I kølvandet på seneste iteration af udbytteskandalen er det oplagte spørgsmål: Hvad bør Folketinget gøre?

En lille tråd med løsningsmuligheder 🧵:

#dkpol #udbytteskat

En lille tråd med løsningsmuligheder 🧵:

#dkpol #udbytteskat

Hvad er på bordet, når ordførere mødes om mulige løsninger? Kort sagt er der vel 4 oplagte modeller i spil, nogle af hvilke kan kombineres:

1) Registrering af aktieejere

2) Nettoafregning

3) Sænket udbytteskat

4) ‘Forbedret’ refusion

1) Registrering af aktieejere

2) Nettoafregning

3) Sænket udbytteskat

4) ‘Forbedret’ refusion

1. Registrering af aktieejere - er den model som embedsmænd i Skat i 20 år har kæmpet for, som entydigt er den, der giver myndighederne bedst kontrol med regelefterlevelsen, da Skat nemt vil kunne tjekke om en refusionsanmodning tilsvarer et aktieejerskab..

Men også en løsning, som irrer international investorer og som Tynells bog viser, at erhvervslivet har bekæmpet i 40 år. Og en model som er sparsom internationalt (Norge). Vi har dog noget af infrastrukturen. Noget ejerdata findes allerede hos VP, Clearstream mv..

Og DK har for nylig indført - ligesom andre lande (snart) gør - et register over selskabers reelle ejere. Denne model har regeringens ekspertgruppe ikke lagt frem til overvejelse, men @JuulMona har fx. fremhævet, at vi må styr på ved hvem der er den retmæssige ejer af aktier.

2. Nettoafregning - her elimineres behovet for refusion ved at udbetale korrekt efter skat (netto) i første omgang. Administreres af (godkendte) banker, og giver derfor kun Skat sekundære kontrolmuligheder. Kan kobles med lokale krav om dokumentation, auditering mv..

Vi har allerede års erfaring hermed (VP-modellen), og modellen er velkendt internationalt (originalt QI-systemet indført af Clinton i USA, globalt med OECD TRACE). Men der er høj kompleksitet og risiko, hvorfor bl.a. ekspertgruppen har anbefalet at man dropper nettoafregning..

Måske vigtigst giver modellen ikke direkte (hvis nogen) adgang til at kontrollere aktiernes reelle ejere (via nominee-depoter/bank-kæder) på afregningstidspunktet. Men det er noget Skatteudvalget har kigget på, og fx. @LouiseElholm fremhæver TRACE (og int'l løsninger fx via EU).

3. Sænket udbytteskat, eller det som ekspertgruppen kalder “den forenklede nettoindeholdelsesmodel”. Refusion kommer fordi vi snupper 27% i udbytteskat for udenlandske aktionærer, men nogle (mange) har ret til 15% eller lavere, som følge af DBO'er mellem DK og andre lande..

Her vil man sænke den generelle sats til 15%, og dermed begrænse behovet for refusion. Det er en, øhm, pragmatisk løsning, som vil betyde færre indtægter men også færre kontroludgifter og mindsket (men absolut ikke elimineret) rum for svindel...

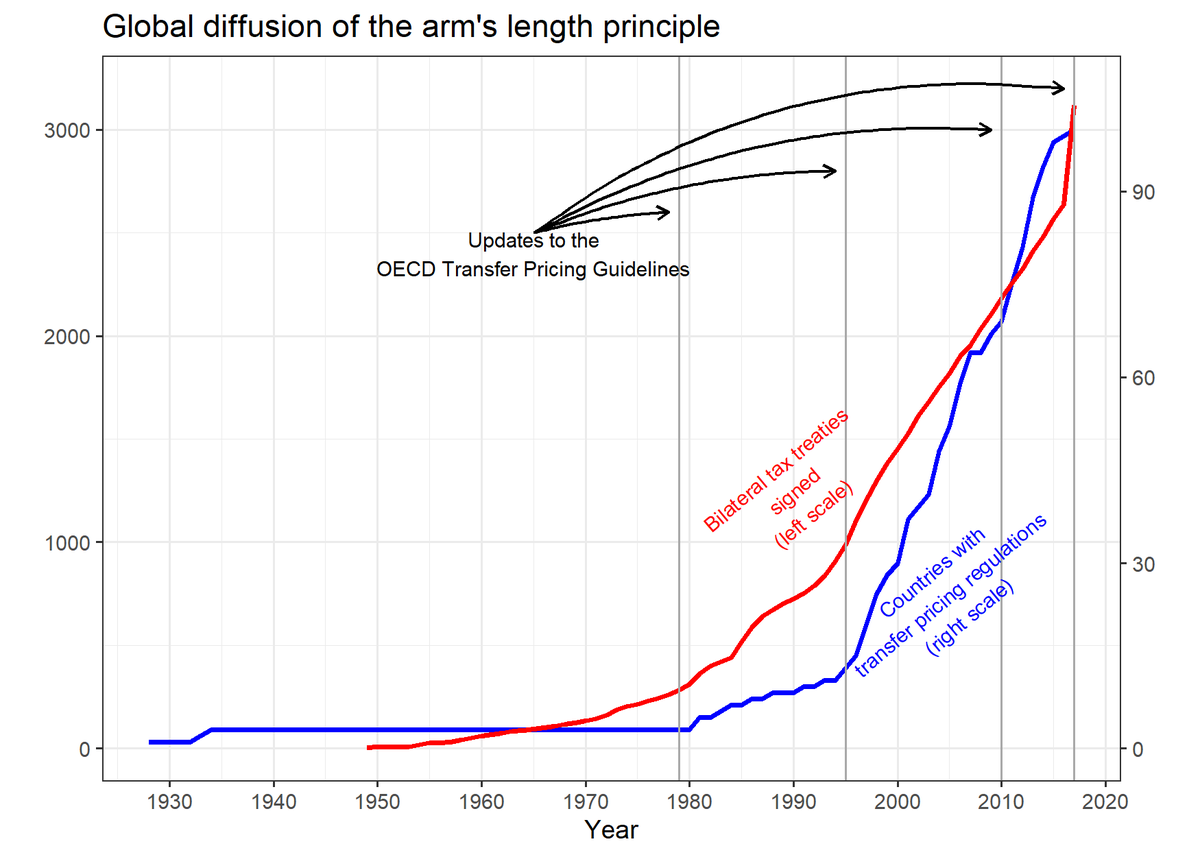

Modellen falder formentlig i tråd med nogle interessenters generelle ønske om lavere kapitalbeskatning i Danmark. Dog er det modsat den internationale trend - i OECD er udbytteskatter steget det sidste årti, blandt andet på grund af et stærkere internationalt skattesamarbejde..

Og i den sammenhæng har den tidligere regering netop foreslået *højere*, ikke lavere, aktieskatter, hvilke jeg har skrevet om her:

information.dk/debat/2022/02/…

Så spørgsmålet er hvor denne model står rent politisk..

information.dk/debat/2022/02/…

Så spørgsmålet er hvor denne model står rent politisk..

4. ‘Forbedret’ refusion er en Orwellsk vending fra ekspertgruppen - som i bund og grund betyder at man fortsætter som hidtil. Det er et stort ønske fra globale banker, at refusionssystem bevares ad hensyn til kunder i visse lande..

Men det siger sig selv, at denne model vil videreføre alle de eksisterende problemer. Nogle nævner muligheden for at indføre gebyrer på refusion for at dække den dyre kontrol på området, men det er vel et mindre plaster på såret.

Flere partier ser ud til at ville have en ordentlig reform af udbytteskatte-systemet som en bunden opgave for det kommende Folketing. Det bør det være. Tynells bog fortæller os hvorfor det har slået fejl så mange gange før. Lad os se om det lykkedes denne gang. /slut

• • •

Missing some Tweet in this thread? You can try to

force a refresh