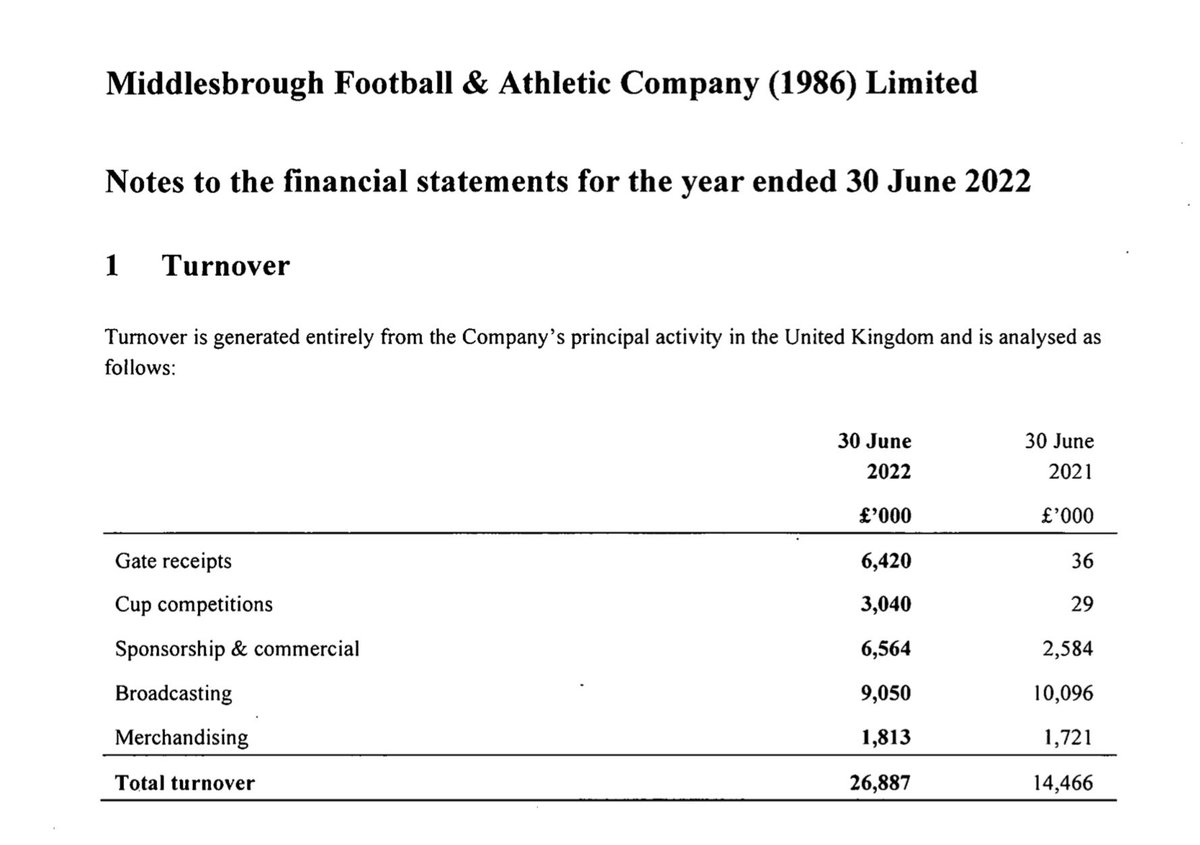

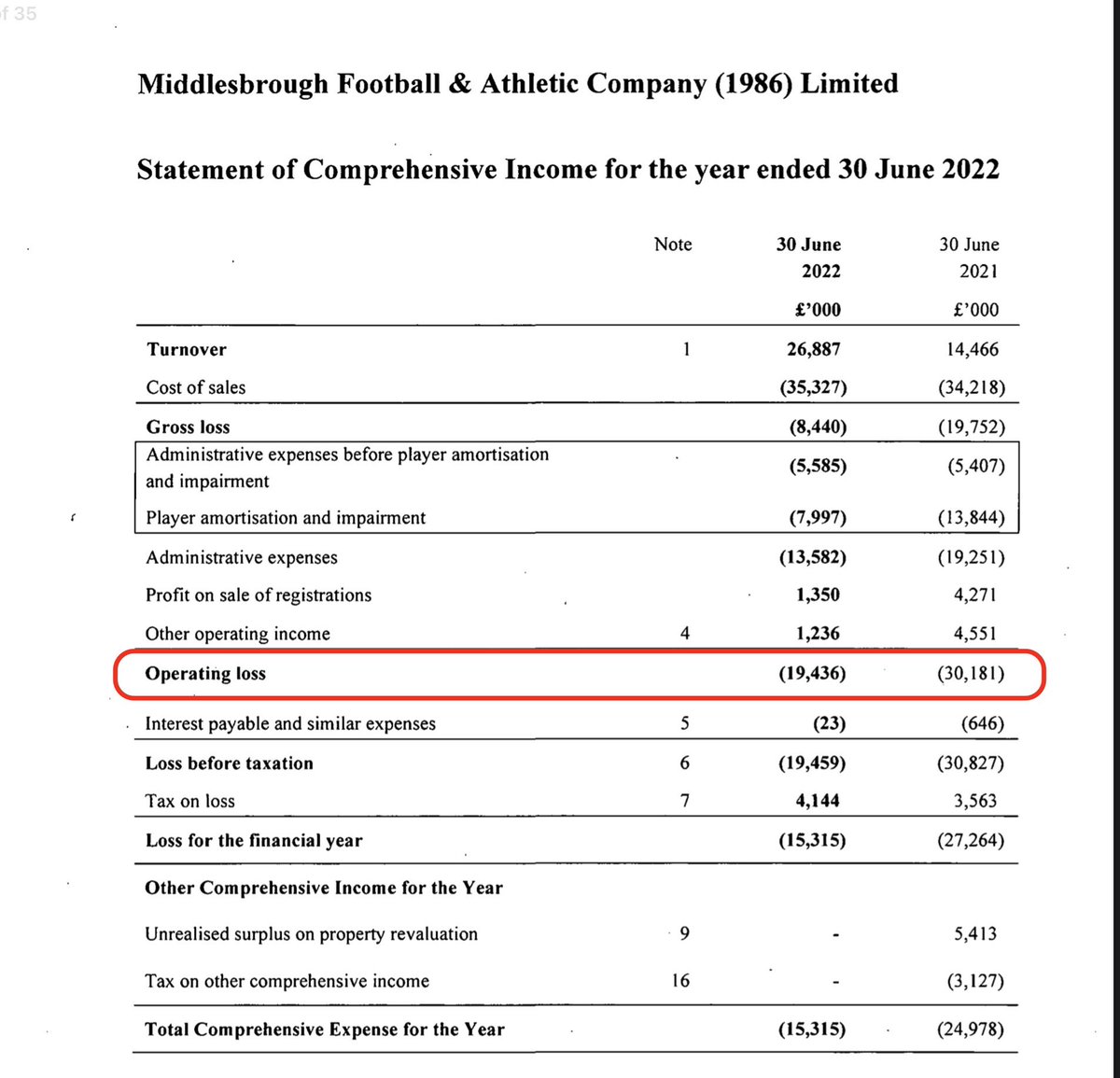

Middlesbrough 2021/22 results. Operating losses down from £30m to £19m as club returned to matches in front of paying fans #MFC

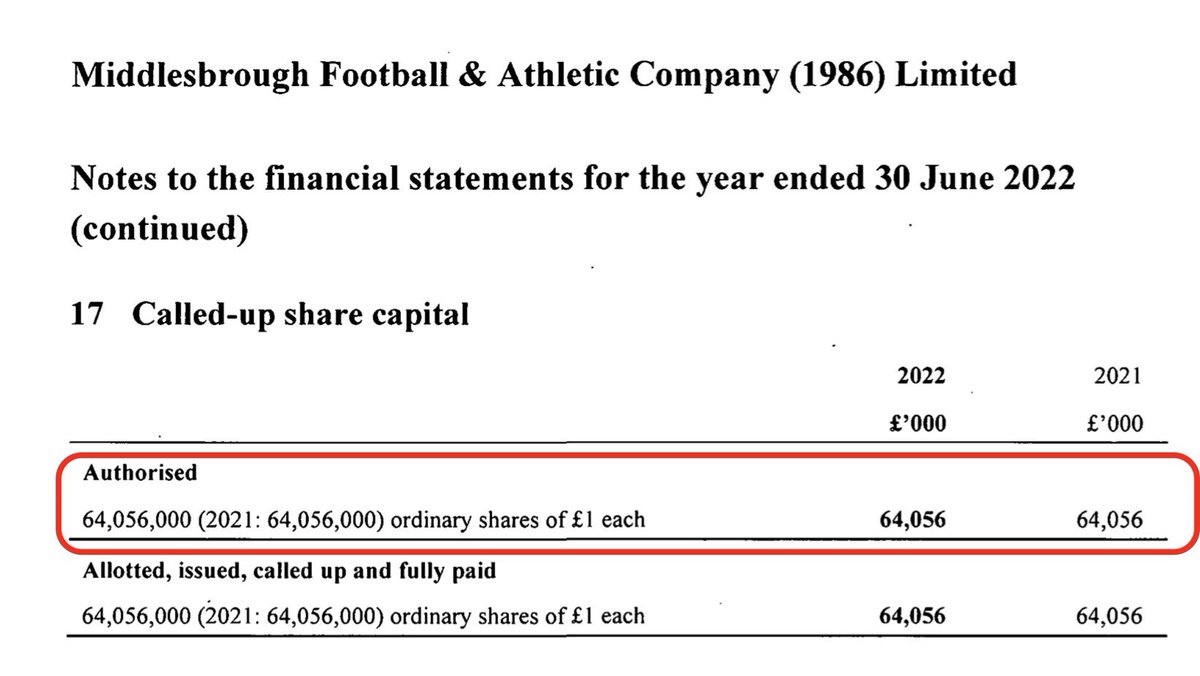

Middlesbrough total losses over the years £247 million. Club technically insolvent as liabilities > assets but parent company commits to support.

Since 30 June Boro have had net negative transfer spend of £13m and received £2.7m from ‘ongoing disputes with third parties’ which could be the Derby County/Mel Morris issue

• • •

Missing some Tweet in this thread? You can try to

force a refresh