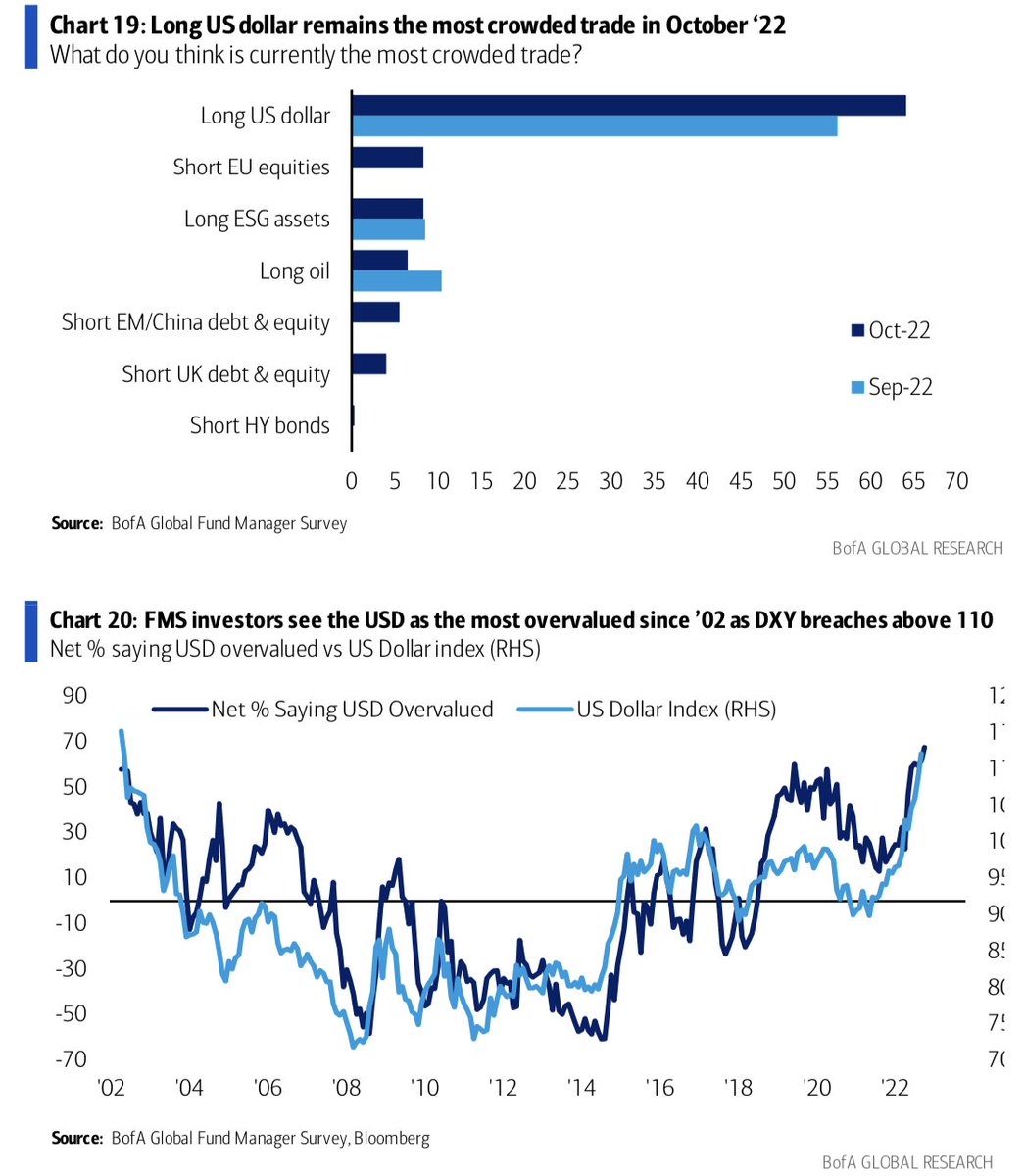

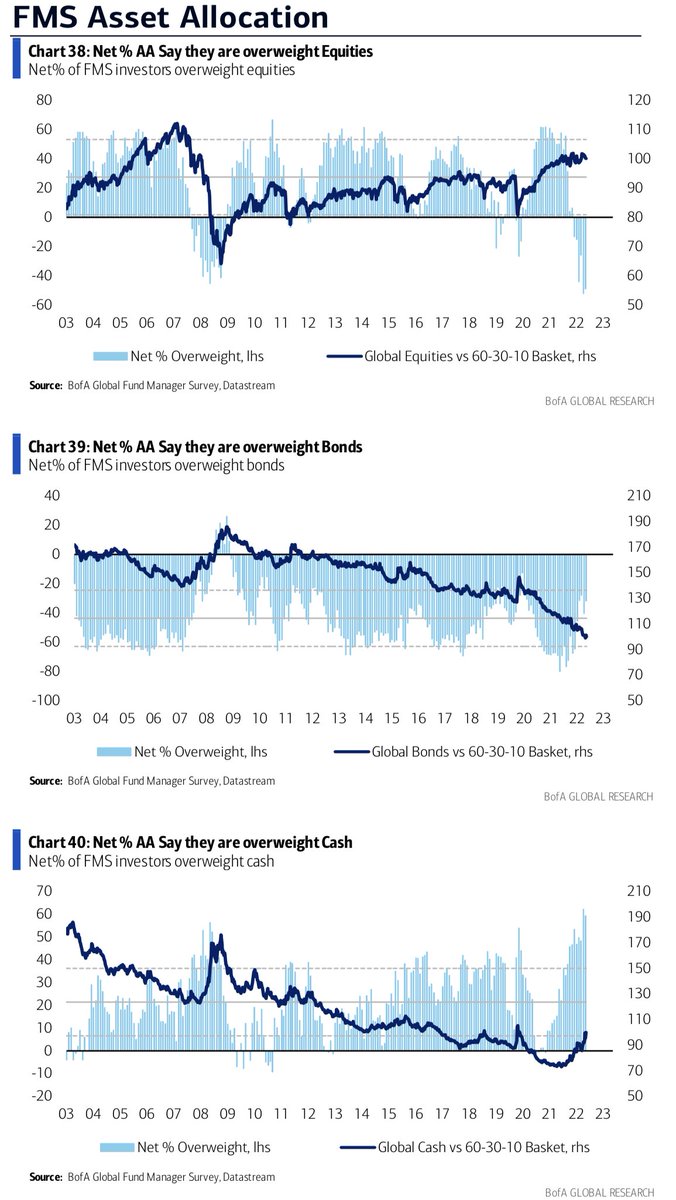

1) BofA Oct Global Fund Manager Survey released today.

Most charts are saying similar things and are at/near '08 extremes. But here's a sample.

Net fund managers % saying overweight cash and underweight equities beyond peak '08 levels.

$SPY $NDX $TLT $GLD #Commodities

Most charts are saying similar things and are at/near '08 extremes. But here's a sample.

Net fund managers % saying overweight cash and underweight equities beyond peak '08 levels.

$SPY $NDX $TLT $GLD #Commodities

2) Close to record levels of investors expect a weaker economy next 12M.

#Inflation expectations at Dec '08 level.

#Inflation expectations at Dec '08 level.

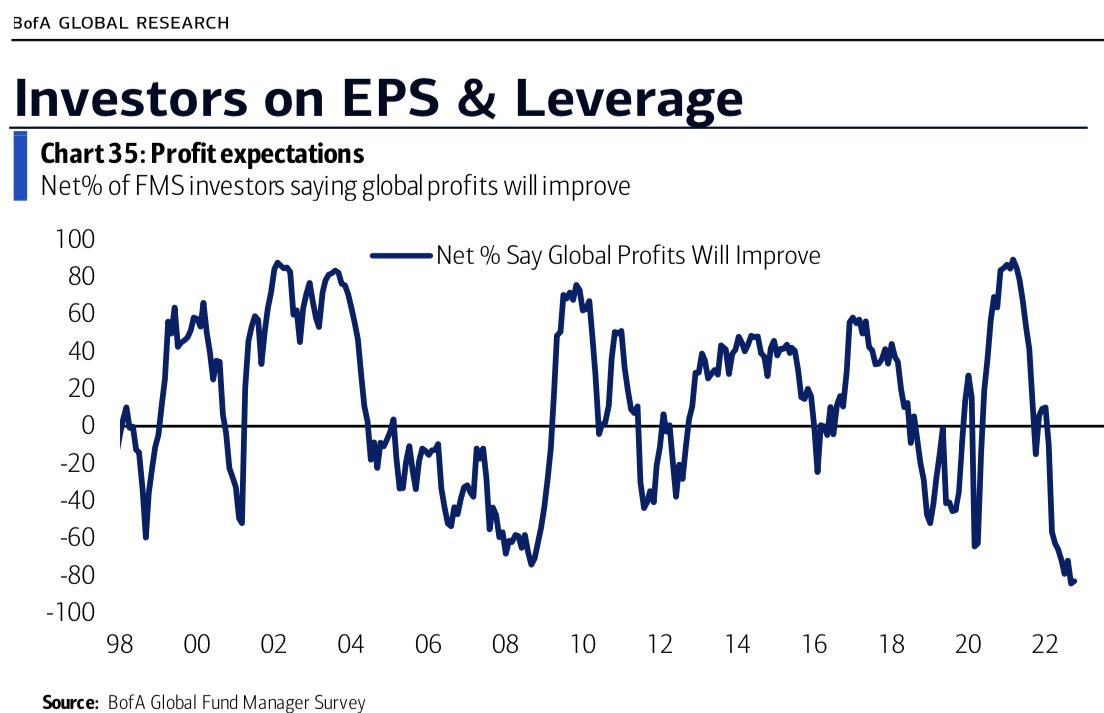

3) Lowest % on record saying taking higher than normal risk.

Lowest % saying global profits will improve.

Lowest % saying global profits will improve.

• • •

Missing some Tweet in this thread? You can try to

force a refresh