$TSLA is the talk of anyone #trading #options these days, so I figured it would be good to go through the data to see what the coming days may bring.

First off, there have been several news events related to $TSLA, including Chinese production slow downs, @elonmusk promising not to sell shares, and new gigafactory announcements. All these have made their splash and will continue to do so.

Lets start by looking at flow via @Tradytics. We see a major surge in put buying. However, compared to recent historical premiums, it wasn't the largest. Algoflow actually has this marked as neutral. The EoD spike can be telling though...

The @Tradytics $TSLA delta correlations still show bearish momentum at play. The 1 day delta correlation is good, but neutral. However, 3 day and 5 day expectations are heavily bearish and very well correlated...

The @Tradytics $TSLA Dark Pool correlations for the next 7 days are also bearish. Block Trade sentiment is bearish and the largest levels are acting as resistance above us. However, here are some bullish prints scattered within.

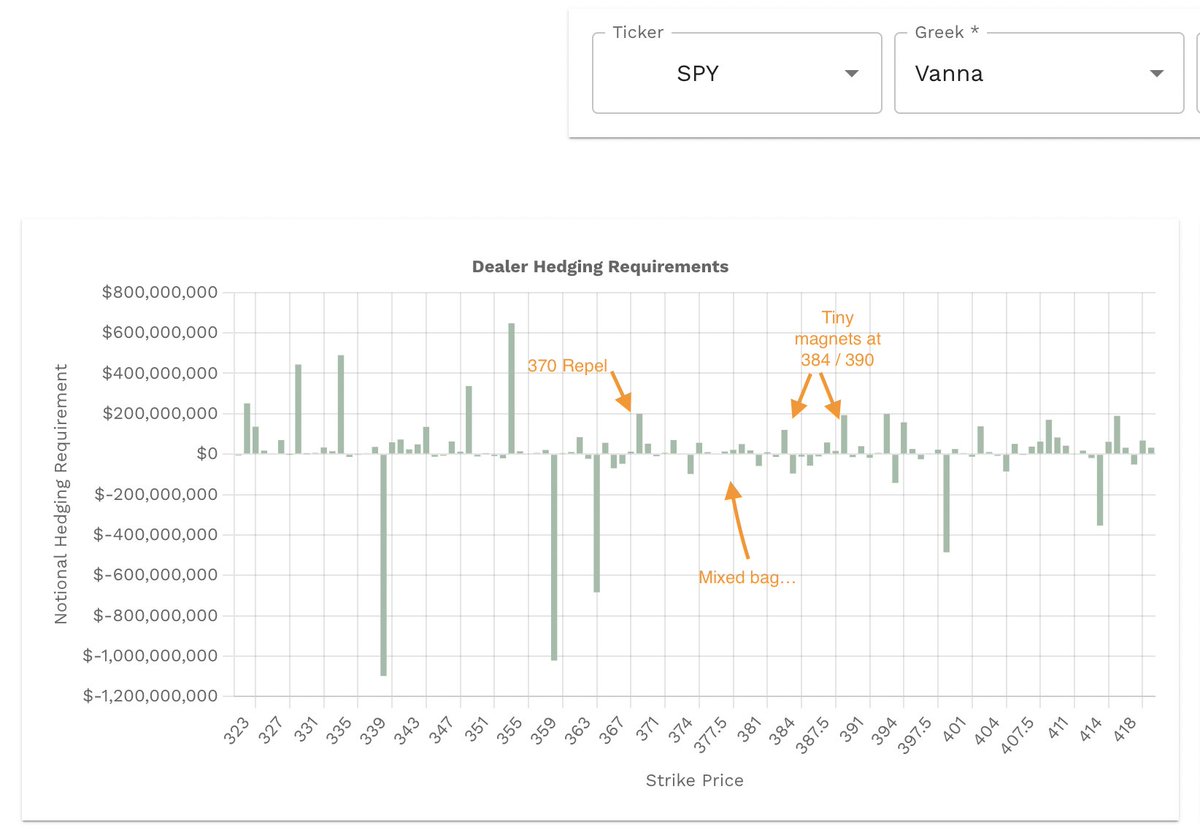

If we use @WizOfOps Vol.land data, we can get a very accurate depiction of dealer side hedging requirements. We can see that $100 will offer some dealer support, but rapid accelerant if shattered. $110 is now resistant (potential magnet).

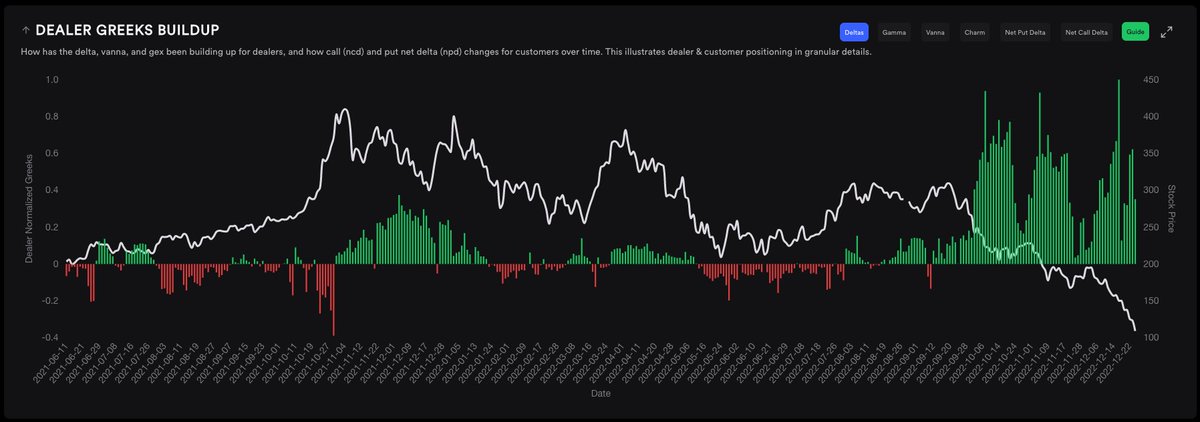

If we have Vol.land combine the #gamma, #vanna, #charm requirements for us, we see dealers are currently short about 1% of $TSLA's total Notational $ Volume traded today. The shorting gets worse as it goes higher AND lower (see screen shots).

The Daily chart clearly shows a falling knife. No signs of institutions stepping in to buy $TSLA until $95 on the Daily. Personally, I never buy falling knives. I wait for a character change first. Earnings coming up on 1/25/2023 which may halt the descent.

I'm not saying certain days won't present call scalping opportunities, however right now the data shows $TSLA is in a very bad spot. We'll see what the coming days/weeks bring. Be sure to keep an eye on the data as well! A curveball news/earnings event could change everything.

• • •

Missing some Tweet in this thread? You can try to

force a refresh