#NorthernData published several press releases since the BOY, but omitted most of the relevant information.

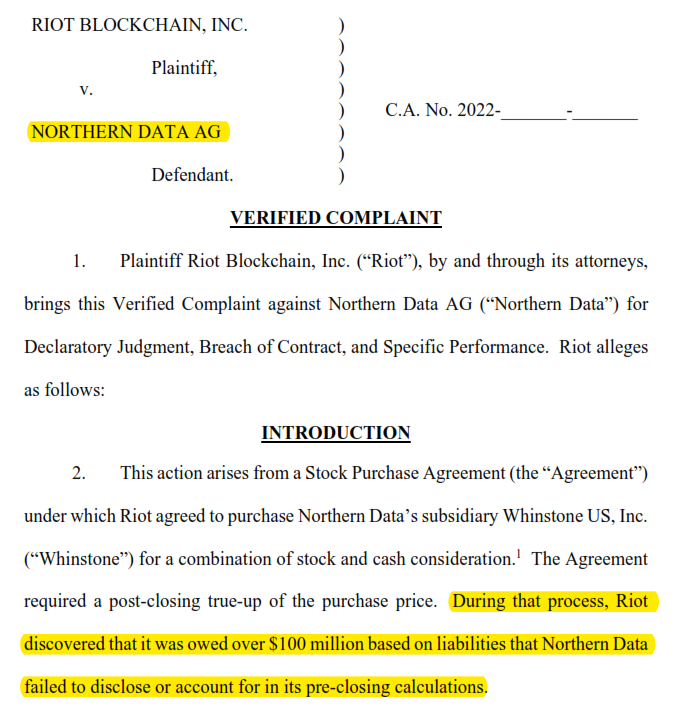

The company missed its already lowered guidance, is sued by $RIOT for $114m and auditors issued a going concern warning

The company missed its already lowered guidance, is sued by $RIOT for $114m and auditors issued a going concern warning

$NB2 guided 100k ASIC miners for 2022, 200m to 250m revenue and adj EBITDA (excl. trading losses) of up to 75m. They missed all of them. Only the mined BTC were slightly above the lower end of the guidance

Partners cut ties with #NorthernData which leads to a revenue decline of at least $25m. On top, $RIOT is suing Northern Data for $114m, the #Bafin and public prosecutors are investigating the company.

Several #executives jumped the ship in 2022 as well. First #CFO Dahn left in February and in October #COO Sickenberger quit. But there is already a new CFO after Dahn’s successor and Mr Yoshida was declared being only an interim CFO. #NorthernData

For years #NorthernData tried to start a cloud business but to date has not generated any #revenue. The revenue is solely from #Bitcoin mining and selling its hardware.

In no press release did the company mention one of the most important facts. That #NorthernData’s own auditor #KPMG issued a going concern warning...

• • •

Missing some Tweet in this thread? You can try to

force a refresh