Look y'all, I'm not saying the halving isn't cool. It's an engineering marvel.

But I will make the argument that the halving doesn't drive price action the way its reputation suggests, and I think a lot of folks have it wrong.

Some charts and ideas 🧵

But I will make the argument that the halving doesn't drive price action the way its reputation suggests, and I think a lot of folks have it wrong.

Some charts and ideas 🧵

https://twitter.com/TXMCtrades/status/1574387149495050242

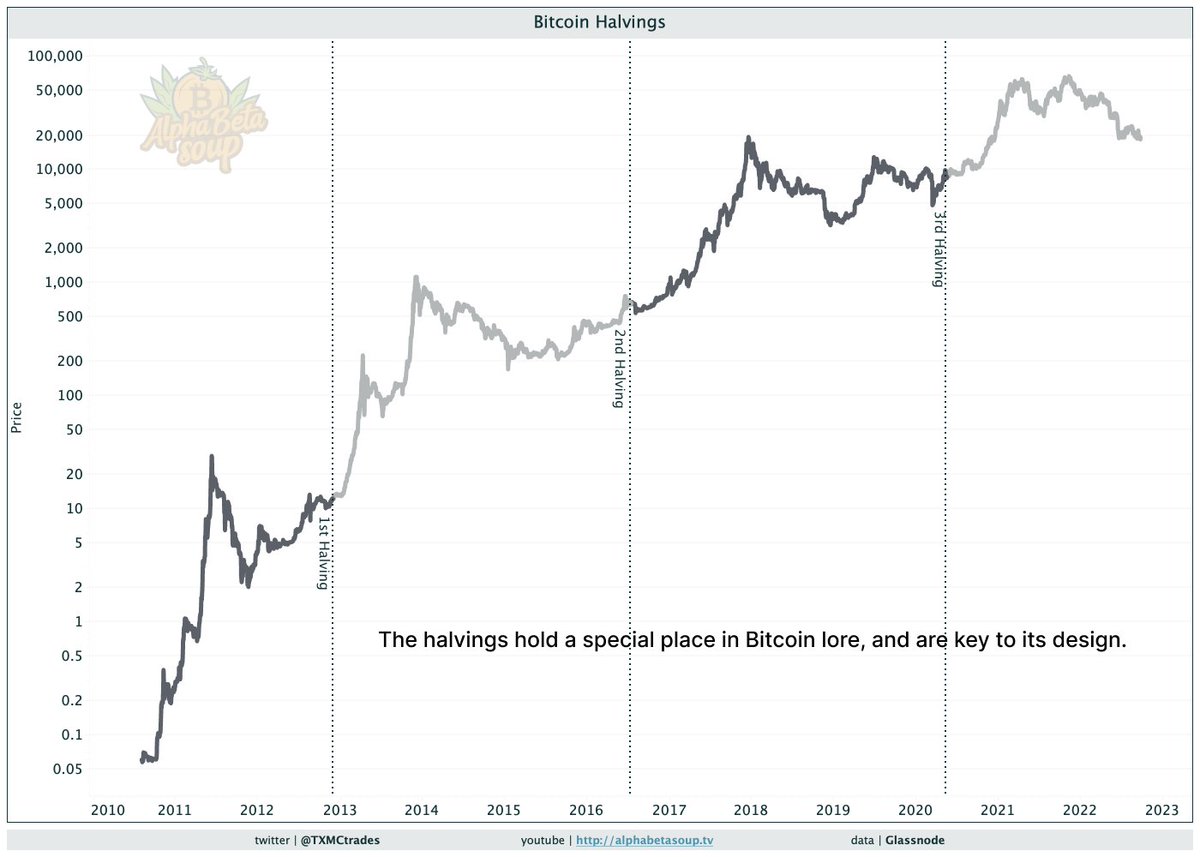

The halving is a magical event where the issuance rate of new #BTC is halved every 210,000 blocks.

It is fundamental to Bitcoin's design.

It is also arguably the most well known, most priced-in aspect of Bitcoin. The entire issuance schedule is known over a century in advance!

It is fundamental to Bitcoin's design.

It is also arguably the most well known, most priced-in aspect of Bitcoin. The entire issuance schedule is known over a century in advance!

Historically, price has mooned within months after the halving, which gave a reputation of bullishness to the event itself.

I argue this credit is misplaced, namely because it is known in advance, but also because daily issuance is not determining market depth nor demand.

I argue this credit is misplaced, namely because it is known in advance, but also because daily issuance is not determining market depth nor demand.

You see, markets are forward looking, and they discount all known information into the present.

The halving is a known event. The specific date and time can be estimated with relative accuracy. All miners have the same information as it is vital for their business models.

The halving is a known event. The specific date and time can be estimated with relative accuracy. All miners have the same information as it is vital for their business models.

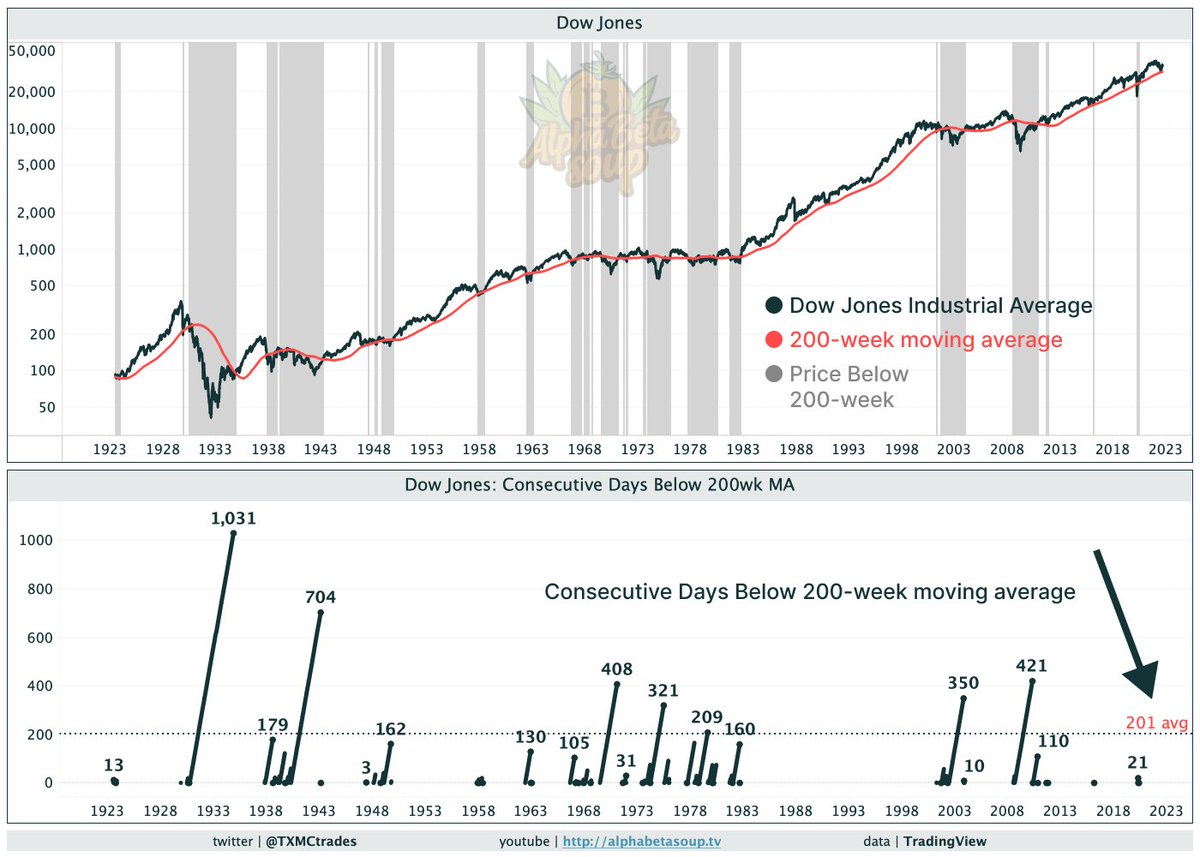

What drives *all* markets, as I've said countless times, are credit conditions and monetary policy. The cost of capital and availability of collateral drive most flows.

Bitcoin, the premiere risk asset, is impacted by these factors in much the same way.

Bitcoin, the premiere risk asset, is impacted by these factors in much the same way.

https://twitter.com/TXMCtrades/status/1519166725949988864

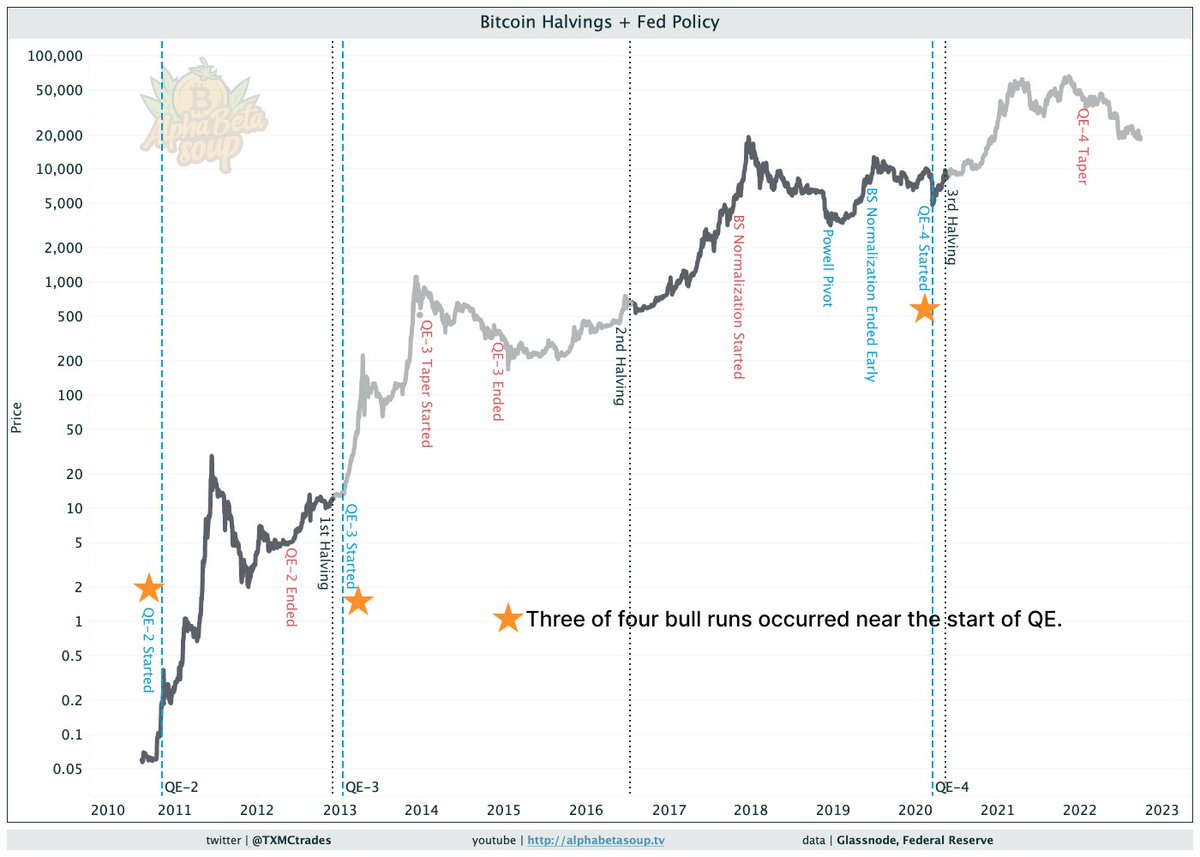

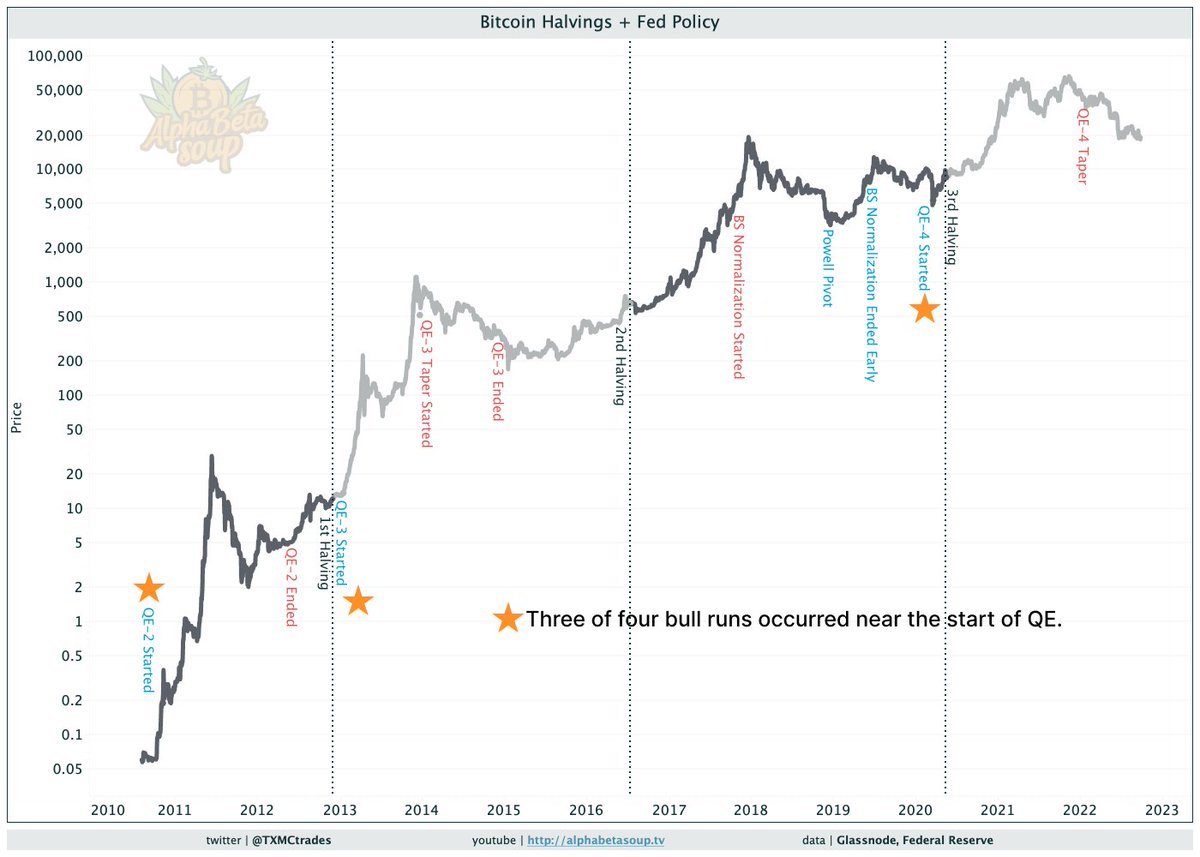

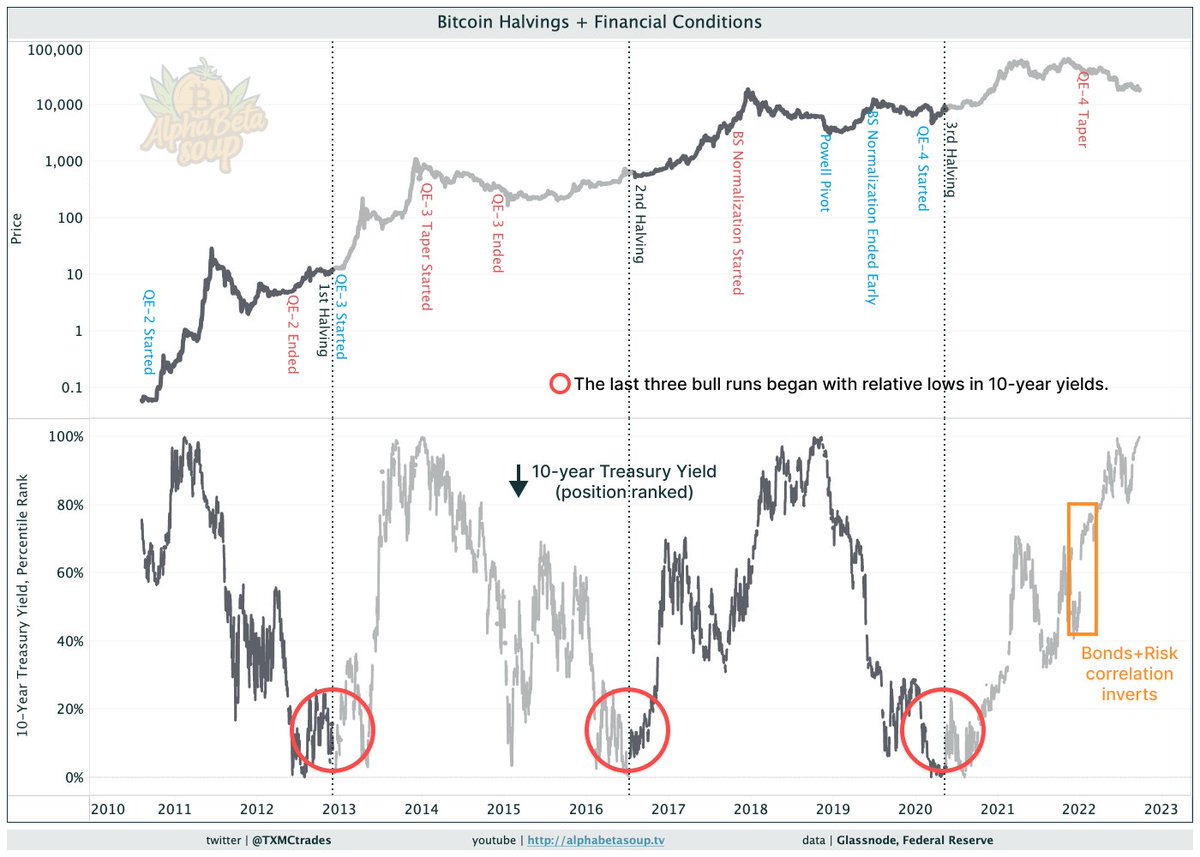

Let's overlay the halvings with Fed policy around QE/QT.

It's not a coincidence, I'd argue, that 3-of-4 bull runs began in close proximity to the ⭐️start of QE.

When the Fed becomes a market buyer, every asset responds including #Bitcoin. This has been true since day one.

It's not a coincidence, I'd argue, that 3-of-4 bull runs began in close proximity to the ⭐️start of QE.

When the Fed becomes a market buyer, every asset responds including #Bitcoin. This has been true since day one.

Adding the 10yr treasury, position ranked by yield.

It *is* a coincidence, I'd argue, that pre-2022 yields found a local low perfectly in time w/#BTC halvings.

Could the reputation of halvings actually be the coincident result of credit conditions and policy? Say it ain't so!

It *is* a coincidence, I'd argue, that pre-2022 yields found a local low perfectly in time w/#BTC halvings.

Could the reputation of halvings actually be the coincident result of credit conditions and policy? Say it ain't so!

Bonds & risk have been inversely related for decades, but the link reversed in 2022 as bonds and risk sold off in tandem.

Everything is connected by the health and flow of credit, by the cost of capital, and thusly broad risk appetite.

Including Bitcoin.

Everything is connected by the health and flow of credit, by the cost of capital, and thusly broad risk appetite.

Including Bitcoin.

https://twitter.com/TXMCtrades/status/1530379364914929664

When I think critically about it- does it make more sense that a pre-scheduled issuance cut, separate from the market, somehow creates new demand *after* the event?

Or does it make more sense that the oscillations of market cycles and fiat policy are turning the rudder a bit?

Or does it make more sense that the oscillations of market cycles and fiat policy are turning the rudder a bit?

Sure, a cut to issuance is good for a money's hardness. This is not in question.

What I propose you question is the mechanism by which a telegraphed change to issuance makes its way into market pricing.

What I propose you question is the mechanism by which a telegraphed change to issuance makes its way into market pricing.

As I said to begin this 🧵, the halving is an engineering marvel, but it isn't deciding the destiny of price in my view.

It's worth considering that bull runs are authored when they are *not* due to BTC magic, but the conditions of fiat from whence all inflows are sourced. 🤷♂️

It's worth considering that bull runs are authored when they are *not* due to BTC magic, but the conditions of fiat from whence all inflows are sourced. 🤷♂️

• • •

Missing some Tweet in this thread? You can try to

force a refresh