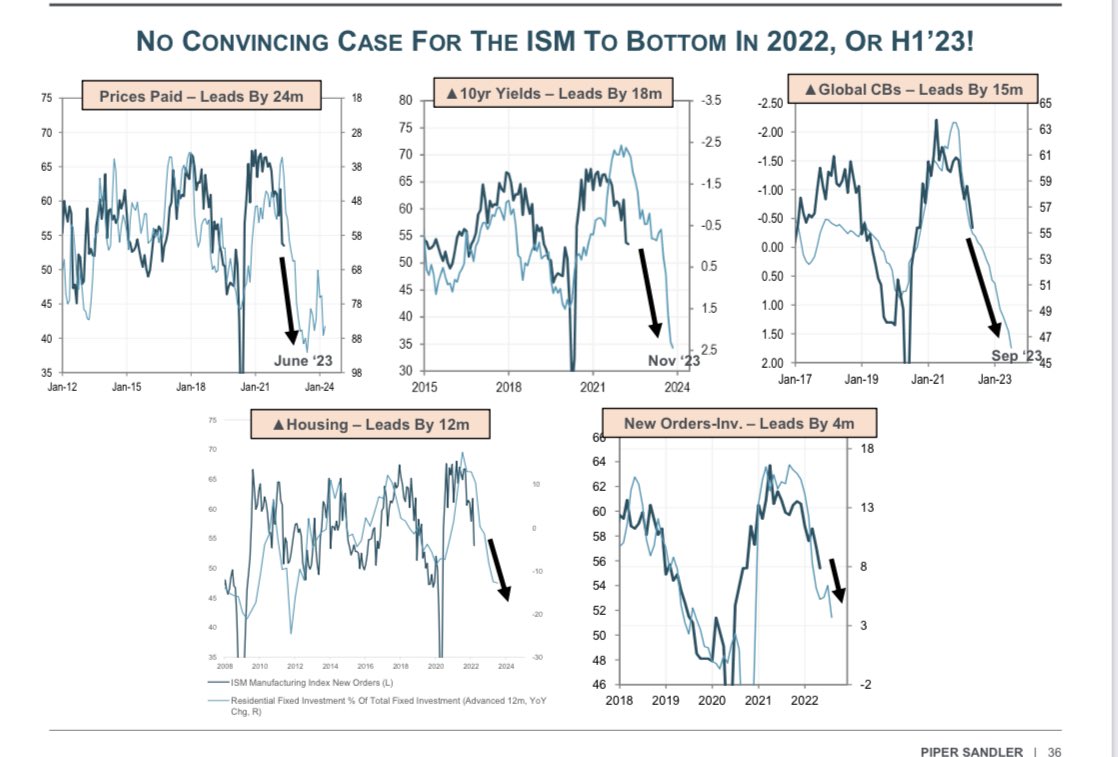

There is no point in arguing about employment today; there is a lag between tightening and the #HOPE cycle. Claims and UR didn’t rise until 4Q of 2000 and 2007. Until then people thought “employment was strong” … just like today. #macro #employment

If claims and the UR aren’t rising by mid 2023 then you have an interesting discussion. #macro

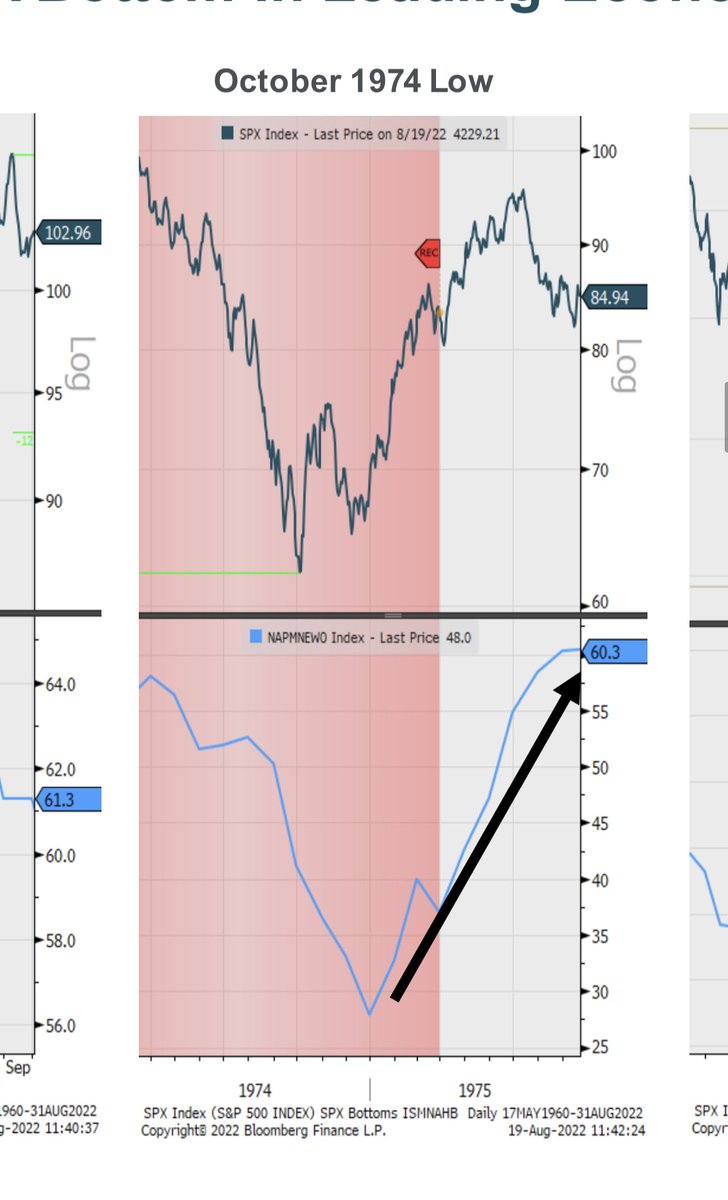

Proof is in the charts (and pudding). #macro $SPY

• • •

Missing some Tweet in this thread? You can try to

force a refresh