So, @Jeremy_Hunt now did a full and welcome u-turn on the #minibudget2022. And they are starting to tackle another policy that needs fixing, the #EnergyPriceguarantee #EPG. Why should this happen? This is a story that can ultimately be summarised in these two pictures.... 1/..

On the left, we have a classic end-terrace house. On the right, well, you have a mansion. The big difference: energy consumption. The left needs around 15,000 kWh per year, the right one, at least 70,000 kWh. How does this compare to the average UK household? Well: 2/..

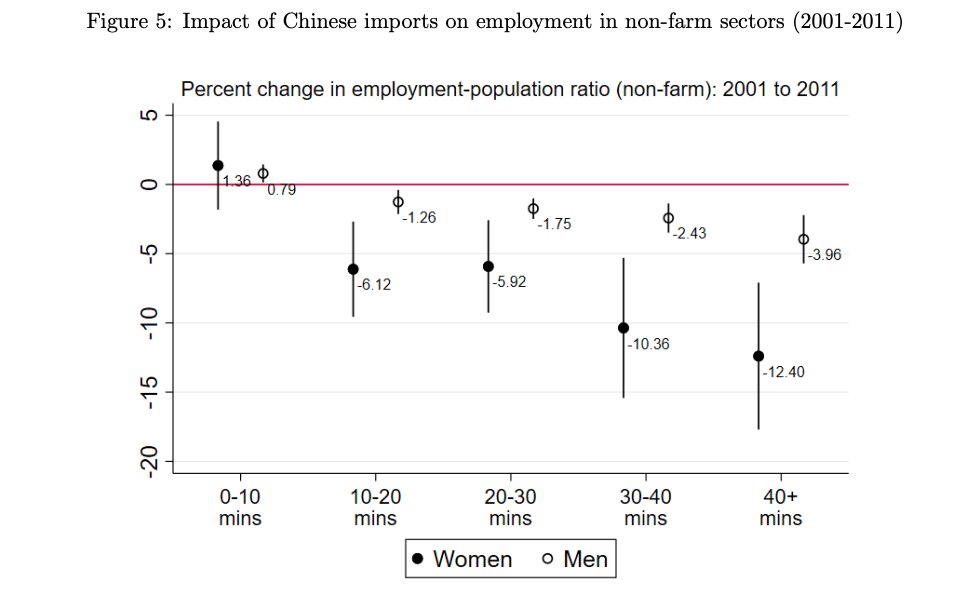

The graph highlights one thing: energy consumption is strongly increasing in household income. But even in the highest income group there is huge variation. 50% of households even in top income group consume less than half as much energy than the top 5% in this group. 3/..

So what does this mean? Well, the EPG disproportionately benefits the better off. How can we quantify this? As economist this falls in the category: what is the counterfactual - what would energy bills have been with and without the EPG. 4/..

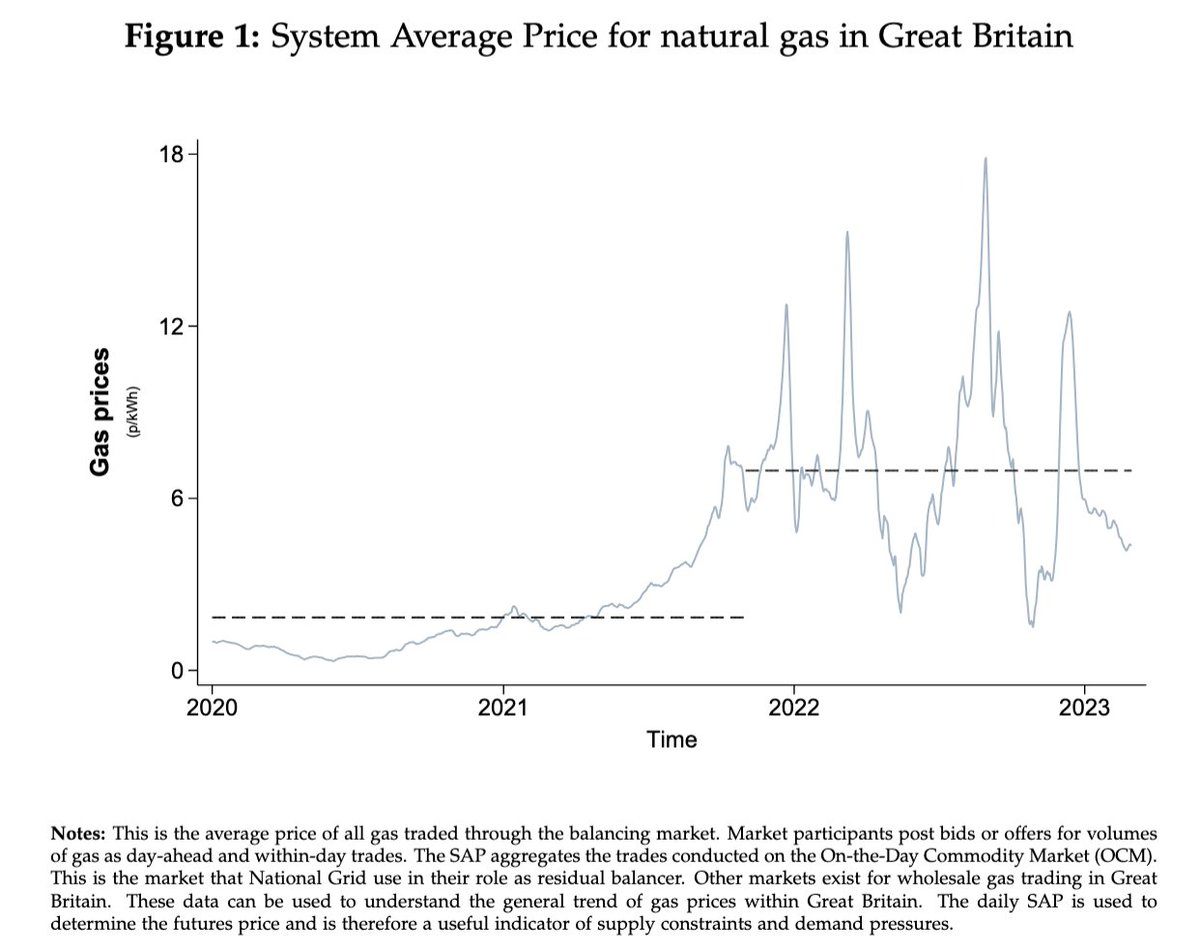

The Oct 2022 price cap seems a good anchor as this would have been the guide to energy prices coming from an independent industry regulator Ofgem. We can then simulate energy bills and compute the difference in bills at EPG prices and at Ofgem Oct 2022 market prices. 5/..

What we see is: the EPG (dashed blue) would reduce bills a lot relative to market prices (red solid). But you still see that bills would go up A LOT to last year (green). We are talking about at least GBP 1,300 for the average household. But again, this masks huge variation 6/..

We can compute this also to shed a light on the distribution within income bracket. The EPG energy subsidy is at least GBP 5,000 for the top 5% in the Income bracket > 150k or more than five times as large as the subsidy for 50% of all UK households at GBP 1,000. 7/..

Just remind yourself, we are comparing these two... and, the subsidy is not free of costs: in fact, recent market turmoil points to the question how this is paid for: it is either #taxation, #austerity or #debt. But cake-and-eat-it politics hits a hard ceiling. 8/..

Let me add some more perspective: the # of households in the top 5% energy/top income bracket is around 14,000. So these 14,000 households stand to benefit at least five times as much per household from the EPG than more than 12 million other households. 9/..

The EPG is regressive but also alienates many traditional Tory voters that are in the higher earning brackets. Many of whom do not have a lavish lifestyle but rather are similar in their consumption and lifestyle to a lot of middle income peers. 10/..

I have worked out a much more targeted alternative & there is much more. A paper and briefing should drop next week. Something bigger a week later. But: a stronger, healthier & more sustainable society can arise form this crisis but the answers are not found in the extremes. End.

• • •

Missing some Tweet in this thread? You can try to

force a refresh