Wow, U.S. job openings dropped sharply to 10.1 million in Aug. That's a steep drop from 11.2 million in Jul and the largest one-month drop since the pandemic began.

While the level is still high, that's a more definitive sign of cooling in one of the Fed's watched metrics.

1/

While the level is still high, that's a more definitive sign of cooling in one of the Fed's watched metrics.

1/

The drop in job openings and jump in unemployment in Aug pushed the ratio of openings to unemployed workers to 1.67, down from 1.97 in Jul.

There are issues w/ this measure, but the Fed refers to it often, so the slowing here is notable.

#JOLTS 2/

There are issues w/ this measure, but the Fed refers to it often, so the slowing here is notable.

#JOLTS 2/

The drop in job openings was across the board, hitting most industries.

Note: this table shows that most industries are still seeing higher openings than pre-pandemic, but again, points to the broader economic slowdown making employers reevaluate hiring plans.

#JOLTS 3/

Note: this table shows that most industries are still seeing higher openings than pre-pandemic, but again, points to the broader economic slowdown making employers reevaluate hiring plans.

#JOLTS 3/

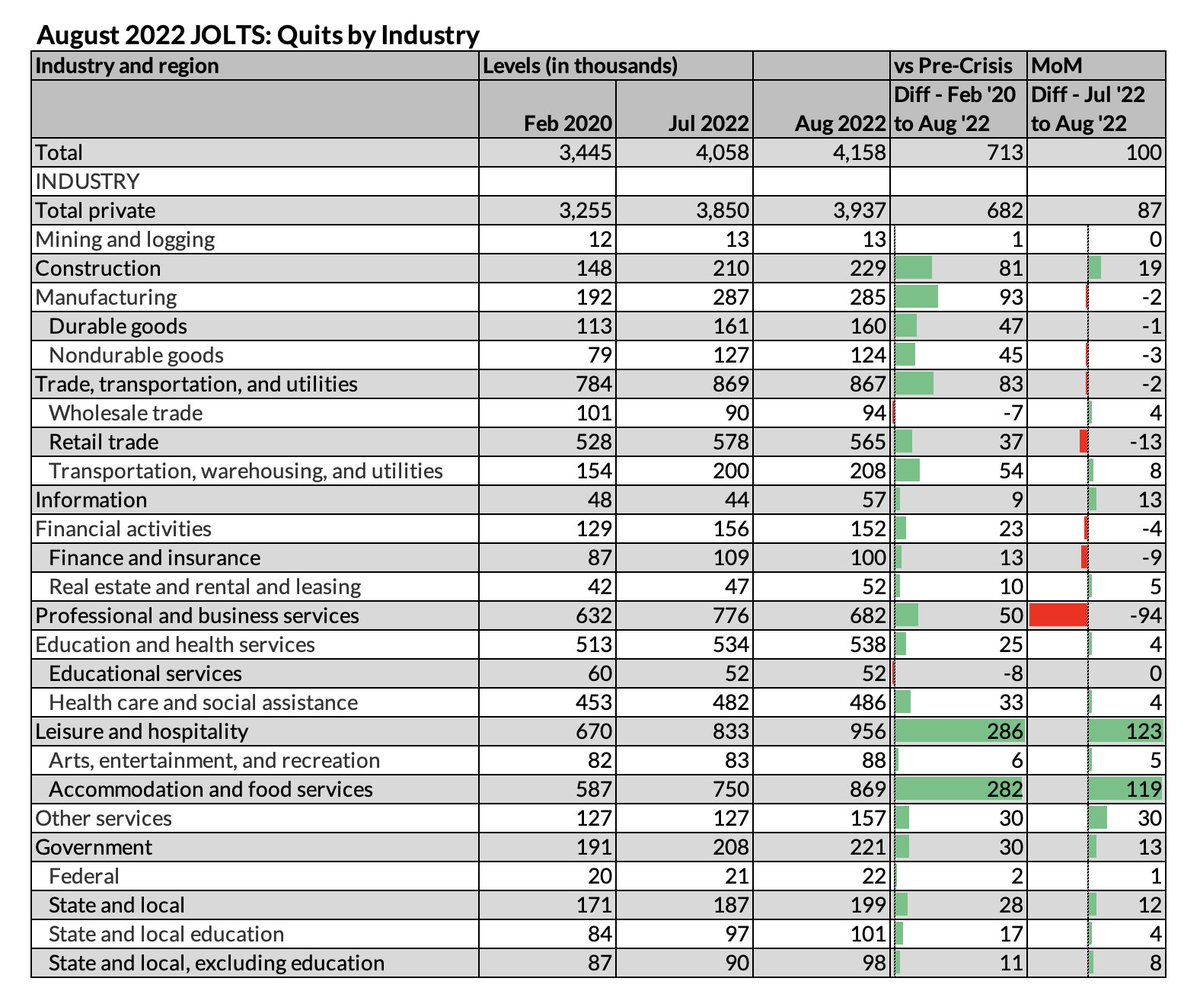

Bit of a weird month for quits:

Quits were largely unchanged in Aug (actually ticked up ever so slightly) even though job openings fell.

And the lack of change was driven by a spike in food services quits being offset by a sharp drop in prof & biz services.

#JOLTS 4/

Quits were largely unchanged in Aug (actually ticked up ever so slightly) even though job openings fell.

And the lack of change was driven by a spike in food services quits being offset by a sharp drop in prof & biz services.

#JOLTS 4/

Layoffs & discharges rose modestly in Aug, starting to tick up from near-record lows.

If you squint, this is the highest level since March 2021, but still well well below pre-pandemic levels. The low level we're at now is not a red flag yet.

#JOLTS 5/

If you squint, this is the highest level since March 2021, but still well well below pre-pandemic levels. The low level we're at now is not a red flag yet.

#JOLTS 5/

Jumping back to quits: The sharp drop in job openings & little change in quits actually brings openings closer to the historical relationship openings & quits have.

Openings had been growing out of whack since Apr 2021, so we may be seeing a return to (more) normal.

#JOLTS 6/

Openings had been growing out of whack since Apr 2021, so we may be seeing a return to (more) normal.

#JOLTS 6/

Falling job openings mean the Beveridge curve is moving more towards the pre-pandemic relationship. So far that hasn't been accompanied by a large jump in unemployment (point to Waller), but clearly we're still in uncharted territory

(Chart is WIP so excuse the mess)

#JOLTS 7/

(Chart is WIP so excuse the mess)

#JOLTS 7/

Overall, the #JOLTS report today shows some clear signs that the job market is cooling even if it's starting from a high temperature.

And interesting to see some patterns start to inch back toward their pre-pandemic relationships.

8/8

And interesting to see some patterns start to inch back toward their pre-pandemic relationships.

8/8

Also embarrassed to just notice that the dates in my chart footnotes are messed up. Today's #JOLTS report is for the end of August 2022, not July 2022. 🤦🏻♂️

• • •

Missing some Tweet in this thread? You can try to

force a refresh