1/ This is so abysmal that I had to actually read the Illinois Teacher's Retirement System acturial and valuation reports for the pension's FY 2022 (ending June 30). #Illinois #Pension #Crisis

Summary Report: trsil.org/financial/fina…

Full Report: trsil.org/financial/actu…

Summary Report: trsil.org/financial/fina…

Full Report: trsil.org/financial/actu…

https://twitter.com/Wirepoints/status/1600471436371456001

2/ Before discussing the TRS pension shortfall, a few things to keep in mind: The TRS unfunded pension liabilities are only a part of the IL state total, and Chicago is in it's own separate pension nightmare. Here are the 2020 figures from Bond Buyer (bondbuyer.com)

3/ And as I have highlighted ad nauseum, Illinois and Chicago's pension shortfalls are completely unsustainable. You don't want to be in the bottom right corner of this chart...

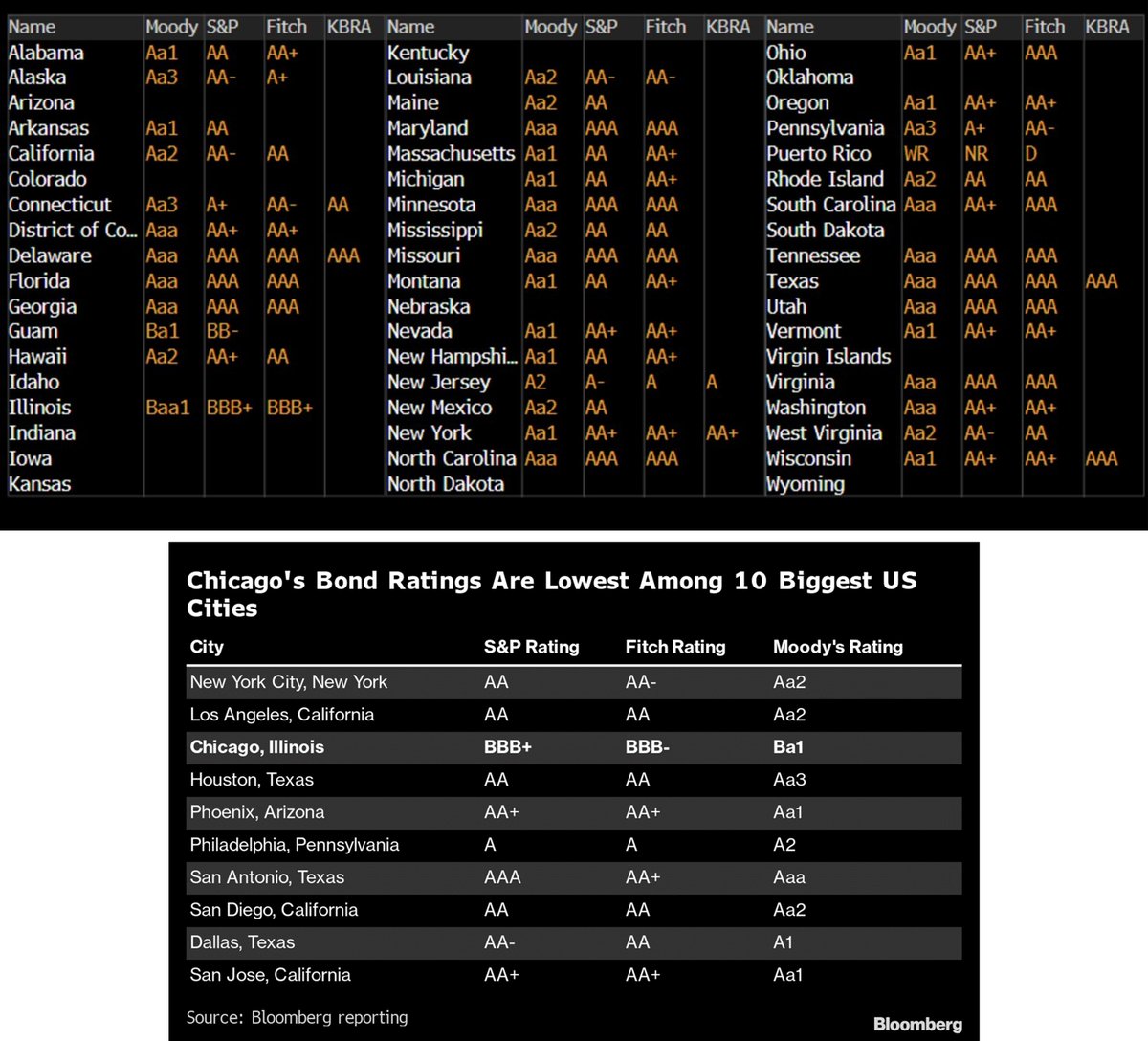

4/ Illinois' and Chicago's poor fiscal stewardship is why we have the worst rated credit in the country, which means a higher cost of borrowing for us, which means more money going to interest payments instead of state services. For these charts, remember, Bs are bad.

5/ And, again, in IL pension's can't default or declare bankruptcy. The two ways out of this are (A) higher taxes (which drive people and businesses out) or (B) implementing policies that support growth to increase revenues and expand the tax base. Of course, we are choosing A...

6/ Before looking at the pension stuff in detail, I highly recommend going through this long thread on the current economic environment and what it means for states like Illinois that already have difficult fiscal circumstances (IL analysis begins at #29).

https://twitter.com/StuLoren/status/1582775336554487813?s=20&t=I9vRO3BZCKcdE5oFGpnxJg

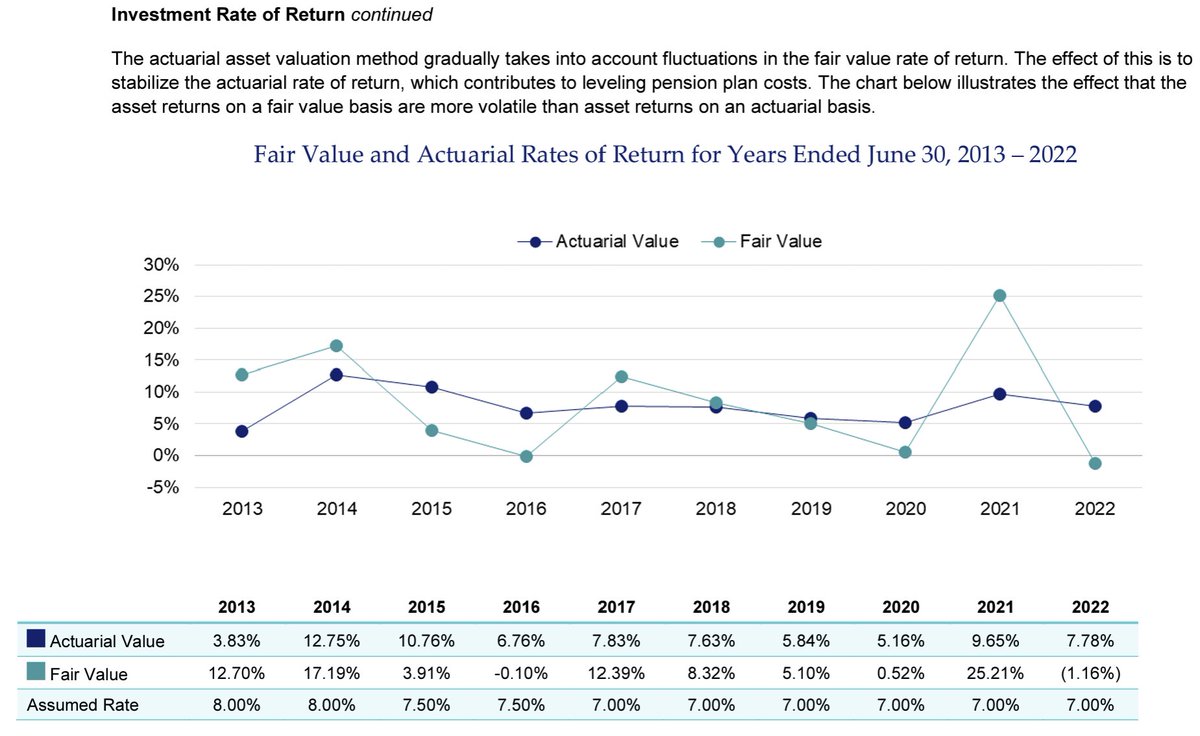

7/ Ok... so the TRS pension. In general, my assessment is: Yikes! I'll be positive though with my first remarks and point out that the returns over the last ten years have been acceptable.

8/ The total return is broadly in line with a 60/40 stock/bond portfolio or te S&P 500. TRS has actually slightly outperformed both its assumed rate of return benchmark and is in line with the relevant benchmark indices over a 10-year period.

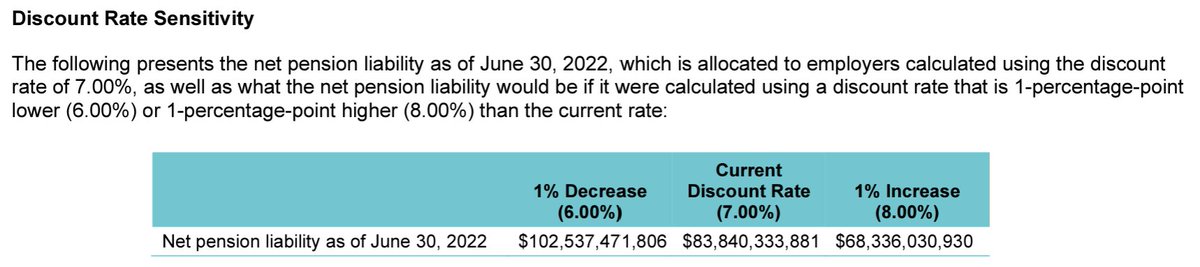

9/ And now for two major problems. First the discount rate. State pensions, unlike their corporate cousins, use an assumed rate of return as the rate at which to discount future liabilities back to present value. Corporates use bond spreads. pionline.com/industry-voice…

10/ All you need to know is that the higher the discount rate, the lower future liabilities. And the lower the discount rate, the higher the future liabilities. Illinois uses a 7% return hurdle / discount rate. Here's a graphic from the report showing a 1% sensitivity analysis.

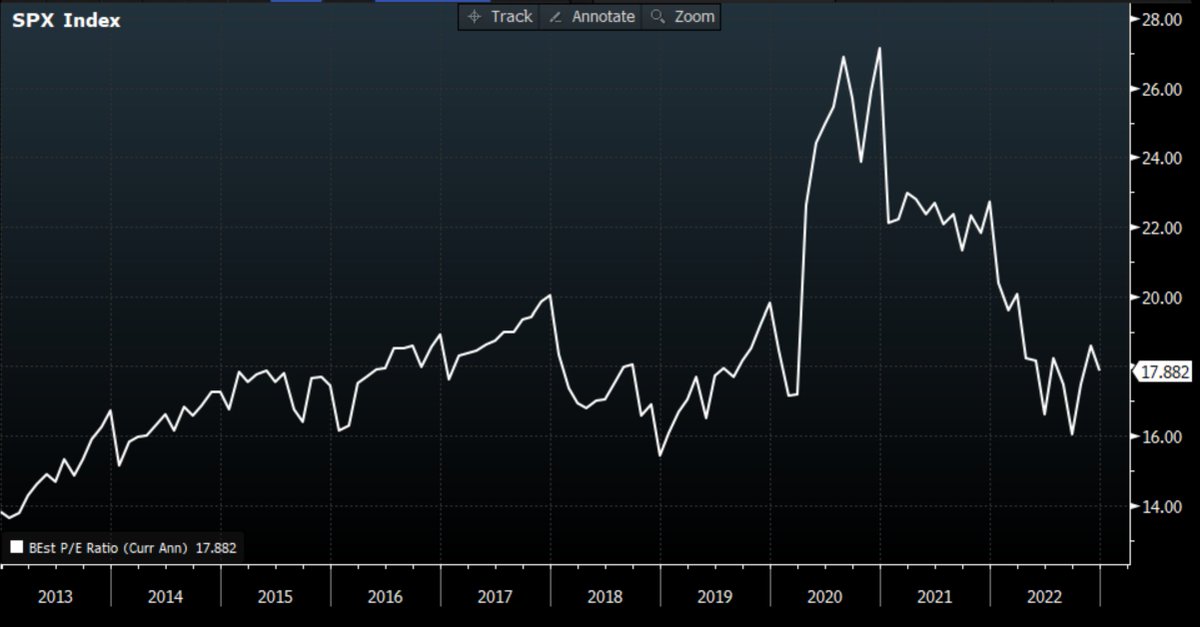

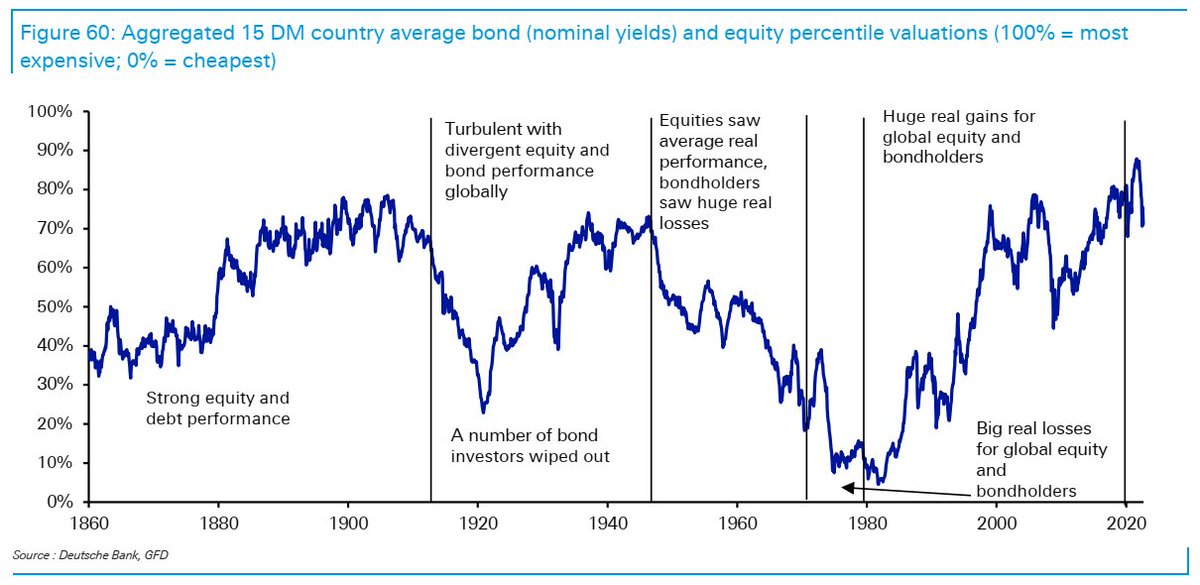

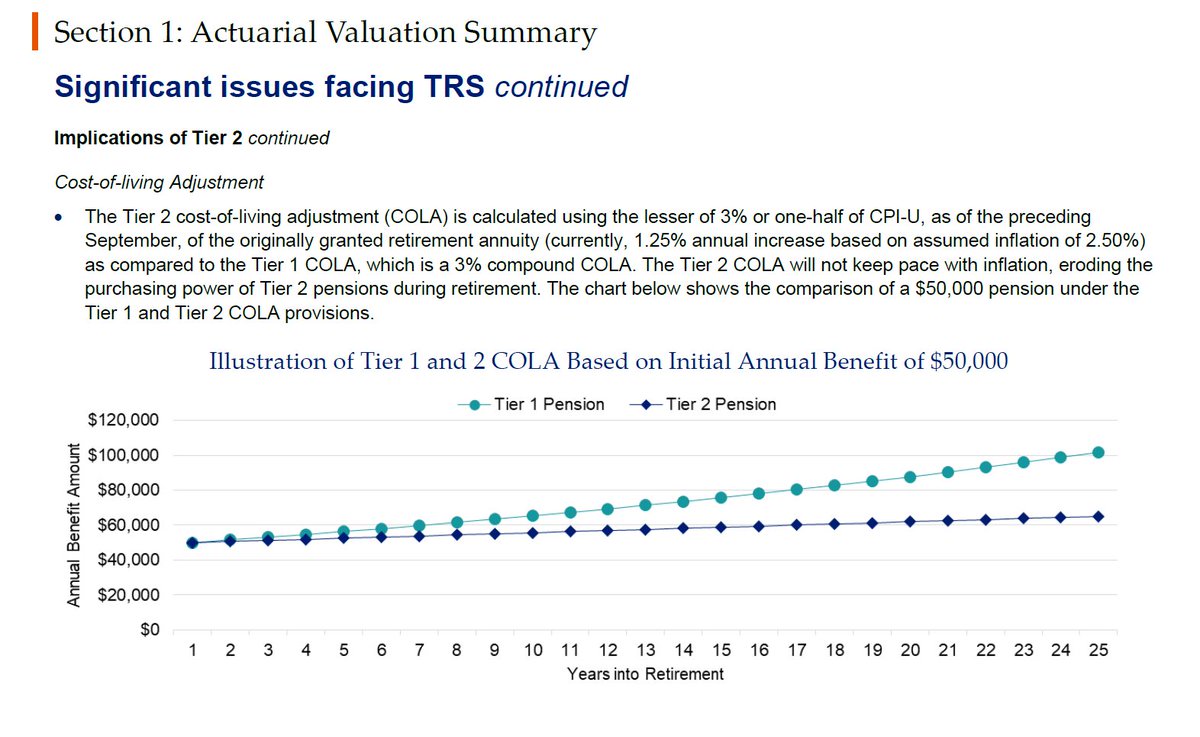

11/ Assuming a 7% forward return is a tall order. I'll keep things simple. 10 years ago, the forward price to earnings ratio of the S&P 500 was 14 (meaning the index price as a multiple of expected earnings). Even after the correction we've had, today it's close to 18.

12/ The more expensive entry point you start at, the lower your future returns. This graphic is from the @FT last year, but at 18x forward earnings implies forward returns closer to 5%. And note that despite high valuations last year, the TRS discount rate was also 7%...

13/ I should also note that inflation has crushed bond prices this year and all the private investments TRS owns will be marked down. That's not reflected yet in FY returns ended June 30... Point is 7% is a high return assumption with stock and bonds still historically expensive.

14/ Another huge problem: The TRS board assumes a long term inflation rate of 2.5%. Here's a short article on why I think long term 2.5% inflation assumptions may be wishful thinking. linkedin.com/pulse/quick-no…

15/ And here's a 149 page slide deck on why I think 2.5% inflation is a byproduct of a different universe we no longer live in. acrobat.adobe.com/link/review?ur…

16/ The 2.5% inflation assumption impacts future costs for the pension. If it's too low, then the pension will have even greater shortfalls. It would be more honest to have more realistic inflation and return assumptions - but it would also show a much larger unfunded liability.

17/ If the two biggest future pension liability assumptions are off, it's going to have a huge impact on long term returns, costs and shortfalls (which means more taxpayer liabilities). Remember, this is just TRS. The state and Chicago have other similarly situated pensions.

18/ As an aside, and this isn't the fault of TRS invesment professionals, the state pensions are handcuffed by our insane ESG stance that limits exposure to energy/resources (one of the few asset classes that does well in an inflationary environment).

19/ The TRS reports I linked to above are dense. Anyone interested, should just read the @Wirepoints summary. Broader point is that our pension system is in terrible shape and will require either herculean returns or more state contributions than forecast.

wirepoints.org/reality-check-…

wirepoints.org/reality-check-…

20/ I've been talking about these problems for awhile and even proposed an idea (that is admitedly tricky to administer) of setting up an "off-balance sheet" arrangement for state pensions. A "bad bank" type model. See below thread.

https://twitter.com/StuLoren/status/1506742913509871622?s=20&t=I9vRO3BZCKcdE5oFGpnxJg

21/ Again, I highly recommend reviewing this thread on why Illinois and similar states are in trouble in an evironment where interest rates are higher and economic growth is choppy.

https://twitter.com/StuLoren/status/1582781901651120129?s=20&t=I9vRO3BZCKcdE5oFGpnxJg

22/ There are no free lunches. We have accrued such an insane amount of pension liabilities at the state and city levels that paying it off is a pipe dream.

23/ The choices to get our fiscal mess in order are:

A) Borrow more (isn’t sustainable),

B) Tax more (causes people to move),

C) Declare bankruptcy (isn’t constitutional), or

D) Implement pro-growth policies (grows tax base)

This is IL, so of course we aren't choosing D...

A) Borrow more (isn’t sustainable),

B) Tax more (causes people to move),

C) Declare bankruptcy (isn’t constitutional), or

D) Implement pro-growth policies (grows tax base)

This is IL, so of course we aren't choosing D...

24/ Now to get a little political. I don't expect an honest discussion of any of this with the current crew of leaders currently in office that twist facts and avoid reality to serve their political narratives.

https://twitter.com/StuLoren/status/1599620068316704770?s=20&t=ZR8FtptLN9V8cWFVpN0p-g

25/ I've been consistent since last year. Illinois' pension and fiscal crisis are huge problems that must be soberly addressed. They won't get resolved until we're serious about improving public safety and implementing pro-growth policies. DM me to discuss

https://twitter.com/StuLoren/status/1455045477284687883?s=20&t=ZR8FtptLN9V8cWFVpN0p-g

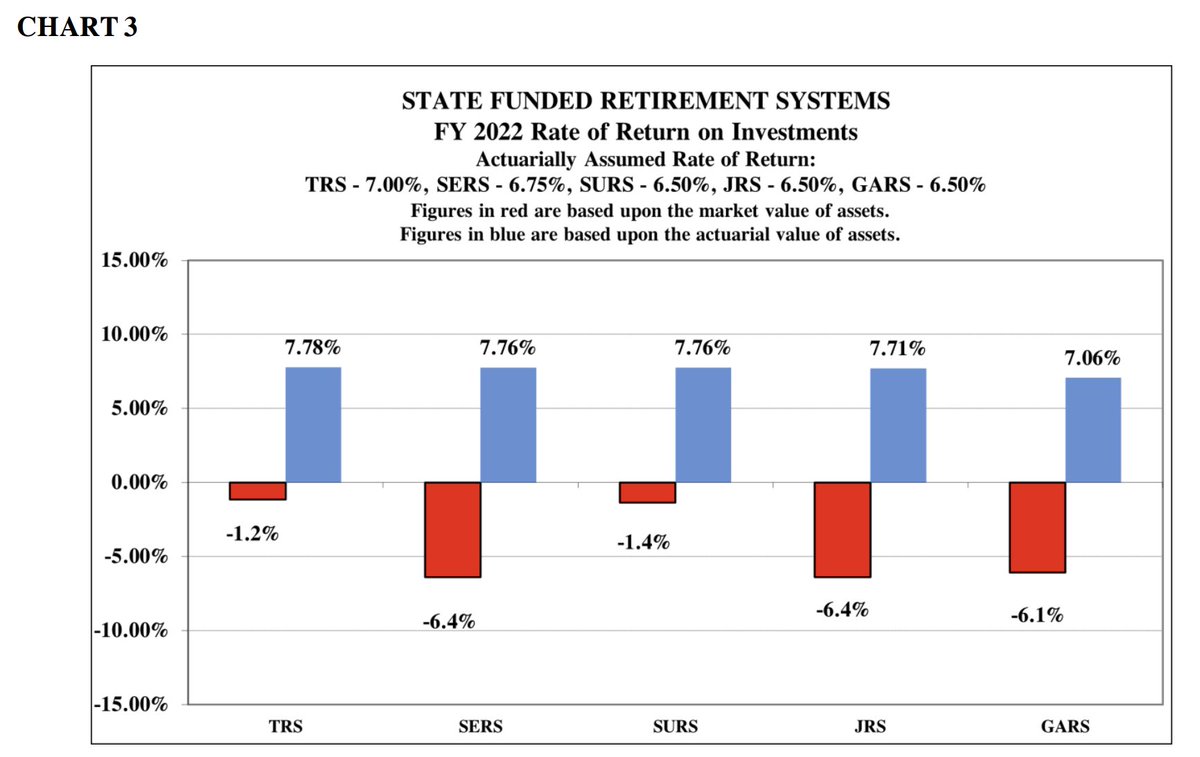

26/ Remember how bad I said everything was yesterday, well it's a lot worse... $139 billion of total unfunded liabilities. TRS was actually the best performing plan last year.

From the Illinois Commission on Government Forecasting and Accountability:

cgfa.ilga.gov/Upload/1122%20…

From the Illinois Commission on Government Forecasting and Accountability:

cgfa.ilga.gov/Upload/1122%20…

27/ Also presenting actuarial smoothed returns (blue bars) is misleading. Returns are whatever the market does. All these plans had a down FY 22 and post-June 30 they will likely be down more as their private holdings get marked down by a lot. So unfunded liabilities will rise.

28/ To my point on “smoothing” returns, see below. Though required by state law, this makes no sense as you can’t “smooth” out the dollars you owe beneficiaries every year. I’m sure many institutional investors would love to report smoothed 5-year returns for 2022…

https://twitter.com/TheBondBuyer/status/1600969876503339008

• • •

Missing some Tweet in this thread? You can try to

force a refresh