How to interpret #ROE ( Return On Equity ) ?

Short Thread With Examples 🧵🧵

Like & retweet for better reach !

Short Thread With Examples 🧵🧵

Like & retweet for better reach !

1) We all know that Return on equity (ROE) is the measure of a company's net income divided by its shareholders' equity.

2)It basically tells us how efficiently a company is at converting its equity financing into profits.

2)It basically tells us how efficiently a company is at converting its equity financing into profits.

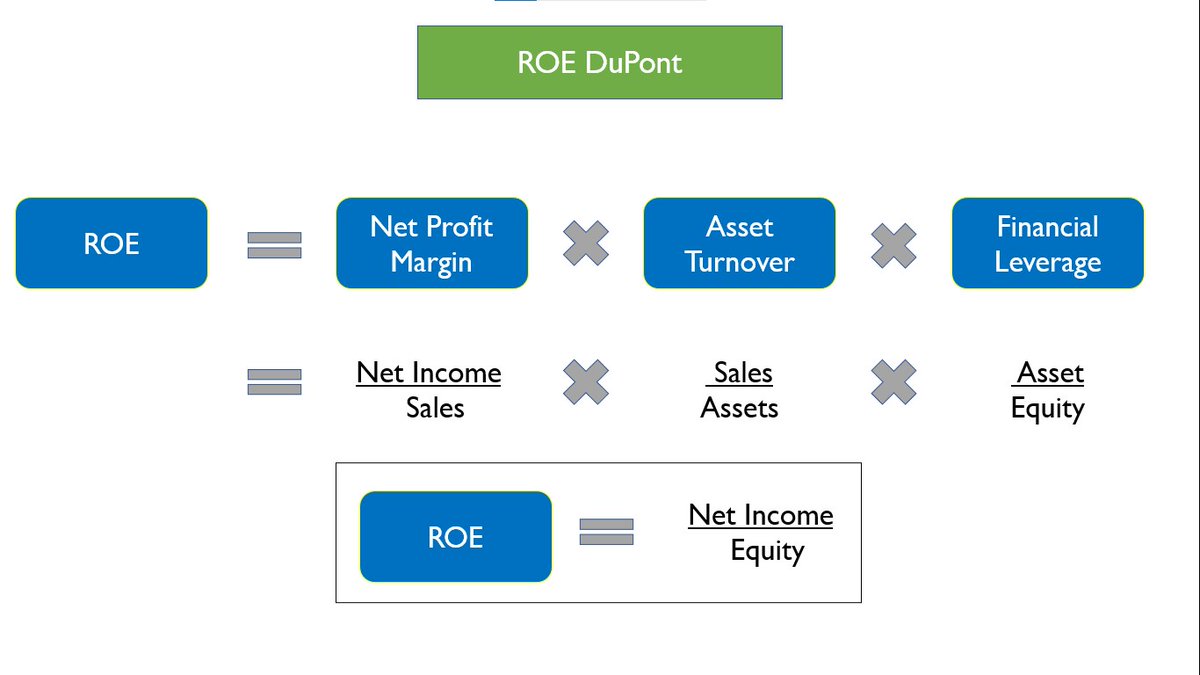

3) But it's very important to understand different drivers of Return on equity (ROE). Return on equity (ROE) is driven by three factors- net profit margin, asset turnover & financial leverage.

4) If it is driven by the net profit margin and asset turnover, generally it is seen in a positive light. We’ll see this using some examples.

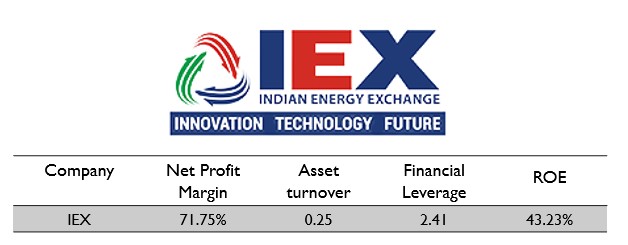

Case 1 : #IEX

If we check in the case of IEX we can see that its ROE is 43.23% and its ROE is majorly driven by net profit margin which is 71.75% as we can check from the table.

If we check in the case of IEX we can see that its ROE is 43.23% and its ROE is majorly driven by net profit margin which is 71.75% as we can check from the table.

IEX’s net profit margin is so high because it is a platform business and it doesn't have any raw material cost and also its employee cost doesn't increase that much as compared to revenues.

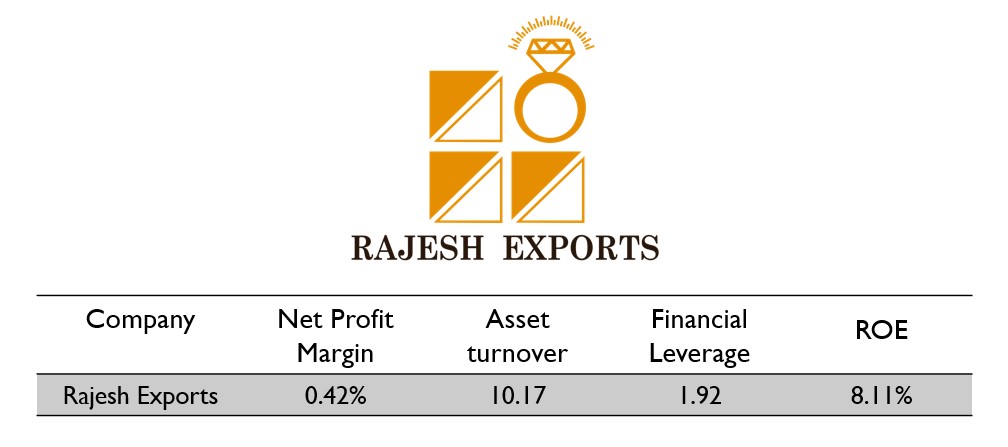

Case 2: #RajeshExports

Similarly, if we check in the case of Rajesh exports we can see that its ROE is 8.11% and its ROE is majorly driven by asset turnover which is 10.17 as we can check from the table.

Similarly, if we check in the case of Rajesh exports we can see that its ROE is 8.11% and its ROE is majorly driven by asset turnover which is 10.17 as we can check from the table.

Rajesh exports is involved in extensive global manufacturing of gold and gold products and marketing network with distribution through Exports. Its business depends on the volumes exported so its asset turnover is high.

Case 3: #TVSMotors

Similarly, if we check in the case of Rajesh exports we can see that its ROE is 17.2% and its ROE is majorly driven by financial leverage which is 6.10 as we can check from the table. Its financial leverage is high because it has high debt on the books.

Similarly, if we check in the case of Rajesh exports we can see that its ROE is 17.2% and its ROE is majorly driven by financial leverage which is 6.10 as we can check from the table. Its financial leverage is high because it has high debt on the books.

Conclusion:

So today's ROE might be high but we should also check for its sustainability. If net profit margin in a business is high it would attract competition and eventually net profit margin will fall which will in turn lead to reduction in ROE.

So today's ROE might be high but we should also check for its sustainability. If net profit margin in a business is high it would attract competition and eventually net profit margin will fall which will in turn lead to reduction in ROE.

So basically ROE is in-turn a function of entry barriers, product differentiation and financial leverage etc

Micro Cap Club : valueeducator.com/micro-cap-club/

Micro Cap Club : valueeducator.com/micro-cap-club/

• • •

Missing some Tweet in this thread? You can try to

force a refresh