most times especially now its best to wait.

Most times especially now its best to wait.

3) Keeping track of grants and hackathons

New projects that often still haven't raised get granted money from infrastructure ecosystem funds such as $MATIC ecosystem fund.

There is no one common page where all of these are found but advanced search function is your friend

New projects that often still haven't raised get granted money from infrastructure ecosystem funds such as $MATIC ecosystem fund.

There is no one common page where all of these are found but advanced search function is your friend

Aside from ecosystem grants:

- Gitcoin: coinlist.co

- DoraHacks: dorahacks.io/hackathon

(blockchaingrants.org)

- Gitcoin: coinlist.co

- DoraHacks: dorahacks.io/hackathon

(blockchaingrants.org)

Hackathons are coding competitions where a mix of nerds and chads code projects in a short timespan and the best projects win prizes/funding.

New infrastructure projects are aggressively pushing hackathons as it is the easiest way to get new projects on their ghost chain.

New infrastructure projects are aggressively pushing hackathons as it is the easiest way to get new projects on their ghost chain.

To track:

- Conferences arranged by infrastructure projects (often have hackatons)

- Winners of the hackatons (project + founding team)

Many of these hackaton winners went on to be be x10-x100 projects

- Conferences arranged by infrastructure projects (often have hackatons)

- Winners of the hackatons (project + founding team)

Many of these hackaton winners went on to be be x10-x100 projects

Bottom line: most high quality projects will reward early community members in some sort of way.

If they aren't then they are simply stupid because it is the easiest way to acquire early growth momentum.

It pays to be early.

If they aren't then they are simply stupid because it is the easiest way to acquire early growth momentum.

It pays to be early.

That’s it!

1) Follow @MacnBTC

2) Join my Telegram: t.me/teammacnbtc

In part 3 I will explain the importance of keeping track of founders/networking/curating your Twitter feed to helping you earn millions - less shitposters, more alpha.

Don't miss it!

1) Follow @MacnBTC

2) Join my Telegram: t.me/teammacnbtc

In part 3 I will explain the importance of keeping track of founders/networking/curating your Twitter feed to helping you earn millions - less shitposters, more alpha.

Don't miss it!

• • •

Missing some Tweet in this thread? You can try to

force a refresh