PetroTal #PTAL $TAL.V

While the company continues to grow its cash and profits, shareholders have seen their shares remain flat.

Within the next few months that could change and we may see the shares re-rated much higher. Let me explain./1

While the company continues to grow its cash and profits, shareholders have seen their shares remain flat.

Within the next few months that could change and we may see the shares re-rated much higher. Let me explain./1

At the end of September PetroTal had $93 million cash on hand. With the news this week that Petroperu is to receive $1 billion++ US in funds, their ability to shortly pay the $64 million noted by PetroTal increases significantly./2

https://twitter.com/hchris999/status/1582029669410361346?s=20&t=7GZyHyd_0Yc204GxGpUllQ

These two numbers total $157 million and are important to the repayment of the bonds. The CFO has stated that they want to maintain $75 million cash on hand (Aug 26 cc), and the bonds are $80 million. Any future cash flows (as of Q4) can then be used for dividends and buybacks./3

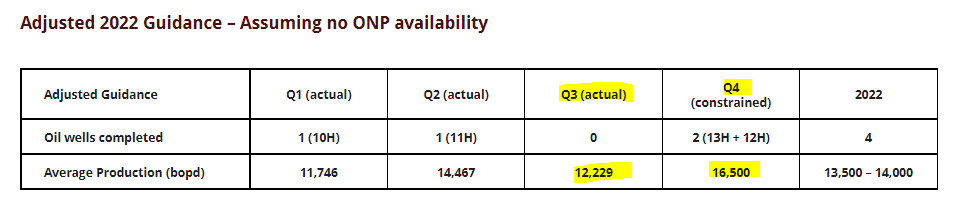

PetroTal has faced many operational challenges, with Q3 being no exception (water levels😞). In the face of this, they have generated an estimated $52 million US in free cash flow in Q3.

(As previously tweeted, they are transparent and their numbers are easier to understand)./4

(As previously tweeted, they are transparent and their numbers are easier to understand)./4

They are guiding significantly higher production for Q4 +35% with a return to higher water levels for barging. Their ability to earn free cash flow at Q2s level is very good, as lower oil prices can be offset by higher shipments./5

Before the news on Petroperu's finances, they anticipated repaying the debt by the end of Q1/23. If Petroperu pays them shortly, repayment sooner would be better as they are incurring $800,000/mth in interest costs (Total of $4 million Nov-Mar)./6

With the debt repaid, one path to a re-rating than comes from a sustainable dividend policy. The CEO very much favors returning funds this way (EnerCom Denver Aug 22).

As an example, a $.03 US/qtr dividend is easily affordable with free cash flow averaging $.06 US/qtr. /7

As an example, a $.03 US/qtr dividend is easily affordable with free cash flow averaging $.06 US/qtr. /7

Using this example, there remains ample funds for stock buybacks and business reinvestment, as noted by the free cash flow numbers.

Annualized it is $0.12 US. Converted it is CAD $0.16 and GBP 0.11

Consider the share price and yield of juniors who have a dividend policy./8

Annualized it is $0.12 US. Converted it is CAD $0.16 and GBP 0.11

Consider the share price and yield of juniors who have a dividend policy./8

Surge Energy - dividend yield 4.75%, market cap $742 million

Evolution Petroleum - dividend yield 6.23%, market cap $258 million

Pine Cliff Energy - dividend yield 7.06%, market cap $600 million

/9

Evolution Petroleum - dividend yield 6.23%, market cap $258 million

Pine Cliff Energy - dividend yield 7.06%, market cap $600 million

/9

With my example of a $0.12 US annual dividend the share price can be re-rated to a range of $1.20 US (10% yield) to $2.40 US (5% yield).

CAD $1.60 to $3.20

GBP 1.05 to 2.10

This alone would increase the stock by 2.5x to 5.0x the current share price./10

CAD $1.60 to $3.20

GBP 1.05 to 2.10

This alone would increase the stock by 2.5x to 5.0x the current share price./10

Once the shackles of their debt restrictions are removed, they will have the ability to significantly influence the share price through dividends. This analysis illustrates that impact.

With Petroperu's payment this opportunity could be shortly upon them./End

With Petroperu's payment this opportunity could be shortly upon them./End

• • •

Missing some Tweet in this thread? You can try to

force a refresh