1/

RAW MATERIAL SHORTAGES WILL ELIMINATE TESLA'S COMPETITION

The tight supply of raw materials will be the main bottleneck to Tesla's 50%/yr vehicle growth target this decade. It is NOT a good thing $TSLA feels the need to get into mining. Rather, it is a huge warning sign...

RAW MATERIAL SHORTAGES WILL ELIMINATE TESLA'S COMPETITION

The tight supply of raw materials will be the main bottleneck to Tesla's 50%/yr vehicle growth target this decade. It is NOT a good thing $TSLA feels the need to get into mining. Rather, it is a huge warning sign...

https://twitter.com/tesla_fix/status/1588665276757073920

2/

that there won't be enough raw materials for most OEMs that have multi-million vehicle/yr growth ambitions. That means the battery input costs will get bid up until OEMs either begin dropping out of the EV race OR the supply of these raw materials increases significantly.

that there won't be enough raw materials for most OEMs that have multi-million vehicle/yr growth ambitions. That means the battery input costs will get bid up until OEMs either begin dropping out of the EV race OR the supply of these raw materials increases significantly.

3/

The latter is unlikely anytime soon. Depending on technical challenges, jurisdiction, permitting, feasibility studies, financing, etc. new #Lithium, #Nickel, #Graphite, and #Copper mines take 5-10+ years just to start production, let alone scale. E.g. On $TSLA Battery Day...

The latter is unlikely anytime soon. Depending on technical challenges, jurisdiction, permitting, feasibility studies, financing, etc. new #Lithium, #Nickel, #Graphite, and #Copper mines take 5-10+ years just to start production, let alone scale. E.g. On $TSLA Battery Day...

4/

$TSLA mentioned purchasing land in Nevada for #Lithium mining. That was over 2 years ago. Nothing material about it has been announced since then. There is no evidence of any permitting being approved or progress on any of the other factors discussed above.

$TSLA mentioned purchasing land in Nevada for #Lithium mining. That was over 2 years ago. Nothing material about it has been announced since then. There is no evidence of any permitting being approved or progress on any of the other factors discussed above.

5/

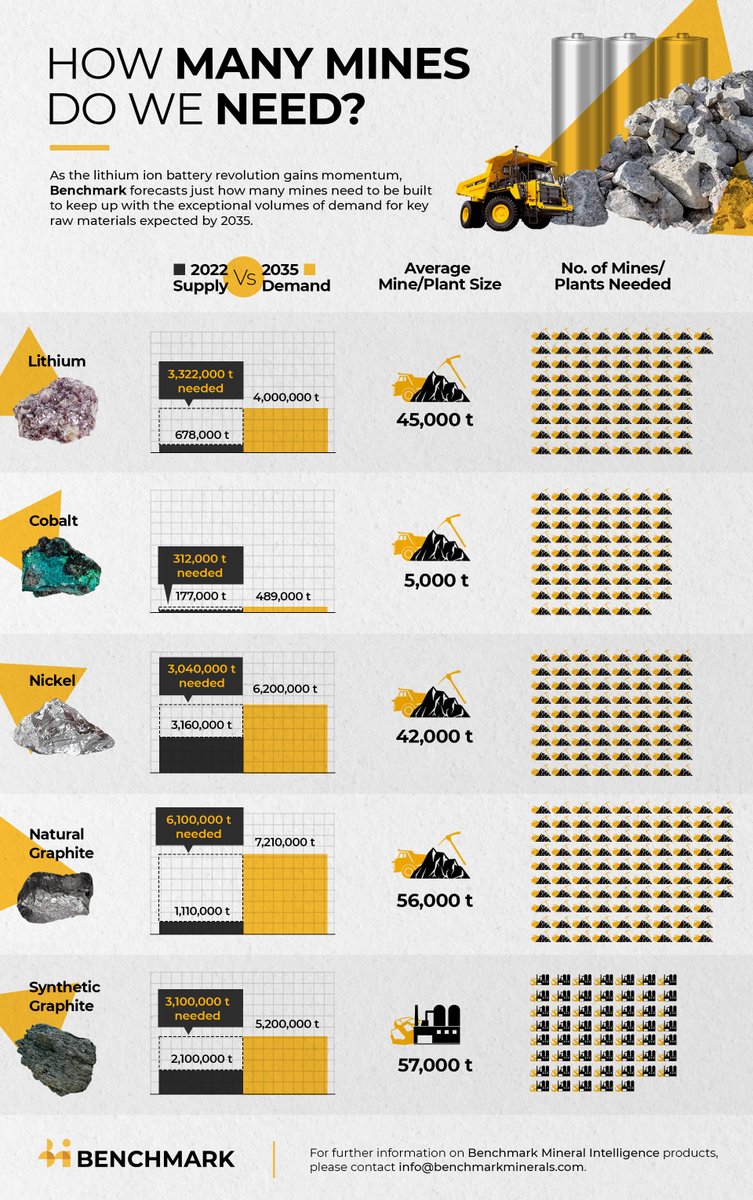

Literally, 100s of mines will be needed just to meet 3.5TWh of demand for batteries in EVs this decade. That's 50 new lithium and 60 new nickel + dozens more copper & graphite mines. $TSLA wants to produce 3TWh internally, so supply will be a problem.

mining.com/hundreds-of-ne…

Literally, 100s of mines will be needed just to meet 3.5TWh of demand for batteries in EVs this decade. That's 50 new lithium and 60 new nickel + dozens more copper & graphite mines. $TSLA wants to produce 3TWh internally, so supply will be a problem.

mining.com/hundreds-of-ne…

6/

As @elonmusk often discusses, a shortage of any part in a production line slows everything down. Sure, there could be technological breakthroughs like DLE for #Lithium that can help solve raw material shortages. But hope is not a strategy and we should be conservative in...

As @elonmusk often discusses, a shortage of any part in a production line slows everything down. Sure, there could be technological breakthroughs like DLE for #Lithium that can help solve raw material shortages. But hope is not a strategy and we should be conservative in...

7/

mining industry growth projections. After all, mining is not an industry known for innovation. Even with significant innovations, it will easily take years to scale from a lab to commercial production. With respect to current mining projects in the pipeline...

mining industry growth projections. After all, mining is not an industry known for innovation. Even with significant innovations, it will easily take years to scale from a lab to commercial production. With respect to current mining projects in the pipeline...

8/

many industry experts are expecting supply deficits in #Lithium #Nickel #Graphite and #Copper. The structural deficit of #Lithium is already in full display, as the price has gone from ~$7.5/kg two years ago to ~$75/kg on the spot market now, and has continued to grind higher.

many industry experts are expecting supply deficits in #Lithium #Nickel #Graphite and #Copper. The structural deficit of #Lithium is already in full display, as the price has gone from ~$7.5/kg two years ago to ~$75/kg on the spot market now, and has continued to grind higher.

9/

That means 2yrs ago, the price of just #lithium (~60kg) in a 75kwh battery pack went from costing $450 to as much as $4,500(!). To be fair, spot prices are a relatively small percentage of the market, but the longer spot prices stay high due to deficits, the more long-term...

That means 2yrs ago, the price of just #lithium (~60kg) in a 75kwh battery pack went from costing $450 to as much as $4,500(!). To be fair, spot prices are a relatively small percentage of the market, but the longer spot prices stay high due to deficits, the more long-term...

10/

contract prices track closer to spot prices. This is all to say that battery input costs will likely not decrease anytime soon as OEMs bid up material costs to secure their supply. Recycling likely won't be a significant contributor to the supply pie until the mid-2030s.

contract prices track closer to spot prices. This is all to say that battery input costs will likely not decrease anytime soon as OEMs bid up material costs to secure their supply. Recycling likely won't be a significant contributor to the supply pie until the mid-2030s.

11/

The problem is OEMs cannot bid up prices that long, b/c they have margins to worry about. Improved manufacturing efficiency, scale, and $45/kWh battery IRA credits will help drive costs down over time, but ultimately it will be a game of musical chairs b/w OEMs to secure...

The problem is OEMs cannot bid up prices that long, b/c they have margins to worry about. Improved manufacturing efficiency, scale, and $45/kWh battery IRA credits will help drive costs down over time, but ultimately it will be a game of musical chairs b/w OEMs to secure...

12/

their supply until then. Only the OEMs with the BEST manufacturing efficiency, scale, EV expertise, brand value, and margins will survive. $TSLA is the only pure EV OEM that has demonstrated the ability to scale to >1M vehicles/yr AND maintain high profit margins.

their supply until then. Only the OEMs with the BEST manufacturing efficiency, scale, EV expertise, brand value, and margins will survive. $TSLA is the only pure EV OEM that has demonstrated the ability to scale to >1M vehicles/yr AND maintain high profit margins.

13/

$TSLA can afford to outbid other OEMs for materials (& mining companies) if they need to thanks to their high margins, strong balance sheet, and big market cap. Even if Tesla d/n grow 50%/yr, it will likely mean that most, if not all, other high-volume OEMs struggle far more.

$TSLA can afford to outbid other OEMs for materials (& mining companies) if they need to thanks to their high margins, strong balance sheet, and big market cap. Even if Tesla d/n grow 50%/yr, it will likely mean that most, if not all, other high-volume OEMs struggle far more.

14/

Putting this all together, it would not be surprising to see $TSLA put up similar market dominance statistics in the EV industry as $AAPL has in the smartphone industry--i.e. ~15% market share, ~40% of revenue, and ~75% of profits.

Putting this all together, it would not be surprising to see $TSLA put up similar market dominance statistics in the EV industry as $AAPL has in the smartphone industry--i.e. ~15% market share, ~40% of revenue, and ~75% of profits.

15/

In fact, $TSLA may very well end up in an even more dominant position than $AAPL. After all, Samsung and Google never had to worry about not having enough #Lithium to even make their smartphones before trying to compete with Apple. It may sound anticlimactic, but...

In fact, $TSLA may very well end up in an even more dominant position than $AAPL. After all, Samsung and Google never had to worry about not having enough #Lithium to even make their smartphones before trying to compete with Apple. It may sound anticlimactic, but...

16/

even if $TSLA does not achieve FSD robotaxis this decade, it is very difficult to see them NOT being the 800-pound gorilla in the auto industry. No other OEM is as vertically integrated as them (batteries, factory "machines that build the machines," insurance,

even if $TSLA does not achieve FSD robotaxis this decade, it is very difficult to see them NOT being the 800-pound gorilla in the auto industry. No other OEM is as vertically integrated as them (batteries, factory "machines that build the machines," insurance,

17/

software (vehicle infotainment, autopilot features, etc.), direct-to-consumer model (no middlemen dealerships), charging network, etc.). This dynamic gives $TSLA extra margin to spend more on other parts of their biz that their competitors cannot, including raw materials...

software (vehicle infotainment, autopilot features, etc.), direct-to-consumer model (no middlemen dealerships), charging network, etc.). This dynamic gives $TSLA extra margin to spend more on other parts of their biz that their competitors cannot, including raw materials...

18/

to keep feeding the 800-pound gorilla, while everyone else fights for scraps. It does not matter if VW or $GM sells cars for $30K before $TSLA if they don't make money on them. Selling a $30K EV is not an achievement in a world of rising raw material costs and shortages.

to keep feeding the 800-pound gorilla, while everyone else fights for scraps. It does not matter if VW or $GM sells cars for $30K before $TSLA if they don't make money on them. Selling a $30K EV is not an achievement in a world of rising raw material costs and shortages.

19/

In fact, it's a sign of weakness and desperation to survive. As soon as the profit margins for a $30K EV will make sense (perhaps later this decade), $TSLA will enter that segment of the market and be able to afford to undercut any competitors with some of the profits made...

In fact, it's a sign of weakness and desperation to survive. As soon as the profit margins for a $30K EV will make sense (perhaps later this decade), $TSLA will enter that segment of the market and be able to afford to undercut any competitors with some of the profits made...

20/

from their already fully scaled-out, higher-priced vehicle offerings. Again, no FSD required for Tesla to win. Just sheer execution of scaling EVs profitably as $TSLA has already demonstrated it is capable of doing, while its competitors have not.

from their already fully scaled-out, higher-priced vehicle offerings. Again, no FSD required for Tesla to win. Just sheer execution of scaling EVs profitably as $TSLA has already demonstrated it is capable of doing, while its competitors have not.

21/

It is becoming more clear that $TSLA will be involved in M&A activity in the mining sector to help control their own destiny. Acquiring #Lithium projects figures to be a priority, since they are already planning to build a lithium refinery:

cnbc.com/amp/2022/09/09…

It is becoming more clear that $TSLA will be involved in M&A activity in the mining sector to help control their own destiny. Acquiring #Lithium projects figures to be a priority, since they are already planning to build a lithium refinery:

cnbc.com/amp/2022/09/09…

22/

This is a big deal since OEMs are usually VERY reluctant to get into mining. Mining has historically been seen as a "dirty" industry due to environmental and geopolitical concerns. It is much easier for OEMs to maintain 1+ degree of separation from their mining suppliers...

This is a big deal since OEMs are usually VERY reluctant to get into mining. Mining has historically been seen as a "dirty" industry due to environmental and geopolitical concerns. It is much easier for OEMs to maintain 1+ degree of separation from their mining suppliers...

23/

so they are not subjected to the public scrutiny that goes along with it. That is why $TSLA is not getting involved in mining because they want to. It is becoming more clear that due to industry-wide concerns about material deficits, Tesla is doing it b/c they need to.

so they are not subjected to the public scrutiny that goes along with it. That is why $TSLA is not getting involved in mining because they want to. It is becoming more clear that due to industry-wide concerns about material deficits, Tesla is doing it b/c they need to.

24/

100s of $Bs will be spent on raw materials p/yr by 2030. The 10+ yrs of underinvestment in mining will lead to shortages. Makes more sense for $TSLA to focus on securing their supply by investing in/acquiring the top mining companies, NOT buybacks.

reuters.com/technology/exc…

100s of $Bs will be spent on raw materials p/yr by 2030. The 10+ yrs of underinvestment in mining will lead to shortages. Makes more sense for $TSLA to focus on securing their supply by investing in/acquiring the top mining companies, NOT buybacks.

reuters.com/technology/exc…

25/

@bradsferguson @LimitingThe @garyblack00 @MatchasmMatt @EmmetPeppers @heydave7 @ValueAnalyst1 @TSLAFanMtl @CPAinNYC @jpr007 @TeslaPodcast @ICannot_Enough @goodsoilinvest @b4ud3r @madmanx89 @sdmoores @benchmarkmin @RodneyHooper13 @LithiumIonBull @globallithium

@bradsferguson @LimitingThe @garyblack00 @MatchasmMatt @EmmetPeppers @heydave7 @ValueAnalyst1 @TSLAFanMtl @CPAinNYC @jpr007 @TeslaPodcast @ICannot_Enough @goodsoilinvest @b4ud3r @madmanx89 @sdmoores @benchmarkmin @RodneyHooper13 @LithiumIonBull @globallithium

• • •

Missing some Tweet in this thread? You can try to

force a refresh