Last week @CurveFinance published the whitepaper for their new $crvUSD stablecoin on GitHub.

What is Curve Finance, the Curve Wars and how will $crvUSD play into the larger ecosystem?

🧵I'll get you from 0 to 100 in this thread👇

$CRV $veCRV #DeFi #AMM #DEX #ethereum

What is Curve Finance, the Curve Wars and how will $crvUSD play into the larger ecosystem?

🧵I'll get you from 0 to 100 in this thread👇

$CRV $veCRV #DeFi #AMM #DEX #ethereum

I will cover:

1. What is Curve Finance

2. The curve ecosystem - $CRV/$veCRV & workings

3. The Great Curve Wars

4. $crvUSD stablecoin

Full article:

fekdaoui.substack.com/p/curve-finance

1. What is Curve Finance

2. The curve ecosystem - $CRV/$veCRV & workings

3. The Great Curve Wars

4. $crvUSD stablecoin

Full article:

fekdaoui.substack.com/p/curve-finance

WHAT?

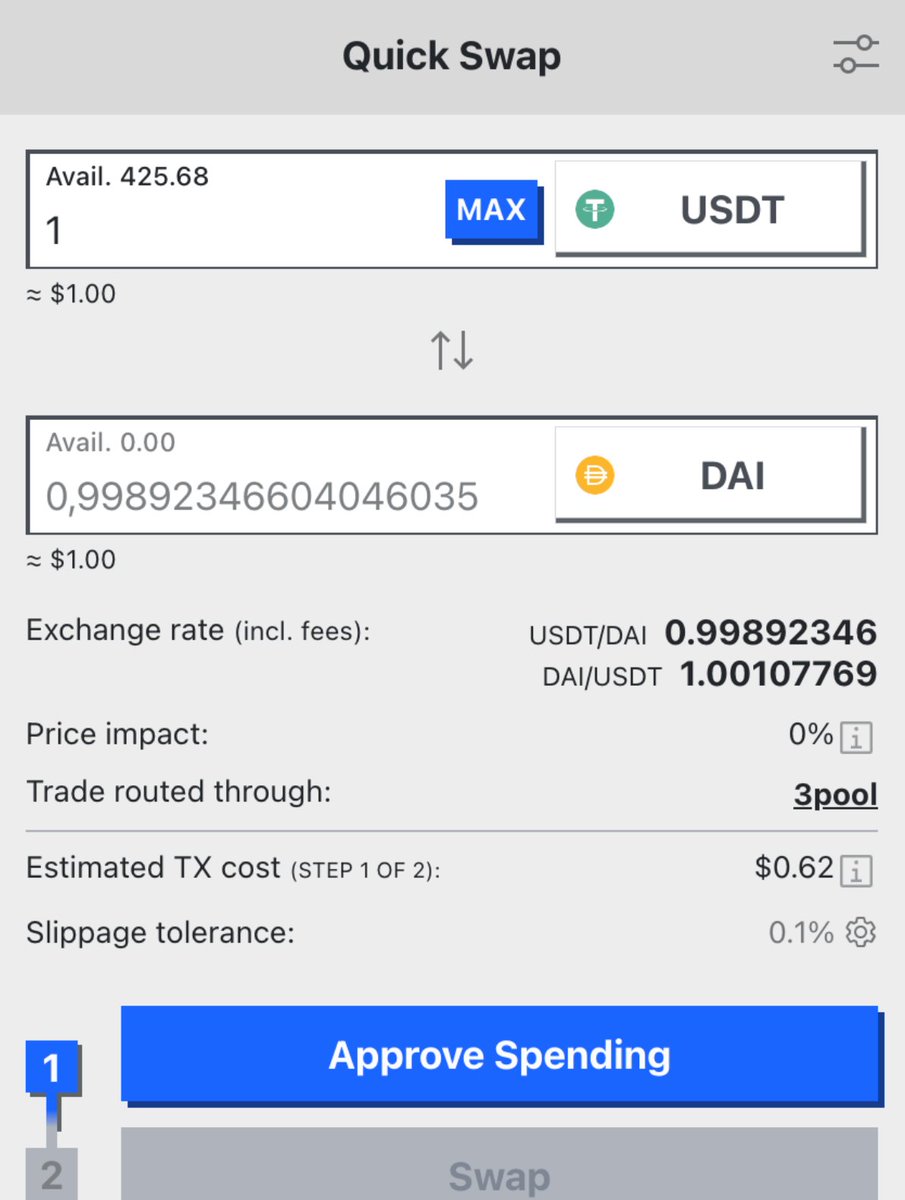

In a nutshell, Curve Finance is a decentralized exchange: it is a protocol that allows you to swap multiple tokens without the involvement of a third party.

In a nutshell, Curve Finance is a decentralized exchange: it is a protocol that allows you to swap multiple tokens without the involvement of a third party.

It is one of the most important protocols in Decentralized Finance being the biggest #DEX in #DeFi at the time of writing.

During last bull market it accumulated more than $24 billion dollars in TVL (total value locked) at its peak.

During last bull market it accumulated more than $24 billion dollars in TVL (total value locked) at its peak.

THE CURVE ECOSYSTEM

Now, what makes Curve Finance and its token ($CRV) so special? In my opinion, there are two major components:

- A special AMM (Stableswap invariant model)

- A vote-locking model that allows users to vote on future token emissions

Now, what makes Curve Finance and its token ($CRV) so special? In my opinion, there are two major components:

- A special AMM (Stableswap invariant model)

- A vote-locking model that allows users to vote on future token emissions

1️⃣ Stableswap invariant:

- Allows for low-slippage exchange of tokens. Especially attractive to swap stablecoins.

- Slippage is the price of your asset changing due to your trade. For stablecoins, low-slippage is extremely important as they need to hold a constant $1 price.

- Allows for low-slippage exchange of tokens. Especially attractive to swap stablecoins.

- Slippage is the price of your asset changing due to your trade. For stablecoins, low-slippage is extremely important as they need to hold a constant $1 price.

The Stableswap invariant AMM model plays a key role in making sure that slippage is minimized during trades.

As you can see in the graph above, the Stableswap invariant is closer to a constant price (which represents a situation with no slippage at all).

As you can see in the graph above, the Stableswap invariant is closer to a constant price (which represents a situation with no slippage at all).

2️⃣ A vote-locking model:

Users can lock $CRV and receive $veCRV (voting escrow) instead.

The token can be locked for a period of 1 to 4 years at a 0.25 to 1 conversion rate.

Users can lock $CRV and receive $veCRV (voting escrow) instead.

The token can be locked for a period of 1 to 4 years at a 0.25 to 1 conversion rate.

The interesting thing here is the following: $veCRV is used to vote and decide which LPs receive more daily $CRV emissions.

This is why DeFi protocols are trying to stack as much CRV as possible: to increase the amount of $CRV emissions that are distributed to their LPs.

This is why DeFi protocols are trying to stack as much CRV as possible: to increase the amount of $CRV emissions that are distributed to their LPs.

In the Curve Finance ecosystem, the $CRV inflation goes to users who provide liquidity & this is where gauges and gauge weight come in:

- Liquidity gauge: how much a user is providing in liquidity.

-Gauge weight: how much of the daily CRV emissions the LP pool will receive.

- Liquidity gauge: how much a user is providing in liquidity.

-Gauge weight: how much of the daily CRV emissions the LP pool will receive.

Gauge weights are important: they decide where the CRV inflation goes. This is decided upon by the voters of the DAO.

In the example below we can see that liquidity providers in pool Y receive around 72% of the daily $CRV emissions.

In the example below we can see that liquidity providers in pool Y receive around 72% of the daily $CRV emissions.

Vote locking might be the major driver for Curve’s success as it aligns token holder incentives with Curve’s incentives:

From Curve’s perspective, having tokens locked for a long period of time means those tokens are out of the circulating supply: lower supply → higher price and higher market cap.

From the token holders perspective, they benefit by sharing in the trading fees generated on CRV. Since September 2020, 50% of all trading fees on Curve are distributed to veCRV holders.

On top of these trading fees, liquidity providers earn $CRV rewards as mentioned above.

On top of these trading fees, liquidity providers earn $CRV rewards as mentioned above.

THE GREAT CURVE WARS

OK, that is cool and all - but what is this thing about the Curve Wars and why are protocols trying to accumulate as much CRV as possible?

OK, that is cool and all - but what is this thing about the Curve Wars and why are protocols trying to accumulate as much CRV as possible?

This vote-locking model is a game-changer when it comes to incentivizing liquidity.

This basically means that DeFi protocols, instead of incentivizing liquidity by inflating their token, are now able to incentivize liquidity at a cheaper cost by using the $CRV token.

This basically means that DeFi protocols, instead of incentivizing liquidity by inflating their token, are now able to incentivize liquidity at a cheaper cost by using the $CRV token.

Suddenly, votes become valuable as they decide which pools receive a higher portion of the $CRV emissions.

Multiple protocols started to offer $CRV holders bribes if they would vote in their interest, as this was cheaper than incentivizing liq. by issuing their own tokens.

Multiple protocols started to offer $CRV holders bribes if they would vote in their interest, as this was cheaper than incentivizing liq. by issuing their own tokens.

And that is what the Curve Wars are all about: protocols seeking cheap liquidity, trying to stack as much $veCRV/$CRV as possible so they can redirect $CRV rewards to their own liquidity pool.

It’s the ultimate battle for liquidity.

It’s the ultimate battle for liquidity.

$crvUSD

Allright - what is this stablecoin hype all about? It seems like every other week another protocol is launching its own stablecoin, so what distinguishes this one from all the others?

The LLAMMA model (Lending-Liquidating AMM Algorithm).

Allright - what is this stablecoin hype all about? It seems like every other week another protocol is launching its own stablecoin, so what distinguishes this one from all the others?

The LLAMMA model (Lending-Liquidating AMM Algorithm).

On most lending platforms, when the price of a token drops, the health of the loan declines rapidly and ends up being liquidated.

Not the best experience of course.

The LLAMMA model has a completely new approach to mitigate this problem.

Not the best experience of course.

The LLAMMA model has a completely new approach to mitigate this problem.

Instead of liquidating everything instantly, it liquidates you bit by bit (in bands) as your loan collateral drops.

For example, let’s say you take out a loan using 1 ETH with a liquidation range between $2000 and $2050.

For example, let’s say you take out a loan using 1 ETH with a liquidation range between $2000 and $2050.

The liquidation ranges could look like the this:

- $2000 - $2010: 0.2 ETH

- $2010 - $2020: 0.2 ETH

- $2020 - $2030: 0.2 ETH

- $2030 - $2040: 0.2 ETH

- $2040 - $2050: 0.2 ETH

- $2000 - $2010: 0.2 ETH

- $2010 - $2020: 0.2 ETH

- $2020 - $2030: 0.2 ETH

- $2030 - $2040: 0.2 ETH

- $2040 - $2050: 0.2 ETH

Once the price drops to the $2040-$2050 range, your position begins to liquidate:

- Price of collateral goes down: LLAMMA automatically liquidates part of your portfolio into $crvUSD.

- Price of collateral goes back up: LLAMMA repurchases your collateral.

- Price of collateral goes down: LLAMMA automatically liquidates part of your portfolio into $crvUSD.

- Price of collateral goes back up: LLAMMA repurchases your collateral.

Instead of liq. your entire position at once, the process occurs smoothly over a continuous range, limiting your potential losses.

This clearly differs from the traditional approach:

- Collateral down: your collateral gets sold

- Collateral back up: you are left holding USD

This clearly differs from the traditional approach:

- Collateral down: your collateral gets sold

- Collateral back up: you are left holding USD

OK - so what are the possible implications?

- The $CRV token might generate more fees from the increased volume and the $crvUSD borrowing fee, and thus more money for $CRV lockers

- More governance utility for $veCRV as the DAO will have control over the $crvUSD ecosystem

- The $CRV token might generate more fees from the increased volume and the $crvUSD borrowing fee, and thus more money for $CRV lockers

- More governance utility for $veCRV as the DAO will have control over the $crvUSD ecosystem

Overall I believe $crvUSD will be a valuable addition to the Curve ecosystem & it will be interesting to see how it plays out long term.

Thank you for reading and I hope I managed to describe things in a clear and understandable way.

Thank you for reading and I hope I managed to describe things in a clear and understandable way.

S/o to the following folks for sharing their resources & inspring me to write this:

@CurveFinance

@0x_illuminati

@CurveCap

@JackNiewold

@knowerofmarkets

@DeFi_Made_Here

@cryptoPothu

@CurveFinance

@0x_illuminati

@CurveCap

@JackNiewold

@knowerofmarkets

@DeFi_Made_Here

@cryptoPothu

That's it - hope you liked the thread.

If you did, please:

- like, leave a comment & retweet first tweet

- follow @fekdaoui

- feedback is appreciated!

Thank you for taking the time to read!

If you did, please:

- like, leave a comment & retweet first tweet

- follow @fekdaoui

- feedback is appreciated!

Thank you for taking the time to read!

https://twitter.com/fekdaoui/status/1597949368253964289?s=20&t=udHLjUQ_OwxzQzqjGUw4KA

• • •

Missing some Tweet in this thread? You can try to

force a refresh