The FOMC is the primary monetary policy decision making body within the federal reserve.

How do these 12 unelected people reach decisions on monetary policy that affects billions of people?

Let’s take a look 🧵

1/14

How do these 12 unelected people reach decisions on monetary policy that affects billions of people?

Let’s take a look 🧵

1/14

2/

We’ve written about the FOMC before: who it’s made up of and what they (are supposed to) do and how the FOMC came into existence:

We’ve written about the FOMC before: who it’s made up of and what they (are supposed to) do and how the FOMC came into existence:

https://twitter.com/CoinbitsApp/status/1552287842910478336

3/

We also wrote about how the Federal Reserve (the Fed) attempts to “maintain financial stability”:

We also wrote about how the Federal Reserve (the Fed) attempts to “maintain financial stability”:

https://twitter.com/coinbitsapp/status/1567846803579469824

4/

This thread is about the process for the meetings where they decide on monetary policy.

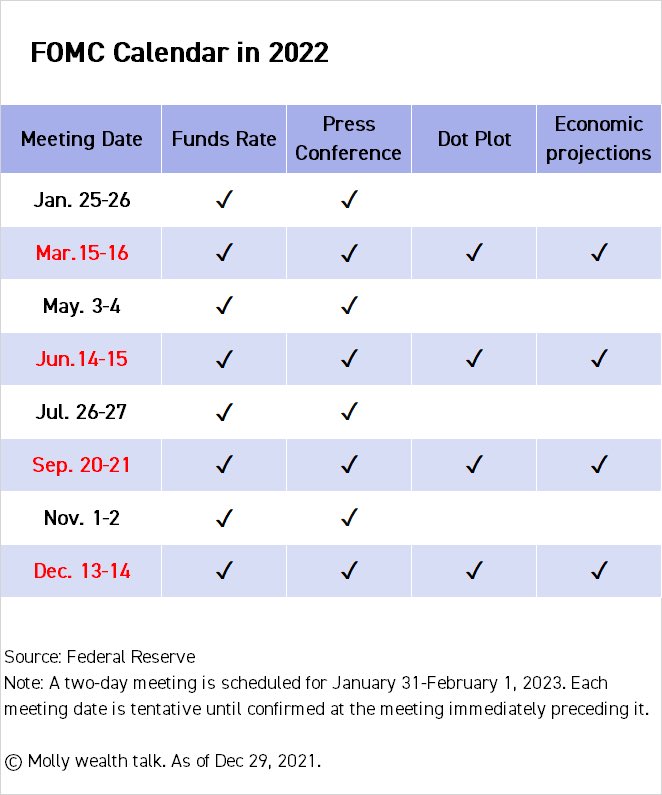

By law, the FOMC must meet at least four times each year in Washington, D.C. Since 1981, eight regularly scheduled meetings have been held each year at intervals of five to eight weeks.

This thread is about the process for the meetings where they decide on monetary policy.

By law, the FOMC must meet at least four times each year in Washington, D.C. Since 1981, eight regularly scheduled meetings have been held each year at intervals of five to eight weeks.

5/

At each meeting, the FOMC votes on the policy to be carried out during the period between meetings.

If circumstances require an action between meetings, members may be called on to participate in a special meeting or teleconference, or to vote on a proposed action by proxy.

At each meeting, the FOMC votes on the policy to be carried out during the period between meetings.

If circumstances require an action between meetings, members may be called on to participate in a special meeting or teleconference, or to vote on a proposed action by proxy.

6/

Meeting Process:

Before each meeting of the FOMC, Fed staff prepare written reports on past and prospective economic and financial developments that are sent to Committee members and to nonmember Reserve Bank presidents.

Meeting Process:

Before each meeting of the FOMC, Fed staff prepare written reports on past and prospective economic and financial developments that are sent to Committee members and to nonmember Reserve Bank presidents.

7/

Additional reports prepared by the Manager of the System Open Market Account on operations in the domestic open market and in foreign currencies since the last regular meeting are also distributed.

Additional reports prepared by the Manager of the System Open Market Account on operations in the domestic open market and in foreign currencies since the last regular meeting are also distributed.

8/

At the meeting itself, staff officers present oral reports on the current and prospective business situation, on conditions in financial markets, and on international financial developments.

At the meeting itself, staff officers present oral reports on the current and prospective business situation, on conditions in financial markets, and on international financial developments.

9/

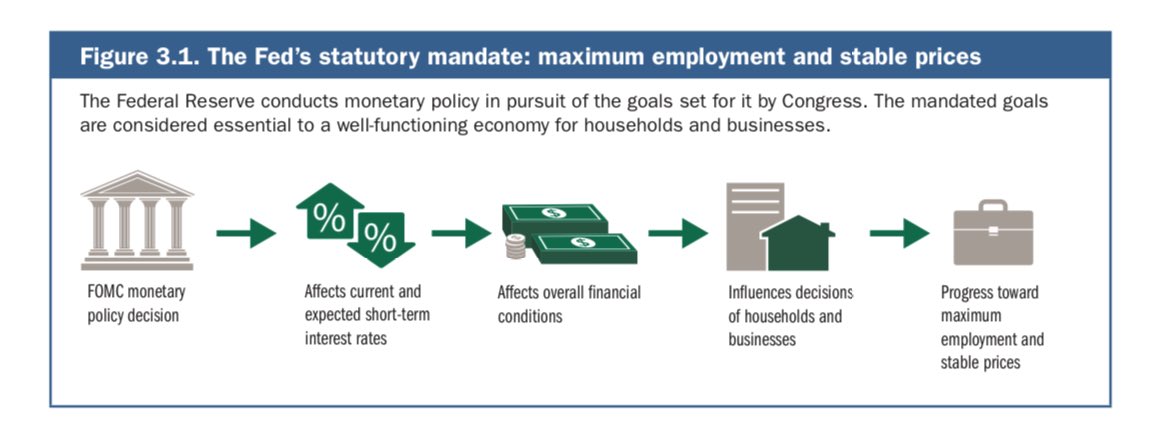

The FOMC considers factors such as trends in prices and wages, employment and production, consumer income and spending, construction, business investment and inventories, foreign exchange markets, interest rates, money and credit aggregates, and fiscal policy.

The FOMC considers factors such as trends in prices and wages, employment and production, consumer income and spending, construction, business investment and inventories, foreign exchange markets, interest rates, money and credit aggregates, and fiscal policy.

10/

After these reports, they then turn to policy. Each participant expresses their own views on the state of the economy and on the appropriate direction for monetary policy. Then each makes a more explicit recommendation on policy for the coming inter-meeting period

After these reports, they then turn to policy. Each participant expresses their own views on the state of the economy and on the appropriate direction for monetary policy. Then each makes a more explicit recommendation on policy for the coming inter-meeting period

11/

Finally, the Committee must reach a consensus regarding the appropriate course for policy, which is incorporated in a directive to the Federal Reserve Bank of New York—the Bank that executes transactions for the System Open Market Account.

Finally, the Committee must reach a consensus regarding the appropriate course for policy, which is incorporated in a directive to the Federal Reserve Bank of New York—the Bank that executes transactions for the System Open Market Account.

12/

The directive is cast in terms designed to provide guidance to the Manager in the conduct of day-to-day open market operations: ie how to buy and sell US treasuries

It also sets the Committee's objectives for long-run growth of key monetary and credit aggregates.

The directive is cast in terms designed to provide guidance to the Manager in the conduct of day-to-day open market operations: ie how to buy and sell US treasuries

It also sets the Committee's objectives for long-run growth of key monetary and credit aggregates.

13/

This is the asinine system by which 12 unelected officials dictate what the price of money should be.

It is arcane, can’t possibly reflect all the nuances of an intricate global economy, even if the decision makers were completely objective and neutral.

An impossible task

This is the asinine system by which 12 unelected officials dictate what the price of money should be.

It is arcane, can’t possibly reflect all the nuances of an intricate global economy, even if the decision makers were completely objective and neutral.

An impossible task

14/14

#bitcoin fixes this.

Monetary policy: transparent and set forever from the get-go.

Meetings: none

Reports: none

Subjective decision-makers: none.

Voting: 🤣 no.

“Aggregates”: 21,000,000.

Consensus: still reached. Every 10 minutes on average.

#bitcoin fixes this.

Monetary policy: transparent and set forever from the get-go.

Meetings: none

Reports: none

Subjective decision-makers: none.

Voting: 🤣 no.

“Aggregates”: 21,000,000.

Consensus: still reached. Every 10 minutes on average.

• • •

Missing some Tweet in this thread? You can try to

force a refresh