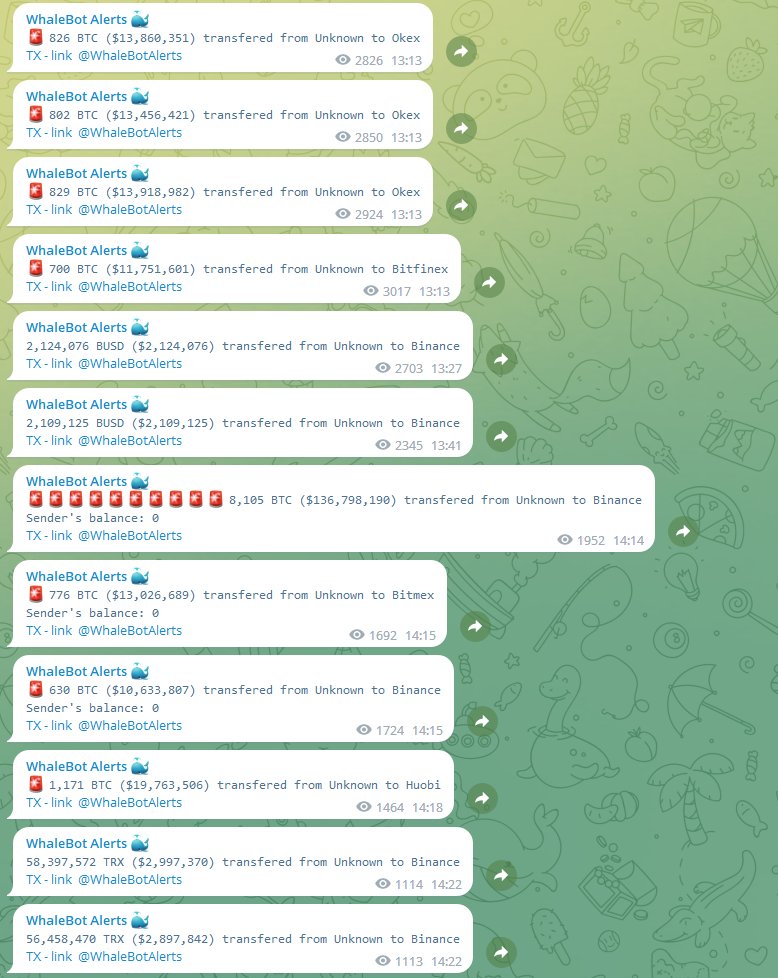

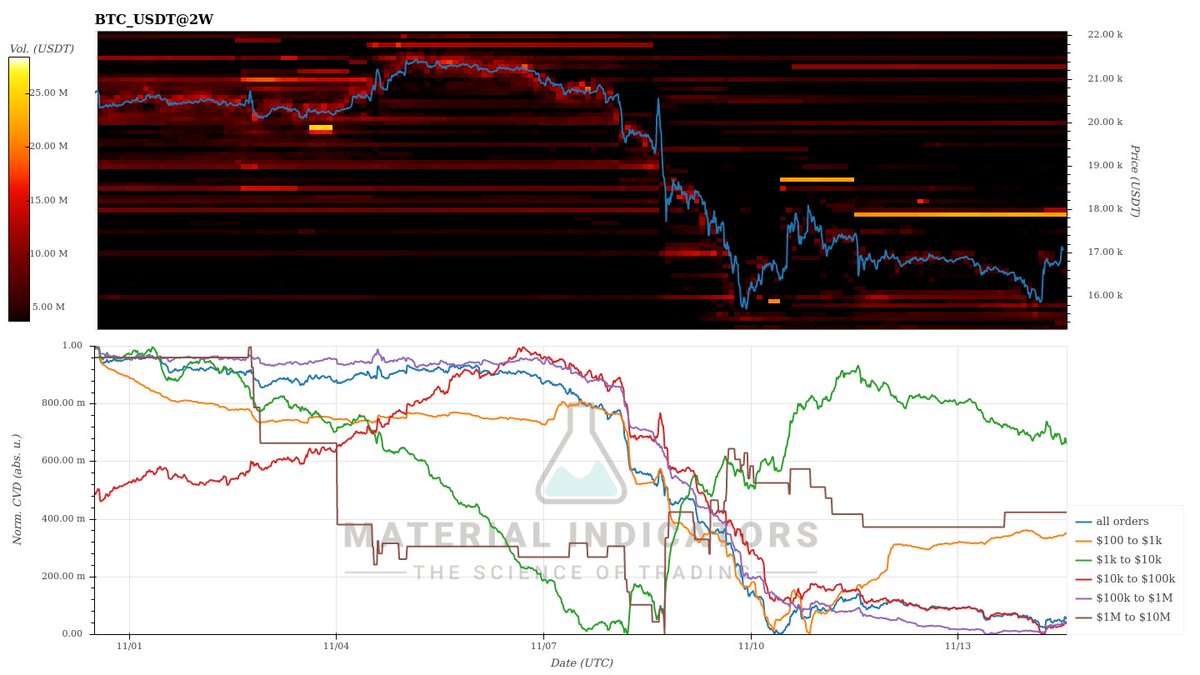

Whales Ratio 30D MA lifting up more, MM entities declining more their balances, correlates with their fund flows while BTC reserves on exchanges are increasing fast.

#BTC #ETH #FSN

#BTC #ETH #FSN

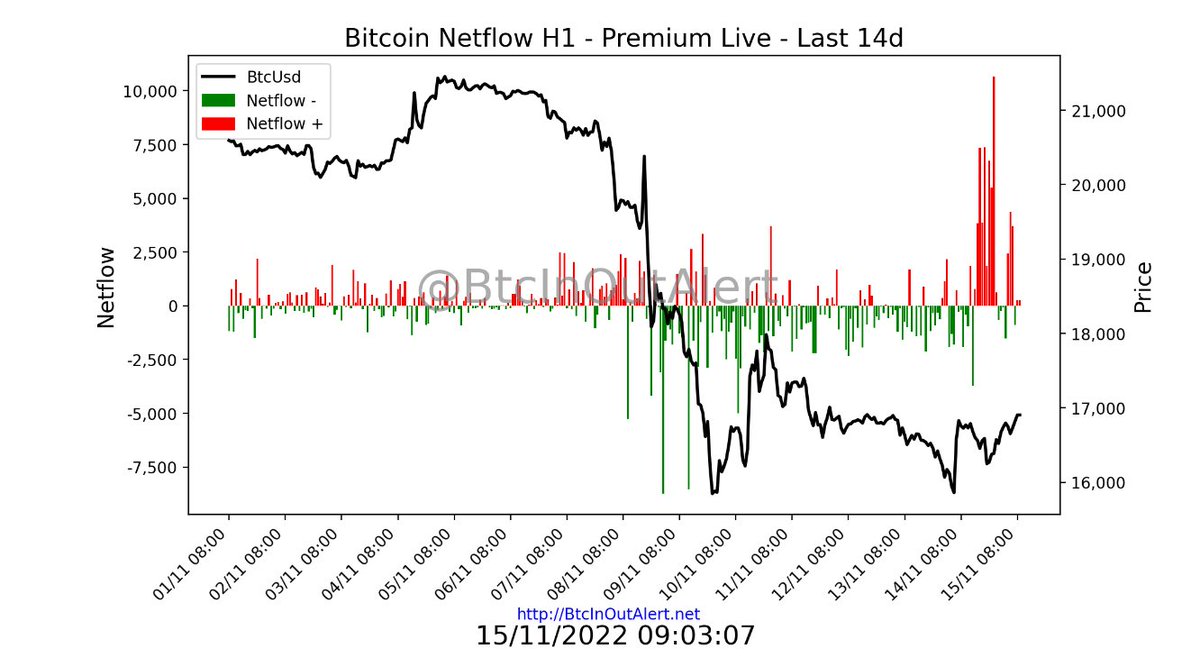

The H1 und H4 netflow chart indicating big inflows arriving to CEX. Today PPI, tomorrow CPI and thursday Philadelphia Fed Manufacturing Index. We will see how that plays out. 🤐

IT'S NOT CPI! CORE RETAIL DATA!

A small note on the side for those who wants to make money with a potential volatile market. Usually before a big pump we have a dump before, before a big dump we have a pump before, to liquidate high leverage positions. Trade careful and avoid high leverage on futures.

Don't be greedy! Before you open your position detect entry level but also, and thats the most important part, exit levels! You need a plan to trade with sucess! Don't let your trades drive by emotions (price action).

• • •

Missing some Tweet in this thread? You can try to

force a refresh