Today at #COP27, we @priceofoil released a briefing peeling back the curtain on the oil & gas industry’s expansion plans: the new extraction approved in 2022 & what’s in the queue for 2023-2025ーunless govts put a stop to it ➡️ priceofoil.org/investing-in-d…

A thread 🧵

A thread 🧵

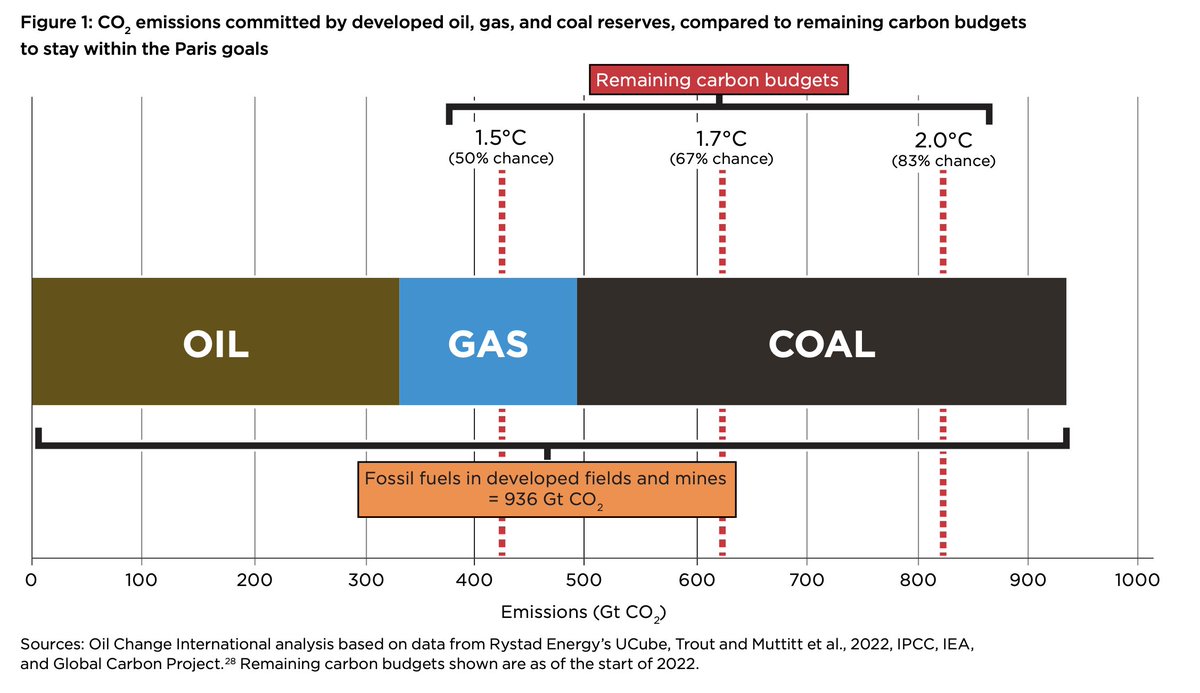

First, let’s look at the deep hole the fossil fuel industry has already drilled, dug, and fracked us into. 🔥Oil & gas fields already producing or approved PRIOR to 2022 would cause 490 GtCO2, if fully extracted. 🔥

That alone is enough to push the world past 1.5C warming.

That alone is enough to push the world past 1.5C warming.

Yet, the oil and gas industry keeps digging the hole deeper. We find new fields & fracking wells approved in 2022 + on the brink of approval in the next 3yrs would lock in an extra 70 Gt of CO2. That’s equal to 17% of the world’s remaining 1.5C carbon budget. #InvestingInDisaster

New expansion is an investment in climate and economic chaos. Either these new projects lock in warming above 1.5C OR force even larger shutdowns of existing fossil infrastructure to stay below it. #PhaseOutFossils theguardian.com/environment/20…

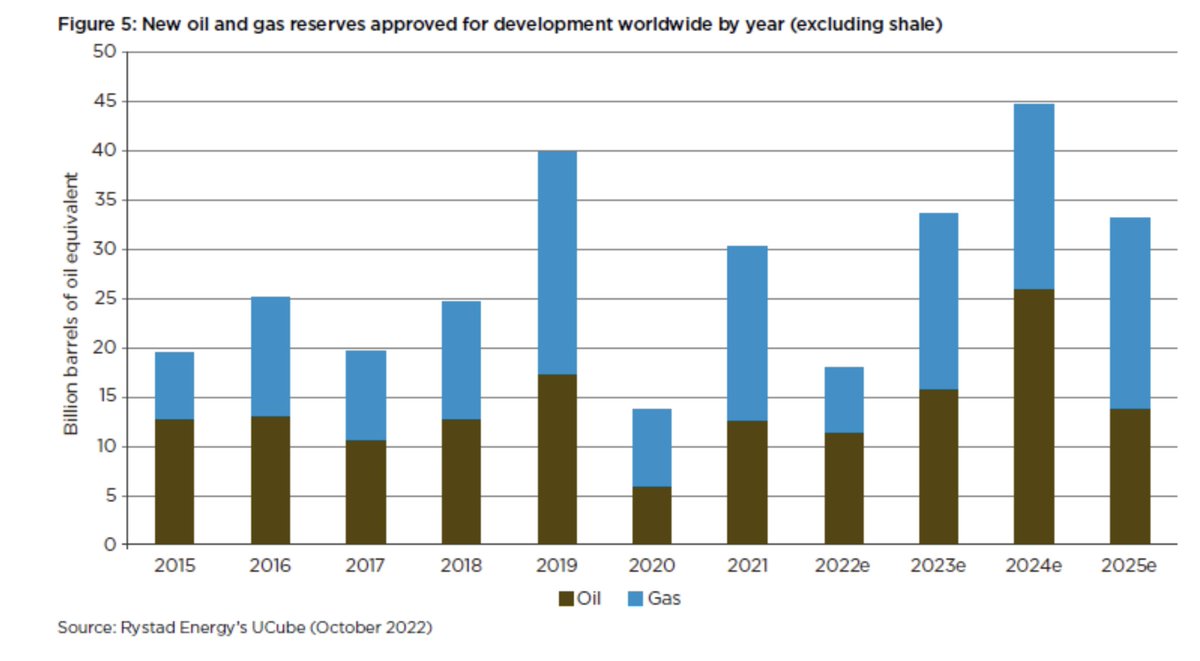

While the oil & gas industry approved less new development in 2022 than last year, the fields & fracking wells greenlit in 2022 lock in 11 Gt CO2. 11 Gt = 75 coal plants worth of new pollution.

We see the risk of a major surge in expansion over 2023-25 👇🏼

We see the risk of a major surge in expansion over 2023-25 👇🏼

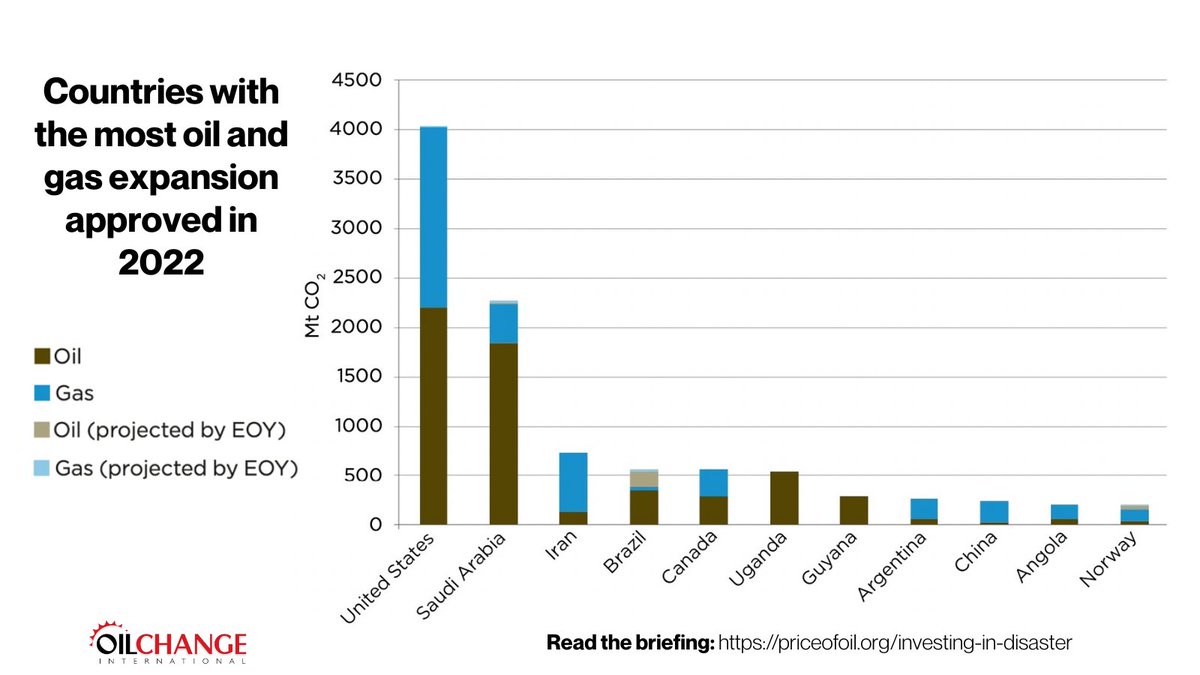

Who’s responsible? 👀

In 2022, the U.S. and Saudi Arabia are by far the countries with the most expansion. The US @POTUS came to #COP27 claiming ‘#climate leadership’ while letting the US oil & gas industry lock in decades of new extraction + LNG exports.

In 2022, the U.S. and Saudi Arabia are by far the countries with the most expansion. The US @POTUS came to #COP27 claiming ‘#climate leadership’ while letting the US oil & gas industry lock in decades of new extraction + LNG exports.

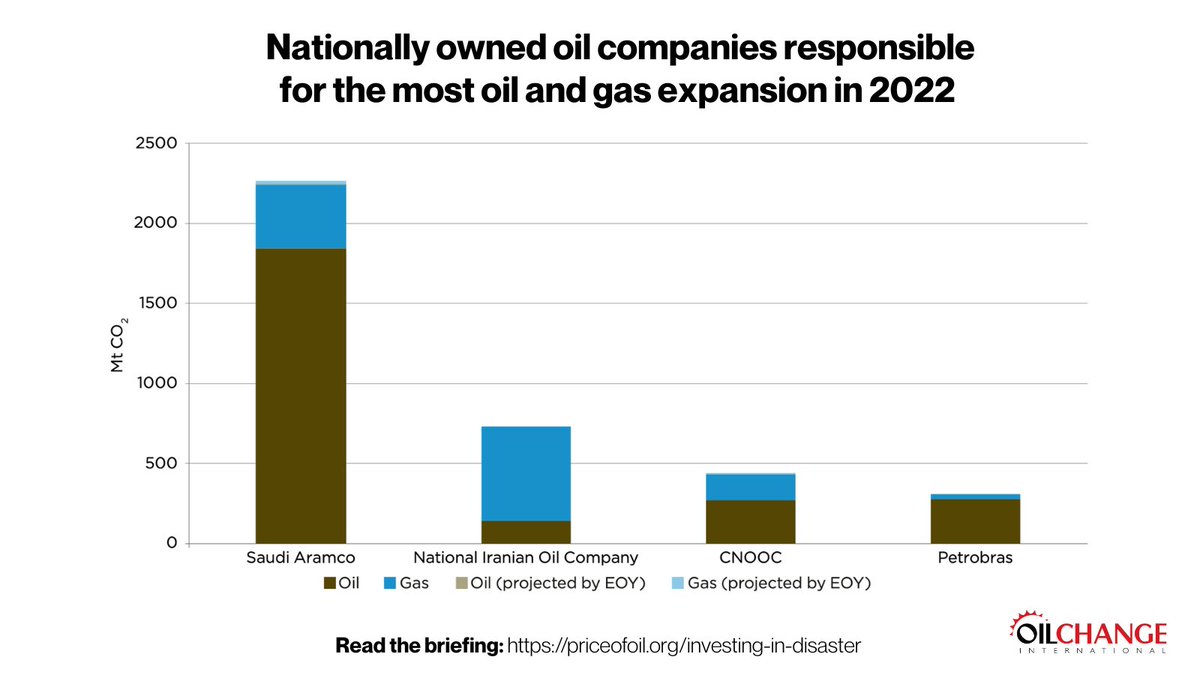

Big Oil & Gas companies touting ‘net zero’ & other greenwashed ‘climate’ plans are amongst the “who’s who” of major fossil fuel expanders.

The top 10 of 2022 includes: TotalEnergies, Chevron, Shell, ExxonMobil & Eni.

Fig. 9 has the full list: priceofoil.org/investing-in-d…

The top 10 of 2022 includes: TotalEnergies, Chevron, Shell, ExxonMobil & Eni.

Fig. 9 has the full list: priceofoil.org/investing-in-d…

A key reason TotalEnergies tops the list of int’l oil companies in 2022 is its approval of extraction in Uganda meant to feed the 1443-km East African Crude Oil Pipeline. Communities are fighting to #StopEACOP & they won’t back down.

https://twitter.com/OmarElmawi/status/1591056356056125442

Over 2023-25, we calculate that oil & gas companies could lock in an extra *59 Gt of carbon pollution* via final investment decisions to develop more fields + wells.

But this expansion can be stoppedーvia people power pushing govts to stop🛑 permits & banks to #PhaseOutFossils.

But this expansion can be stoppedーvia people power pushing govts to stop🛑 permits & banks to #PhaseOutFossils.

Just last week, @EquinorASA paused its plans to develop the Wisting oil field in 🇳🇴, a huge win against what would be the northernmost oil field in the world. Wisting was slated for approval in 2023. Norwegian campaigners halted it.

https://twitter.com/SiljeLundberg/status/1590658788750553093

Bottom line: The industry most responsible for causing the climate crisis isn’t going to phase itself out.

Governments at #COP27 must commit to #PhaseOutFossils & invest in a rapid and just clean energy transition.

See our full briefing here: priceofoil.org/investing-in-d…

Governments at #COP27 must commit to #PhaseOutFossils & invest in a rapid and just clean energy transition.

See our full briefing here: priceofoil.org/investing-in-d…

This is why it is so important that countries at #COP27 commit to phasing out all fossil fuels.

We need to keep it in the ground. So we need to put it in the text.

Read our press release here: priceofoil.org/2022/11/16/new…

We need to keep it in the ground. So we need to put it in the text.

Read our press release here: priceofoil.org/2022/11/16/new…

• • •

Missing some Tweet in this thread? You can try to

force a refresh