#BANKNIFTY

A pause/ a healthy correction before the next leg up

Outlook for the week Sep 26 - Sep 30, 2022.

THREAD: Deconstructing BANKNIFTY on 4 different TF's.

A pause/ a healthy correction before the next leg up

Outlook for the week Sep 26 - Sep 30, 2022.

THREAD: Deconstructing BANKNIFTY on 4 different TF's.

#BANKNIFTY

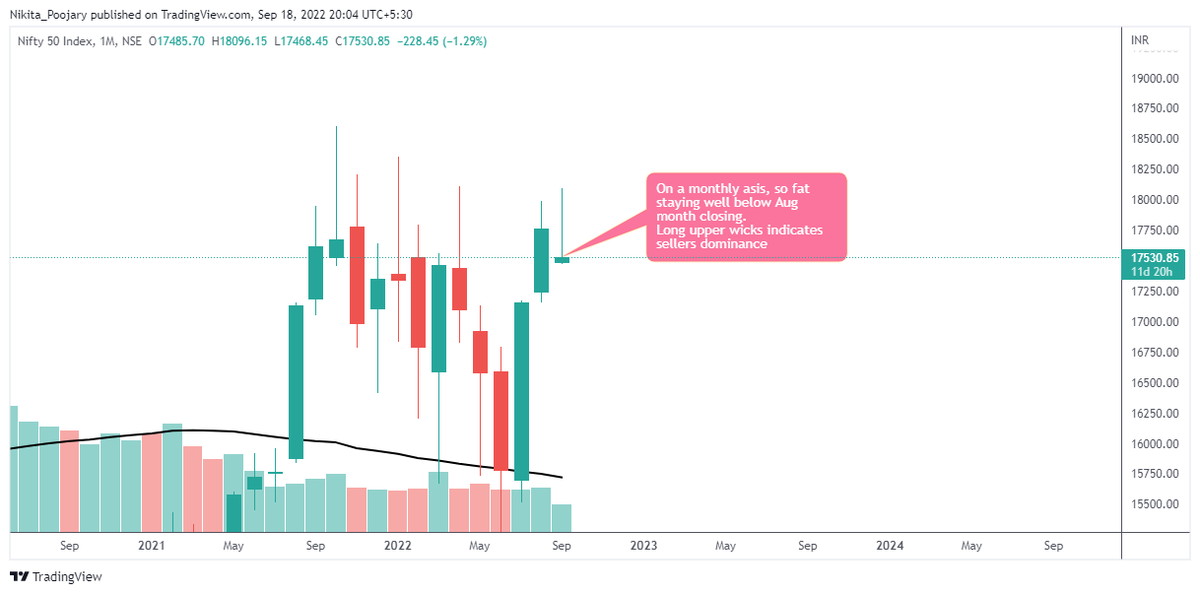

1. Monthly TF:

• Third consecutive month of upmove, although faced resistance at 41830

• Clear presence of the sellers at higher levels, and BNF is back in the August 2022 range.

• Expecting a healthy correction before hitting a ATH in 2022.

1. Monthly TF:

• Third consecutive month of upmove, although faced resistance at 41830

• Clear presence of the sellers at higher levels, and BNF is back in the August 2022 range.

• Expecting a healthy correction before hitting a ATH in 2022.

#BANKNIFTY

2. Weekly TF:

• 2nd tgt of the channel BO will take few more weeks.

• Evening star under formation

•As per Fibo, the upmove which started since June 2022, may retrace upto 38.2% i.e. 38200 levels.

• A healthy correction before the next leg up towards ATH

2. Weekly TF:

• 2nd tgt of the channel BO will take few more weeks.

• Evening star under formation

•As per Fibo, the upmove which started since June 2022, may retrace upto 38.2% i.e. 38200 levels.

• A healthy correction before the next leg up towards ATH

#BANKNIFTY

3. Daily TF:

• Clear BD of the M pattern

• Sellers have entered near 41800-41500 levels

• Broke the low of Sep 14, 2022 candle, and now bears are in control.

3. Daily TF:

• Clear BD of the M pattern

• Sellers have entered near 41800-41500 levels

• Broke the low of Sep 14, 2022 candle, and now bears are in control.

#BANKNIFTY

4. Hourly TF:

• S/R mentioned on the charts.

• Remember Fibo 38.2% retracement is around 38200

4. Hourly TF:

• S/R mentioned on the charts.

• Remember Fibo 38.2% retracement is around 38200

#BANKNIFTY

Conclusion:

• After almost 3 months of one sided rally, a small correction would be healthy for the next up move.

• Current week would be monthly expiry.

• Event: Friday, Sep 30, 2022 - RBI policy.

Conclusion:

• After almost 3 months of one sided rally, a small correction would be healthy for the next up move.

• Current week would be monthly expiry.

• Event: Friday, Sep 30, 2022 - RBI policy.

Strategy: For the current week the texture has changed to sell on rise.

We have an upcoming two day workshop on October 15th and 16th, 2022.

Venue: Andheri East.

Go through these links and sign up for the workshop.

- FAQ here: bit.ly/3wRBirR

- Registration form: bit.ly/3ezh4Nk

Venue: Andheri East.

Go through these links and sign up for the workshop.

- FAQ here: bit.ly/3wRBirR

- Registration form: bit.ly/3ezh4Nk

• • •

Missing some Tweet in this thread? You can try to

force a refresh