I am a fan of history. There is a lot to learn from it.

If the price pattern followed by spot prices is consistent, we may finally see a significant move up in the spot price of #uranium in 2023. 🧵/1

If the price pattern followed by spot prices is consistent, we may finally see a significant move up in the spot price of #uranium in 2023. 🧵/1

There are 3 spot prices that play a key role; conversion, enrichment and, of course, uranium. The price of all three typically move in the same direction, but not simultaneously. The sequence in prices between the last bull market and this one appears so far to be consistent./2

In the last bull market, as today, the first spot price out of the gate was the conversion spot price. North American conversion spot prices rallied early in 2005 and stayed at those levels through 2007./3

Back then, spot prices rose from $5.88/kgU at the end of 2003 to $11.50/kgU at the end of 2005 and levelled off.

In 2021 the price fell from $21 to $16. However, once Russia attacked Ukraine, the price quickly rose 150% in 2022 to $38-40 level where it remains since summer. /4

In 2021 the price fell from $21 to $16. However, once Russia attacked Ukraine, the price quickly rose 150% in 2022 to $38-40 level where it remains since summer. /4

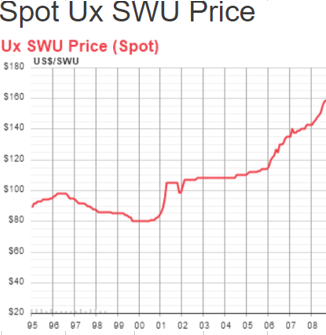

Enrichment spot prices can stay flat for a very long time. In the last bull market it was no different as the spot price remained at the $100-$110/SWU level until 2005, and then 🚀🚀🚀🚀 in 2006. This was after the conversion spot price jumped./5

For me, it makes sense that utilities, as a group, would max out existing enrichment contracts first, than secure available conversion & UF6 driving up spot, before returning to secure more enrichement, and thus driving spot SWU up./6

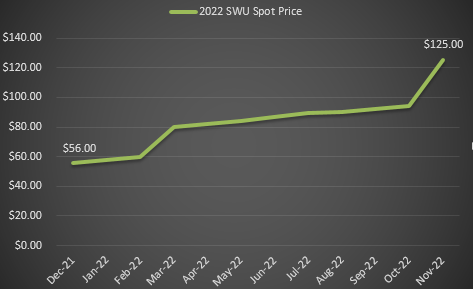

In the most recent period SWU spot prices have seen a slow rise from $51/SWU to $56/SWU in 2021. Similar to conversion spot prices in 2022, once the war started the price jumped to $80. However, as the focus turns back to enrichment, prices have soared further./7

To date the spot price of SWU, or enrichment, has risen 123% so far in 2022. If the past is to repeat itself, the spot price will continue rising through 2023 and beyond. So far every indication is that is the case./8

Which brings us to uranium.

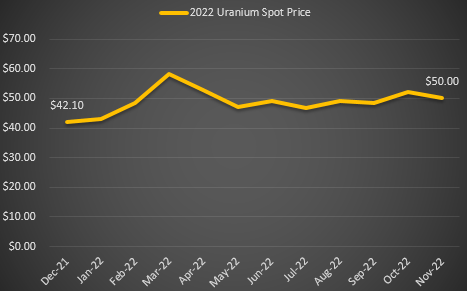

In the prior bull market the spot price saw increases in 2004 and 2005, before seeing a 100% increase in 2006, on the way to its peak in 2007. While enrichment went vertical from the start of 2006, it took 6 mths later for uranium to take off./9

In the prior bull market the spot price saw increases in 2004 and 2005, before seeing a 100% increase in 2006, on the way to its peak in 2007. While enrichment went vertical from the start of 2006, it took 6 mths later for uranium to take off./9

In the current bull market the uranium spot price continues to rise. 2020 saw a 25% price rise, while 2021 had a 40% price rise. To November, the price is up 19% in 2022.

Not surprisingly, the spot price has lagged the current %age gains of both conversion and enrichment./10

Not surprisingly, the spot price has lagged the current %age gains of both conversion and enrichment./10

This is not unusual as uranium is last. IMO, uranium's spot price rise will follow the rise in SWU spot prices (33% in one month for SWU is a great start).

If the past foretells the future, as the price of SWU goes 🚀, the uranium price will follow shortly in 2023./end

If the past foretells the future, as the price of SWU goes 🚀, the uranium price will follow shortly in 2023./end

• • •

Missing some Tweet in this thread? You can try to

force a refresh