@MessariCrypto recently published a comprehensive report on the State of Ethereum in Q3 2022.

We read the whole report so that you don't have to!

Here's a comprehensive summary

👇🧵

We read the whole report so that you don't have to!

Here's a comprehensive summary

👇🧵

Before we get started...

You can find this thread as a blog post here:

thecryptoilluminati.substack.com/p/state-of-eth…

You can find this thread as a blog post here:

thecryptoilluminati.substack.com/p/state-of-eth…

A Primer on @ethereum:

The Ethereum network is a decentralized data storage and transaction validation platform

The protocol gained broad recognition after the groundbreaking introduction of smart contracts

/1

The Ethereum network is a decentralized data storage and transaction validation platform

The protocol gained broad recognition after the groundbreaking introduction of smart contracts

/1

As a result, there are thousands of individual tokens and applications built on top of the #Ethereum blockchain

As a result, Ethereum became the world's second-largest cryptocurrency by market capitalization

/2

As a result, Ethereum became the world's second-largest cryptocurrency by market capitalization

/2

1. NETWORK PERFORMANCE:

1.1) Protocol's revenue:

The protocol's revenue has plummeted to near-all-time lows. This might be due to the following factors:

• Crypto bear market

• Increased volume on L2s

• The upgrades in protocol contracts for gas efficiency

/3

1.1) Protocol's revenue:

The protocol's revenue has plummeted to near-all-time lows. This might be due to the following factors:

• Crypto bear market

• Increased volume on L2s

• The upgrades in protocol contracts for gas efficiency

/3

Total fees also fell off a cliff in Q3, dropping to their lowest levels since 2020

Now that Ethereum has switched to POS, the decline in 'total fees' will impact the staking yields of the ETH2 network

/4

Now that Ethereum has switched to POS, the decline in 'total fees' will impact the staking yields of the ETH2 network

/4

1.2) AVERAGE DAILY TRANSACTIONS:

The average daily transactions were 1.2 million, up 6% from the previous quarter

Average daily transactions of:

$ETH transfers grew by 7%

DeFi transactions grew by 14%

NFT transactions fell 17%

Bridge transactions fell by 41%

/5

The average daily transactions were 1.2 million, up 6% from the previous quarter

Average daily transactions of:

$ETH transfers grew by 7%

DeFi transactions grew by 14%

NFT transactions fell 17%

Bridge transactions fell by 41%

/5

1.3) AVERAGE DAILY ACTIVE ADDRESSES:

Active addresses have a similar pattern to transactions

Average daily active addresses grew by 5% from the previous quarter to ~550,000

However, the growth was primarily due to a spike in active addresses on July 27, 2022

/6

Active addresses have a similar pattern to transactions

Average daily active addresses grew by 5% from the previous quarter to ~550,000

However, the growth was primarily due to a spike in active addresses on July 27, 2022

/6

The spike was caused by @ChandlerGuo announcing plans for an ETHPOW fork, along with some wallet “maintenance activity” from @binance

This indicates that the rise in active addresses wasn't brought on by a surge in new users or a novel application

/7

This indicates that the rise in active addresses wasn't brought on by a surge in new users or a novel application

/7

1.4) ETH SUPPLY IN SMART CONTRACTS:

Over the period, Ethereum supply grew by 0.7%

The annualized supply came in at 4.2%

All of the inflation came from PoW rewards since the burn from transaction fees (EIP-1559) was higher than the inflation from Beacon Chain rewards

/8

Over the period, Ethereum supply grew by 0.7%

The annualized supply came in at 4.2%

All of the inflation came from PoW rewards since the burn from transaction fees (EIP-1559) was higher than the inflation from Beacon Chain rewards

/8

ETH in smart contracts has trended upwards since 2020 since it was increasingly used within the #DeFi ecosystem

This resulted in a multi-year decrease in $ETH held on centralized exchanges

However, the collapse of Terra seemed to have eroded trust in smart contracts

/9

This resulted in a multi-year decrease in $ETH held on centralized exchanges

However, the collapse of Terra seemed to have eroded trust in smart contracts

/9

The percentage of $ETH in smart contracts peaked at 30% on May 9, 2022 (the same day as Terra’s collapse).

Since then, $ETH supply in smart contracts has trended downwards. At the end of August, it stood at 27%, falling 2% from the end of June

/10

Since then, $ETH supply in smart contracts has trended downwards. At the end of August, it stood at 27%, falling 2% from the end of June

/10

2. LAYER 2 ANALYSIS:

Ethereum’s scaling solution with the help of rollups has gained a lot of traction

Average transactions from January 2022 to August 2022:

@arbitrum grew from 39,000 to 115,000 (~3x)

@optimismFND grew from 41,000 to 142,000 (~3.5x)

/11

Ethereum’s scaling solution with the help of rollups has gained a lot of traction

Average transactions from January 2022 to August 2022:

@arbitrum grew from 39,000 to 115,000 (~3x)

@optimismFND grew from 41,000 to 142,000 (~3.5x)

/11

The primary growth for these L2s is from the underlying protocols (especially GMX and Synthetix)

However, some of this growth may be attributed to mercenary capital rather than organic users, as OP incentives went live and an Arbitrum airdrop is anticipated

/12

However, some of this growth may be attributed to mercenary capital rather than organic users, as OP incentives went live and an Arbitrum airdrop is anticipated

/12

Catalysts for L2 growth and adoption:

• Arbitrum’s Nitro upgrade (higher throughput and lower fees)

• zkEVM announcements: @0xPolygon, zkSync, and Scroll

• @StarkWareLtd's plans to decentralize StarkNet and launch its own token

/13

• Arbitrum’s Nitro upgrade (higher throughput and lower fees)

• zkEVM announcements: @0xPolygon, zkSync, and Scroll

• @StarkWareLtd's plans to decentralize StarkNet and launch its own token

/13

Note:

These token launches with 'airdrops' are important events for the ecosystem. They help in creating a community

However, they may be an unsustainable approach to adoption

These ecosystems may need to create organic user adoption to thrive long term

/14

These token launches with 'airdrops' are important events for the ecosystem. They help in creating a community

However, they may be an unsustainable approach to adoption

These ecosystems may need to create organic user adoption to thrive long term

/14

3. SECTOR ANALYSIS:

3.1) DEXs:

The daily transaction volume of DEXs dropped from $2.7B in Q2 to $1.83B in Q3

Uniswap had ~75% of DEX market share throughout Q3

Curve’s volume share fell from 16% to 8% despite continuing to issue higher incentives than the competition

/15

3.1) DEXs:

The daily transaction volume of DEXs dropped from $2.7B in Q2 to $1.83B in Q3

Uniswap had ~75% of DEX market share throughout Q3

Curve’s volume share fell from 16% to 8% despite continuing to issue higher incentives than the competition

/15

3.2) BORROWING AND LENDING:

The daily average lending volume fell from $280B in Q2 to $116B in Q3

However, the volume picked up slightly in August

This could be due to the demand from spot $ETH for individuals looking to farm the $ETH POW airdrop

/16

The daily average lending volume fell from $280B in Q2 to $116B in Q3

However, the volume picked up slightly in August

This could be due to the demand from spot $ETH for individuals looking to farm the $ETH POW airdrop

/16

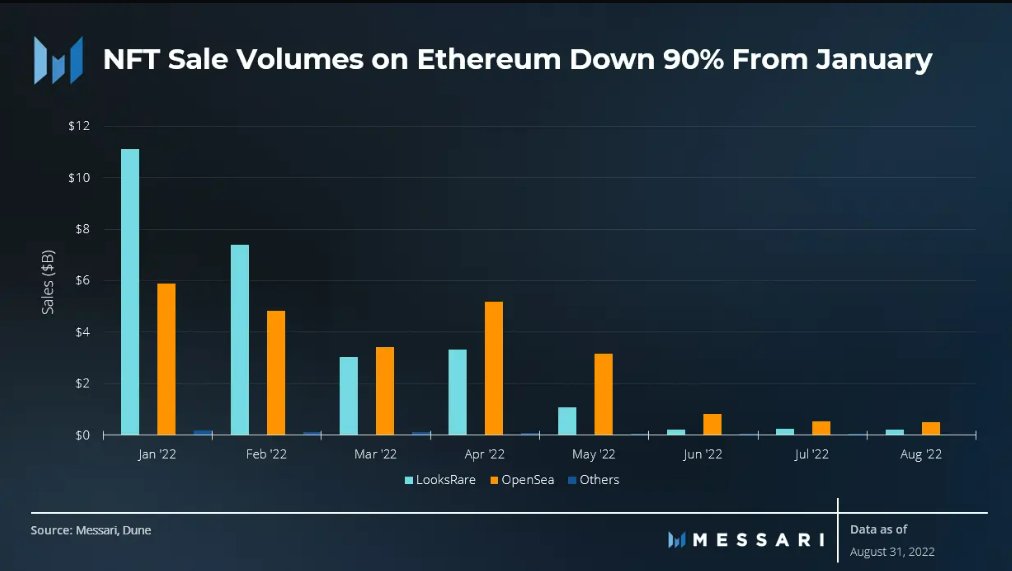

3.3) NFTs:

The NFT daily trading volumes dropped dramatically

However, the average number of daily traders witnessed a much smaller decline

This might indicate a sticky user base of 40,000 users per day

/17

The NFT daily trading volumes dropped dramatically

However, the average number of daily traders witnessed a much smaller decline

This might indicate a sticky user base of 40,000 users per day

/17

NFT sale volumes (in dollar terms) fell 90% from January 2022

NFT sales have averaged less than $1B per month in Q3 compared to $4.6 billion in Q2

This decline might be due to:

• Slowing market for NFTs

• Drop in $ETH price

/18

NFT sales have averaged less than $1B per month in Q3 compared to $4.6 billion in Q2

This decline might be due to:

• Slowing market for NFTs

• Drop in $ETH price

/18

4. THE MERGE AND TRANSITION TO POS:

The Merge occurred successfully on September 15, 2022

Miners created an ongoing POW fork called $ETHW

The chain has seen no support from users and limited support from infrastructure providers

/19

The Merge occurred successfully on September 15, 2022

Miners created an ongoing POW fork called $ETHW

The chain has seen no support from users and limited support from infrastructure providers

/19

The #Merge resulted in a decrease of 90% in block rewards

This significantly reduces the network’s inflation and reduces its annual security expense

The transition to PoS also allowed $ETH to significantly lower energy consumption, down by 99.95%

/20

This significantly reduces the network’s inflation and reduces its annual security expense

The transition to PoS also allowed $ETH to significantly lower energy consumption, down by 99.95%

/20

$ETH deposits into the Beacon Chain have slowed down significantly. It grew by only 4% compared to 17% for Q2

The primary reason for this low growth is that stETH currently trades at a discount to spot $ETH

/21

The primary reason for this low growth is that stETH currently trades at a discount to spot $ETH

/21

5. COMPETITIVE ANALYSIS:

62% of Crypto's TVL is on ETH and its L2 ecosystem

$ETH contributes the lion’s share of the TVL with $34B, however, its TVL has grown by just 8% since the end of Q2

/22

62% of Crypto's TVL is on ETH and its L2 ecosystem

$ETH contributes the lion’s share of the TVL with $34B, however, its TVL has grown by just 8% since the end of Q2

/22

The Ethereum ecosystem has an advantage with the number of active developers on the network

The developer activity on Ethereum has stood up better than on other ecosystems in the bear market

Its developer activity share has increased by 10% compared to last year

/23

The developer activity on Ethereum has stood up better than on other ecosystems in the bear market

Its developer activity share has increased by 10% compared to last year

/23

6. NEXT STEPS ON THE ROADMAP:

• Developers are now looking to the Shanghai upgrade which will enable withdrawals for stakers

• EIP-4844 proposal which might be included in the Shanghai upgrade will make it cheaper for L2s to post their transactions to Ethereum L1

/24

• Developers are now looking to the Shanghai upgrade which will enable withdrawals for stakers

• EIP-4844 proposal which might be included in the Shanghai upgrade will make it cheaper for L2s to post their transactions to Ethereum L1

/24

• The EIP-4444 proposal would enable nodes to prune the transaction history after one year

This means that the nodes don't need to download this set of history

As a result, this will drastically reduce node resource requirements and further decentralize the network

/25

This means that the nodes don't need to download this set of history

As a result, this will drastically reduce node resource requirements and further decentralize the network

/25

• Ethereum is expected to further scale with danksharding towards the end of 2023

With the increased volume of L2 solutions, EIP-4844, and danksharding, Ethereum will likely be fast and cheap enough for 99% of users in the next 12–18 months

/26

With the increased volume of L2 solutions, EIP-4844, and danksharding, Ethereum will likely be fast and cheap enough for 99% of users in the next 12–18 months

/26

7. Closing Summary:

Ethereum remains the most vibrant ecosystem in all of crypto, with the majority of the developer, user, and application activity

However, with new L1s like Aptos, Sui, and Celestia, it will have to continue to build its moat to remain the top dog!

/27

Ethereum remains the most vibrant ecosystem in all of crypto, with the majority of the developer, user, and application activity

However, with new L1s like Aptos, Sui, and Celestia, it will have to continue to build its moat to remain the top dog!

/27

Subscribe to our newsletter if you want our weekly digest of the most important happenings in the Cryptoverse:

thecryptoilluminati.substack.com

thecryptoilluminati.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh