How to Research New Crypto Projects

Crypto is a probability game. You can increase or lower your chances depending on what projects you choose.

Understanding how to do research is one of the most important skills in crypto.

/THREAD

Crypto is a probability game. You can increase or lower your chances depending on what projects you choose.

Understanding how to do research is one of the most important skills in crypto.

/THREAD

Check this if you prefer to read the article, instead of the Twitter thread.

Here you will find a summary of the most critical points.

/2

https://twitter.com/CryptosEngineer/status/1576482965844283393

Here you will find a summary of the most critical points.

/2

Most people do research in an unstructured way, so their choices are influenced by their emotional stance, other investors, and media news.

This is the reason why we should have a process to evaluate projects in the same way.

/3

This is the reason why we should have a process to evaluate projects in the same way.

/3

This will allow us to compare different projects and build our winning portfolio.

An investment strategy should answer four questions:

• Investment Process -> How to choose

• Screening -> What to choose

• Selection -> How to evaluate it

• Back-tests -> How to check it

/4

An investment strategy should answer four questions:

• Investment Process -> How to choose

• Screening -> What to choose

• Selection -> How to evaluate it

• Back-tests -> How to check it

/4

Two of them are already covered by me in previous articles. I encourage you to also check them.

Here is a summary of these frameworks:

/5

Here is a summary of these frameworks:

https://twitter.com/CryptosEngineer/status/1560936721491050497

/5

Selection.

After we have created our investment and screening strategy, we have to choose tokens.

Depending on our screening criteria, we probably now have more projects than we want to invest in.

/6

After we have created our investment and screening strategy, we have to choose tokens.

Depending on our screening criteria, we probably now have more projects than we want to invest in.

/6

Tokenomics.

Many people talk about tokenomics, but few people understand it.

Focusing only on demand or supply won’t help you. To evaluate project tokenomics, you need to consider two parts of this equation and understand its dynamics.

/7

Many people talk about tokenomics, but few people understand it.

Focusing only on demand or supply won’t help you. To evaluate project tokenomics, you need to consider two parts of this equation and understand its dynamics.

https://twitter.com/CryptosEngineer/status/1517768650870116352

/7

Price is the result of supply and demand:

Demand & Supply => Price

It is set by these forces and will reflect everything that investors collectively believe, hope for, and fear.

Value is not equal to the price. It is driven by fundamentals (cash flows, growth, and risks).

/8

Demand & Supply => Price

It is set by these forces and will reflect everything that investors collectively believe, hope for, and fear.

Value is not equal to the price. It is driven by fundamentals (cash flows, growth, and risks).

/8

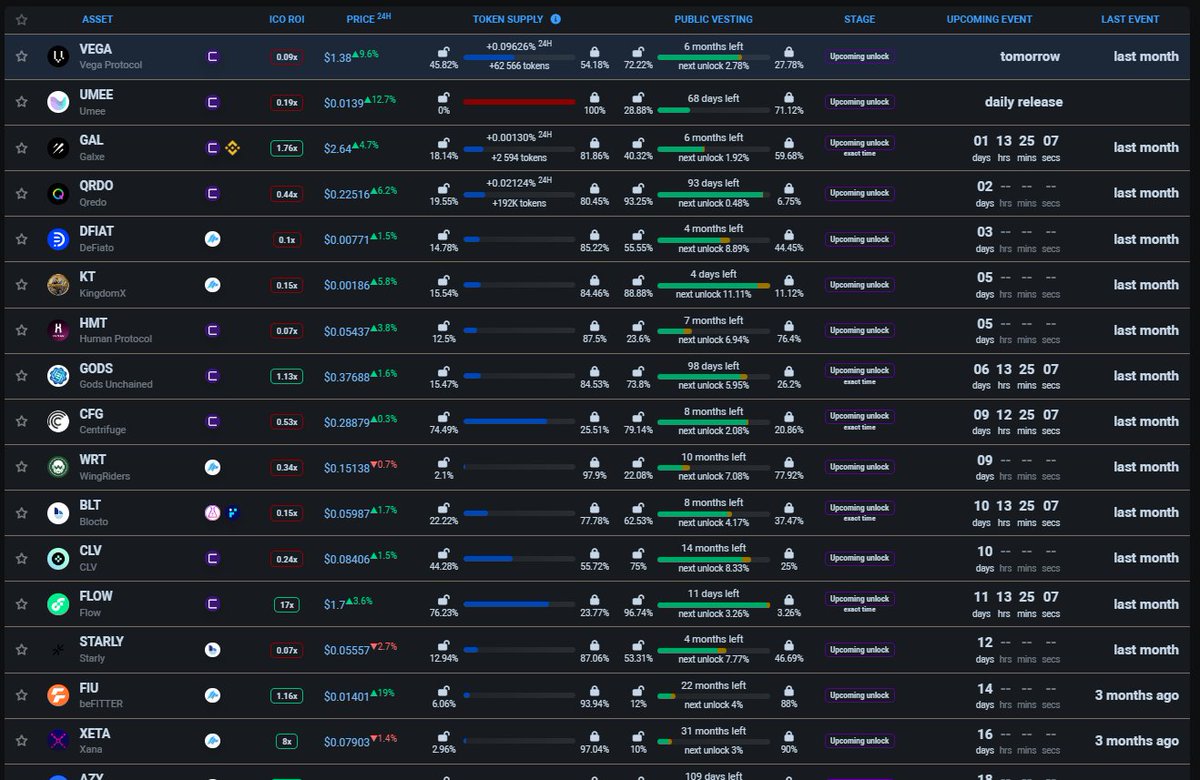

A supply tells us how many coins or tokens we have.

Supply = Inflation/vesting - buybacks - staking (locking)

For most projects, we have Circulating, Total, Max supplies, which we can find on sites like @coingecko

Circulating supply can be changed by the following:

/9

Supply = Inflation/vesting - buybacks - staking (locking)

For most projects, we have Circulating, Total, Max supplies, which we can find on sites like @coingecko

Circulating supply can be changed by the following:

/9

Inflation and vesting – new tokens are created and are tradable after the vesting period.

This is mostly used to compensate for different protocol personas like an investor, projects team, or users.

/10

This is mostly used to compensate for different protocol personas like an investor, projects team, or users.

/10

Buybacks – tokens can also be destroyed (similar to stock buybacks).

This reduces outstanding project tokens or requires the team to first buy tokens from the market.

Staking or locking – some tokens can be withdrawn from the public market to be locked in the protocol.

/11

This reduces outstanding project tokens or requires the team to first buy tokens from the market.

Staking or locking – some tokens can be withdrawn from the public market to be locked in the protocol.

/11

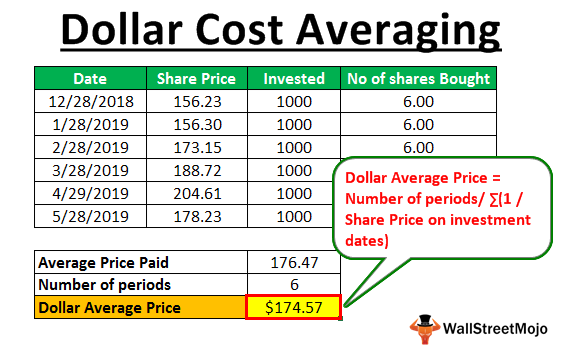

The dynamic behind this equation is complex and for many projects, we have to analyze all factors.

The most important metric to analyze is selling pressure. It tells us how the circulating supply will change after x months, where x is our investment horizon.

/12

The most important metric to analyze is selling pressure. It tells us how the circulating supply will change after x months, where x is our investment horizon.

/12

If we will have a higher circulating supply in the future, the demand side will have to compensate, maintain and especially increase its price.

Demand⬇️ OR Supply⬆️ => Price⬇️

Demand⬆️ OR Supply⬇️ => Price⬆️

/13

Demand⬇️ OR Supply⬆️ => Price⬇️

Demand⬆️ OR Supply⬇️ => Price⬆️

/13

These 3 tools below can help you calculate the circulating supply:

@etherscan

@VestLab

@UnlocksCalendar

/14

@etherscan

@VestLab

@UnlocksCalendar

/14

Demand.

The demand side is much harder to evaluate, so we will spend more time here.

Circulating supply, on the other hand, doesn’t give you any signal without analyzing the right side of the equation

/15

The demand side is much harder to evaluate, so we will spend more time here.

Circulating supply, on the other hand, doesn’t give you any signal without analyzing the right side of the equation

/15

Demand can be divided into three forces:

Demand = Real Utility (Value) + Financial Utility (Earning on token/coin in Defi) + Valuation Changes (Speculation)

We start with the last part of the demand which is Valuation Changes caused by 3 factors.

/16

Demand = Real Utility (Value) + Financial Utility (Earning on token/coin in Defi) + Valuation Changes (Speculation)

We start with the last part of the demand which is Valuation Changes caused by 3 factors.

/16

Valuation Changes

• Momentum (price action) – Most people (and some bots) are buying if the price is rising.

• Investor mood – What is trendy now? Where is money flowing?

• Other pricing factors – Accessibility for US citizens, CEX and DEX availability, etc.

/17

• Momentum (price action) – Most people (and some bots) are buying if the price is rising.

• Investor mood – What is trendy now? Where is money flowing?

• Other pricing factors – Accessibility for US citizens, CEX and DEX availability, etc.

/17

This is the most important factor in the short and very often mid-terms in crypto.

As this market will be more mature, its impact will diminish. Master it if you are a trader.

/18

As this market will be more mature, its impact will diminish. Master it if you are a trader.

/18

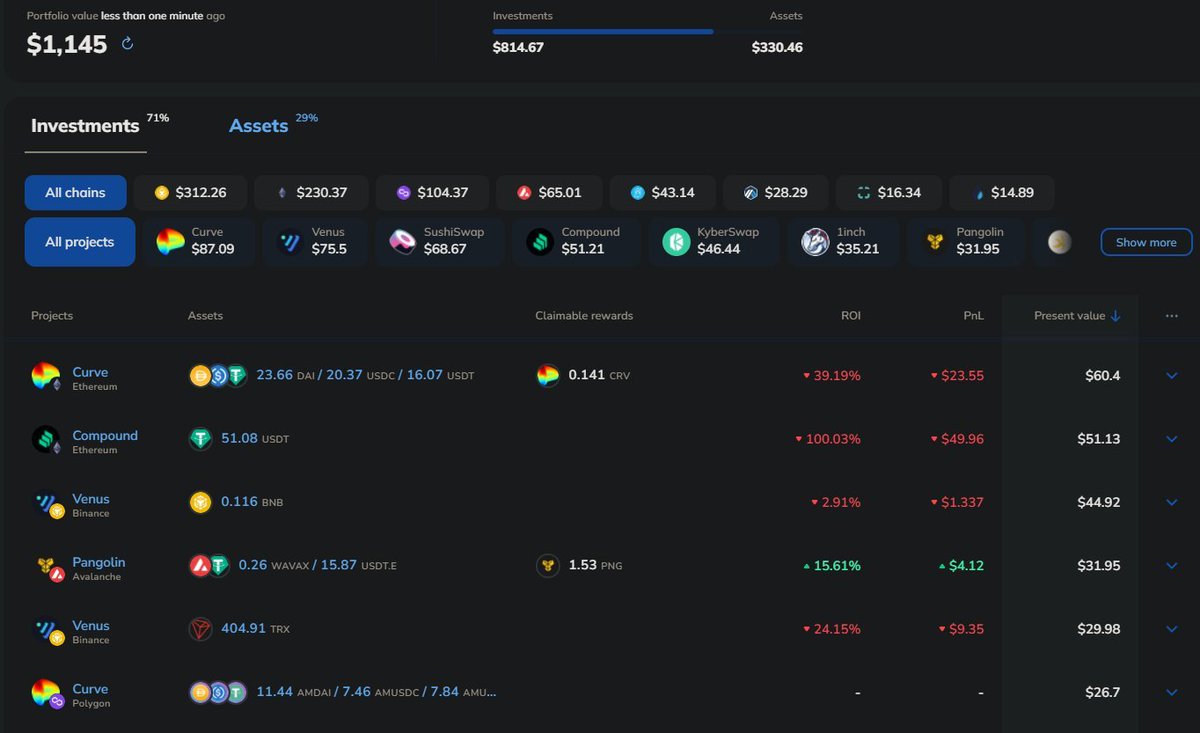

Financial Utility.

When you have stocks, you can’t do much with them. You can just wait for price appreciation and dividends.

In crypto, we have tokens, which can be used as commodities or money in DeFi. You can lend it to someone, or provide liquidity in AMM DEX.

/19

When you have stocks, you can’t do much with them. You can just wait for price appreciation and dividends.

In crypto, we have tokens, which can be used as commodities or money in DeFi. You can lend it to someone, or provide liquidity in AMM DEX.

/19

Financial Utility is the ability to earn on our tokens in #DeFi:

• Cash flow (APY) – How much we will earn in one year if nothing changes?

• Growth of APY – How likely these changes are going to happen?

• Risk – How can you lose money here?

/20

• Cash flow (APY) – How much we will earn in one year if nothing changes?

• Growth of APY – How likely these changes are going to happen?

• Risk – How can you lose money here?

https://twitter.com/CryptosEngineer/status/1481319609005445126

/20

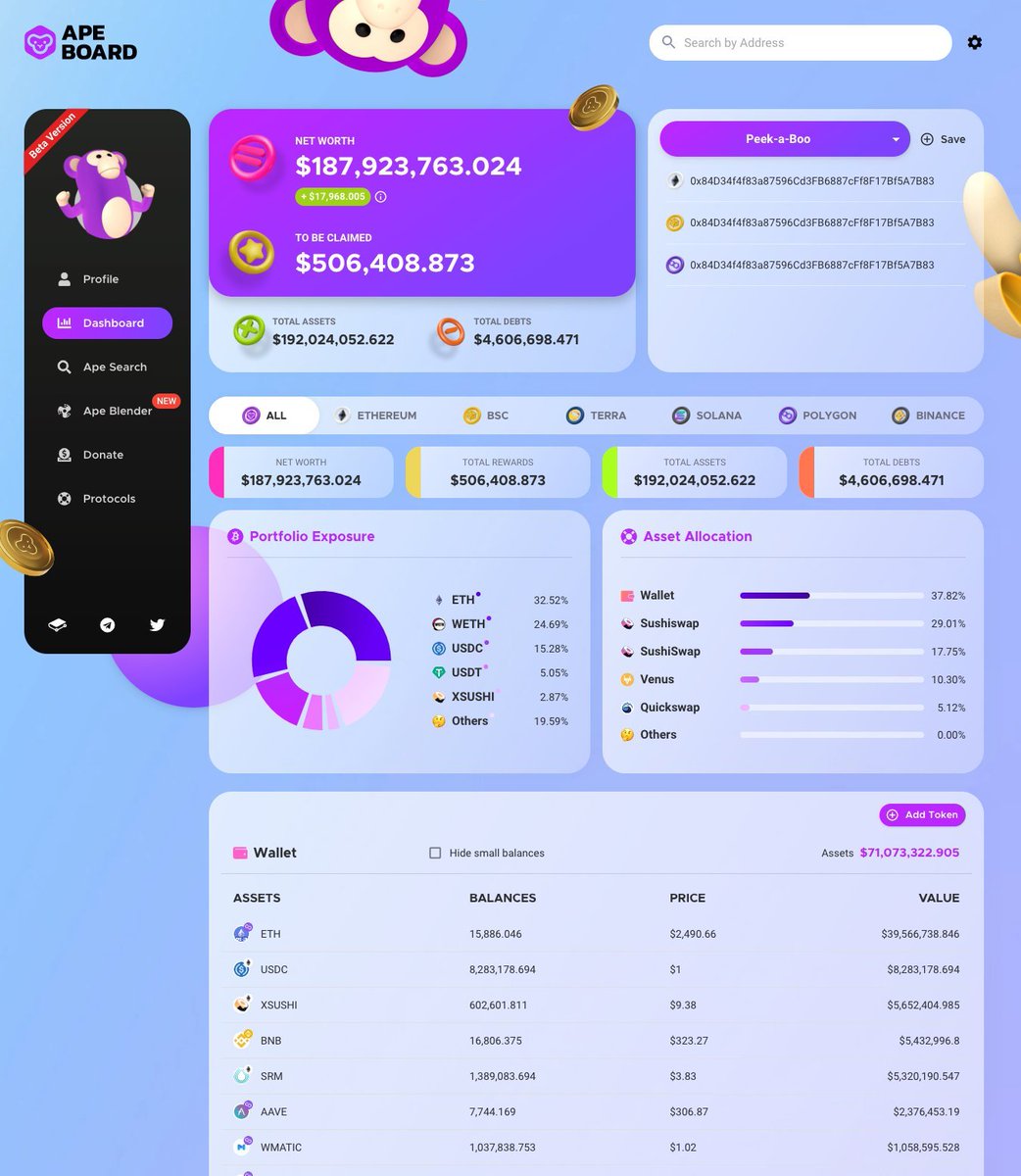

Real Utility.

The real utility is an answer to the question “what value is provided by this protocol”?

For many projects there is no value, so you will have to filter them during Crypto Screening.

/21

The real utility is an answer to the question “what value is provided by this protocol”?

For many projects there is no value, so you will have to filter them during Crypto Screening.

/21

To provide real utility, a project needs to have credible resources to deliver it. In most cases we need:

• Teams and advisors

• Partnerships

• Investors, capital, and compliant product with regulators

/22

• Teams and advisors

• Partnerships

• Investors, capital, and compliant product with regulators

/22

Specific requirements for them depend on our project’s operating model:

• Do we have enough resources (team, money, knowledge) to deliver this project?

• Do we have the required support from other companies and organizations?

• Do we believe that this is possible?

/23

• Do we have enough resources (team, money, knowledge) to deliver this project?

• Do we have the required support from other companies and organizations?

• Do we believe that this is possible?

/23

Next, what problems do we want to solve? How exactly do we want to create value for our users?

• The market for which we can provide a solution to our problem (someone will have to buy our products or services)

• Competitors – we need to be better in some way

/24

• The market for which we can provide a solution to our problem (someone will have to buy our products or services)

• Competitors – we need to be better in some way

/24

Now, we can evaluate the solution.

• Product/Service – how do we want to deliver value?

• Roadmap & Progress – when will this promise be fulfilled?

• Adoption & Community – who will benefit from this?

/25

• Product/Service – how do we want to deliver value?

• Roadmap & Progress – when will this promise be fulfilled?

• Adoption & Community – who will benefit from this?

/25

As you see, the selection is the most time-consuming process of crypto investing.

This is the reason why many people follow a simple strategy like Buy and Hold using BTC to reduce the required time.

/26

This is the reason why many people follow a simple strategy like Buy and Hold using BTC to reduce the required time.

/26

Check these accounts for other #crypto Investment Tips:

@cryptoPothu

@Route2FI

@KoroushAK

@shivsakhuja

@kamikaz_ETH

@DeFi_Made_Here

@rektdiomedes

@danreecer_

@0xmisaka

@puntium

@Gojo_Crypto

@0x_illuminati

@TaikiMaeda2

@sabocrypto

@thedefiedge

/27

@cryptoPothu

@Route2FI

@KoroushAK

@shivsakhuja

@kamikaz_ETH

@DeFi_Made_Here

@rektdiomedes

@danreecer_

@0xmisaka

@puntium

@Gojo_Crypto

@0x_illuminati

@TaikiMaeda2

@sabocrypto

@thedefiedge

/27

• • •

Missing some Tweet in this thread? You can try to

force a refresh