World Energy Outlook 2022 is out!

It shows energy markets & policies are changing profoundly as a result of Russia’s invasion of Ukraine

Today’s crisis promises to be a historic turning point towards a cleaner & more secure energy system

Read more ⬇️ iea.li/3SOmGBW

It shows energy markets & policies are changing profoundly as a result of Russia’s invasion of Ukraine

Today’s crisis promises to be a historic turning point towards a cleaner & more secure energy system

Read more ⬇️ iea.li/3SOmGBW

The world is dealing with a crisis of unprecedented breadth & complexity

Oil & gas markets are facing major uncertainties amid today’s geopolitical upheaval

High energy prices have stoked inflation & created a looming risk of global recession

Read more: iea.li/3DwmvWj

Oil & gas markets are facing major uncertainties amid today’s geopolitical upheaval

High energy prices have stoked inflation & created a looming risk of global recession

Read more: iea.li/3DwmvWj

Governments around the world are responding to the crisis by doubling down on clean energy – in the US, EU, Japan, China, India & elsewhere

Their new policies are set to help global clean energy investment rise above $2 trillion a year by 2030, an increase of over 50% from today

Their new policies are set to help global clean energy investment rise above $2 trillion a year by 2030, an increase of over 50% from today

For the 1st time ever, today's policy settings are strong enough to deliver a distinct peak in fossil fuel use within this decade.

This isn't enough to avoid severe climate impacts, but it's progress from where we were a few years ago. Stronger policies can steepen the decline.

This isn't enough to avoid severe climate impacts, but it's progress from where we were a few years ago. Stronger policies can steepen the decline.

The rise in coal use this year has attracted a lot of attention, but it's small & our new analysis suggests it will be temporary.

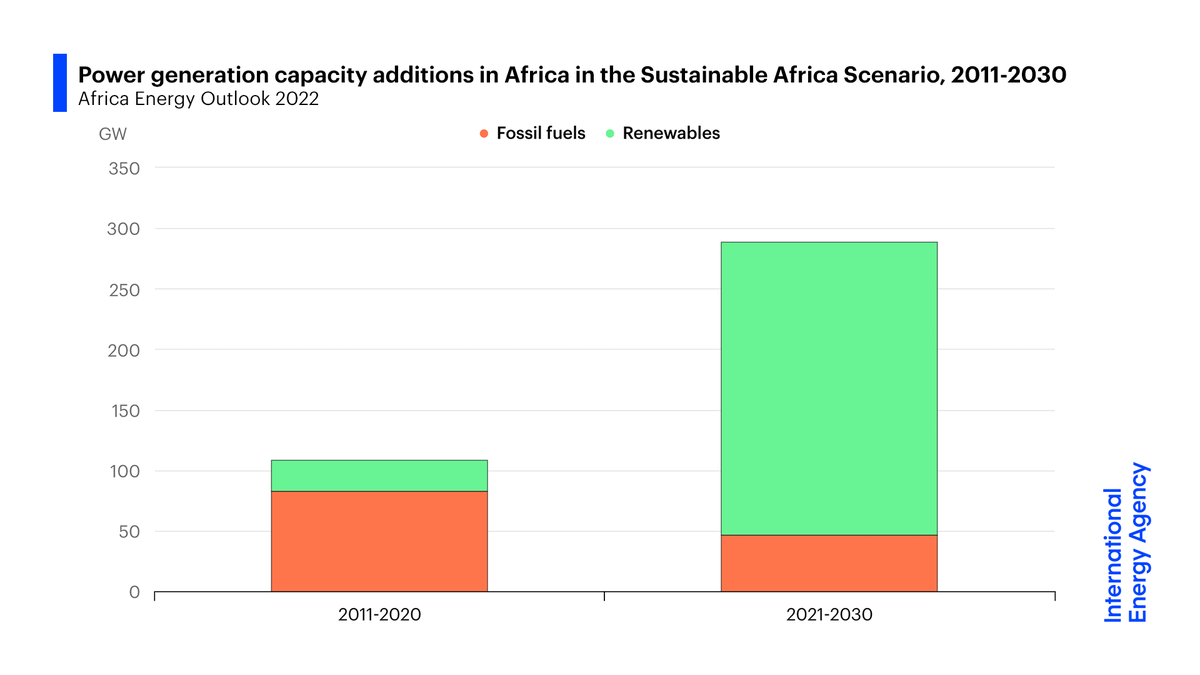

Renewables are set to surge even higher, with their electricity generation rising 90% by 2030, eating into coal & gas's share of the power mix.

Renewables are set to surge even higher, with their electricity generation rising 90% by 2030, eating into coal & gas's share of the power mix.

Progress in policies & technologies since 2015 has shaved 1°C off projected global warming, but much more is needed to reach the temperature goals of the Paris Agreement

Implementing announced climate pledges in full would lower warming to 1.7°C, moving us closer to safer ground

Implementing announced climate pledges in full would lower warming to 1.7°C, moving us closer to safer ground

Limiting global warming to 1.5°C would mean a much faster scaling up of clean energy globally

What's encouraging is that the announced pipeline of clean energy manufacturing projects would, in several areas, approach the levels needed to put the world on track for #NetZeroby2050

What's encouraging is that the announced pipeline of clean energy manufacturing projects would, in several areas, approach the levels needed to put the world on track for #NetZeroby2050

One of the effects of the current crisis is that the era of rapid growth in global gas demand draws to a close.

In Europe, climate policies accelerate the shift away from gas. New supply brings prices down by the mid-2020s, and LNG becomes even more important to gas security.

In Europe, climate policies accelerate the shift away from gas. New supply brings prices down by the mid-2020s, and LNG becomes even more important to gas security.

This year's WEO makes clear the long-term impacts of Russia's actions on its energy exports.

Russian fossil fuel exports never return – in any of our scenarios – to their 2021 levels. Within 10 years, Russia’s share of internationally traded oil & gas is set to fall by half.

Russian fossil fuel exports never return – in any of our scenarios – to their 2021 levels. Within 10 years, Russia’s share of internationally traded oil & gas is set to fall by half.

Amid these major changes, a new energy security paradigm is needed to ensure reliability & affordability while reducing emissions

That's why #WEO22 provides 10 principles to help guide policymakers through the period of declining fossil fuel & expanding clean energy systems

That's why #WEO22 provides 10 principles to help guide policymakers through the period of declining fossil fuel & expanding clean energy systems

To learn more about the new analysis in @IEA’s World Energy Outlook 2022, explore the freely available report online ➡️ iea.li/3SOmGBW

And join lead authors @Laura_Cozzi_ & @tim_gould_ and me for our live launch event at 11am Paris time ➡️ iea.li/3U0cQ0F

And join lead authors @Laura_Cozzi_ & @tim_gould_ and me for our live launch event at 11am Paris time ➡️ iea.li/3U0cQ0F

• • •

Missing some Tweet in this thread? You can try to

force a refresh