In the last few years, I've developed a model based largely on #CANSLIM fundamentals characteristics to focus on the best stocks.

Not having the money to afford a #MarketSmith sub at the time, I built my own fundamental & technical scoring system into an Excel spreadsheet

🧵👇

Not having the money to afford a #MarketSmith sub at the time, I built my own fundamental & technical scoring system into an Excel spreadsheet

🧵👇

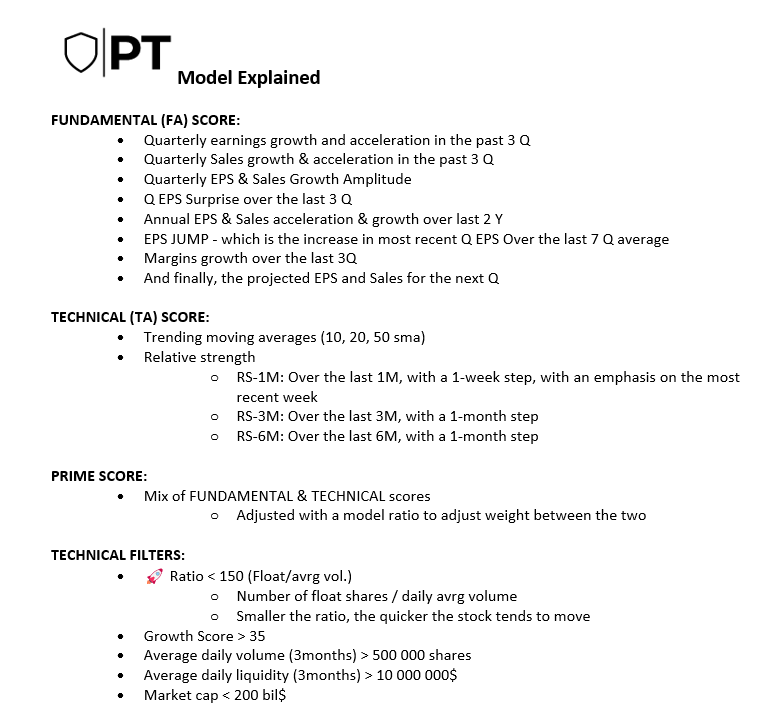

PRIME Model explained 🥇

I use this model to narrow the entire US stock market to the top 400/500 names with the best fundamentals and technical characteristics I'm looking for.

It creates the universe list that I use every day to find the best setups for the FL.

👇👇

I use this model to narrow the entire US stock market to the top 400/500 names with the best fundamentals and technical characteristics I'm looking for.

It creates the universe list that I use every day to find the best setups for the FL.

👇👇

In the coming days, that's something that I will share daily with the PrimeTrading Newsletter subscriber as added content.

This weekend, I share it over here on #fintwit for you folks.

Enjoy, and use it wisely! ☺️✌️

Free access to my PT_database 🔗

1drv.ms/x/s!AgrlbDaERG…

This weekend, I share it over here on #fintwit for you folks.

Enjoy, and use it wisely! ☺️✌️

Free access to my PT_database 🔗

1drv.ms/x/s!AgrlbDaERG…

PrimeTrading offers 2 services to learn swing/position trading the proper way...and without ruining you.

• A daily Market update & Focuslist Newsletter

• A private Discord channel where you can learn live from me

Join the community 👇🛡️

primetrading.substack.com/about

❤️🔁

• A daily Market update & Focuslist Newsletter

• A private Discord channel where you can learn live from me

Join the community 👇🛡️

primetrading.substack.com/about

❤️🔁

PrimeTrading offers 2 services to learn swing/position trading the proper way...and without ruining you.

• A daily Market update & Focuslist Newsletter

• A private Discord channel where you can learn live from me

Join the community 👇🛡️

primetrading.substack.com/about

❤️🔁

• A daily Market update & Focuslist Newsletter

• A private Discord channel where you can learn live from me

Join the community 👇🛡️

primetrading.substack.com/about

❤️🔁

• • •

Missing some Tweet in this thread? You can try to

force a refresh