[1/9] Starker Post zum Thema @FlareNetworks #API-Portal! 💪

Die Schnittstelle schlechthin um z.B. über #HTTP-#GET (+#POST) Anfragen, Zustände (#States) der angefragten #Blockchains (+#DLTs) zu erhalten

Mein praktisches Beispiel für die Zukunft: Ein 🧵

Die Schnittstelle schlechthin um z.B. über #HTTP-#GET (+#POST) Anfragen, Zustände (#States) der angefragten #Blockchains (+#DLTs) zu erhalten

Mein praktisches Beispiel für die Zukunft: Ein 🧵

https://twitter.com/JoshuaGEdwards/status/1589987291841589249

[2/9] Für alle die meine Zusammenfassung zur #FlareNetworks x #GoogleCloudTech (#GCP) Partnerschaft verpasst hatten, hier der Deepdive:

https://twitter.com/krippenreiter/status/1587887151995297800?s=20&t=ENFV1B3lPW2vbJP88m1P2Q

[3/9] Ich pflege derzeit für ein Portfolio von Assets (#Cash, #Immobilien, #Aktien, #Edelmetalle und #Krypto) eine selbstgebastelte Excel, die mir per API, je nach Wunsch, aktualisierte Zahlen liefert 💪

[4/9] Kopfzerbrechen hat mir stets nur eine Anlageklasse gemacht, in der sich ständig der #Public-Key und die #Token Anzahl ändert, jedoch kein Automatismus per #REST-#API möglich ist: #Krypto 😅

Aber warum eigentlich? 🧐

Aber warum eigentlich? 🧐

[5/9] Möchte man in der #Krypto Welt Zustände per #API abfragen, muss man entweder für jede #Krypto einen #Blockexplorer finden, der einen öffentlichen #API-Zugang anbietet oder aber selbst aktiver Teilnehmer des Ökosystems werden und einen "Read-Only" Reporting-Server aufsetzen

[6/9] Das man sich als Investor keine #Nodes aufsetzt nur um Daten für eine Excel-Tabelle auszulesen, sollte verständlich sein 😉

Die Lösung: api-portal.flare.network

--> "... providing access to blockchains without needing to run blockchain nodes." 🙏

Die Lösung: api-portal.flare.network

--> "... providing access to blockchains without needing to run blockchain nodes." 🙏

https://twitter.com/FlareNetworks/status/1589980401367322625?s=20&t=fLXRVViLKINZVDYbeYPH8w

[7/9] 👉 Was werde ich also machen?

@FlareNetworks haben versprochen auch eine "rate limited", aber freie und öffentliche API zur Verfügung zu stellen

Diese werde ich ganz klassisch per #HTTP-#GET nach meinen #PublicKeys befragen und so meine #Wallet-Informationen auslesen

@FlareNetworks haben versprochen auch eine "rate limited", aber freie und öffentliche API zur Verfügung zu stellen

Diese werde ich ganz klassisch per #HTTP-#GET nach meinen #PublicKeys befragen und so meine #Wallet-Informationen auslesen

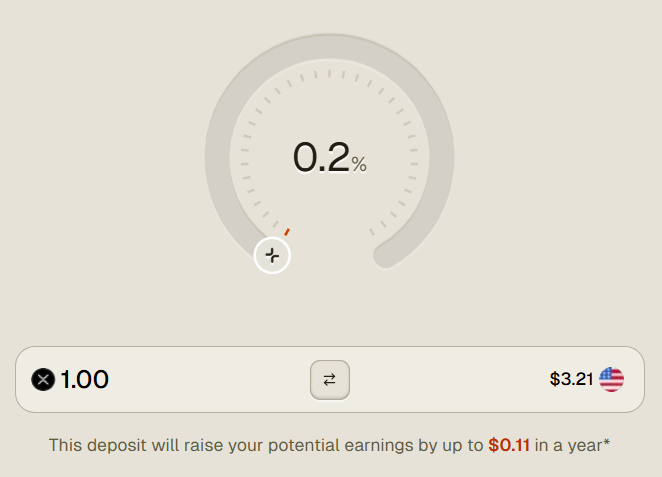

[8/9] Was ich mir für die Zukunft vorstelle, ist ganz nach dem Model von #CloudFunding, die wöchentlichen $FLR o. $SGB Rewards zu nutzen um die Kosten zu tragen. Schade, dass man später, um den vollen Umfang von #GCP #APIgee nutzen zu können, Google Rechnungen zahlen muss 🫤

[9/9] Auch die Abo-Gebühr klingt derzeit noch so gar nicht nach #web3, mit einer prepaid-Bezahlung, die als Gebühr, monatlich abgezogen wird

Die Idee steht, aber die Feinheiten lassen noch Spielraum zur Verbesserung offen

Lasst uns gespannt sein! 👀

#ConnectEverything $FLR $SGB

Die Idee steht, aber die Feinheiten lassen noch Spielraum zur Verbesserung offen

Lasst uns gespannt sein! 👀

#ConnectEverything $FLR $SGB

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh