@eigenlayer #restaking #LSD #ethereum

Eigen Layer: The Restaking Collective

1/ Introduction

As you know, after Ethereum switched to PoS, it also opened up new problems like how to reduce the cost of storing data on ethereum to reduce rollups fees, in addition problems Other

Eigen Layer: The Restaking Collective

1/ Introduction

As you know, after Ethereum switched to PoS, it also opened up new problems like how to reduce the cost of storing data on ethereum to reduce rollups fees, in addition problems Other

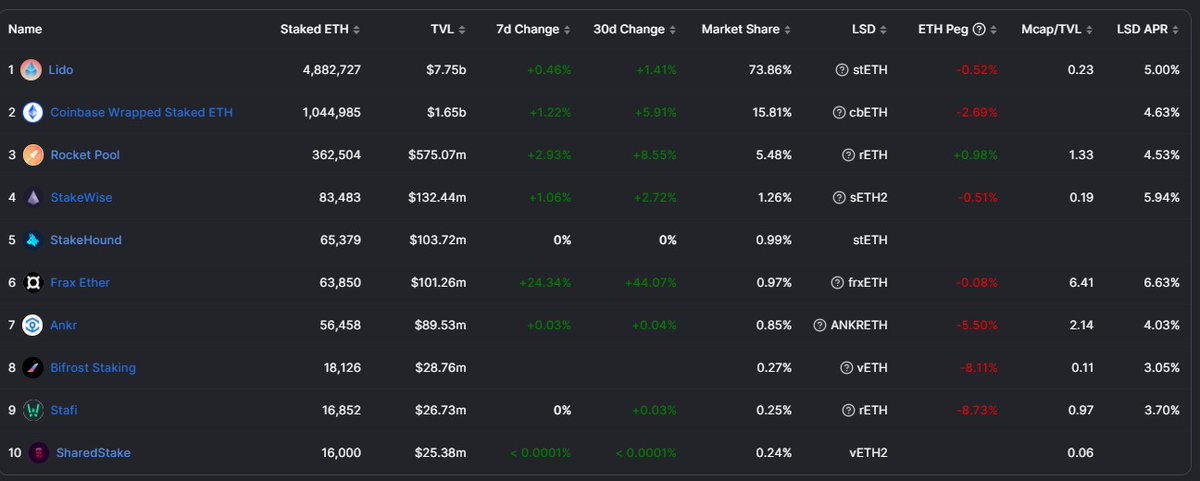

topics like MEV or Censorship Resistance are also worth mentioning. Another problem that the Proof-of-stake mechanism brings is that a large amount of Ethereum is staked and is almost not liquid for economic purposes, so there are new solutions. Liquid Staking (LSDs).

Eigenlayer, a team that saw these issues, was determined to develop a project that could simultaneously solve the data storage fees for proofs from L2 (data availability) and take advantage of the features of LSDs to bring security of Ethereum to the DA layer.

Specifically, let's find out below.

2/Background

Inside a blockchain, the task of the Block proposer/Sequencer is to execute transactions and propose them to the block. Then put that block on the entire network for other nodes to validate. The requirement here is that all nodes must validate each transaction in its

Inside a blockchain, the task of the Block proposer/Sequencer is to execute transactions and propose them to the block. Then put that block on the entire network for other nodes to validate. The requirement here is that all nodes must validate each transaction in its

entirety.

With zk Rollups, the Sequencer can generate proofs that ensure transactions have been properly executed. The rest of the nodes in the network only need to validate this proof. This is a huge step forward in improving computing power.

With zk Rollups, the Sequencer can generate proofs that ensure transactions have been properly executed. The rest of the nodes in the network only need to validate this proof. This is a huge step forward in improving computing power.

Solutions

One of the proposed solutions is to add a dedicated Data Availability layer that is separate from the main chain. Instead of Ethereum, Sequencer will store data on the new DA layer, this DA layer is responsible for ensuring data is available and updated for Ethereum.

One of the proposed solutions is to add a dedicated Data Availability layer that is separate from the main chain. Instead of Ethereum, Sequencer will store data on the new DA layer, this DA layer is responsible for ensuring data is available and updated for Ethereum.

This model, also known as Validium, provides a way to reduce the cost barrier for Rollups. However, Validiums still face other challenges: Poor security,

Capital cost/ Cost of capital use ,

Capital cost/ Cost of capital use ,

Conflict of Interest (Detached DA will collect all fees from Rollups instead of Ethereum. When Ethereum fails to derive value from Rollups, the L1 - L2 relationship breaks down)

So how to both achieve economic efficiency and own high security like Ethereum?

5/ Introduction to Eigenlayr and Restaking concept:

5/ Introduction to Eigenlayr and Restaking concept:

Eigen Layer can be said to be the first project to take the lead in this concept, more specifically EigenLayr is a series of smart contracts deployed on Ethereum, which can be customized to become specialized Middlewares serving different purposes. We have EigenDA and Eigenlayer

EigenDA: The DA layer serves the function of storing data so that Ethereum nodes can verify proofs from Layer 2.

EigenLayer :

A platform to perform “restaking” allows Ethereum nodes to simultaneously perform multiple functions and earn more yield.

EigenLayer :

A platform to perform “restaking” allows Ethereum nodes to simultaneously perform multiple functions and earn more yield.

Eigen Layer allows Ethereum stakers to reuse (restake) their staked ETH, or even LSD forms like rETH, stETH.. to secure other networks such as DA system or sequencers system of rollups .

Using staked Eth to secure these systems will eliminate the assumption of trust that the decoupled DA layer brings,these nodes will accept additional penalties if the above services are inefficiently operated when retaking their assets.into the Eigen Layer. In return,these nodes

will receive an additional yield for the accompanying services they choose to serve. EigenDA is also one of the functions that EigenLayer allows Eth staker to take on and receive more yield for. So we can see with eigenlayer,

the yield that can be earned for participating ETH stakers is extremely large:

Restaking yield = Ethereum Yield + boosted liquid staking yield + yield from eigenlayer's emission + yield from services nodes perfoms (increasing with the number of additional services)

Restaking yield = Ethereum Yield + boosted liquid staking yield + yield from eigenlayer's emission + yield from services nodes perfoms (increasing with the number of additional services)

6/ Advantages of Eigen Layer and Restaking:

Eigen Layer allows validators/stakers to participate in promoting additional services without worrying about capital costs. The capital cost of stakers has been offset by apr from Ethereum core protocol, the Marginal cost (

Eigen Layer allows validators/stakers to participate in promoting additional services without worrying about capital costs. The capital cost of stakers has been offset by apr from Ethereum core protocol, the Marginal cost (

when retaking with Eigen Layer is pure Operating cost. And it makes perfect sense for stakers to operate with the service fees they receive.

With restaking, dApps / Rollups will almost fully inherit safety and security from Ethereum.

With restaking, dApps / Rollups will almost fully inherit safety and security from Ethereum.

Instead of small units, Ethereum can deploy its services on Eigen Layer and open the door for validators to retake. An increase in the value of rstETH (derivatives of eigenlayer ETH) means that ETH accumulates more value, creating an effective symbiotic relationship.

7/Issues must still be taken into account for resetting

Centralization:

As validators have to take on more functions, the configuration requirements for participating validators also increase, resulting in only a few that can be accommodated and these few will be easily

Centralization:

As validators have to take on more functions, the configuration requirements for participating validators also increase, resulting in only a few that can be accommodated and these few will be easily

available. . dominant

Smart Contract Vulnerability: Since Eigen Layer is a collection of smart contracts, bugs or security holes are quite possible. In the event that more ETH is staked for use at the Private Layer, the risk is much greater.

Smart Contract Vulnerability: Since Eigen Layer is a collection of smart contracts, bugs or security holes are quite possible. In the event that more ETH is staked for use at the Private Layer, the risk is much greater.

In short, all the provided solutions are also geared towards the solution to the Ethereum scaling problem. Options that improve Ethereum's current infrastructure limitations, such as Reset the Eigen Layer, could become the future of Defi,

generating sustainable profits while enhancing security for Grade 2. #EigenLayer and #restaking will be hot keys in the near future

• • •

Missing some Tweet in this thread? You can try to

force a refresh