On Tuesday 3pm EST, join us at Polycrisis @phenomenalworld for an awesome panel to discuss:

MONEY & THE CLIMATE CRISIS

bit.ly/money-and-clim…

featuring: @MonaAli_NY_US, @rishirbhandary, @AGelpern, @AvinashPersau15, @Brad_Setser, and @adam_tooze

MONEY & THE CLIMATE CRISIS

bit.ly/money-and-clim…

featuring: @MonaAli_NY_US, @rishirbhandary, @AGelpern, @AvinashPersau15, @Brad_Setser, and @adam_tooze

https://twitter.com/kmac/status/1589855890567753736

Climate crisis has added fuel to a debt fire. Global south countries borrowing costs have soared just when they need it the most. Many face impossible choices.

This is menu of what must be done. What are political blockages to action on these fronts?

eurodad.org/a_tale_of_two_…

This is menu of what must be done. What are political blockages to action on these fronts?

eurodad.org/a_tale_of_two_…

3/ Burdened by Covid, Debt & Climate crises, Latin & Central Am are at frontlines of 21stC system-level shocks. Green investment, debt write-offs, and bigger welfare states are solutions.

Must-read by Tooze on dollar world-order adamtooze.substack.com/p/chartbook-ne…

Must-read by Tooze on dollar world-order adamtooze.substack.com/p/chartbook-ne…

https://twitter.com/70sBachchan/status/1399794668121034753

4/ The position of developing countries is analogous to the position of municipalities in rich countries. Both face extremely high financing costs in bond markets even though they need to do adaptation & decarbonization the most.

https://twitter.com/70sBachchan/status/1382453944274796545

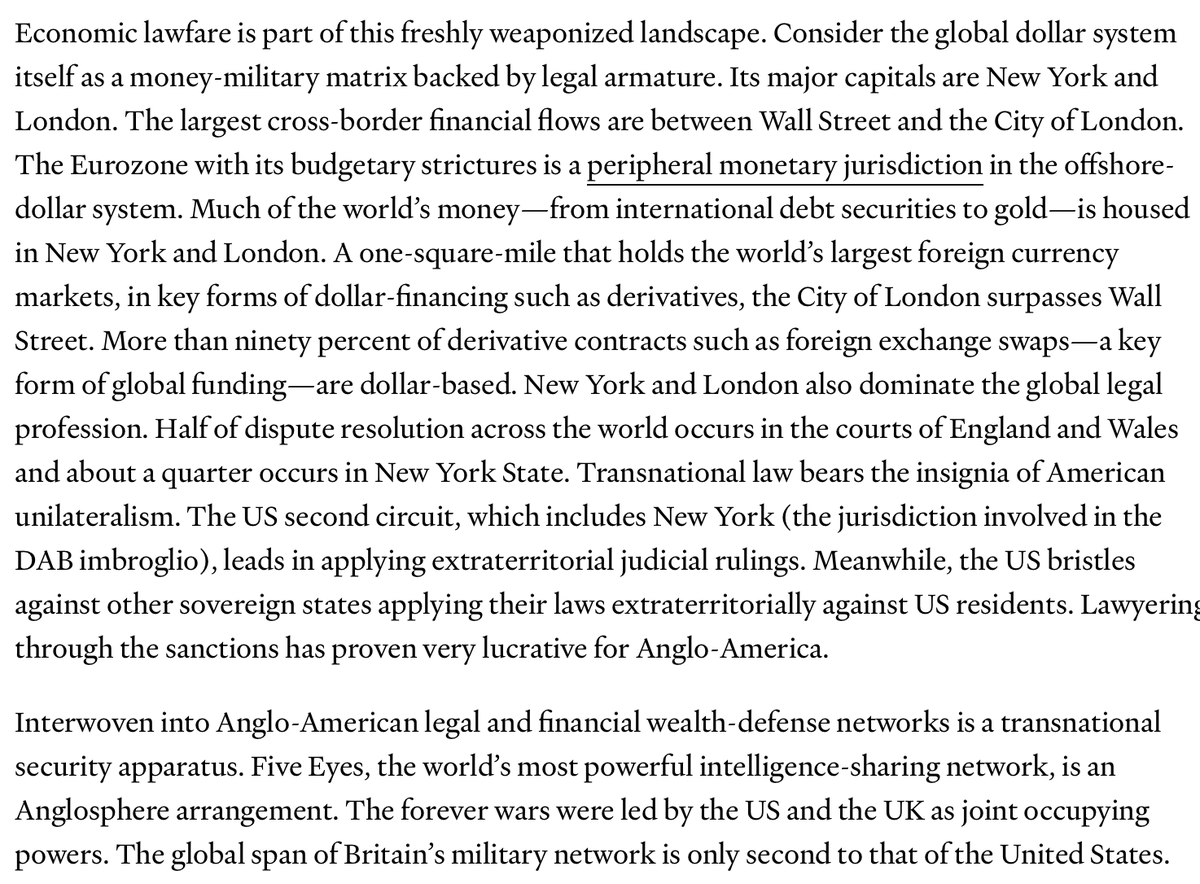

5/ Climate & finance ppl must grok geopolitics. "Interwoven into Anglo-American legal and financial wealth-defense networks is a transnational security apparatus"

Read @MonaAli_NY_US essay why dollar hegemony is more entrenched than ever before.

phenomenalworld.org/analysis/regim…

Read @MonaAli_NY_US essay why dollar hegemony is more entrenched than ever before.

phenomenalworld.org/analysis/regim…

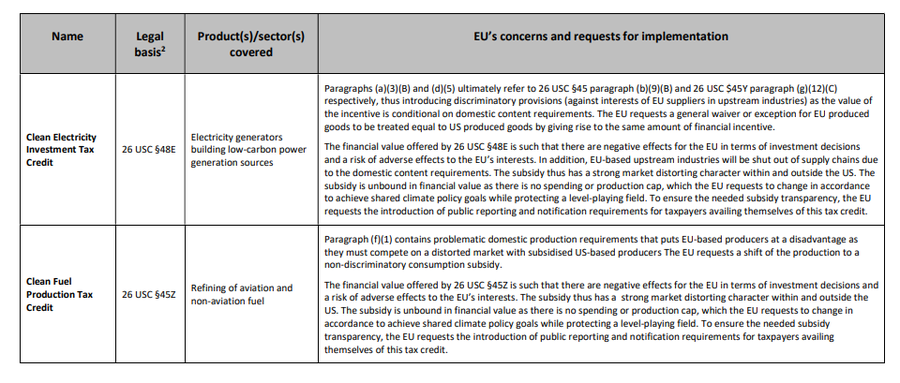

6/ There have been a slew of proposals to reform IMF & World Bank governance as they empower put creditor interests.

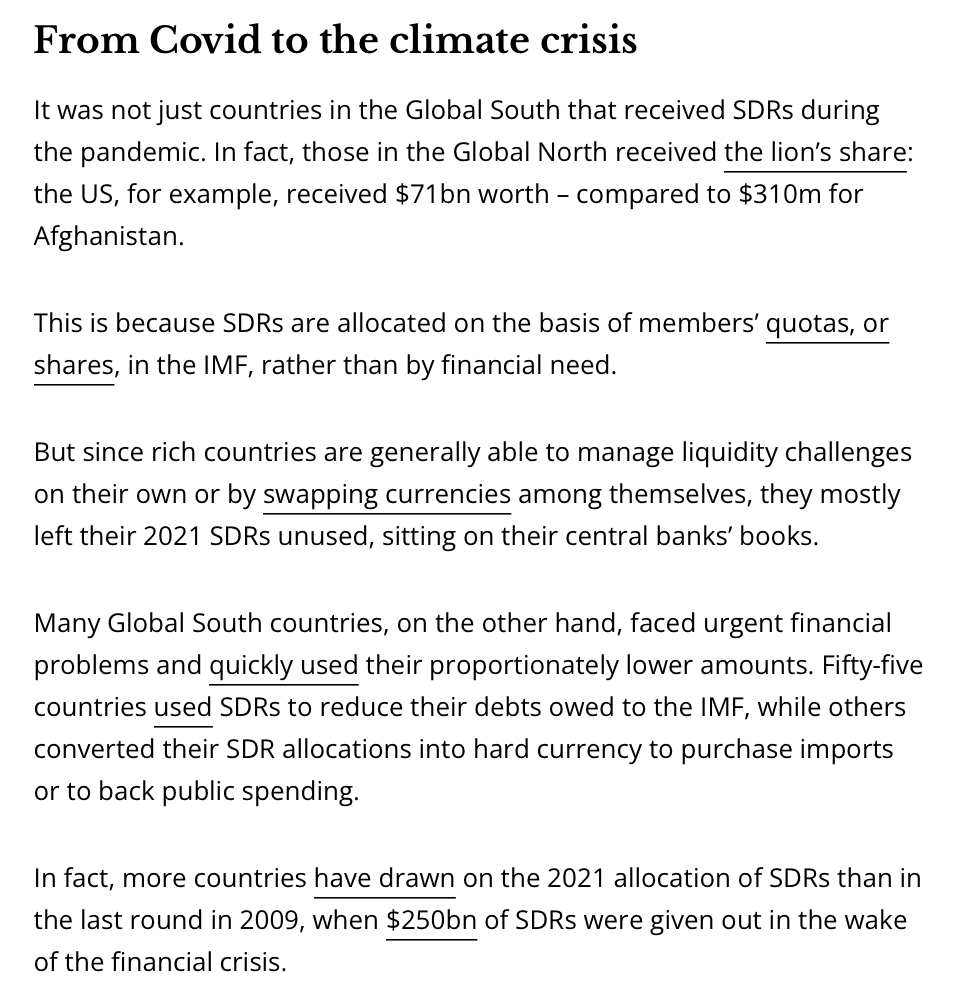

Unequal country quotas at the IMF make climate-vulnerable countries underrepresented in decisions that disproportionately impact them.

bu.edu/gdp/files/2022…

Unequal country quotas at the IMF make climate-vulnerable countries underrepresented in decisions that disproportionately impact them.

bu.edu/gdp/files/2022…

7/ Are there ways to break the deadlock? Can climate finance flow without changing intl finance architecture?

If you have heard about Barbados PM Mia Mottley's "Bridgetown Agendaa" and want to know more about it, @AvinashPersau15 fine essay is here:

geopolitique.eu/en/articles/br…

If you have heard about Barbados PM Mia Mottley's "Bridgetown Agendaa" and want to know more about it, @AvinashPersau15 fine essay is here:

geopolitique.eu/en/articles/br…

8/ In bombshell report @danielmunevar finds poor countries will pay an astonishing $330B in debt service on bonds worth $691B. What governs the size of the pound of flesh that global bondholders demand for lending money to poor countries? ht @policytensor

policytensor.substack.com/p/global-polar…

policytensor.substack.com/p/global-polar…

9/ @rishirbhandary on how intl fin architecture is being pushed

">#COP27 called on MDBs to do more on climate finance

>Yellen has called for a World Bank evolution roadmap

>G20 report on MDB capital adequacy shows they could increase lending by billions"

opendemocracy.net/en/oureconomy/…

">#COP27 called on MDBs to do more on climate finance

>Yellen has called for a World Bank evolution roadmap

>G20 report on MDB capital adequacy shows they could increase lending by billions"

opendemocracy.net/en/oureconomy/…

10/ It is a rich irony that states who drilled the most oil and gas - US, Saudi Arabia, UAE etc - also have the money that is being used for climate finance

Unsurprisingly, they want to keep drilling & don't want to turn into "stranded countries". Thread

Unsurprisingly, they want to keep drilling & don't want to turn into "stranded countries". Thread

https://twitter.com/70sBachchan/status/1587526194551046147

11/ Climate finance is riddled with greenwashing schemes.

Saudis and Emiratis are taking Biden's CCS and Hydrogen program to the developing world. The "Build Back Better world agenda", is brought to you by the gulf petrostates #GeopoliticsOfGHGs

Saudis and Emiratis are taking Biden's CCS and Hydrogen program to the developing world. The "Build Back Better world agenda", is brought to you by the gulf petrostates #GeopoliticsOfGHGs

https://twitter.com/70sBachchan/status/1590037909465616385

Nothing in life is certain except destabilizing climate, 'uneven & combined development' & taxes.

Join us in a few hours (3pm EST) with an amazing panel to discuss Climate, global political economy, & power. There will be a recording if you can't make it

bit.ly/money-and-clim…

Join us in a few hours (3pm EST) with an amazing panel to discuss Climate, global political economy, & power. There will be a recording if you can't make it

bit.ly/money-and-clim…

"Problem of modernization has not gone away. In fact, it has returned with unprecedented urgency with #climatecrisis. The advanced nations of the world want a global energy transition. The Third World states have more urgent priorities..."

@policytensor

policytensor.substack.com/p/global-polar…

@policytensor

policytensor.substack.com/p/global-polar…

Fun & insightful Polycrisis panel. If you missed it,don't FOMO. Recording here:

-Financing & dollars are drying up for rest of the world just when they need it the most

-get domestic politics right & countries can creatively do a lot

-Financing & dollars are drying up for rest of the world just when they need it the most

-get domestic politics right & countries can creatively do a lot

https://twitter.com/phenomenalworld/status/1597720228204777475

• • •

Missing some Tweet in this thread? You can try to

force a refresh