Weimar 2.0 Electric Boogaloo - It's all just a little bit of history repeating.

Tales in Hyper-Inflation Part 1:

Tales in Hyper-Inflation Part 1:

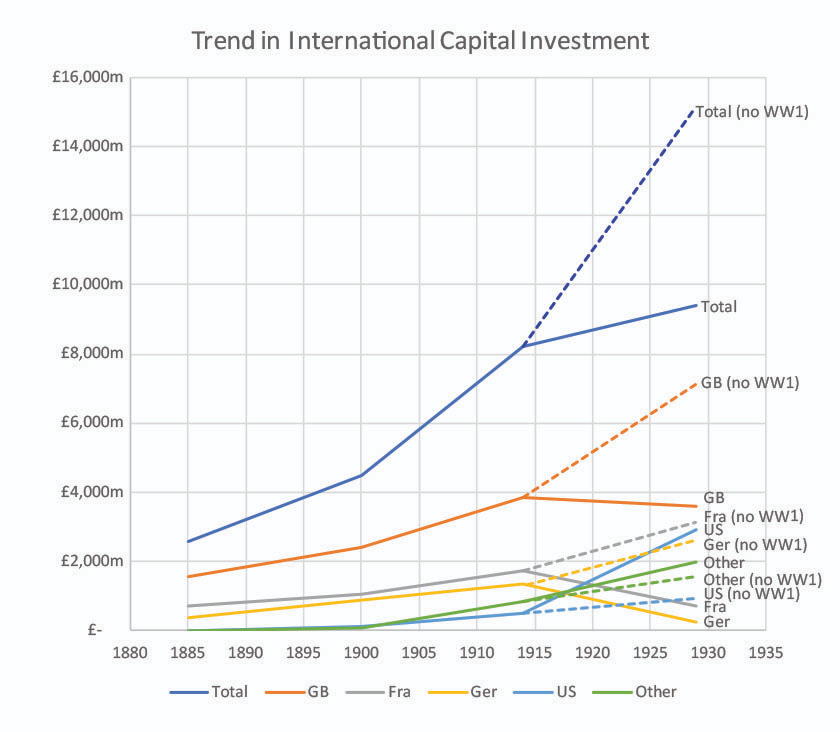

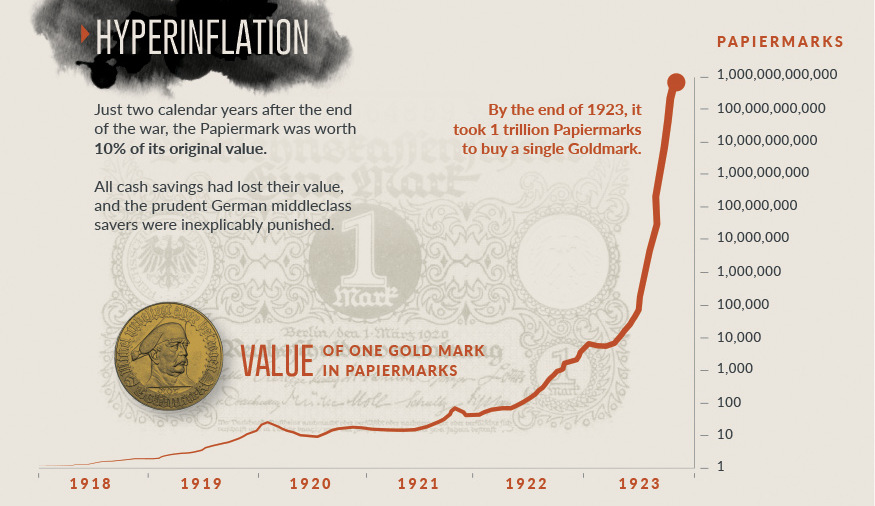

Just before WWI in 1913, the German Mark, British Shilling and Italian lira were worth about the same. At the end of 1923 the Mark was dead, worth one-million-millionth of its former self. It took ten years to die.

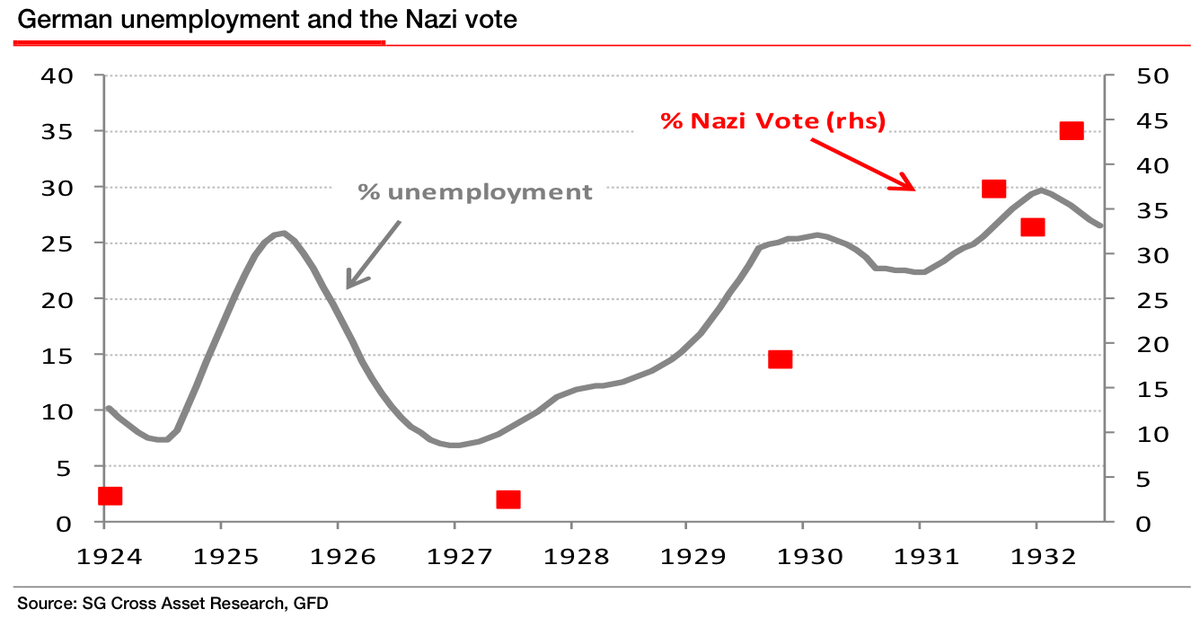

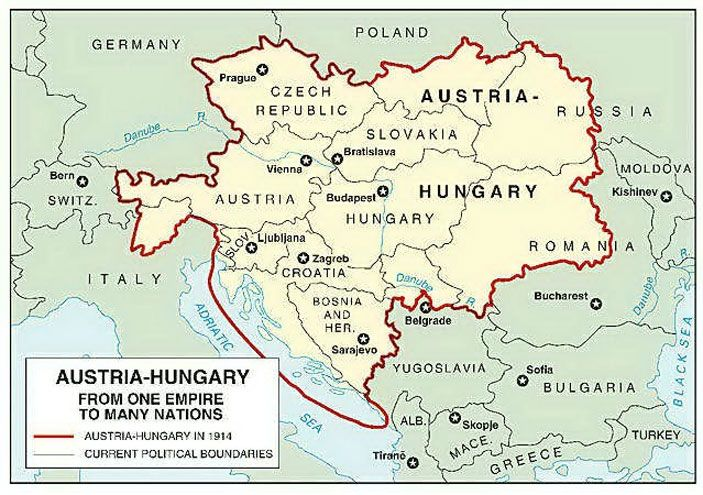

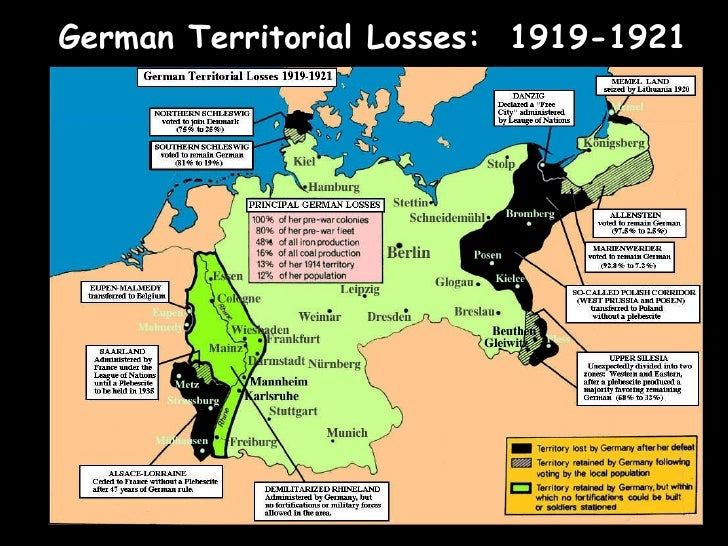

How did it die? Gradually at first, then all of a sudden. Exceptional circumstances, the cost of war itself, defeat in WWI and the reparations due, loss of productive territory, all contributed to the downfall of the Mark

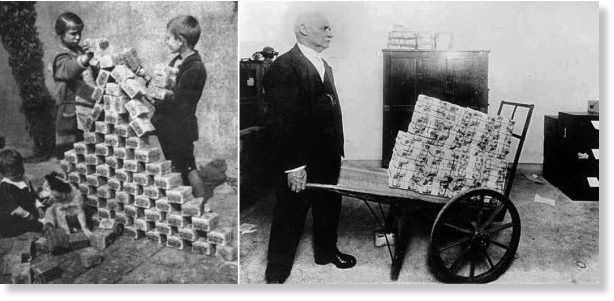

In the end, during 1923, was the year of astronomical figures, of 'wheel barrow inflation', a financial phenomenon not witnessed before.

This bankrupted thousands, robbed millions of their livelihoods and killed the hopes of millions more, indirectly extracting a price the whole world had to pay.

In the end, the inflation was so preposterous that it has been passed off as more of a historical curiosity rather than a chain of economic, social and political blunders.

The danger of inflation, however caused, affects its nation: it's government, it's people, it's officials, and it's society.

The more materialistic the society, the more it hurts. Our modern society is engineered and relies on consumption and materialism to further the concept of 'growth forever'.

Advertising executives in 1932 said that "consumer engineering must see to it that we use up the kind of goods we now merely use"

Domestic theorist Christine Frederick observed in 1929 that "the way to break the vicious deadlock of a low standard of living is to spend freely, and even waste creatively"

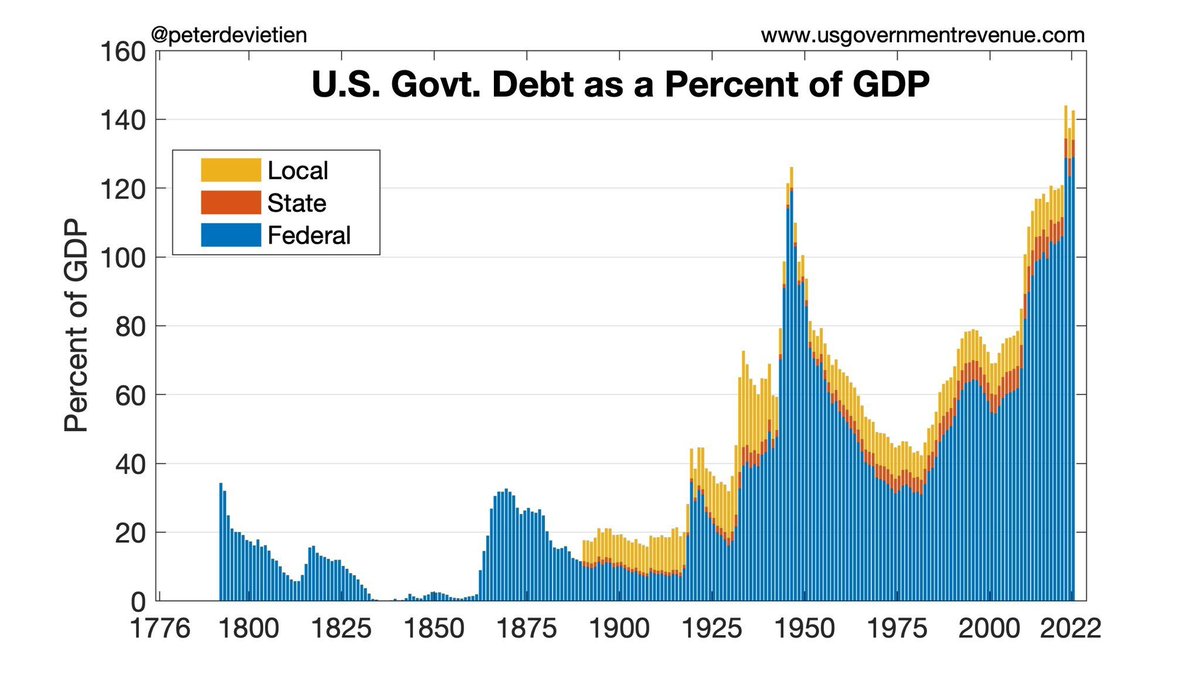

By 1920 most Americans had experimented with occasional instalment buying. Buy now, pay later, spend, don't save. Borrow from your future earnings. Or in the Gov case, borrow against future taxes.

Collapse of the recognised, trusted medium of exchange unleashes such greed, violence, unhappiness, and hatred, bred from fear, as no society can survive unchanged.

These conditions set mob against state, class against class, race against race, family against family, husband against wife, trade against trade, town against country.

It causes the worst in everybody, fosters xenophobia, contempt for government and law. It corrupts where corruption had been unknown before.

The news articles and official records at the time all reported month by month that things could not go on any longer, but they always did, from bad to worse.

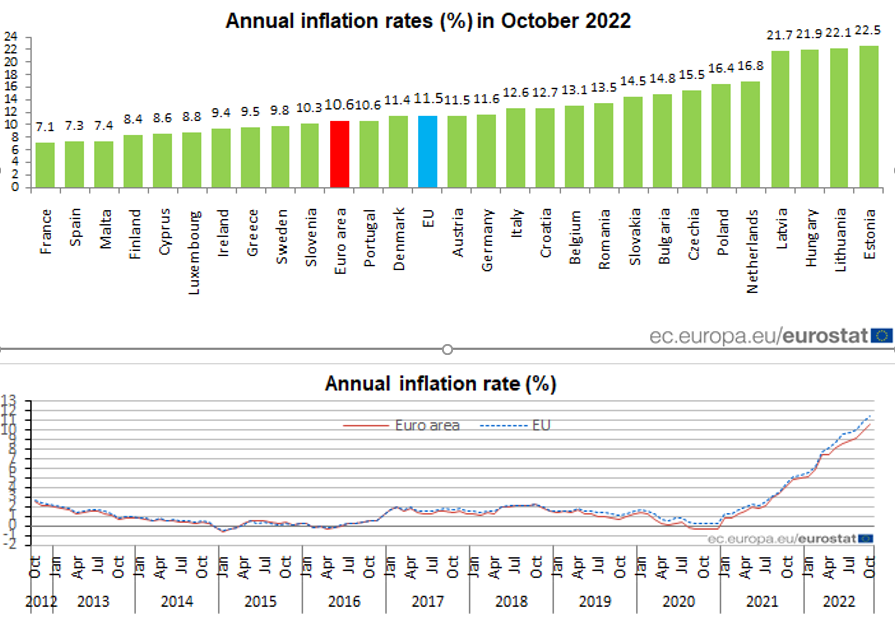

As prices increase, people demand not a stable currency, but more money to buy what they need. bbc.co.uk/news/business-…

The more money that's printed, the more prices go up. The more prices go up, the more the people will demand to be paid. People will look for scapegoats that have profited from all the inflationary money printing.

"The factory owners in Germany have growth wealthy: dysentery dissolves our bowels" - All Quiet on the Western Front reuters.com/world/uk/uk-la…

"The country issued milliards in the form of levies, war loans, treasury bonds without withdrawing from circulation, it created new paper income while the national wealth was diminishing".

When Money Dies

When Money Dies

This is not the end of the story, I will be working on this thread series, inspired by When Money Dies, Adam Fergusson.

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh