Thousands of attendees gathered together at #SmartCon 2022 for two jam-packed days of keynotes, presentations, networking, satellite events, and afterparties.

Here's what it was like to be on the ground in #NYC.

Here's what it was like to be on the ground in #NYC.

2/ The conference took place at The Market Line—an expansive, three-floor space perfect for everything from in-depth technical discussions to making new friends.

3/ There were four presentation stages: Aristotle, Descartes, Rand, and Socrates.

Here, 150+ of the brightest minds from across Web2 and #Web3 spoke about the developments pushing our space forward.

Here, 150+ of the brightest minds from across Web2 and #Web3 spoke about the developments pushing our space forward.

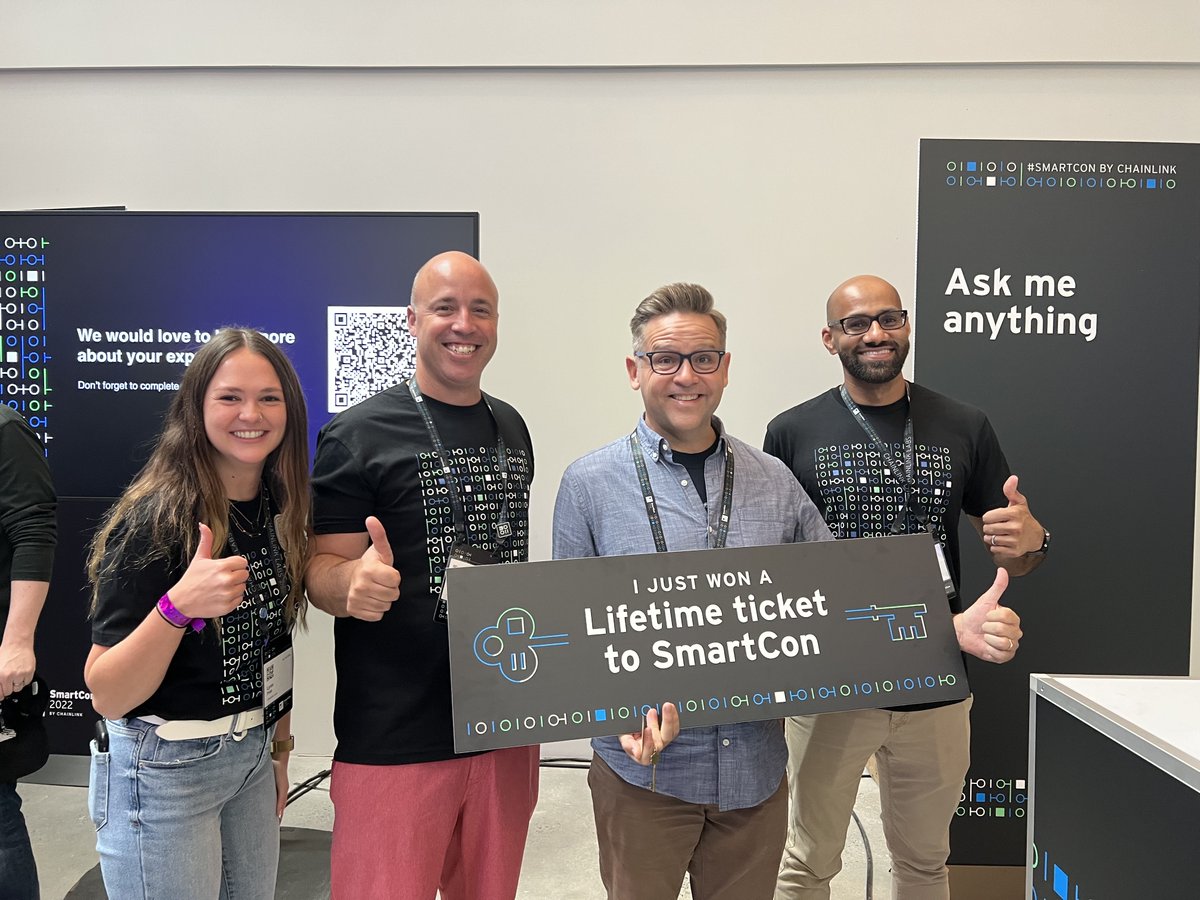

4/ From live music to secret treasure hunts, Big Mac meals to an elaborate mural, there were experiences hidden at every corner of the conference.

5/ Attendees ended each conference day at SmartCon afterparties, with lines that wrapped around the block.

Afterparties were the perfect way to decompress, whether they took place under the famous NYC skyline or inside the vibrant Museum of Ice Cream.

Afterparties were the perfect way to decompress, whether they took place under the famous NYC skyline or inside the vibrant Museum of Ice Cream.

6/ Thank you to all those who played a part in bringing the SmartCon 2022 experience to life.

We hope to see everyone again next year.

We hope to see everyone again next year.

• • •

Missing some Tweet in this thread? You can try to

force a refresh