Leading On-chain Data/Analytics Provider

💡 Insights: https://t.co/4soN6kP21x

🔔 Alerts: https://t.co/kINun4rMMM

How to get URL link on X (Twitter) App

2/ Retail Investor Demand Dropped >5%

2/ Retail Investor Demand Dropped >5%

The survey shows crypto users are young, experienced, and educated. 60% are aged 25-44, with over 62% having 3+ years in the industry.

The survey shows crypto users are young, experienced, and educated. 60% are aged 25-44, with over 62% having 3+ years in the industry.

Fear & Greed Index above 80

Fear & Greed Index above 80

1/ SSR hits a 2-year high

1/ SSR hits a 2-year high

https://twitter.com/TheBlock__/status/1687522794421047299?s=20

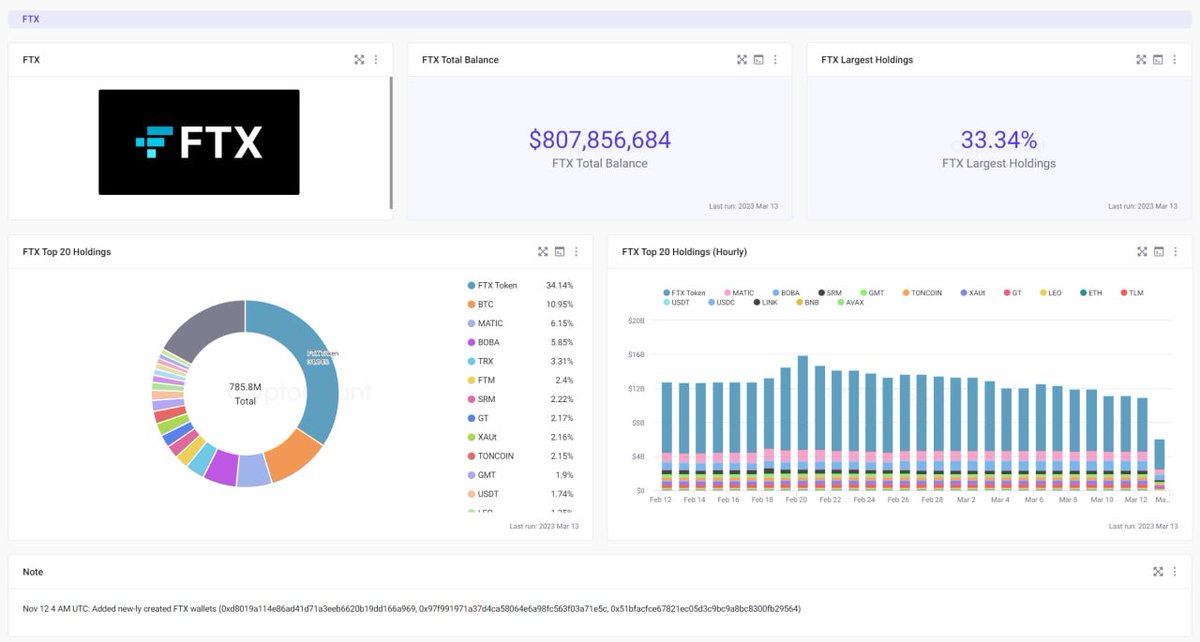

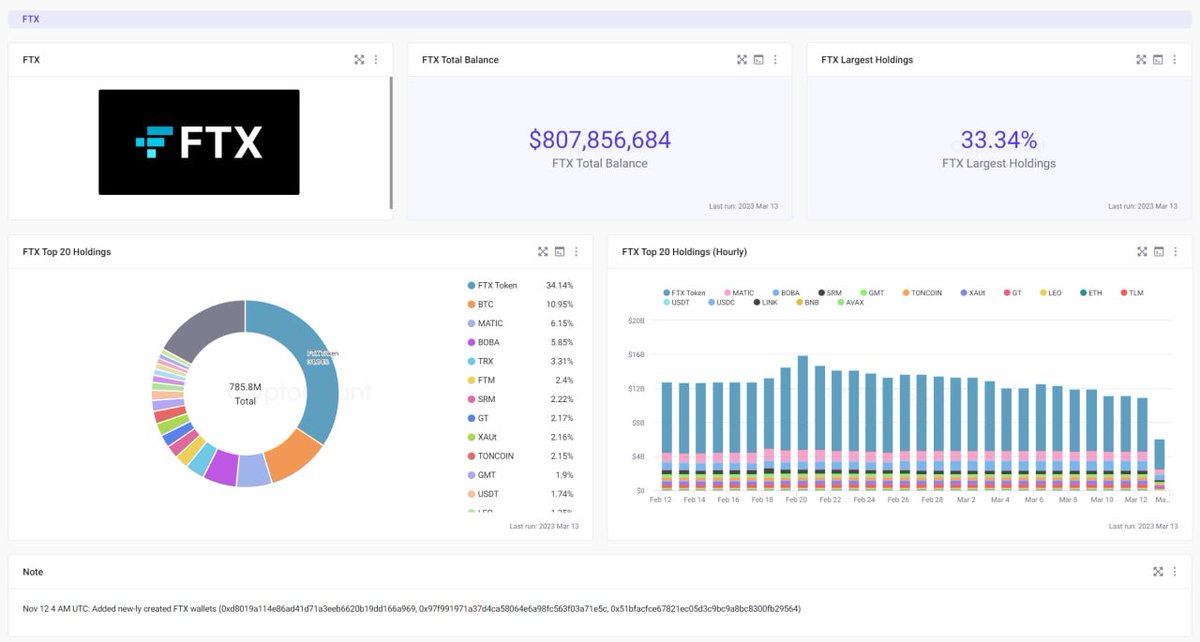

1/ "Fund holdings" refer to the cryptocurrency holdings of institutional investors, including hedge funds, investment firms, and cryptocurrency private funds. Analyzing the holdings of these funds provides valuable insights into the market dynamics and investor sentiment.

1/ "Fund holdings" refer to the cryptocurrency holdings of institutional investors, including hedge funds, investment firms, and cryptocurrency private funds. Analyzing the holdings of these funds provides valuable insights into the market dynamics and investor sentiment.

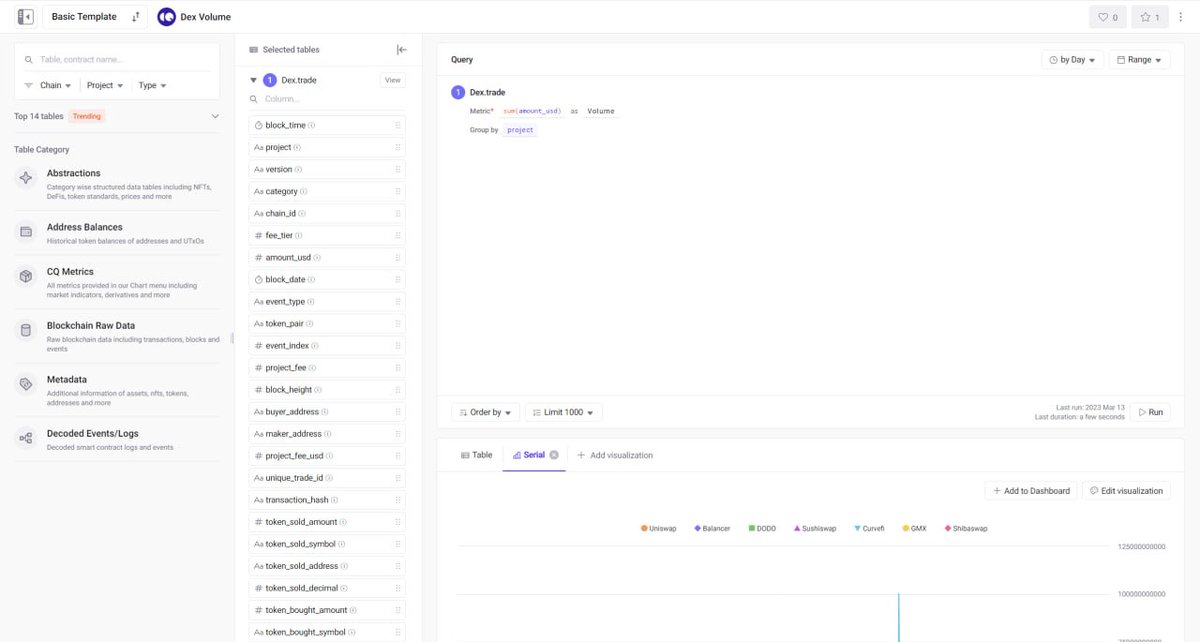

2/ 👉 Are you interested in being one of our beta testers? If so, we'd love to have you on board! With 'Factory', you can create your data set without learning to use coding skills and visualize it in a way that's most comfortable for you to analyze.

2/ 👉 Are you interested in being one of our beta testers? If so, we'd love to have you on board! With 'Factory', you can create your data set without learning to use coding skills and visualize it in a way that's most comfortable for you to analyze.

2/4

2/4

Funding rates make the perpetual futures contract price close to the index price.

Funding rates make the perpetual futures contract price close to the index price.

The Inter-exchange Flow Pulse Metric is a summary of how traders and investors act.

The Inter-exchange Flow Pulse Metric is a summary of how traders and investors act.

https://twitter.com/cryptoquant_com/status/1603537064049250304?s=20&t=y1MnkdPI7CFPqQ2yLalsNA

2/ #Ethereum 'Shanghai Hard Fork' is set for March next year.

2/ #Ethereum 'Shanghai Hard Fork' is set for March next year.

The report highlighted the following points:

The report highlighted the following points: