#Juventus 2021/22 accounts cover a season when they finished 4th in Serie A, won the Coppa Italia, but were eliminated in the Champions League last 16. The club noted that finances were “once again significantly penalised” by COVID. Some thoughts in the following thread.

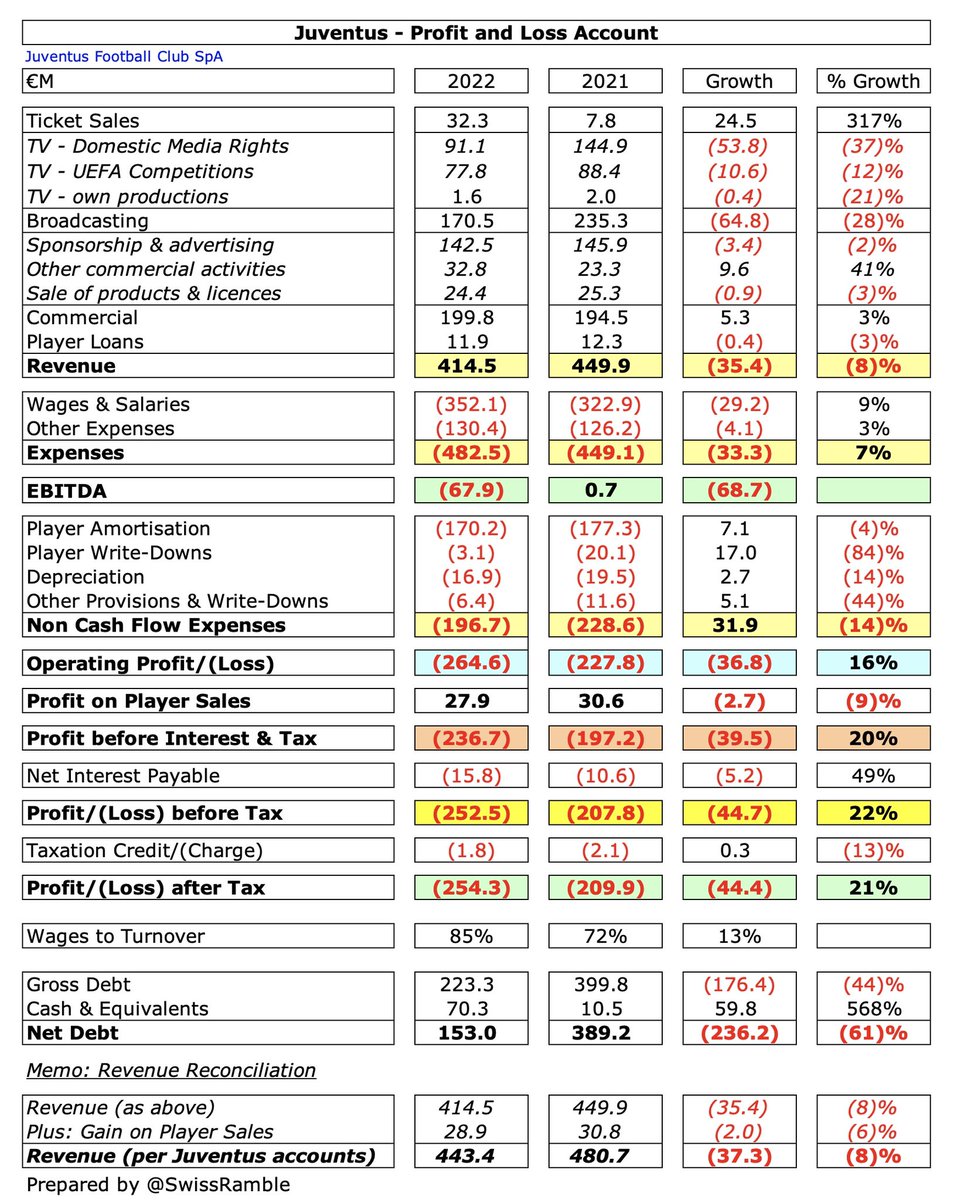

#Juventus pre-tax loss widened from €208m to €252m (€254m after tax), as revenue dropped €35m (8%) from €450m to €415m and profit on player sales fell €3m (9%) to €28m. Operating expenses rose €1m (6%), while net interest payable increased €5m (49%) to €16m.

The return of fans to the stadium meant growth in #Juventus ticket sales, up €25m to €32m, and commercial, up €5m (3%) to €200m. However, broadcasting fell €65m (28%) to €171m, partly as income in prior year deferred from extended 2019/20 season. Player loans flat at €12m.

As a technical aside, this international definition of #Juventus €415m revenue is different to the one used in the club accounts, which also includes €29m gain on player sales, giving revenue of €443m, which decreased €38m (8%) from prior year’s €481m.

#Juventus wage bill rose €29m (9%) from €323m to €352m, but player amortisation (including write-downs) was cut €24m (12%) to €173m and depreciation/other provisions fell €8m. Other expenses grew €4m (3%) to €130m.

Unsurprisingly, #Juventus huge €254m post-tax loss is the worst in Italy to date for 2021/22, much higher than Inter €140m and Milan €67m. Almost all Italian clubs have posted losses in the past 2 years, influenced by COVID. One exception is Atalanta who made €35m net profit.

In fact, #Juventus €254m post-tax loss is the highest ever in Italy, ahead of #Inter €246m and their own €210m in 2020/21. Their total €289m deficit for 2020 and 2021 was one of the worst in Europe, only surpassed by Barcelona €689m, PSG €350m, Inter €337m & #EFC €296m.

Italy’s traditional Big Three lost a shocking €1.4 bln between them in the last 3 years with #Juventus “leading the way” with €554m, followed by Inter €488m & Milan €358m. Little wonder that president Andrea Agnelli described this as the club’s “gloomiest moment” financially.

Losses were largely, but not solely, caused by the impact of COVID, which #Juventus estimated as a hefty €320m for 3-year period between 2020 and 2022, including losses in match day income and retail sales, plus lower money from player sales due to a deflated transfer market.

#Juventus profit from player sales fell €3m from €31m to €28m, mainly Rodrigo Bentancur to #THFC €12m and Merih Demiral to Atalanta €10m. This was the club’s lowest gain from this activity since 2015, and also less than Atalanta €50m and Sassuolo €33m in 2021/22.

After 4 years of profits , #Juventus have now made losses 5 seasons in a row, worsening each year and adding up to a €579m pre-tax deficit in that period. The club expects 2022/23 results to “significantly improve”, though not so much that they will manage to break-even.

COVID has impacted #Juventus ability to make big money from player sales. In 4 years to 2020 they averaged €132m profit, but only managed to realise €31m in 2021 & €28m in 2022. Ronaldo €15m sale to #MUFC was at a slight loss. Made €34m this summer, mainly De Ligt to Bayern.

The importance of player trading to the #Juventus business model is illustrated by them making €557m profit from player sales in the 5 years up to 2021, nearly €200m more than Napoli, and the best performance in Europe, comfortably ahead of #CFC €471m and Real Madrid €411m.

#Juventus operating loss widened from €228m to €265m in 2022, which is the highest in Italy, ahead of Inter €204m and Roma €157m (both 2020/21 figures). Even before COVID this had been on a steady downward trend from just €1m in 2015.

Excluding player sales, #Juventus revenue fell €80m (16%) in the past 3 years from the €494m peak to €415m, though still club’s 3rd highest ever. Reduction has been driven by match day, down €38m due to COVID restrictions, and broadcasting, partly offset by commercial growth.

Despite the fall, #Juventus €415m revenue is still highest in Italy, well ahead of Inter €354m, Milan €241m, Roma €197m & Napoli €179m (2020/21 figures). The only leading club that has greatly grown revenue is Atalanta, doubling from €85m in 2019 to €169m thanks to CL.

#Juventus climbed one place to 9th place in the Deloitte Money League, based on 2020/21 revenue, having overtaken #THFC. However, they were still over €200m below table-topping #MCFC €645m and Real Madrid €641m. Also €59m less than 8th placed #CFC.

#Juventus broadcasting revenue fell €64m (28%) from €235m to €171m, as prior year benefited from income deferred from the extended 2019/20 season (games played in July & August). One of the highest in Italy (Inter 2020/21 also boosted by deferrals), but below average in Europe

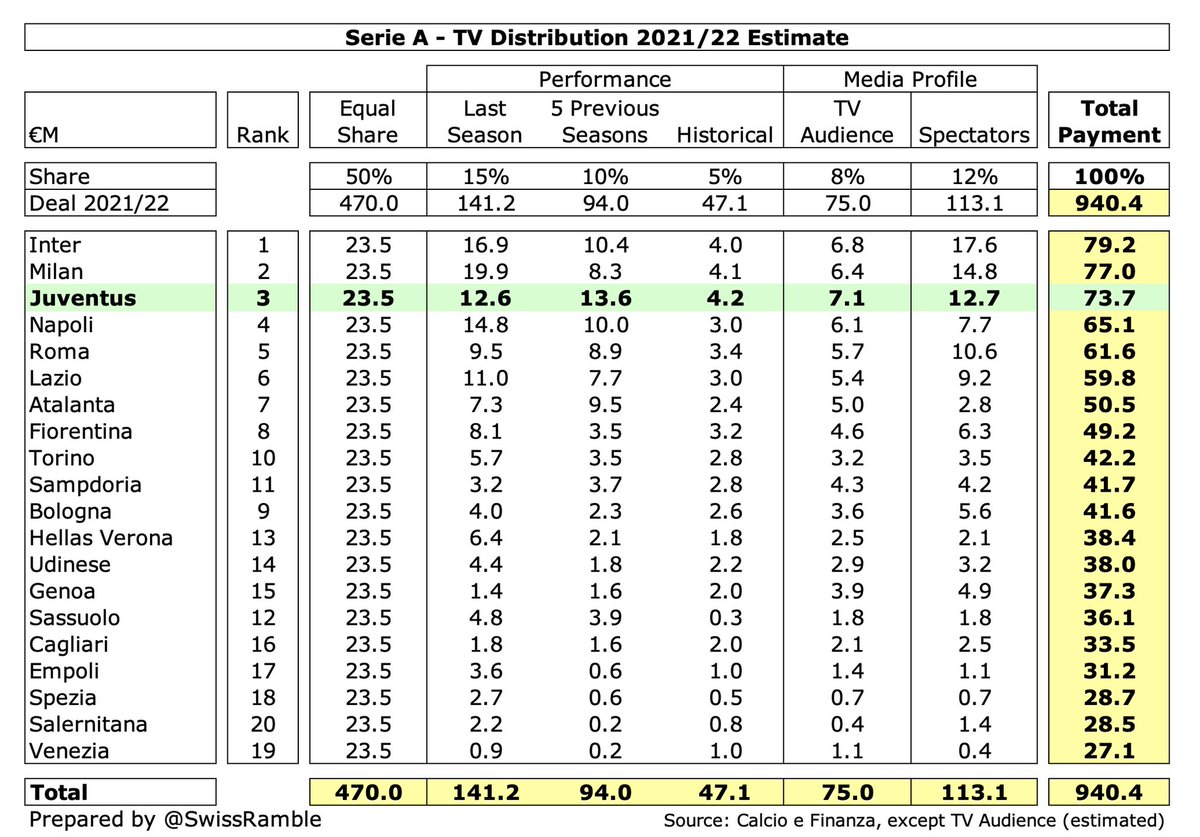

Per my model, #Juventus received €74m TV money from Serie A in 2021/22: 50% equal share; 30% performance (15% last season, 10% last 5 years, 5% historical); 20% media profile (8% TV audience, 12% fans). Lower than Inter €79m and Milan €77m.

It is imperative that #Juventus do well in Champions League to boost broadcasting income, as Serie A TV rights are low at €1.1bln, especially after new deal fell 13% (domestic down 5%, international 37%). Agnelli described the Premier League €3.9bln deal as “unapproachable”.

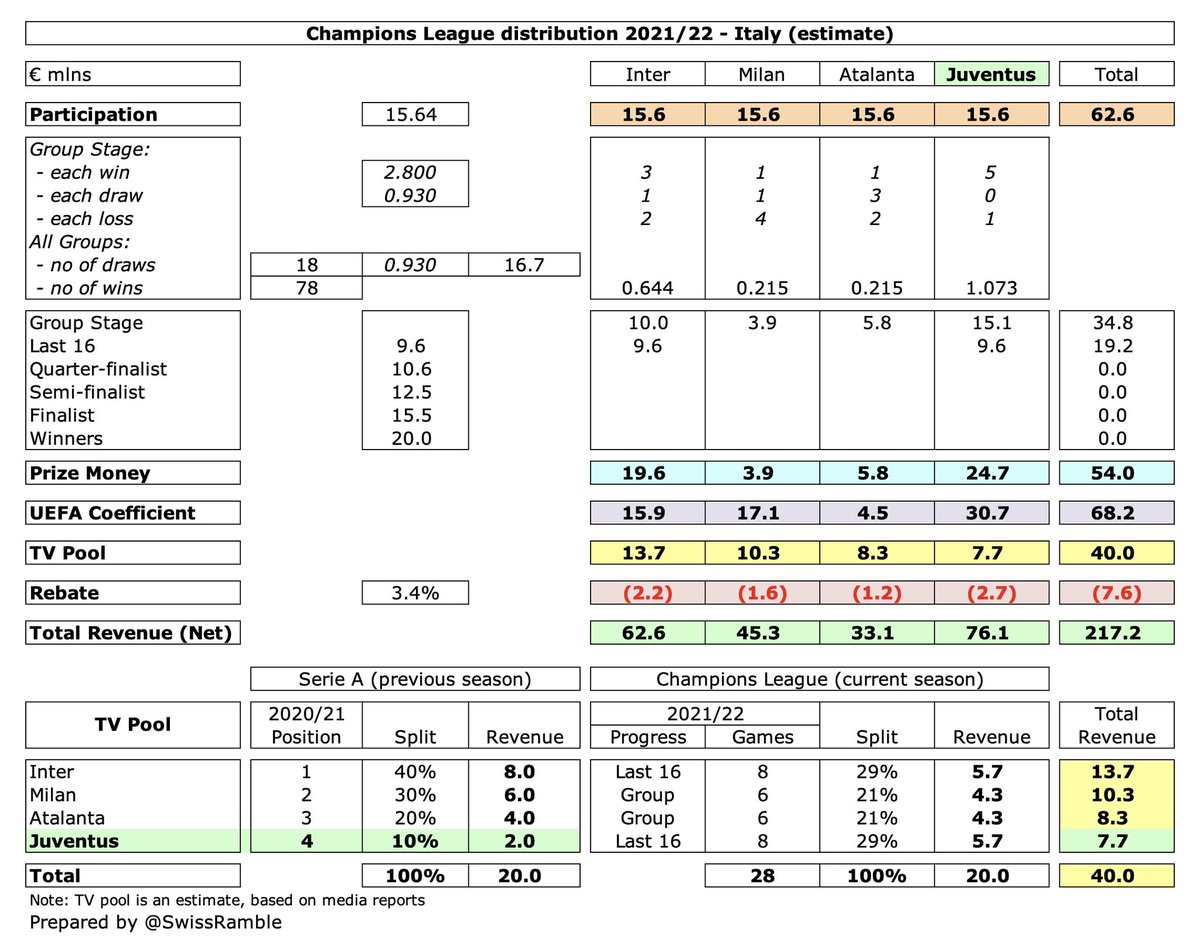

I estimate that #Juventus earned €76m from the Champions League after reaching the last 16, €7m less than prior year, mainly due to TV pool (smaller Italian deal, less favourable Serie A finish). Still better than other Italian clubs: Inter €63m, Milan €45m & Atalanta €39m.

Worth noting the influence on Champions League money of the UEFA coefficient payment (based on performances over 10 years), where #Juventus had the 6th highest ranking, guaranteeing them €31m, compared to much lower amounts at Milan €17m, Inter €16m and Atalanta €5m.

The Champions League is extremely important for #Juventus, earning them €419m in the last 5 year, significantly higher than other Italian clubs (Inter €225m, Roma €201m & Napoli €193m), though they peaked in 2017 with €110m. This season’s struggles are therefore meaningful.

#Juventus match day income rose €25m to €32m, due to the return of fans to the stadium, though many games were played with restricted capacity. Also offset by credits from 2019/20 pandemic season. This revenue stream was as much as €71m pre-COVID, easily the highest in Italy.

#Juventus average attendance was down to 23,800 in 2021/22, as stadium capacity was restricted to 50% - 75% until end-March 2022. Even before COVID struck, Juve’s average attendance was only the 3rd highest in Serie A, but their tickets are relatively expensive.

#Juventus commercial income rose €5m (3%) to €200m, including more money from activities taking place at the stadium. Juve have almost doubled this revenue stream since 2016, distancing themselves from Inter, whose revenue from Chinese sponsors has fallen from its peak.

As a result, #Juventus €200m commercial income is comfortably the highest in Italy, well ahead of Inter €142m, then a big gap to Milan €94m, Fiorentina €58m & Roma €53m. However, Juve miles below other too European clubs like Bayern €345m, PSG €337m & Real Madrid €322m.

#Juventus shirt sponsor Jeep, up from €42m to €45m, extended to 2024 (only €17m in 2019), while Adidas kit deal increased from €23m to €51m in 2020 (to 2027). Best deals in Italy, but a little behind the curve on the European landscape. Allianz stadium/training kit €10m.

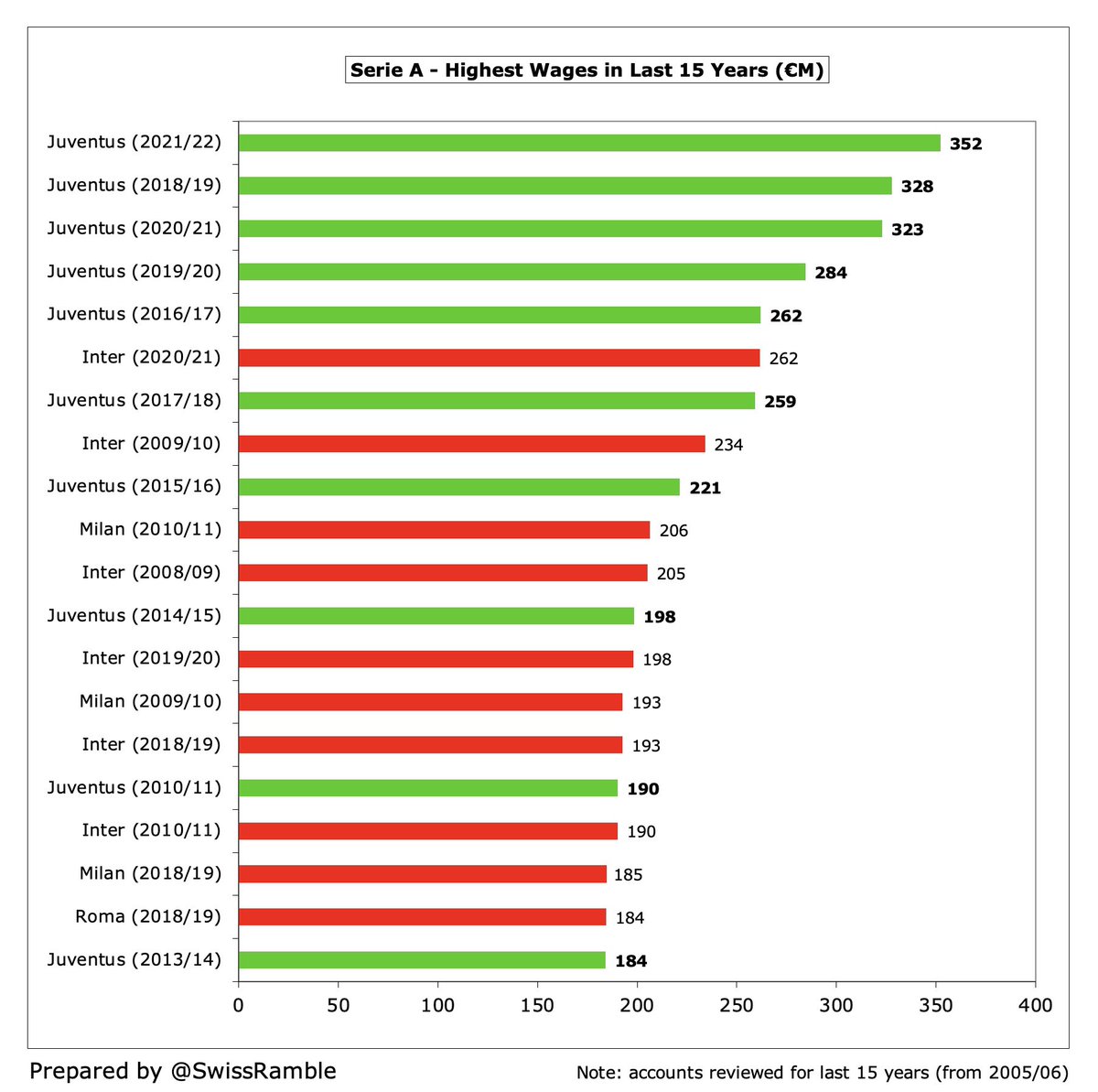

#Juventus wage bill rose €29m (9%) from €323m to €352m, the highest ever in Serie A, despite Cristiano Ronaldo’s move to #MUFC. The only other Italian club with similar growth in the past 5 years is Inter, but others have hardly increased at all, e.g. Milan and Roma.

#Juventus wage bill of €352m is significantly higher than the rest of Serie A with closest challengers being Inter €262m, Milan €170m, Roma €169m & Napoli €155m. However, a fair bit less than European peers, e.g. PSG €503m, Barcelona €432m and #MCFC €401m (all from 2021).

#Juventus wages to turnover ratio increased from 72% to 85%, the club’s highest since 2011 and well above UEFA’s recommended 70% limit. This is mid-table in Italy, around the same as Napoli and Roma, but a fair bit higher than Inter 74% and Milan 70% (though these are from 2021).

#Juventus player amortisation, the annual cost of writing-off transfer fees, fell €7m (4%) from €177m to €170m, though up from only €54m in 2015. Still the highest in Italy, ahead of Inter €137m and Napoli €111m. In addition, player write-downs decreased from €20m to €3m.

#Juventus gross transfer spend in 2022 was €229m, mainly Vlahovic €81m & Chiesa €41m (both from Fiorentina), Kean from #EFC €37m and Locatelli from Sassuolo €27m. Juve €1.2bln player purchases in 5 years to 2021 were highest in Europe, even ahead of Barcelona, #MCFC & #CFC.

Based on Transfermarkt, #Juventus have by far the highest gross transfer spend in Serie A in last 5 years (up to 2022/23) of €880m, around €400m more than Inter €495m, Roma €489m, Milan €478m and Napoli €443m. On a net spend basis, Juve €282m is just ahead of Milan €261m.

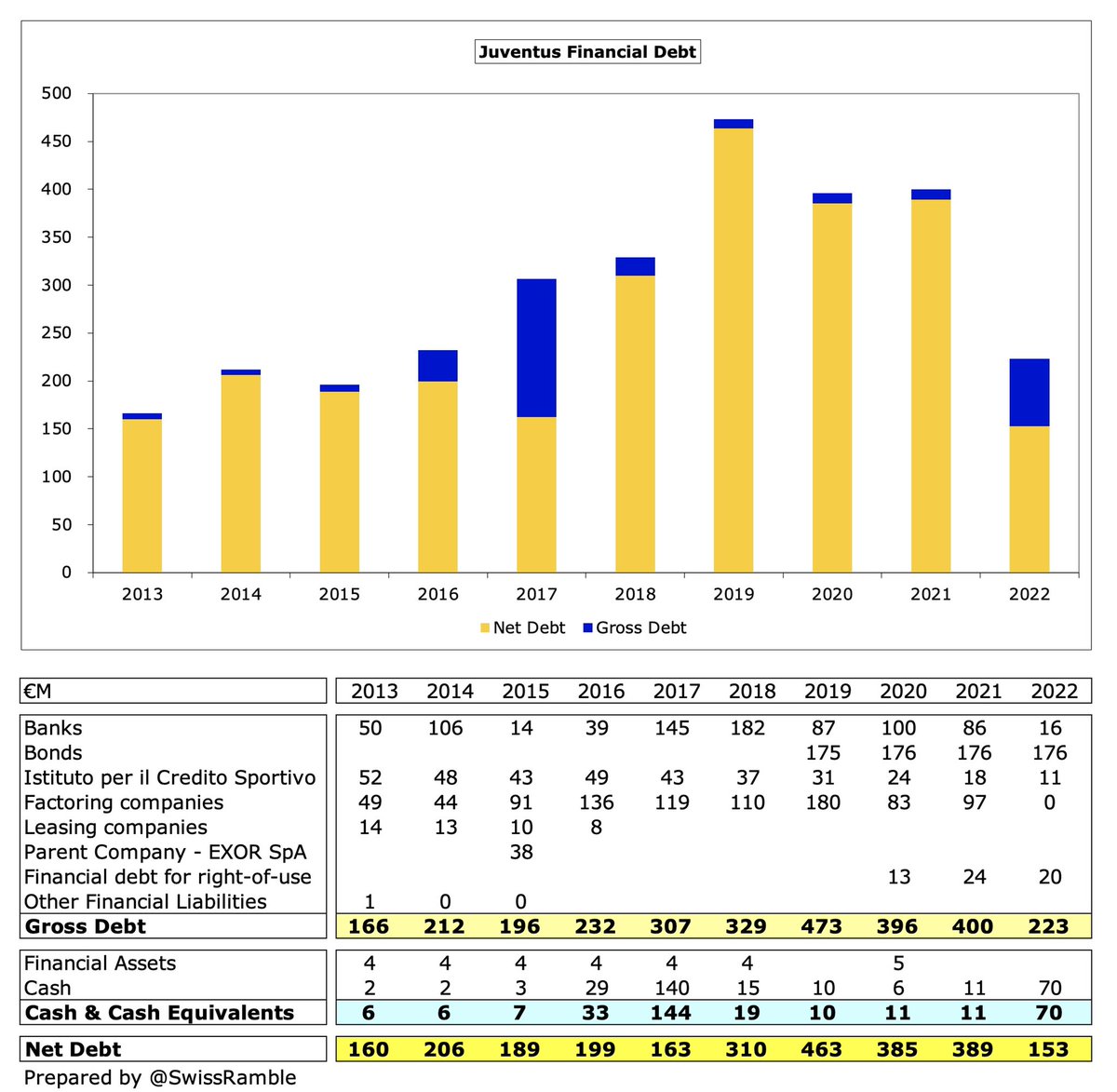

#Juventus gross financial debt was reduced from €400m to €223m, mainly due to use of proceeds from capital increase. Includes €176m bonds, €16m bank loans, €11m owed to Istituto per il Credito Sportivo and €20m other debt. Significantly down from €473m peak in 2019.

#Juventus gross debt of €223m is now 3rd highest in Italy, below both Inter €472m & Roma €335m. Loans were originally for stadium development, but have increasingly been used to finance investment in squad. Still far below clubs like #CFC €1.7bln, #THFC €964m & #MUFC €599m.

#Juventus net interest payable increased €5m (49%) from €11m to €16m, which was the third highest in Italy, but still a fair way below Roma €36m and Inter €35m (both 2020/21 figures).

#Juventus transfer debt increased from €265m to €290m, almost twice as much as Inter €152m. Largest amounts due to Fiorentina €91m, Barcelona €45m, Sassuolo €32m & #EFC €32m. In 2021 they owed more to football clubs than anyone in Europe, even higher than Barcelona €231m.

After adding back €197m non-cash items & €36m working capital moves, #Juventus had €32m negative operating cash flow in 21/22, boosted by €94m from player sales. Spent €204m on player purchases, €6m interest & €5m capex. Reduced loans by €181m, but received €394m capital

#Juventus strengthened its balance sheet with a €394m capital increase, which means that the club has received €913m from its shareholders since 2007, including nearly €700m in last 3 years. In the 3 years up to 2021, the only European club with higher owner funding was Milan.

#Juventus losses resulted in a UEFA FFP settlement of €23m, though only €3m paid immediately with remainder conditional depending on compliance with targets. Even after allowable deductions and COVID consideration, my model suggests Juve were far above acceptable deviation.

#Juventus have not given up hope of being able to join a European Super League with Agnelli talking of football’s “financial unsustainability”. Given their challenges, this is unsurprising, especially with the reported size of ESL revenue, including a €270m welcome bonus.

Agnelli said, “The road to economic recovery has already been embarked upon by the club, but it is a very demanding step-by-step path.” #Juventus financial performance will be influenced by sports results, especially the Champions League, hence the questions on Allegri’s future.

• • •

Missing some Tweet in this thread? You can try to

force a refresh