[NEW TODAY] Due to recent events, investors are understandably inquiring deeper into their crypto investments. In this thread we’ve compiled additional information about the safety and security of the assets held by our digital asset products. gryscl.co/3EHaS0m 🧵

2) Each of Grayscale’s digital asset products is set up as a separate legal entity: an investment trust for single asset products, and limited liability company for diversified products.

3) The laws, regulations, and documents that define Grayscale's digital asset products prohibit the digital assets underlying the products from being lent, borrowed, or otherwise encumbered.

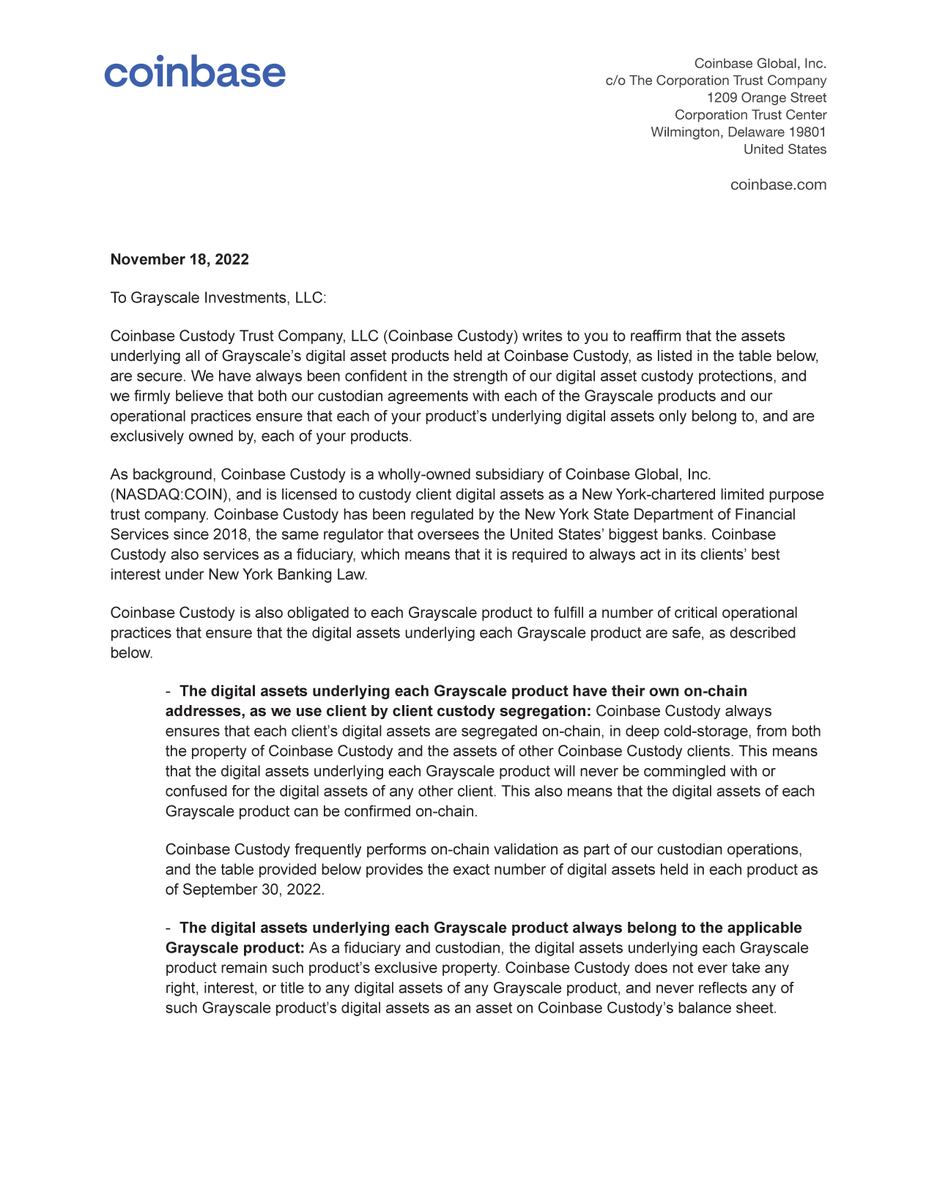

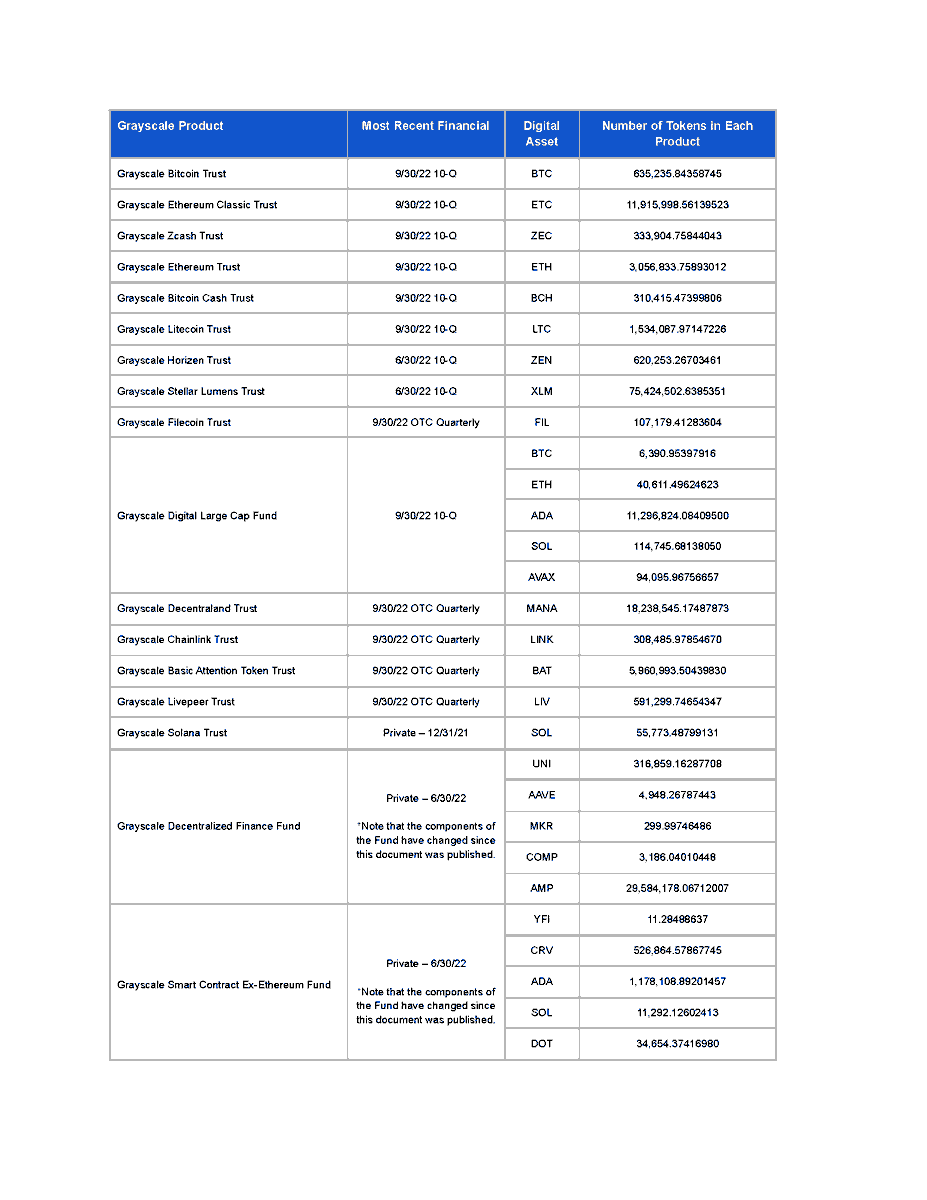

4) All digital assets that underlie Grayscale’s digital asset products are stored under the custody of Coinbase Custody Trust Company, LLC. Read more from @Coinbase’s CFO Alesia Haas, and CEO of Coinbase Custody Aaron Schnarch:

5) To be perfectly clear: the $BTC underlying Grayscale Bitcoin Trust are owned by $GBTC and $GBTC alone.

6) Coinbase frequently performs on-chain validation. Due to security concerns, we do not make such on-chain wallet information and confirmation information publicly available through a cryptographic Proof-of-Reserve, or other advanced cryptographic accounting procedure.

7) We know the preceding point in particular will be a disappointment to some, but panic sparked by others is not a good enough reason to circumvent complex security arrangements that have kept our investors’ assets safe for years.

8) We have compiled more information for investors on our website. We hope to alleviate any potential uncertainties and reaffirm the safety and security of the assets underlying Grayscale's products. gryscl.co/3EHaS0m

• • •

Missing some Tweet in this thread? You can try to

force a refresh