The Bull Run is over. DeFi Summer a distant memory. And the NFT Bubble - popped 📉

Markets are down bad & Degens no longer have a #Crypto casino to play in.

Or so it seems..

With the American Football Season, & 2022 Fifa World Cup, traders may have a way to make it all back 🧵

Markets are down bad & Degens no longer have a #Crypto casino to play in.

Or so it seems..

With the American Football Season, & 2022 Fifa World Cup, traders may have a way to make it all back 🧵

https://twitter.com/max_bronstein/status/1577825303006937088

While many US states refuse to legalize sports betting, fans turn to offshore gambling sites that accept Cryptocurrency.

Bovada is one of the most popular of these and has been accepting deposits on Ethereum since 2020.

Bovada is one of the most popular of these and has been accepting deposits on Ethereum since 2020.

NCAA football kicked off on Aug 27th, and the #NFL started slightly later on Sep 8th.

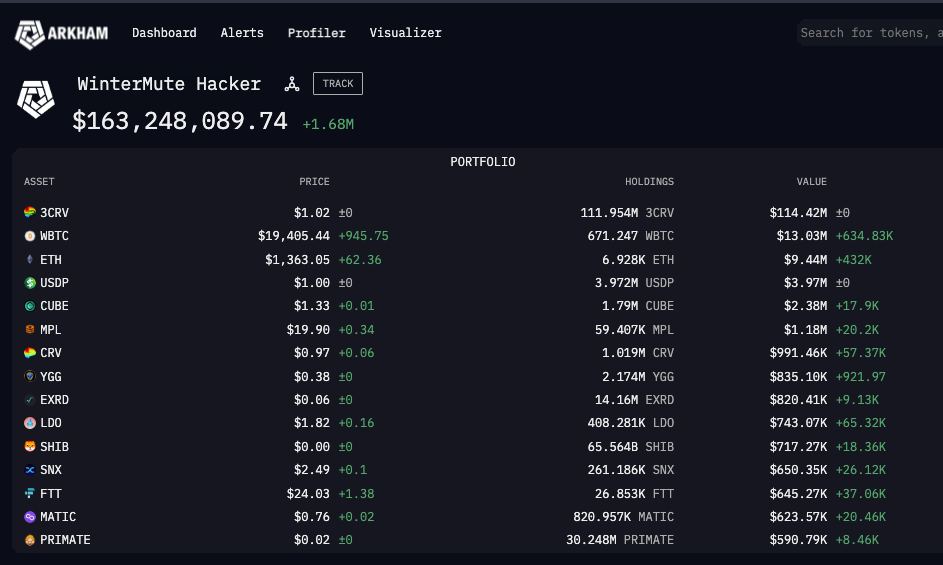

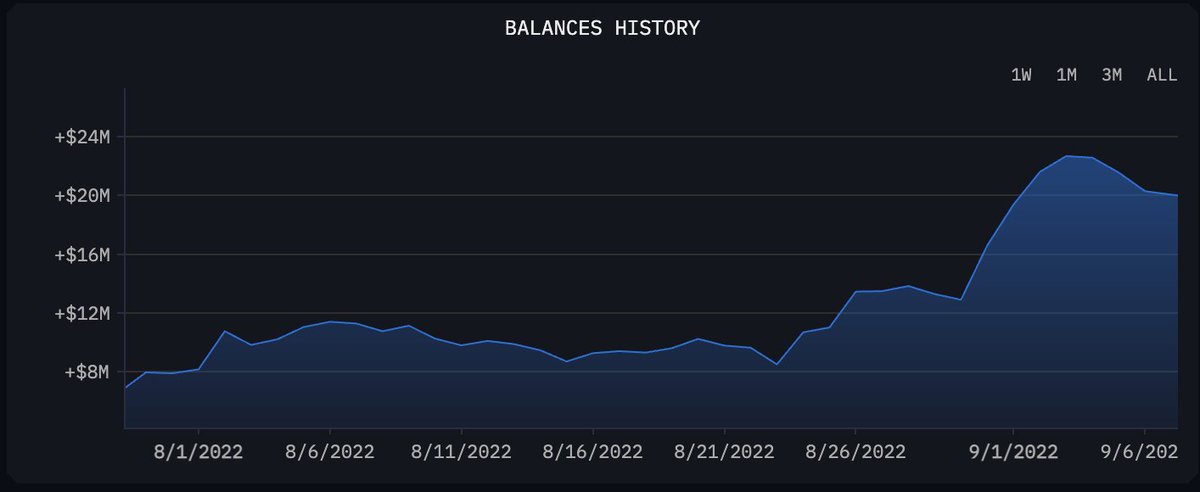

As football fanatics loaded their accounts from Aug 23rd to Sep 12th, @BovadaOfficial’s Ethereum wallet balance more than *tripled* from $8.5 million to $26.5 million.

As football fanatics loaded their accounts from Aug 23rd to Sep 12th, @BovadaOfficial’s Ethereum wallet balance more than *tripled* from $8.5 million to $26.5 million.

@BovadaOfficial’s hourly deposits are usually around $1100.

On September 9th, a day before the football weekend, Bovada saw a staggering $2 million in deposit volume, in 1 hour alone!

On September 9th, a day before the football weekend, Bovada saw a staggering $2 million in deposit volume, in 1 hour alone!

This football season has been of historical significance for Bovada.

24 of Bovada’s 100 largest lifetime deposits via Ethereum have occurred since August 4th

.. with the single largest deposit ever totalling $3.5 million on Aug 31st.

24 of Bovada’s 100 largest lifetime deposits via Ethereum have occurred since August 4th

.. with the single largest deposit ever totalling $3.5 million on Aug 31st.

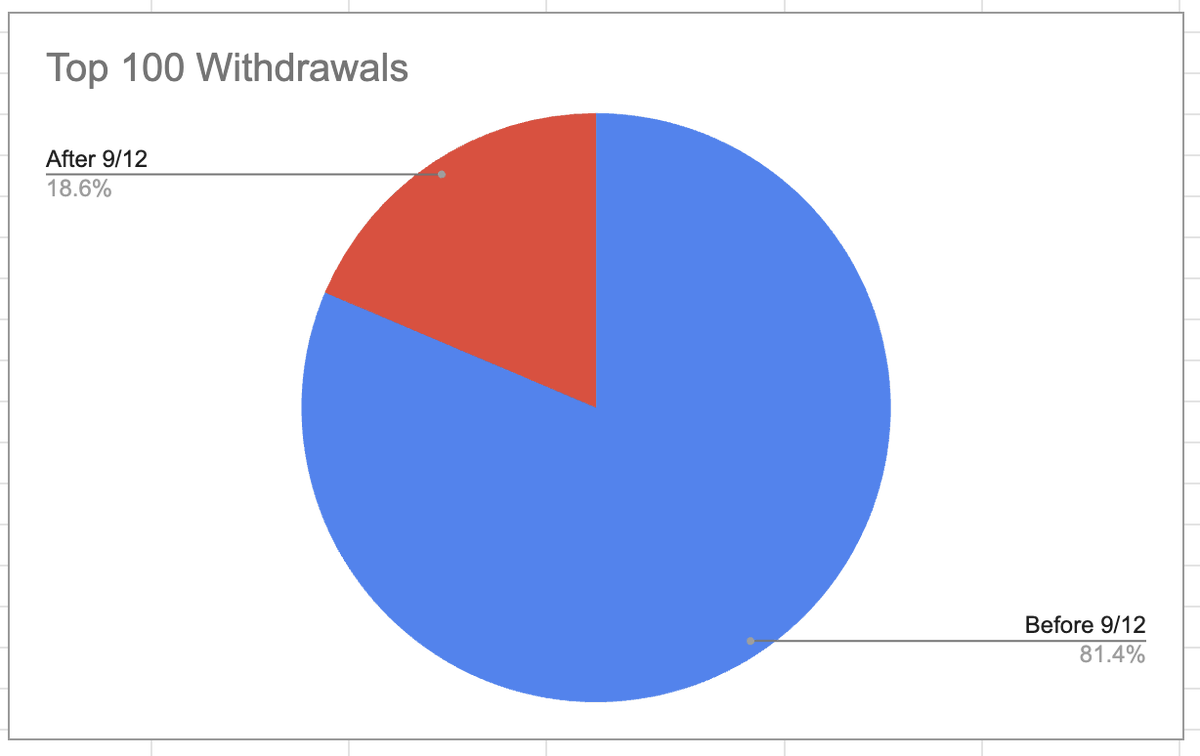

However, on-chain data doesn’t just show that people are spending.

Gamblers are also winning

14 of Bovada’s 100 largest ERC-20 payouts occurred after September 12th, with the largest of these a whopping $3 million - their highest ever payout on Ethereum!

#GamblingTwitter

Gamblers are also winning

14 of Bovada’s 100 largest ERC-20 payouts occurred after September 12th, with the largest of these a whopping $3 million - their highest ever payout on Ethereum!

#GamblingTwitter

The significance of this is threefold:

1. Americans are true degens 🫡

1. Americans are true degens 🫡

2. Gambling deposits can accelerate the mass adoption of #Crypto.

People depositing $100 in Bovada are not necessarily Crypto natives.

They are sports fans seeking a way to move money without waiting days, getting blocked, or paying high fees.

People depositing $100 in Bovada are not necessarily Crypto natives.

They are sports fans seeking a way to move money without waiting days, getting blocked, or paying high fees.

The growth of ERC-20 deposits to Bovada suggests the public are becoming far more comfortable with blockchain technologies.

Web 3 tools which make people's lives easier, cheaper & more efficient are likely to grow in popularity faster.

Web 3 tools which make people's lives easier, cheaper & more efficient are likely to grow in popularity faster.

3. Crypto makes onramping to gambling sites like Bovada seamless.

And sports betting provides all of the volatility, thrill & monetary upside to become Crypto natives' new outlet for outsized gains.

In fact, it appears this may already be happening ..

And sports betting provides all of the volatility, thrill & monetary upside to become Crypto natives' new outlet for outsized gains.

In fact, it appears this may already be happening ..

https://twitter.com/GCRClassic/status/1576210086762270720

Thank you to @GiganticRebirth, @max_bronstein & @Bovada for inspiring this research 🫡

Part 2 on $CHZ & Fan Tokens coming soon.

(And please like & Retweet the first Tweet of this thread if you found it useful!)

Part 2 on $CHZ & Fan Tokens coming soon.

(And please like & Retweet the first Tweet of this thread if you found it useful!)

• • •

Missing some Tweet in this thread? You can try to

force a refresh