Public blockchains open up transaction data that has historically been locked away from retail traders.

This allows traders to see what the competition is doing - in real time.

Our CEO @RealMiguelMorel spoke on how anyone can use blockchain-level data, with @Voxchain.

This allows traders to see what the competition is doing - in real time.

Our CEO @RealMiguelMorel spoke on how anyone can use blockchain-level data, with @Voxchain.

Traditionally, analysis of a specific asset was based on either company fundamentals or pricing data.

However, blockchain technology provides a new subset of information that could be useful in determining future flows or price movements:

Transaction level data.

However, blockchain technology provides a new subset of information that could be useful in determining future flows or price movements:

Transaction level data.

Fundamental Analysis could be based upon data such as:

- balance sheet information

- cashflows of a company

and modified by premiums based upon:

- quality of executive team

- rates environment

- being part of a high-growth sector, such as fintech.

- balance sheet information

- cashflows of a company

and modified by premiums based upon:

- quality of executive team

- rates environment

- being part of a high-growth sector, such as fintech.

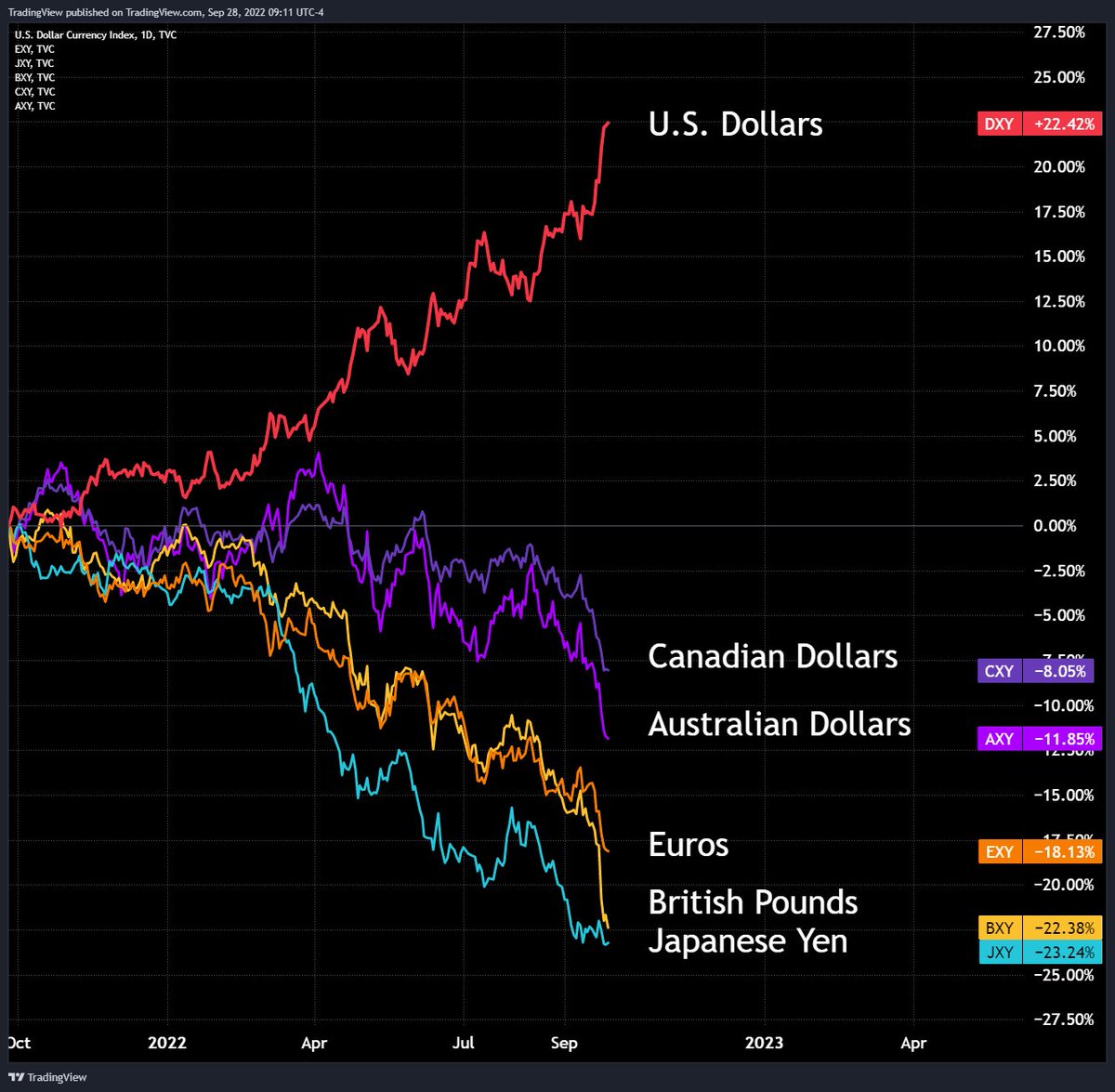

Alternatively - pricing data could also be used to predict future changes in value - aka #TechnicalAnalysis.

The concept of mean reversion is often used to identify price bands of support or resistance, and to bet against pricing anomalies.

The concept of mean reversion is often used to identify price bands of support or resistance, and to bet against pricing anomalies.

Transactions being made on a public and open blockchain provides a new set of data, which can be used by traders to gain an advantage on the open market.

This data exists in tradfi as well, but is guarded by brokers, exchanges and regulators.

In #crypto it is very different.

This data exists in tradfi as well, but is guarded by brokers, exchanges and regulators.

In #crypto it is very different.

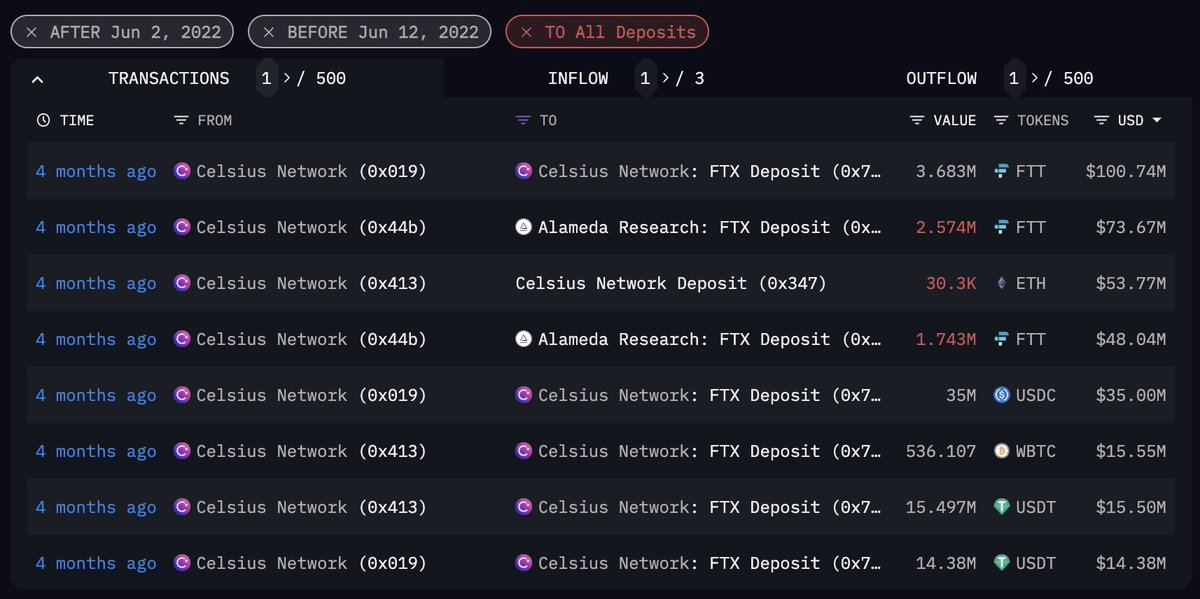

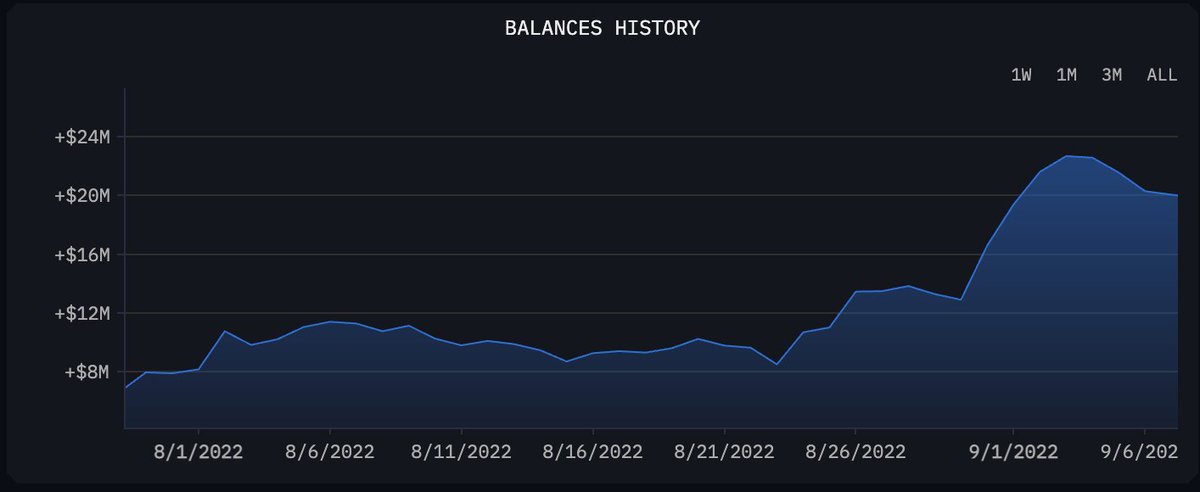

Arkham provides the ability to see an entity's existing positions, and monitor when new positions are being taken.

Being able to identify flows to and from significant addresses and exchanges can also provide significant edge.

Being able to identify flows to and from significant addresses and exchanges can also provide significant edge.

Transactions to and from project treasuries, insiders and VC's can be very important for traders to prevent getting dumped on unknowingly.

Token flows from market makers can provide insight into how liquidity is provisioned, and when price is at an inflection point.

Token flows from market makers can provide insight into how liquidity is provisioned, and when price is at an inflection point.

Effectively monitoring Institutional and Retail flow can also be an important tool in a trader's arsenal.

Depending on the project, retail or institutional interest can often move price in ways unpredictable by chart patterns.

Staying informed is edge above all else.

Depending on the project, retail or institutional interest can often move price in ways unpredictable by chart patterns.

Staying informed is edge above all else.

Check out the rest of the talk here:

• • •

Missing some Tweet in this thread? You can try to

force a refresh