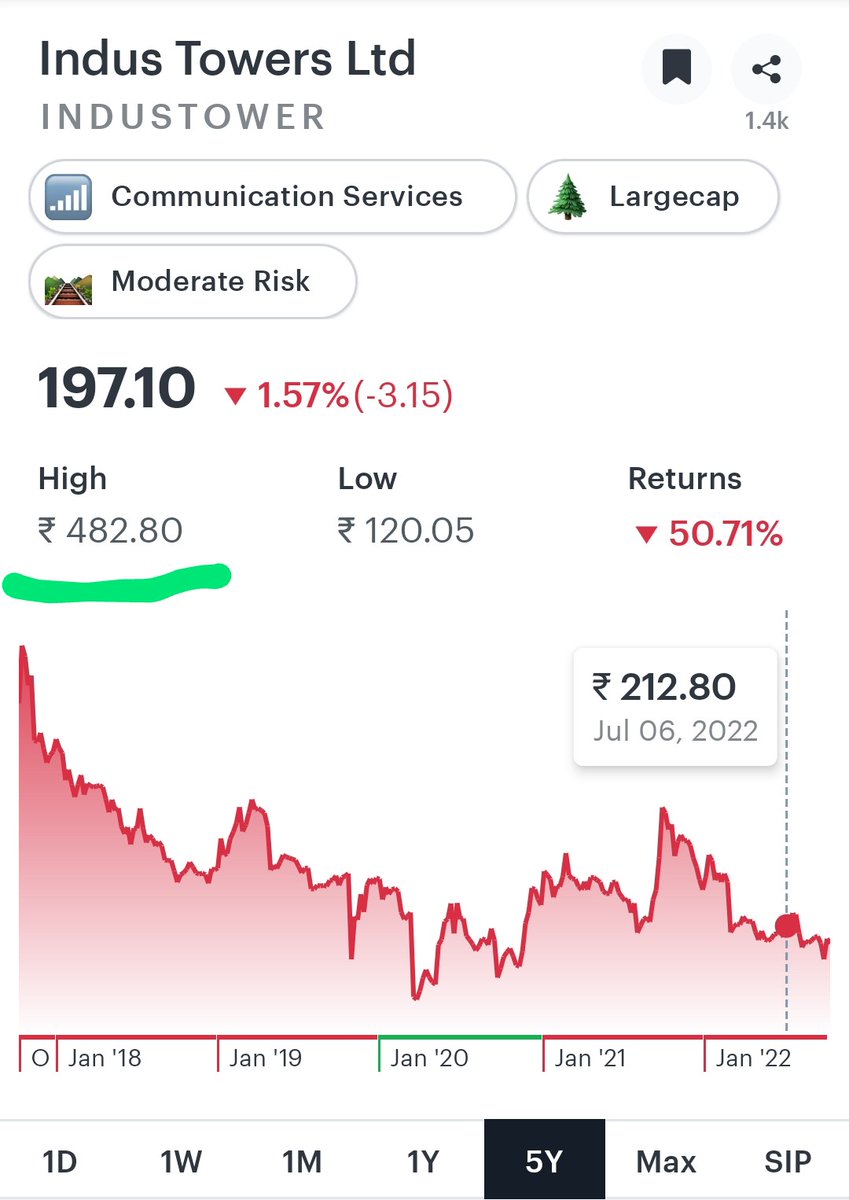

#Industower CMP ₹184. 29-Sep-2022

Strong fundamentals with double bottom formation ?

1) Market leader in Tower🗼 Biz

2) 3yr sales growth- 59.5%

3) 3yr profit growth- 39.9%

4) Dividend yield - 5.70%

5) Stock in accumulation zone

Worth studying it ☝️

#5G #stockstowatch

Strong fundamentals with double bottom formation ?

1) Market leader in Tower🗼 Biz

2) 3yr sales growth- 59.5%

3) 3yr profit growth- 39.9%

4) Dividend yield - 5.70%

5) Stock in accumulation zone

Worth studying it ☝️

#5G #stockstowatch

#industower could be #outperformer from here vs #nifty

10-Oct-2022.

Disc: #notareco #justaopinion #invested

10-Oct-2022.

Disc: #notareco #justaopinion #invested

During the last three years, Indus Towers produced sturdy free cash flow equating to 78% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

The good news is that Indus Towers's demonstrated ability to grow its EBIT delights us. And the good news does not stop there, as its conversion of EBIT to free cash flow also supports that impression!

Zooming out, Indus Towers seems to use debt quite reasonably; and that gets the nod from us.

While debt does bring risk, when used wisely it can also bring a higher return on equity.

While debt does bring risk, when used wisely it can also bring a higher return on equity.

Indus Towers had ₹54.9b of debt at March 2022, down from ₹81.7b a year prior. However, it also had ₹26.3b in cash, and so its net debt is ₹28.5b.

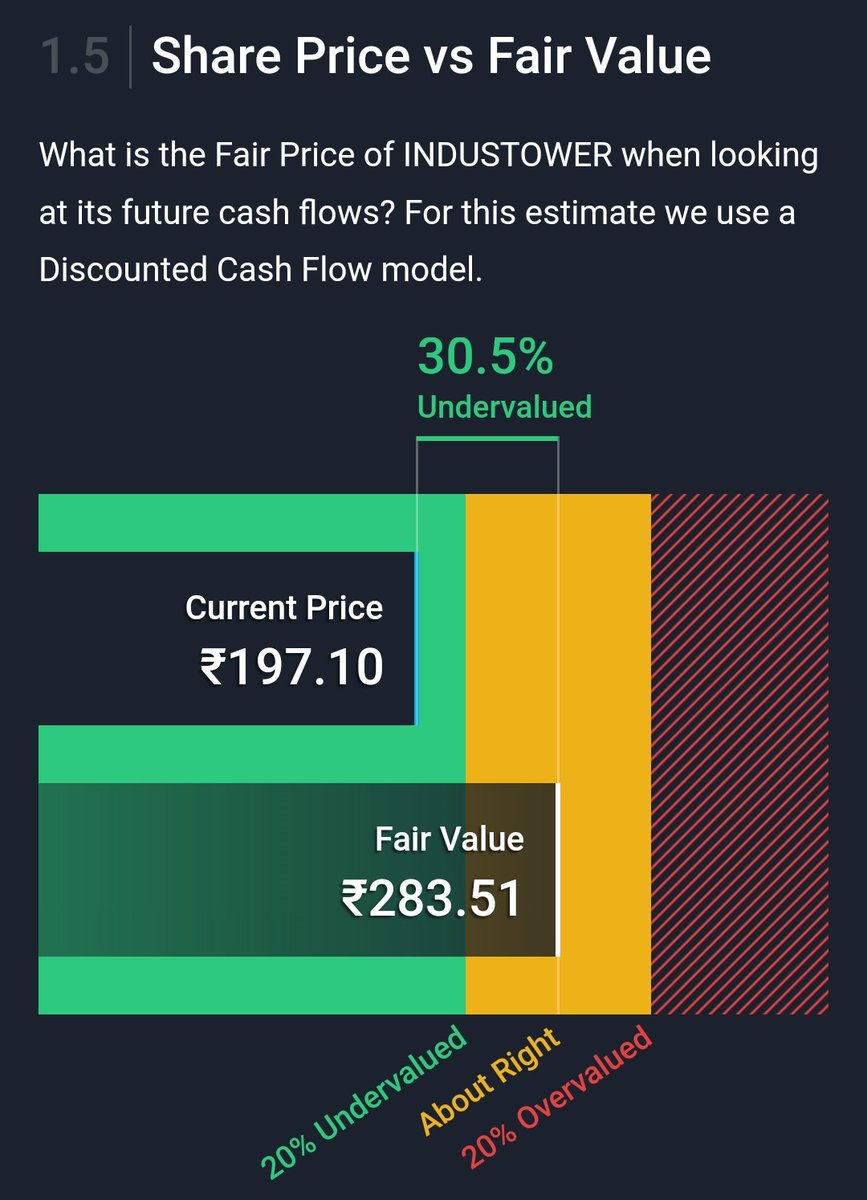

#INDUSTOWER

src: simply wall st.

#INDUSTOWER

src: simply wall st.

@threadreaderapp please unroll this tweet

• • •

Missing some Tweet in this thread? You can try to

force a refresh