Grayscale, the world’s largest digital asset-focused investment platform // Terms: https://t.co/GLVgvtRKFz

How to get URL link on X (Twitter) App

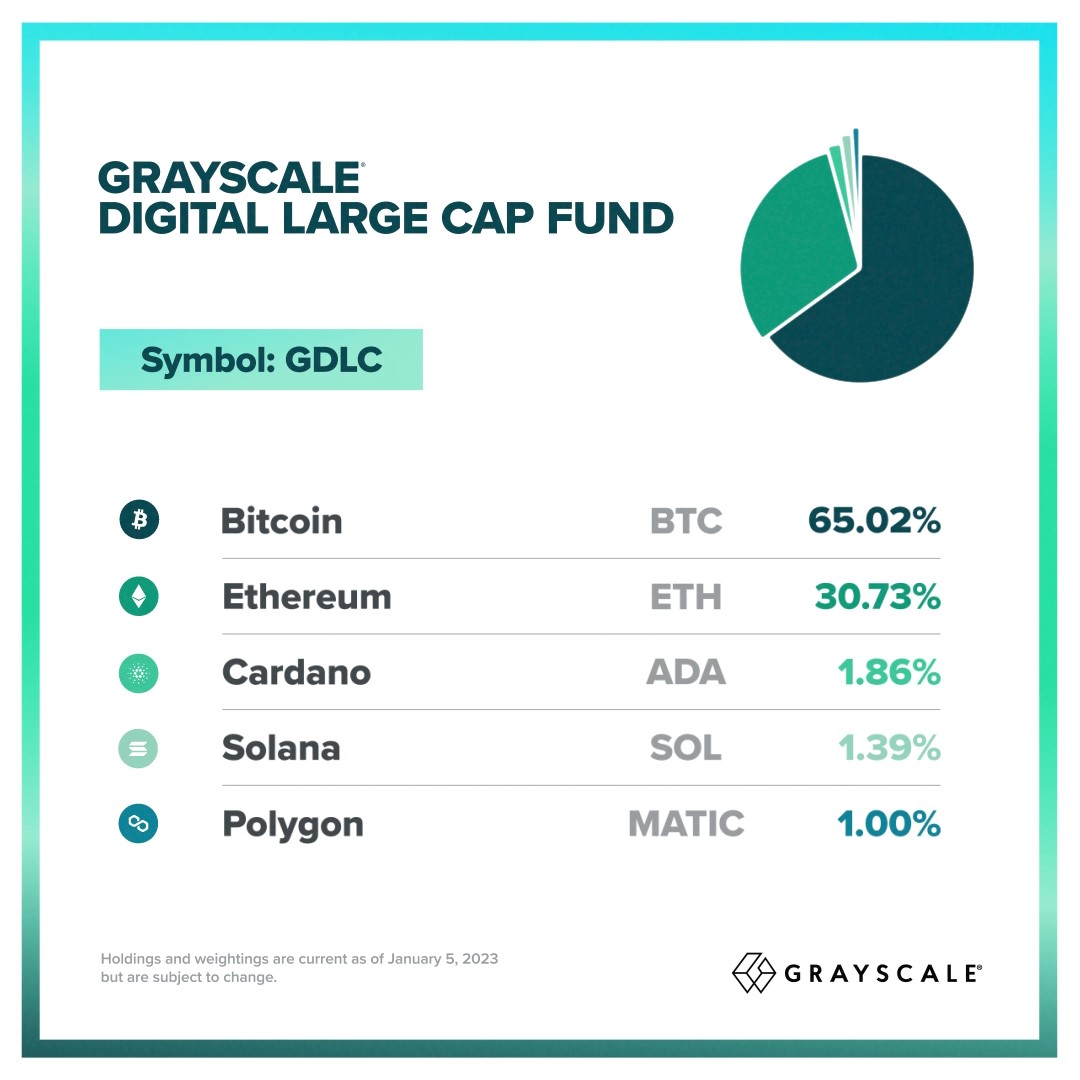

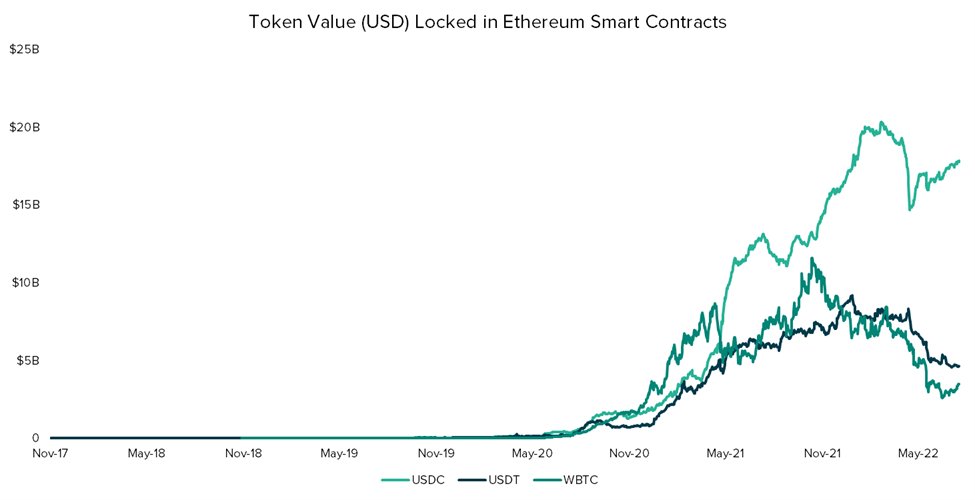

1/ Explore the vast potential of #Ethereum. Our latest report dives deep into the diverse ecosystem, from DeFi projects like $AAVE and $UNI to L2 solutions like $MATIC.

1/ Explore the vast potential of #Ethereum. Our latest report dives deep into the diverse ecosystem, from DeFi projects like $AAVE and $UNI to L2 solutions like $MATIC.

GDIF seeks to optimize income in the form of staking rewards associated with proof-of-stake digital assets, with capital appreciation from such investments as a secondary goal. (2/5)

GDIF seeks to optimize income in the form of staking rewards associated with proof-of-stake digital assets, with capital appreciation from such investments as a secondary goal. (2/5)

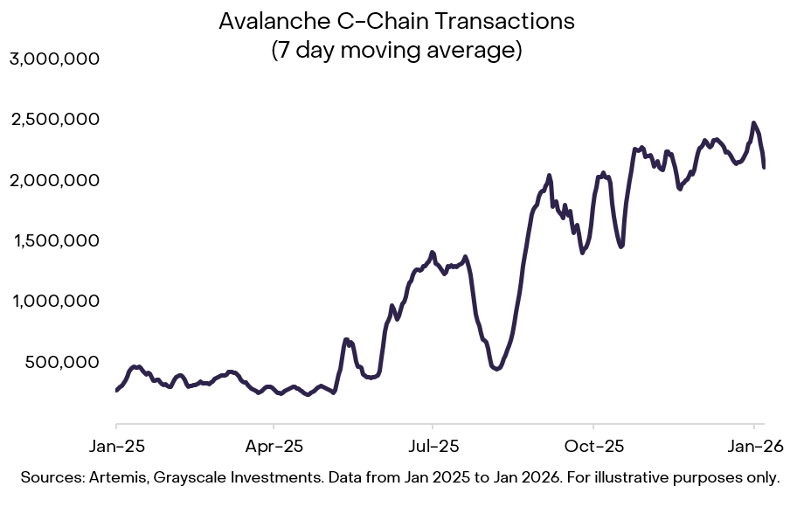

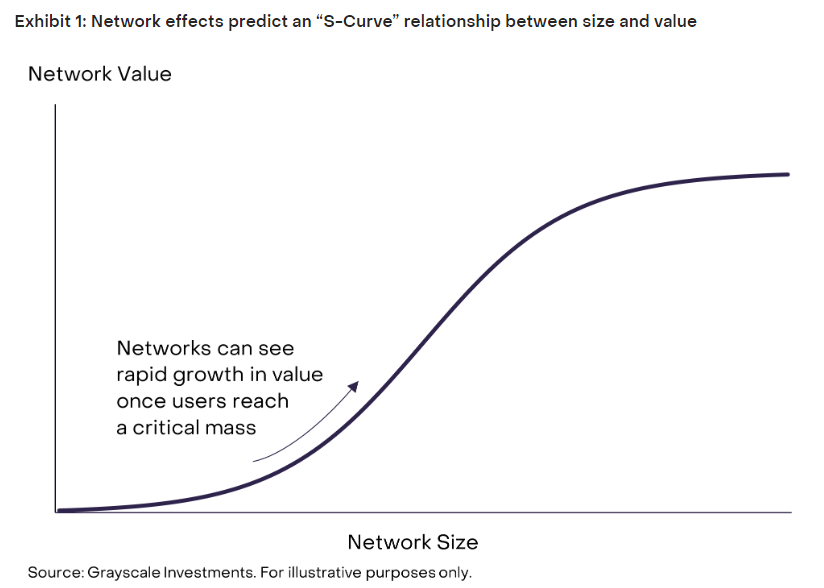

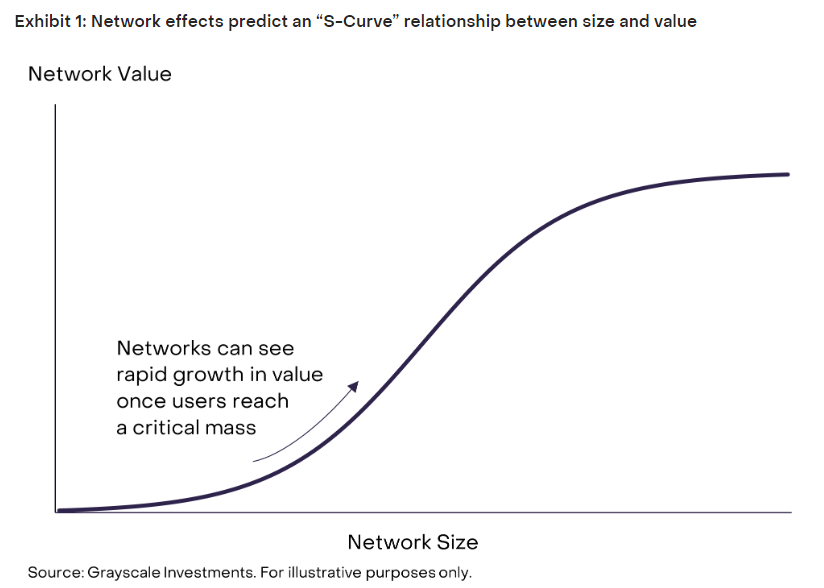

Network effects predict a nonlinear relationship between user adoption and network value. This is why assets tied to a network’s economic value may produce outsized returns during certain phases of network growth. (2/6)

Network effects predict a nonlinear relationship between user adoption and network value. This is why assets tied to a network’s economic value may produce outsized returns during certain phases of network growth. (2/6)

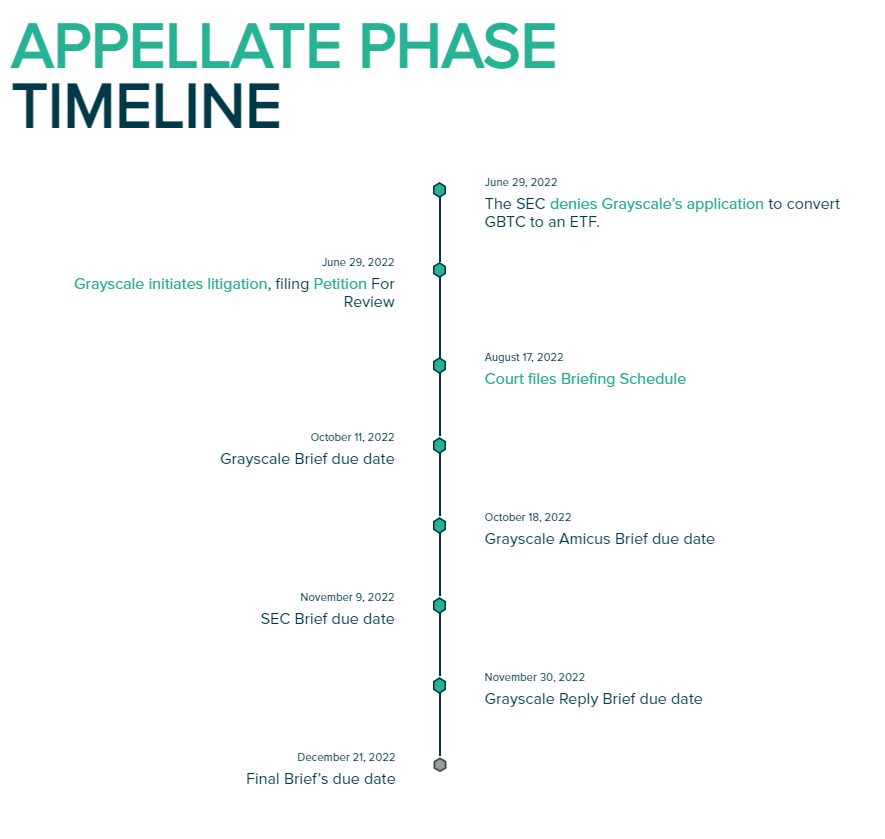

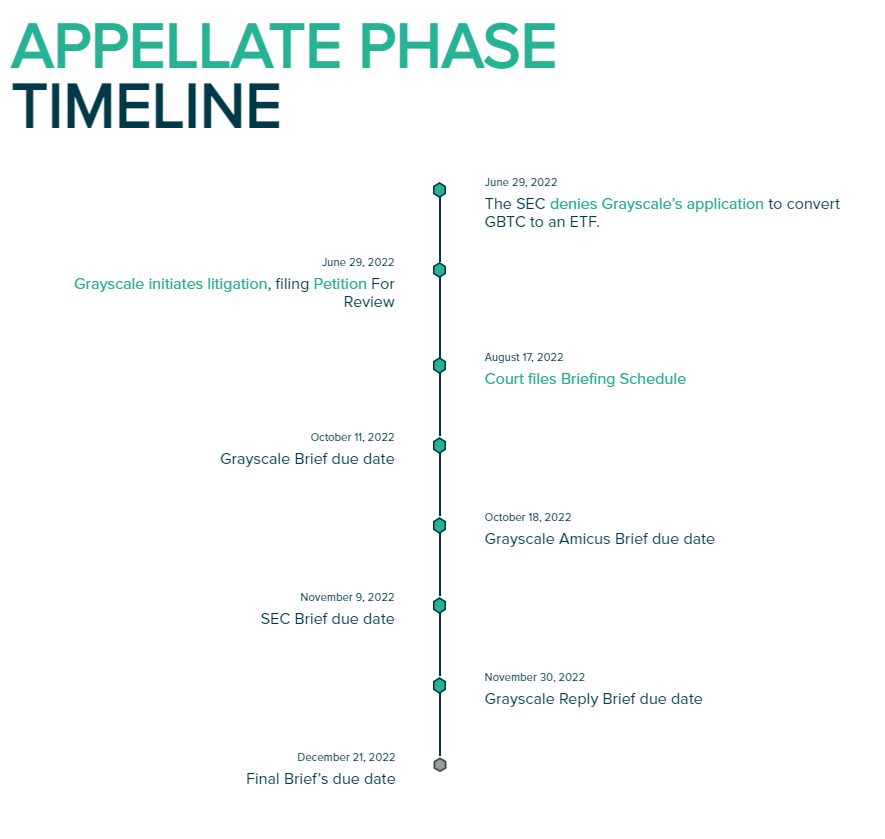

“American investors should have a choice in how to obtain #Bitcoin exposure,” said Grayscale CEO Michael @Sonnenshein. “We will use the strength of Grayscale’s brand and resources to continue to advocate for these investors.” gryscl.co/35hb474 (2/5) $GBTC

“American investors should have a choice in how to obtain #Bitcoin exposure,” said Grayscale CEO Michael @Sonnenshein. “We will use the strength of Grayscale’s brand and resources to continue to advocate for these investors.” gryscl.co/35hb474 (2/5) $GBTC