🚨 $ETH Mass-Selling Event Is Coming?

1/ The #ETH2 Deposit has amassed, holding 12% of the total supply.

As the $ETH exchange reserve drops down to 15% of the total supply and continues to decrease,

What will happen on $ETH after the Shanghai Hard Fork?🧵

shorturl.at/svV08

1/ The #ETH2 Deposit has amassed, holding 12% of the total supply.

As the $ETH exchange reserve drops down to 15% of the total supply and continues to decrease,

What will happen on $ETH after the Shanghai Hard Fork?🧵

shorturl.at/svV08

2/ #Ethereum 'Shanghai Hard Fork' is set for March next year.

After the fork, it will enable withdrawals for $ETH stakers/validators from the Beacon Chain.

📝 #ShanghaiHardFork #Shanghai

🗓️ Mar 2023

theblock.co/post/193350/et…

After the fork, it will enable withdrawals for $ETH stakers/validators from the Beacon Chain.

📝 #ShanghaiHardFork #Shanghai

🗓️ Mar 2023

theblock.co/post/193350/et…

3/ How much $ETH be withdrawn on #ETH2?💰

It can be estimated to be about 15M, or 12% of the total $ETH supply.

From a short-term perspective, there are higher APY strategies than staking rewards by depositing ETH2 that might not be promised to withdraw.

shorturl.at/grvx1

It can be estimated to be about 15M, or 12% of the total $ETH supply.

From a short-term perspective, there are higher APY strategies than staking rewards by depositing ETH2 that might not be promised to withdraw.

shorturl.at/grvx1

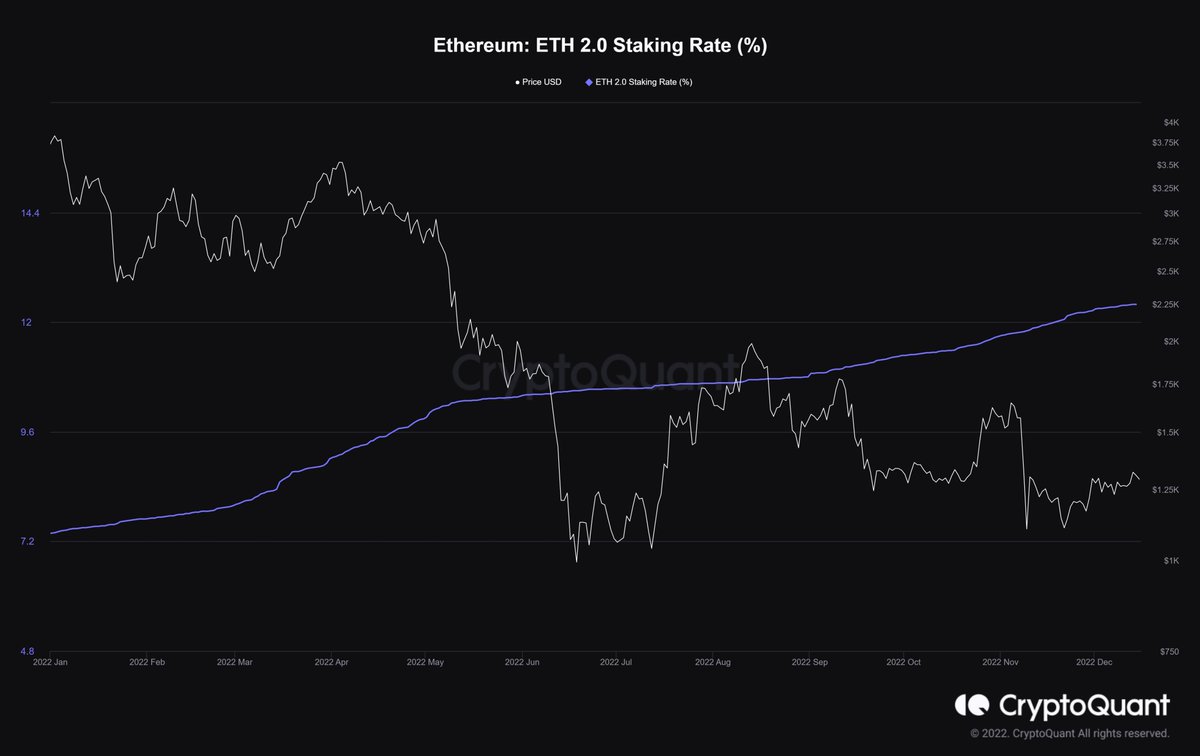

4/ How have the ETH2 depositors and balance changed? 📊

Compared to 2021, the number of depositors decreased by 57% in 2022.

But the deposited balance is similar to last year.

In other words, the total balance per deposit increased by 133% in 2022👀

Compared to 2021, the number of depositors decreased by 57% in 2022.

But the deposited balance is similar to last year.

In other words, the total balance per deposit increased by 133% in 2022👀

5/ What about the $ETH exchange reserve?

It may be that the balance of $ETH2 increases as the $ETH exchange reserve decreases.

18M of $ETH are held on the exchange, 15% of the total supply.

However, the exchange reserve is an ongoing downtrend.

shorturl.at/clnR1

It may be that the balance of $ETH2 increases as the $ETH exchange reserve decreases.

18M of $ETH are held on the exchange, 15% of the total supply.

However, the exchange reserve is an ongoing downtrend.

shorturl.at/clnR1

6/ After the Merge, the supply began to decline; 0.1M🔥

The supply and demand dynamics will shift after the fork, $ETH price volatility is imminent.

Will #Shanghai trigger mass-selling?

Or is it an opportunity that provides more liquidity to buy more $ETH

shorturl.at/amH18

The supply and demand dynamics will shift after the fork, $ETH price volatility is imminent.

Will #Shanghai trigger mass-selling?

Or is it an opportunity that provides more liquidity to buy more $ETH

shorturl.at/amH18

• • •

Missing some Tweet in this thread? You can try to

force a refresh