„You can ignore the tsunami, but the tsunami will not ignore you“

-

Youtube: https://t.co/GTZPTEhL9b

How to get URL link on X (Twitter) App

https://twitter.com/urso_de_shorts/status/1618197150508421123

https://twitter.com/InspoCrypto/status/1618208913744351233?s=20&t=Qol8esSB6-LXQ84iFsmzMw

Obvious you need to buy spot to support the futures to drive the spot price.

Obvious you need to buy spot to support the futures to drive the spot price.

1) As we know the US has an own oil production and can control its oil price increasing their production to reduce oil prices.

1) As we know the US has an own oil production and can control its oil price increasing their production to reduce oil prices.https://twitter.com/CryptoSlate/status/1597894517449199616"monitor the impact of the crypto market on the health of the financial system." He believes Brazil's central bank should draw up regulations to prevent illegal use of crypto for money laundering and fraudulent trading.

Interesting. SIG invested in #Voyager, bankrupt. SIG invested in #BlockFi, bankrupt.

Interesting. SIG invested in #Voyager, bankrupt. SIG invested in #BlockFi, bankrupt.

Why should demand disappear? Well, inflation makes products expensive. Means while you're receiving the same salary (real salary) every month with a rising (or stable but high) inflation means, less money available to consume. So, retail has to attract you with lower product

Why should demand disappear? Well, inflation makes products expensive. Means while you're receiving the same salary (real salary) every month with a rising (or stable but high) inflation means, less money available to consume. So, retail has to attract you with lower product

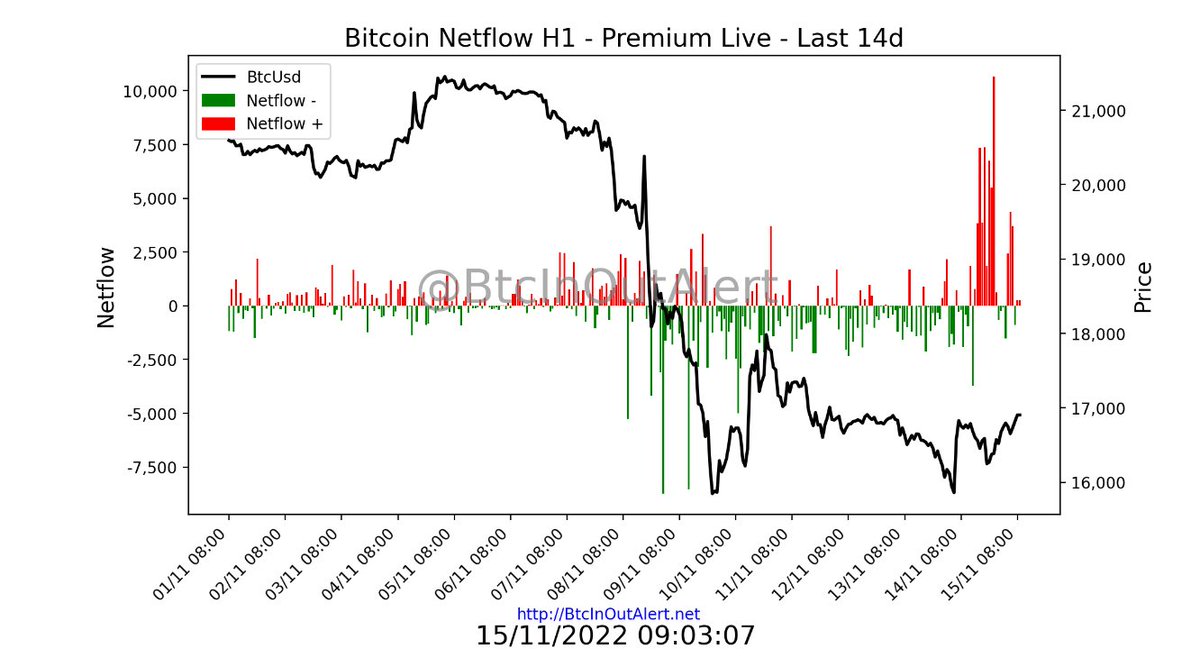

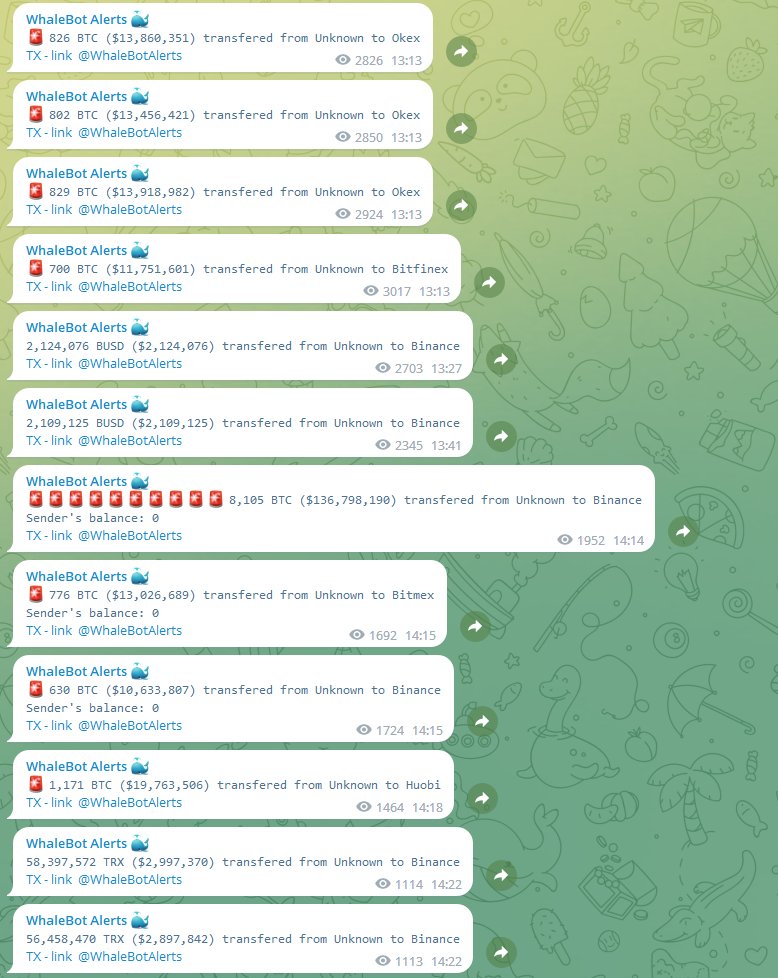

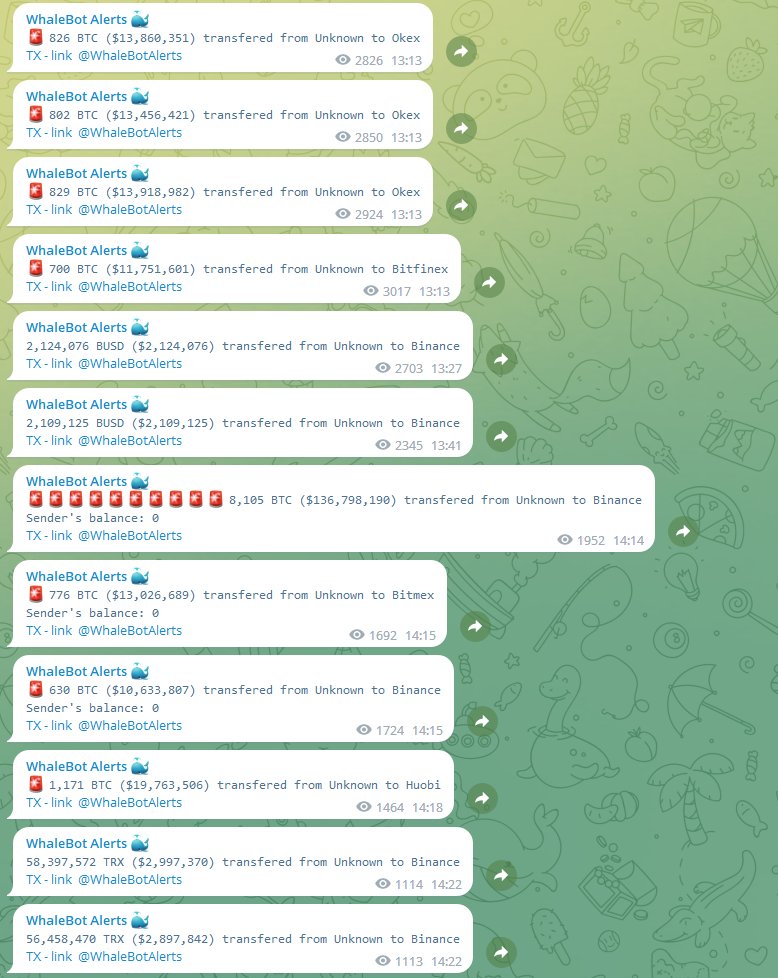

Anyway, doesn't mean big players are not also buying. Even if the CEX BTC reserves provided by @BTCInOutAlert showing big inflows happening right now indicating a big sell pressure will happen soon.

Anyway, doesn't mean big players are not also buying. Even if the CEX BTC reserves provided by @BTCInOutAlert showing big inflows happening right now indicating a big sell pressure will happen soon.

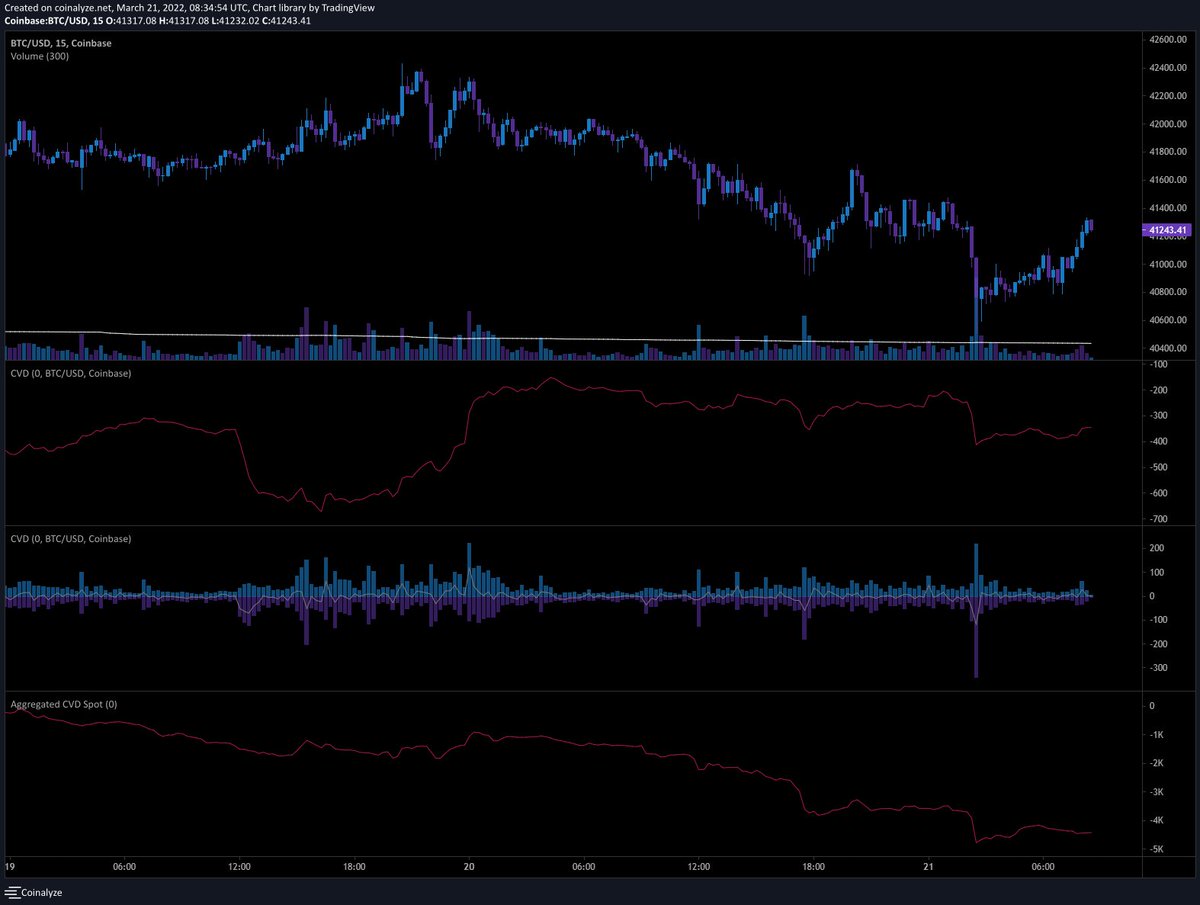

The H1 und H4 netflow chart indicating big inflows arriving to CEX. Today PPI, tomorrow CPI and thursday Philadelphia Fed Manufacturing Index. We will see how that plays out. 🤐

The H1 und H4 netflow chart indicating big inflows arriving to CEX. Today PPI, tomorrow CPI and thursday Philadelphia Fed Manufacturing Index. We will see how that plays out. 🤐

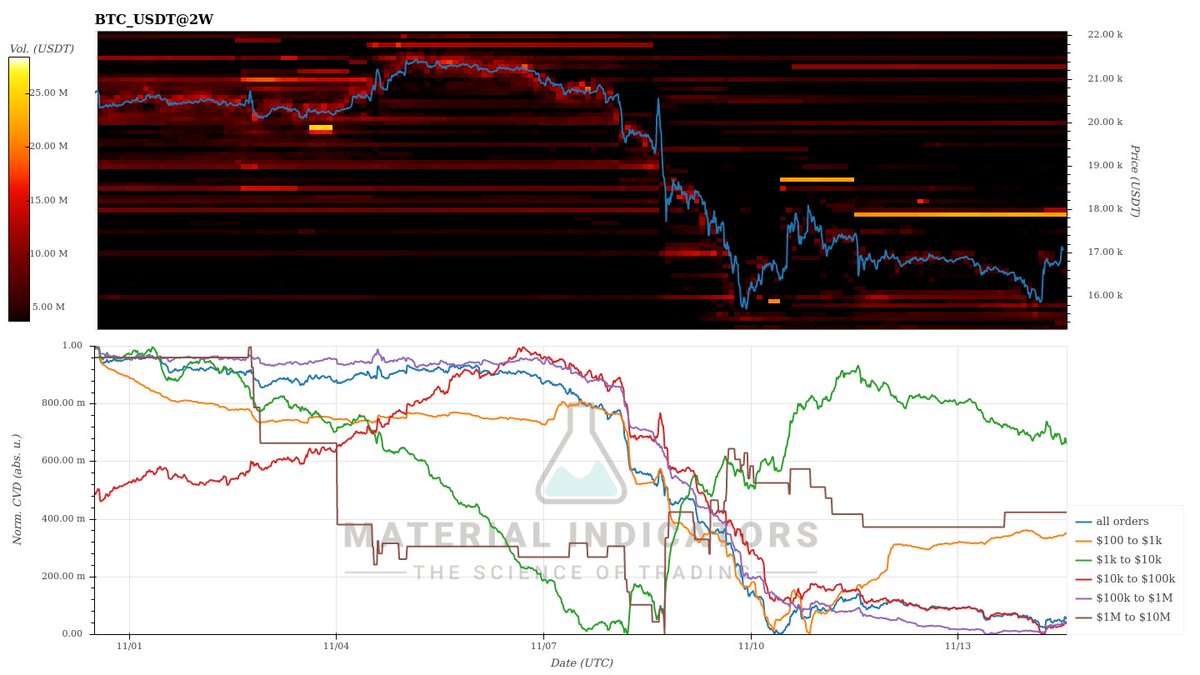

Provided by @Mtrl_Scientist 18k big resistance waiting, big entities not buying the pump. 🤷♂️

Provided by @Mtrl_Scientist 18k big resistance waiting, big entities not buying the pump. 🤷♂️

Some of you are wondering how they manipulate the price with future contracts.

Some of you are wondering how they manipulate the price with future contracts.

Also interesting here. They place positions in 3 different leverages. X100, X50 and X25. Can someone please rekt them. 🙏❤️

Also interesting here. They place positions in 3 different leverages. X100, X50 and X25. Can someone please rekt them. 🙏❤️

stabilize the price to distribute without to dump the price. They have distributed all tokens they bought when they pumped the price. 🧐

stabilize the price to distribute without to dump the price. They have distributed all tokens they bought when they pumped the price. 🧐

while stablecoins are leaving the derivative exchanges indicating taking profit. As expected and mentioned yesterday in my analysis is GEX rising. Imo we will see 41.8k soon again due its still our POC there. Except we will find enough liquidity in upper range. Something I doubt.

while stablecoins are leaving the derivative exchanges indicating taking profit. As expected and mentioned yesterday in my analysis is GEX rising. Imo we will see 41.8k soon again due its still our POC there. Except we will find enough liquidity in upper range. Something I doubt.

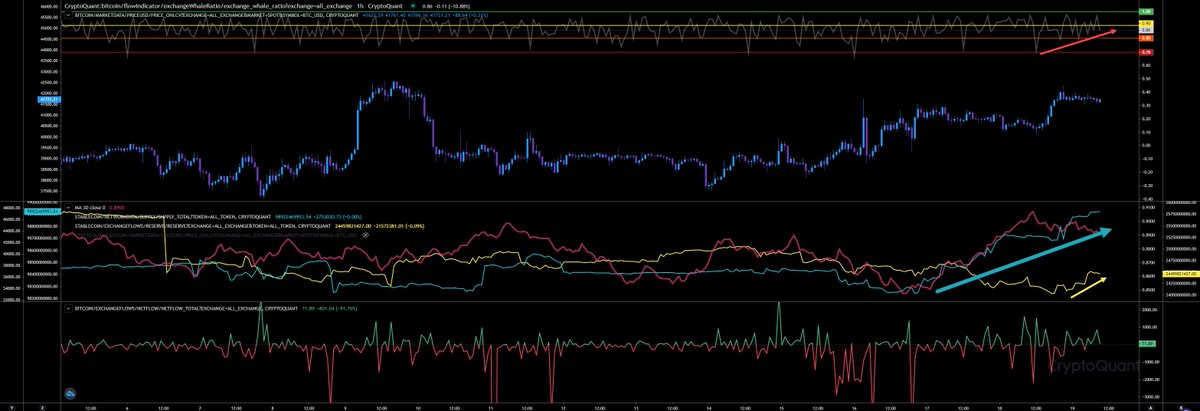

but bearish if we lose 40.3k. Usually we will swing between 41.3k and 40.3k from now on a bit and start some retests. If we lose 40.3k is 39.2k our next level. No big exchange walls detected yet. Whales ratio hourly view high, stablecoin reserves on exchanges have declined by

but bearish if we lose 40.3k. Usually we will swing between 41.3k and 40.3k from now on a bit and start some retests. If we lose 40.3k is 39.2k our next level. No big exchange walls detected yet. Whales ratio hourly view high, stablecoin reserves on exchanges have declined by

Whales ratio hourly view rising indicating more inflows coming from whales, we have received in the last hours almost $260m in stablecoins and 1,400 #BTC to derivative exchanges. Stablecoin supply rising since 16MAR22 by almost $700m and stablecoin reserves on exchanges rised by

Whales ratio hourly view rising indicating more inflows coming from whales, we have received in the last hours almost $260m in stablecoins and 1,400 #BTC to derivative exchanges. Stablecoin supply rising since 16MAR22 by almost $700m and stablecoin reserves on exchanges rised by

https://twitter.com/whale_alert/status/1504356106675630082?s=20&t=7oFFVs4Jpe2cC3j8oVjXmQ

What Is a Bull Call Spread?

What Is a Bull Call Spread?

While we are accumulating more and more longs liquidation volume.

While we are accumulating more and more longs liquidation volume.